- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 24-06-2015.

(raw materials / closing price /% change)

Oil 60.22 -0.08%

Gold 1,174.50 +0.14%

WTI crude oil prices traded higher as U.S. crude oil inventories declined last week. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 4.9 million barrels to 463 million in the week to June 19. It was the eight consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

Gasoline inventories were up by 680,000 barrels to 218.5 million barrels last week, according to the EIA.

U.S. oil production increased to 9.6 million barrels a day from 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 1.87 million barrels to 56.2 million barrels.

U.S. crude oil imports declined by 432,000 barrels per day.

Refineries in the U.S. were running at 94.0% of capacity, down from 93.1% the previous week.

Kuwaiti Oil Minister Ali al-Omair said on Tuesday that oil prices are expected to rise as stockpiles and the number of drilling rigs declined.

"We have reached a stage where a drop in oil prices is unlikely," he said.

WTI crude oil for August delivery increased to $61.57 a barrel on the New York Mercantile Exchange.

Brent crude oil for August fell to $64.25 a barrel on ICE Futures Europe.

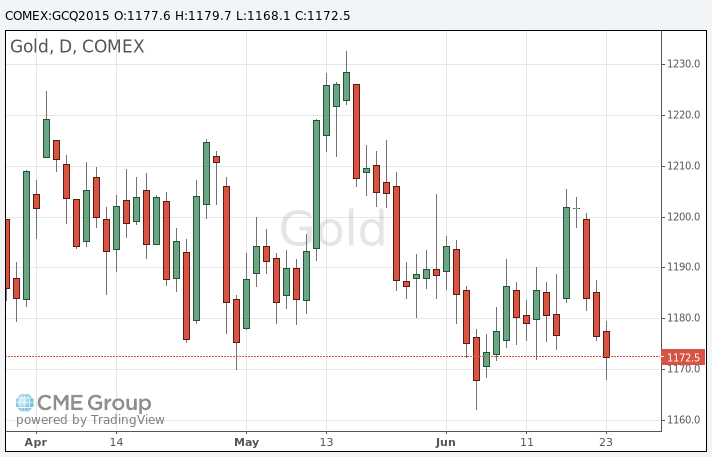

Gold price traded lower as the U.S. dollar strengthened after the release of the final U.S. gross domestic product (GDP). The U.S. final GDP declined 0.2% in the first quarter, in line with expectations, up from the previous estimate of a 0.7% drop.

The upward revision was partly driven by an upward revision to consumer spending. Consumer spending rose by 2.1% in the first quarter, up from the previous estimate of a 1.8% increase.

Debt talks between Greece and its creditors remain in focus. Tsipras said before flying to Brussels on Wednesday that some latest Greek reform proposals were refused by its creditors.

Greece rejected on Wednesday a "counter proposal" from its international creditors, according a government source.

August futures for gold on the COMEX today fell to 1168.10 dollars per ounce.

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 4.9 million barrels to 463 million in the week to June 19. It was the eight consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

Gasoline inventories were up by 680,000 barrels to 218.5 million barrels last week, according to the EIA.

U.S. oil production increased to 9.6 million barrels a day from 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 1.87 million barrels to 56.2 million barrels.

U.S. crude oil imports declined by 432,000 barrels per day.

Refineries in the U.S. were running at 94.0% of capacity, down from 93.1% the previous week.

West Texas Intermediate futures for August delivery climbed to $61.12 (+0.18%), while Brent crude for August advanced to $64.59 (+0.22%) a barrel. Today investors are waiting for data on U.S. crude inventories (14:30 GMT), while the deadline for an agreement on Iran nuclear program will be the center of attention next week (June the 30th).

Some sources say that Iran has at least 34 tankers of oil ready to be sold as soon as sanctions are lifted. At the same time Saudi Arabia, OPEC's largest producer, is not going to reduce output to allow Iran claim its market share. This could push oil prices down. In addition to that, Gulf exporters may offer discounts to their customers to protect their own interests.

However there are still obstacles on the way to an agreement and the June 30 dead line could be postponed.

Gold is currently at $1,176.80 (+0.02%) an ounce. The non-interest-paying metal has declined for a fourth session in a row amid a stronger dollar and equity markets' optimism about Greek debt agreement.

Gold is losing its appeal as a safe-haven asset as Greek officials express confidence that a deal with Greece's international lenders will be reached soon.

Gold is also experiencing pressure from expectations that the Federal Reserve will raise rates this year. The dollar's strength is also a negative factor for bullion.

Physical demand in Asia remained weak.

(raw materials / closing price /% change)

Oil 61.13 +0.20%

Gold 1,176.40 -0.02%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.