- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 23-09-2016.

In the course of today's trading oil was moving smoothly as market participants receive mixed signals as to whether the leading oil exporters will agree to work together to eliminate the excess supply, which is observed for two years.

At the beginning of the European session, oil prices declined, however, they moved into positive territory after Reuters reported that Saudi Arabia is ready to cut production if Iran decides to limit its oil production.

Meanwhile, the representatives of Saudi Arabia and Iran are not in consultations this week to agree on how to define the levels at which can limit production. This was reported by Wall Street Journal.

Skepticism towards the OPEC meeting still persists. It is believed that the largest OPEC members, including Saudi Arabia, Iran and Iraq, will not be able to reach an agreement on the reduction or production restrictions. Geopolitical rivalry also aggravates the situation. In addition, these countries are fighting for market share.

"Even the agreement of the leading oil producers will not be positive in view of the current high level of offer. Prices may be supported only if they agree a clear and significant production cut, that under current conditions it is highly unlikely" - said Tamas Varga of PVM Oil Associates.

The cost of the November futures for US light crude oil WTI (Light Sweet Crude Oil) fell to 45.44 dollars per barrel on the New York Mercantile Exchange.

November futures price for North Sea petroleum mix of mark Brent fell to 46.93 dollars a barrel on the London Stock Exchange ICE Futures Europe.

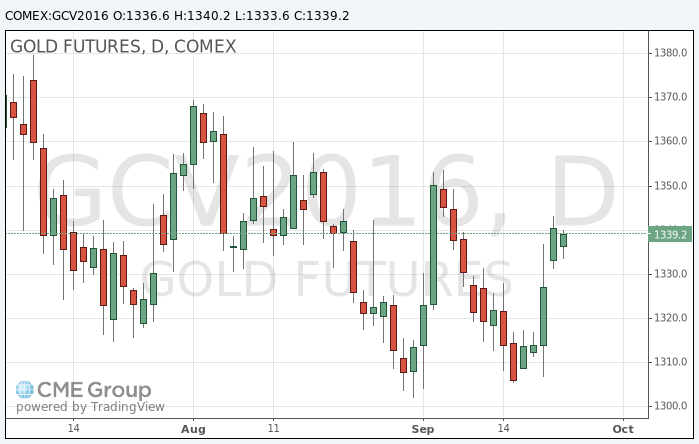

In today's trading, gold price rose slightly after touching a 2-week high yesterday.

Gold gained after the Fed's decision to keep interest rates earlier adopted on Wednesday. Since gold does not bring interest income, it is usually more in demand at low interest rates.

While investors continue to look for signals that will help to understand when rates may be increased, a slight increase in demand for metals in China and India could support prices, said Joni Tevez, strategist at UBS.

"We believe that the volume of purchases before the end of the year is likely to be limited and lower than in previous years, however, the purchase will be significantly higher than in the first half of 2016." - Tevez said.

Physical gold is usually purchased during festivals and weddings. A good rainy season in India has traditionally support growth of incomes of those engaged in agriculture, and this segment has a particularly high demand for gold.

Support for gold prices also had a weakening US dollar after the release of the business activity data. Preliminary data released by Markit Economics showed that the index of business activity in the manufacturing sector fell in September to 51.4 points compared to 52.0 points in August. The last reading was the lowest since June. Economists had expected the index to fall to only 51.9 points. It is worth emphasizing that the index remained above 50 points since October 2009, which indicates expansion

The cost of the October futures for gold on COMEX rose to $ 1340.2 per ounce.

This morning, New York crude oil futures for WTI have fallen by 1.04% to $ 45.84 and Brent oil futures fell 0.80% to $ 47.26 per barrel. Thus, the black gold is traded in the red zone on a technical sales background, and because of caution on the eve of the OPEC ministerial meeting next week in Algeria. Lower prices also associated with an increase in oil supplies as the global volume of production exceeds consumption almost constantly since mid 2014.

OPEC may try again to signal the first agreement on curbing production since 2008, when members of the organization will gather in Algiers, but most traders believe that the agreement is unlikely to significantly help reduce the record production figures.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.