- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 28-04-2015.

(raw materials / closing price /% change)

Oil 57.06 +0.12%

Gold 1,213.90 +0.89%

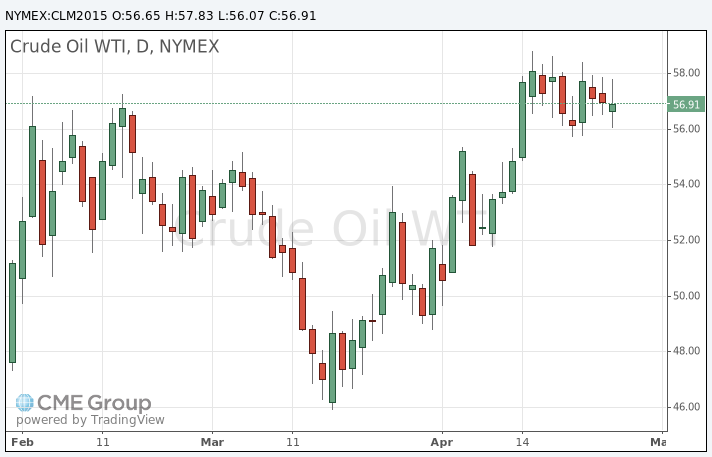

Brent crude traded lower, while WTI crude oil rose on news that troops from Iran have captured a US cargo ship in the Strait of Hormuz and have directed it to Bandar Abbas port on the southern coast of Iran.

The Pentagon said that no U.S. ship was involved.

Saudi Arabia's Oil Minister Ali al-Naimi said on Tuesday that Saudi Arabia will meet oil demand in Asia despite the increasing demand in Asia.

"Oil will retain its preeminent position and Saudi Arabia will remain the number one supplier," he said.

His comments indicate that the country will keep producing oil at high levels despite low prices.

WTI crude oil for June delivery increased to $57.83 a barrel on the New York Mercantile Exchange. Brent crude oil for June fell to $64.52 a barrel on ICE Futures Europe.

Gold price jumped on the soft U.S. economic data. The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index dropped to 95.2 in April from 101.4 in March, missing expectations for a rise to 102.6. March's figure was revised up from 101.3.

It was the lowest level since December 2014.

The increase was driven by the weaker outlook for the labour market and business conditions. The percentage of consumers expecting more jobs in the coming months declined to 13.8% in April from 15.3% in March.

The percentage of consumers expecting business conditions to improve over the next six months fell to 16.0% in April from 16.8% in March.

The Conference Board's consumer expectations index for the next six months decreased to 87.5 in April from 96.0 in March.

The present conditions index plunged to 106.8 in April from 109.5 in March. It was the consecutive decline.

Investors are awaiting the results of the Fed's monetary policy meeting on Wednesday. It is likely that the Fed will delay its first interest rate hike due to the recently released soft U.S. economic data.

The Greek debt crisis remains in focus. Greek Prime Minister Alexis Tsipras reshuffled his team negotiating with European and IMF creditors on Monday. Deputy Foreign Minister, Euclid Tsakalotos, was appointed co-coordinator of the team.

June futures for gold on the COMEX today increased to 1214.90 dollars per ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.