- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 25-02-2016.

Oil prices declined on concerns over the global oil oversupply. According to market intelligence provider Genscape's data, crude stocks at the Cushing, Oklahoma, increased by more than 503,000 barrels between February 19 and February 24.

Market participants are awaiting comments by Saudi Arabian Oil Minister Ali Al-Naimi. He said this week that there will be no cut in oil output.

Oil prices yesterday were supported by the first decline of U.S. gasoline inventories since November, which decreased by 2.2 million barrels last week.

According to the U.S. Energy Information Administration's (EIA) data on Wednesday, U.S. crude inventories rose by 3.5 million barrels to 507.6 million in the week to February 19. Analysts had expected U.S. crude oil inventories to rise by 3.17 million barrels.

Crude stocks at the Cushing, Oklahoma, increased by 333,000 barrels.

WTI crude oil for April delivery decreased to $31.40 a barrel on the New York Mercantile Exchange.

Brent crude oil for April rose to $33.86 a barrel on ICE Futures Europe.

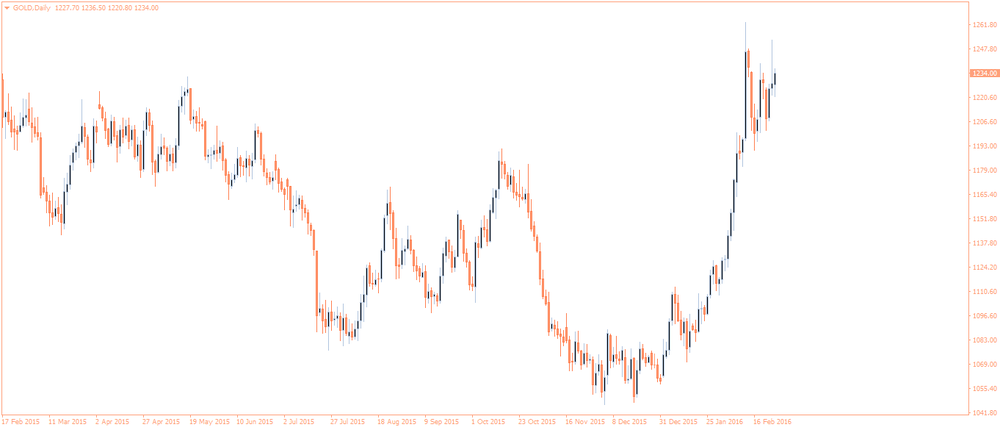

Gold price rose on increasing demand for safe-haven assets as oil prices declined. A weaker U.S. dollar also supported gold.

Market participants eyed the U.S. economic data. The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 20 in the U.S. increased by 10,000 to 272,000 from 262,000 in the previous week. Analysts had expected jobless claims to rise to 270,000.

The U.S. Commerce Department released durable goods orders data on Thursday. The U.S. durable goods orders jumped 4.9% in January, exceeding expectations for a 2.9% gain, after a 4.6% drop in December. December's figure was revised up from a 5.0% fall.

The increase was mainly driven by a strong demand for transportation equipment.

The U.S. durable goods orders excluding transportation climbed 1.8% in January, exceeding expectations for a 0.2% increase, after a 0.7% decline in December. December's figure was revised up from a 1.2% drop.

The U.S. durable goods orders excluding defence rose 4.5 % in January, after a 2.5% decline in December. December's figure was revised up from a 2.9% decrease.

March futures for gold on the COMEX today rose to 1237.60 dollars per ounce.

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending February 20 in the U.S. increased by 10,000 to 272,000 from 262,000 in the previous week.

Analysts had expected jobless claims to rise to 270,000.

Jobless claims remained below 300,000 the 51st straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims declined by 19,000 to 2,253,000 in the week ended February 13.

The International Monetary Fund (IMF) released its report "Global Prospects and Policy Challenges" prepared for the G20 summit. The IMF said that global recovery weakened further due to increasing financial turbulence and falling asset prices.

"Growth in advanced economies is modest already under the baseline, as low demand in some countries and a broad-based weakening of potential growth continue to hold back the recovery," it said.

"Adding to these headwinds are concerns about the global impact of China's transition to more balanced growth, along with signs of distress in other large emerging markets, including from falling commodity prices," the fund added.

The report said that the global economy was "highly vulnerable to adverse shocks".

The IMF noted that G20 countries should coordinate their stimulus measures to boost the global economy.

The IMF cut its global growth forecast in January to 3.4% from 3.6%. The fund pointed out that further cut is possible in April.

West Texas Intermediate futures for April delivery is currently at $32.12 (-0.09%), while Brent crude is at $34.36 (-0.15%). Crude oil prices rose on Wednesday as market participants assessed a report on U.S. crude oil inventories. The Energy Information Administration reported that crude oil inventories rose by 3.5 million barrels in the week ended February 19. Investors looked beyond this increase and welcomed declines in stocks of refined products: gasoline and distillate stockpiles fell by 2.2 million barrels and 1.7 million barrels respectively. However concerns over the persistent supply glut outweighed optimism about declining gasoline inventories and weighed on prices.

Gold is currently at $1,235.20 (-0.31%). The precious metal retreated on Wednesday after climbing 2% as stocks advanced. Stocks rose following higher oil prices, however many Asian shared fell after crude resumed declines. Weak stocks and oil support demand for gold and other safe-haven assets. Rising expectations that the Federal Reserve will keep delaying the next rate hike are favorable for bullion too.

Holdings of SPDR Gold Trust, the largest gold-backed exchange-traded-fund, rose to 760.32 tonnes on Wednesday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.