- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 24-12-2013.

Brent crude

advanced to near its highest level in three weeks as violence in

Futures

were up as much as 0.3 percent and are poised to end the year higher for the

fifth time. Fighting in South Sudan, which exports about 220,000 barrels a day,

has killed at least 500 people and led to the evacuation of employees from

UN

Secretary General Ban Ki-moon asked the Security Council for 5,500 soldiers to

add to the peacekeeping mission of 7,000 already in

South Sudan

has sub-Saharan Africa’s biggest oil reserves after

Gasoline

stockpiles stockpiles in the

Crude

inventories are projected to have decreased by 3 million barrels, the survey

shows.

Brent for

February settlement rose as much as 34 cents to $111.90 on the London-based ICE

Futures Europe exchange and was at $111.74 as of 1:08 p.m. in

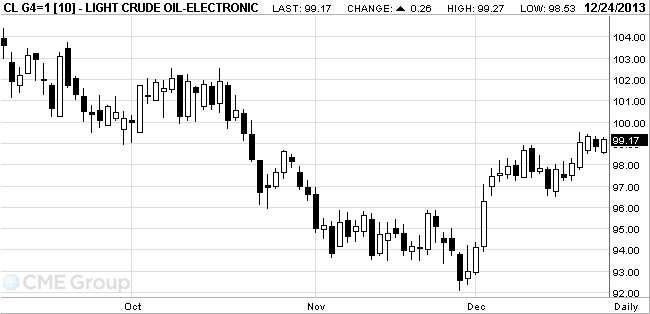

West Texas

Intermediate for February delivery was up 16 cents at $99.07 in electronic

trading on the New York Mercantile Exchange. Brent was at a premium of $12.69

to WTI. The spread widened yesterday for a fourth day to close at $13.

Gold prices held near $ 1,200 , showing a slight increase after a report on orders for durable goods in the U.S. increased the appeal of gold as a safe asset.

Last week, the price dropped to a six-month low of $ 1.185,10 an ounce, after the Fed announced a reduction incentive program . From the beginning, gold fell by nearly 30 percent a year and can complete a maximum decline in 32 years .

Recent data from the Ministry of Commerce showed that demand for durable goods increased significantly in the last month , surpassing forecasts while . Experts point out that with the growth of business investment at the fastest pace since January , the latest report is a sign of renewed confidence among companies.

According to the report , orders for U.S. durable goods rose 3.5 percent last month , while offsetting the decline of 0.7 per cent , which was recorded in October. Excluding transportation , orders for durable goods rose 1.2 percent , showing the largest increase since May of this year. According to the average forecast of economists , total orders had increased by only 1.7 percent, compared with a decline of 1.6 percent in October , which was originally reported. As for orders excluding transportation , they are estimated to have been up by 0.9 percent, after rising 0.7 percent in October (initially reported drop of 0.1 percent) .

Stocks of the world's largest exchange-traded fund backed by gold (ETF) SPDR Gold Trust on Monday fell by 8.4 tonnes to 805.72 tonnes - the minimum level in nearly five years.

Surcharge gold 99.99 percent purity on the Shanghai Futures Exchange on Tuesday rose to $ 20 per ounce to $ 16 on Monday, pointing to the increase in demand at the price falls below $ 1,200 .

Cost February gold futures on the COMEX today rose to $ 1202.30 per ounce.

Gold $1,197.20 +0.20 +0.02%

Oil $98.80 -0.11 -0.11%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.