- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 22-03-2013.

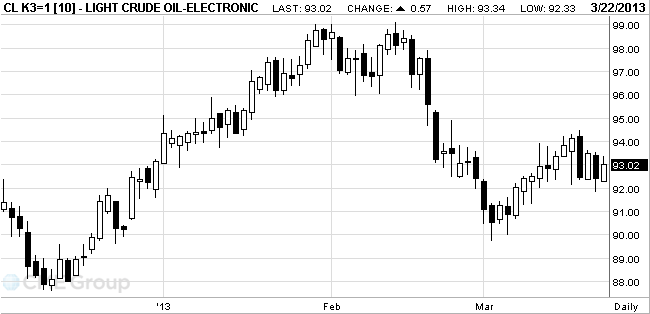

West Texas

Intermediate crude rose, narrowing its discount versus Brent to the lowest

level in two months, as the euro strengthened against the dollar and data

showed the

WTI climbed

as much as 1 percent and the euro increased from near a four-month low as

Cypriot lawmakers debated measures needed to get a bailout.

Jobless

claims dropped to a five-year low in the

Brent slid

to the lowest level in more than three months in intraday trading as German

business confidence unexpectedly fell. German business confidence fell from a

10-month high in March as

WTI for May delivery gained to $93.34 a barrel on the New York Mercantile Exchange. Prices are down 0.5 percent this week.

Brent for

May settlement rose 19 cents to $107.66 a barrel on the London-based ICE

Futures Europe exchange after falling to $106.90, the weakest intraday level

since Dec. 7.

Prices for the yellow metal retreated slightly from lows amid growing optimism about the bailout program for Cyprus. While the ECB and others are closely monitoring the developments in the troubled country, the price of gold fell to around 1603, which is the bottom of the last three sessions. After that, prices rebounded in early U.S. session after the euro rally on news that the ruling party of Cyprus was confident that in the coming hours will be agreed with the EU on the issue of providing financial assistance to the country.

Gold prices are close to the second weekly increase due to the demand for safe assets in the midst of a financial crisis in Cyprus. EU told to Cyprus until Monday to find several billion euros to get international help. Otherwise, the country is threatened by the collapse of the financial system and leaving the euro.

Stocks of the world's largest gold-exchange-traded fund (ETF) SPDR Gold Trust on Thursday fell by 0.902 tonnes to 1.221,26 tons - the lowest level since July 2011.

April futures price of gold today fell to 1,602.6 dollars per ounce, and then recovered slightly above $ 1,611 an ounce on the New York Mercantile Exchange.

(symbol/close price(00:00 GMT +02:00)/change, %)

GOLD 1,615.30 +6.30 +0.39%

OIL 92.33 -0.81 -0.87%© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.