- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 21-10-2016.

Gold price was littIe changed as investors consider the strengthening of the dollar and the alleged rise in demand for the metal from India.

The dollar index, which tracks the greenback against a basket of currencies, was up 0.3%, to 88.60. A stronger dollar usually exerts pressure on the gold price. Gold prices are denominated in dollars, so that the metal becomes less attractive.

Meanwhile, the seasonal demand for gold in India since the beginning of the season of festivals is growing, according to Commerzbank AG.

"At the end of this month will be the feast of Diwali and Dhanteras. Both are important in the Hindu tradition, and at that time people used to give gold".

India and China are two of the world's largest gold-consuming countries.

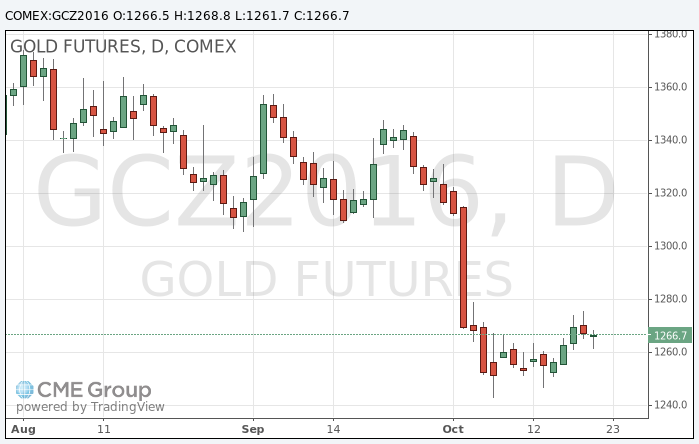

The cost of December futures for gold on COMEX is trading in the range of $ 1261.7 - $ 1268.8 per ounce.

This morning, New York futures for Brent have fallen in price 0.14% to $ 50.56 and WTI trading flat at $ 51.38 per barrel. Thus, the black gold's rally stops for now, move caused by a strengthening dollar. The dollar rose to the highest level since March against major currencies, potentially limiting the oil demand, because the fuel has risen in price in countries with other currencies. But despite the decline, the oil market was optimistic, as financial investors are still keen to invest more in oil futures.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.