- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 25-07-2013.

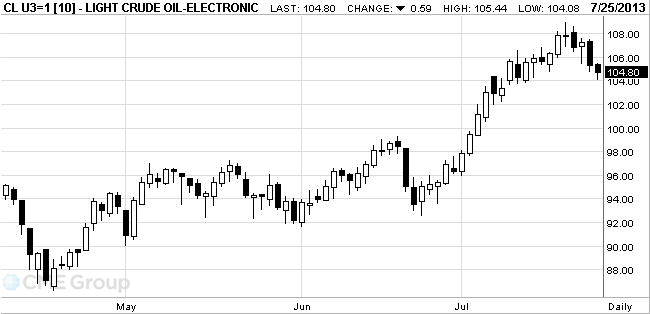

West Texas

Intermediate crude dropped for a second day, extending the biggest loss in more

than a month, as

Futures

fell as much as 1.2 percent after decreasing 1.7 percent yesterday as the

Energy Information Administration reported

Crude

inventories decreased 2.8 million barrels last week, data yesterday from the

EIA, the Energy Department’s statistical arm, show. Stockpiles decreased 29.9

million barrels in the four weeks ended July 19, the largest four-week drop in

data dating to 1982.

Bookings

for U.S. goods meant to last at least three years increased 4.2 percent, led by

transportation equipment, after a revised 5.2 percent gain in May that was

bigger than initially reported, the Commerce Department said today in

Washington.

WTI crude

for September delivery declined 32 cents to $105.07 a barrel at 11:06 a.m. on

the New York Mercantile Exchange. Futures touched $104.08, the lowest level

since July 9. The volume of all futures traded was 14 percent above the 100-day

average for the time of day.

Brent for

September settlement rose 20 cents to $107.39 a barrel on the London-based ICE

Futures Europe exchange. The volume of all futures traded was 11 percent below

the 100-day average. The European benchmark traded at a $2.32 premium to WTI,

up from $1.80 yesterday. Brent dropped below WTI on July 19 for the first time

since August 2010.

Gold prices recovered after falling earlier in the session against the backdrop of mixed U.S. statistics.

As shown by recent data that have been published by the Ministry of Commerce, at the end of last month, orders for durable goods increased substantially, which primarily was due to higher demand for airplanes. However, it is worth noting that with the exception of transport, the number of orders remained unchanged. According to the report, the seasonally adjusted total orders for durable goods rose in June by 4.2% - to $ 244,500 bn add that the last increase was slightly less than the revised growth in May - at the level of 5.2% (originally reported +3.6%), but significantly more than the average forecast of experts - at the level of 1.1%. The data showed that the June increase in orders was due to the 31.4% increase in orders for civilian aircraft, and increasing by 18.7% of the orders for defense and details. Excluding transportation orders for durable goods in June remained at $ 157.420 billion The report also showed that the growth in business investment has slowed.

Another Labor Department report showed that by the end of last week, the number of Americans who first applied for unemployment benefits rose slightly, a sign that the labor market recovery is faltering. According to the report, the seasonally adjusted number of initial claims for unemployment insurance for the week ending July 20 rose by 7,000 to 343,000. In addition, it was reported that the value of this index for the previous week was revised to the level of 336 thousand to 334 thousand, which was originally reported. According to the average forecasts of experts, the number of appeals would grow to 339 thousand worth noting that in recent weeks, the numbers were very volatile, partly due to seasonal factors. This includes the typical summer shutdown auto plants and the closure of schools for the holidays, which can affect performance. However, adding that the average number of calls in the last four weeks fell by 1,250 to 345,250 last week. In general, employers fired fewer workers, and in some cases even increased staff. According to reports, the economy added a little more than 200,000 jobs each month for the last nine months, although the unemployment rate remains high - at 7.6%.

The cost of the August gold futures on COMEX today dropped to $ 1308.40, and then rose to $ 1328.50 per ounce.

Change % Change Last

GOLD 1,321.40 -13.30 -1.00%

OIL (WTI) 105.23 -2.00 -1.87%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.