- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 23-01-2014.

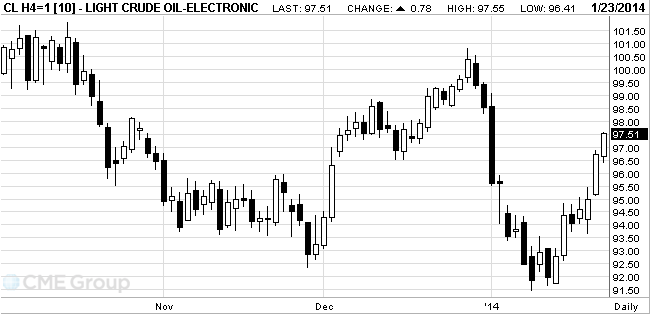

The cost of oil brand West Texas Intermediate rose to three-week high after a government report showed that U.S. inventories of distillates fell as demand rose.

Commercial crude oil inventories in the United States (excluding strategic reserves ) for the week ending January 17 , increased by 1 million barrels , or 0.3 % - to 351.2 million barrels , according to a weekly review of the country's Ministry of Energy .

Analysts believed that oil reserves will grow by only 588,000 barrels. Oil reserves increased for the first time since November.

While total gasoline inventories increased by 2.1 million barrels , or 0.9 %, to 235.3 million barrels . Distillate inventories decreased by 3.2 million barrels , or 2.6 % - to 120.7 million barrels .

The cost of oil is growing against the depreciation of the dollar after the publication of a series of statistical data from the United States .

The dollar index ( dollar to a basket of six currencies of countries - major trade partners of the U.S. ) fell by 0.74 % to 80.59 points.

Investors pay attention to data on the U.S. housing market . Number of home sales in the secondary market in December increased by 1 % compared to November - to 4.87 million. Data were worse than analysts' forecasts , which expect that the number of transactions amounts to 4.99 million.

March futures price for U.S. light crude oil WTI (Light Sweet Crude Oil) rose to $ 97.79 per barrel on the New York Mercantile Exchange (NYMEX).

March futures price for North Sea Brent crude oil mixture fell 42 cents , or 0.4 percent, to $ 107.85 a barrel on the London exchange ICE Futures Europe.

Gold prices rebounded from two-week low after reporting a slowdown in manufacturing activity in China and on the eve of the Fed meeting , at which the central bank may continue to reduce incentives.

Manufacturing activity in China slowed in January for the first time in six months , the index showed PMI, fell to 49.6 points from 50.5 points in December .

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Wednesday declined by 1.2 tons to 795.85 tons. Surcharge 99.99 fine gold on the Shanghai Gold Exchange holds near $ 12 per ounce.

Growth of gold comes amid weakening U.S. dollar. Recent data from the U.S. Labor Department showed that the number of applications for unemployment benefits rose slightly last week , although the overall level indicates a marked improvement in the labor market .

According to the report , the seasonally adjusted number of initial claims for unemployment benefits rose for the week ending January 18 , 1000 , reaching a level with 326 thousand Many experts expect that the number of applications will increase to 331 thousand to 326 thousand , of which initially reported last week. In addition, it was reported that the average number of applications for benefits over the past four weeks decreased by 3750 - to the level of 331,500 .

Cost February gold futures on the COMEX today rose to $ 1267.00 per ounce.

Gold $1,237.40 -1.20 -0.10%

Oil $96.77 +0.04 +0.04%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.