- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 23-10-2015.

Oil prices fell on a stronger U.S. dollar. The greenback rose against other currencies on better-than-expected U.S. preliminary manufacturing purchasing managers' index. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

The greenback also rose on China's interest rate decision. The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

Market participants are awaiting the release of the number of active U.S. rigs later in the day. The oil driller Baker Hughes reported last Friday that the number of active U.S. rigs declined by 10 rigs to 595 last week. It was the seventh consecutive decrease and the lowest level since the week ending July 23, 2010.

WTI crude oil for December delivery declined to $45.31 a barrel on the New York Mercantile Exchange.

Brent crude oil for December fell to $48.07 a barrel on ICE Futures Europe.

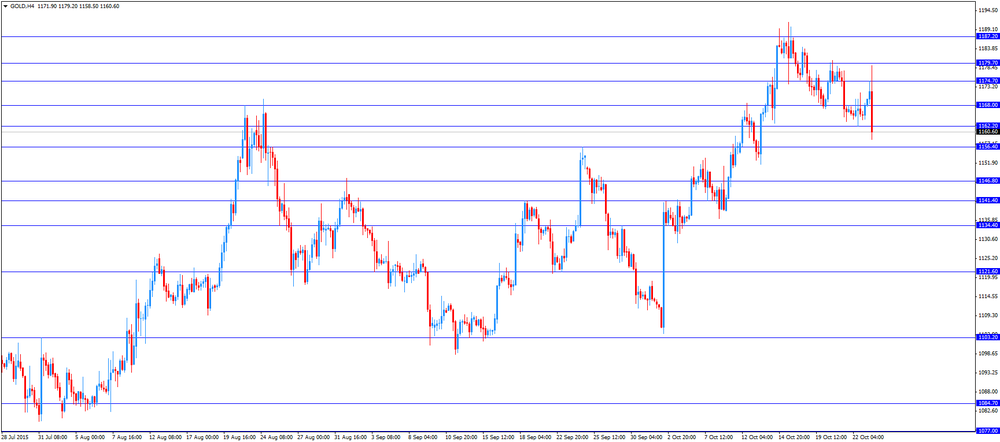

Gold price declined on a stronger U.S. dollar. The greenback rose against other currencies on better-than-expected U.S. preliminary manufacturing purchasing managers' index. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

Earlier, gold price rose on China's interest rate decision. The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

One-year benchmark deposit rates were cut by 25 basis point to 1.50%, reserve requirements (RRR) were lowered by 50 basis points to 17.5% for all banks.

New reserve requirements would be effective on October 24.

December futures for gold on the COMEX today declined to 1162.90 dollars per ounce.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) climbed to 54 in October from 53.1 in September, beating expectations for a decline to 52.8.

A reading above 50 indicates expansion in economic activity.

The increase was driven by a faster pace of expansion in output and new orders volumes.

"The positive start to the fourth quarter suggests the economy may be picking up speed again after slowing in the third quarter, for which the PMI surveys pointed to annualised GDP growth of 2.2%," Markit Chief Economist Chris Williamson.

"The faster growth of export sales is particularly good news and will help to alleviate fears that the US economy is being hurt by the stronger dollar and slower growth in China," he added.

The People's Bank of China (PBoC) announced on Friday that it lowered the one-year benchmark bank lending rate by 25 basis points to 4.35%. It was the sixth interest rate cut since last November.

The central bank hopes with this decision to support the country's economy.

The interest rate cut would be effective from October 24.

One-year benchmark deposit rates were cut by 25 basis point to 1.50%, reserve requirements (RRR) were lowered by 50 basis points to 17.5% for all banks.

New reserve requirements would be effective on October 24.

Chinese Premier Li Keqiang said during a meeting with former U.S. treasury secretary Henry Paulson in Beijing on Thursday that there is no basis for long-term depreciation of the yuan.

Li also said that the country implemented measures to deal with unusual capital market fluctuations.

"We will continue to boost reform and institutional construction, fostering an open, transparent, stable and healthy multiple-level capital market," he said.

West Texas Intermediate futures for December delivery climbed to $45.58 (+0.44%), while Brent crude rose to $48.47 (+.81%) amid favorable economic data and gains in stock markets around the globe.

Market participants are waiting for the latest U.S. rig count data and preliminary PMI data for the euro zone and the U.S. to assess production and demand.

Gold climbed to $1,169.30 (+0.27%) on Friday, but a relatively strong dollar and strong economic data intensified expectations for an imminent rate hike by the Federal Reserve thus limiting bullion's growth.

Physical demand failed to support the precious metal. Retailers in India (world's second biggest consumer) sold gold at reduced prices even during the festival season. Dealers were offering a discount of $8 to $12 an ounce this week, compared to $7 to $11 in the previous week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.