- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 28-05-2013.

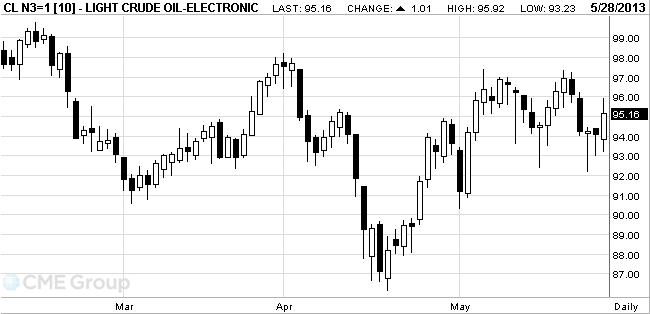

West Texas

Intermediate crude climbed for the first time in five days after

Futures

gained as much as 1.9 percent and equities surged as the Conference Board’s

index of sentiment rose to

The

confidence total from the Conference Board, a New York-based private research

group, exceeded the highest estimate in a survey of economists. The median

forecast called for an increase to 71.2.

The

S&P/Case-Shiller housing index was projected to show a 10.2 percent

advance, according to the median forecast of 30 economists.

WTI crude

for July delivery rose $1.20, or 1.3 percent, to $95.35 a barrel at 11:03 a.m.

on the New York Mercantile Exchange. The volume of all contracts traded was 5.4

percent above the 100-day average for this time of day. Floor trading was

closed yesterday because of the Memorial Day holiday, and yesterday’s

electronic transactions will be booked with today’s trades for settlement

purposes.

Brent oil

for July settlement increased $1.68, or 1.6 percent, to $104.30 a barrel on the

ICE Futures Europe exchange. Volume for all contracts was 20 percent lower than

the 100-day average. The European benchmark grade traded at an $8.95 premium to

WTI.

The value of gold decreases,

while the U.S. dollar exchange rate shows growth after strong

consumer confidence data in the U.S..

According to the Conference Board, in May, the index of U.S. consumer confidence improved to 76.2 against 69 the previous month. Analysts had expected the result at 70.7.

At the same time, as shown by the results of recent studies, which were presented to the Federal Reserve Bank of Richmond, in the current month's index of manufacturing activity for the Richmond region increased slightly, but still remained below the zero mark. According to the report, in May, the index of manufacturing activity from the Federal Reserve Bank of Richmond rose to the level -2, from -6 in the previous month. It is worth noting that, according to the average forecast of most experts, the value of this index was to increase to +2. Recall that the index value below 0 indicates decreased activity, while rising above a given level involves increasing activity.

The cost of the June gold futures on COMEX today dropped to 1372.10 dollars an ounce.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.