- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: raw news — 30-10-2012.

Oil rose from the lowest level in almost four months in New York on speculation that demand will soon rebound after Atlantic superstorm Sandy made landfall on the U.S. East Coast.

Futures climbed as much as 0.8 percent after the storm came ashore in southern New Jersey at 8 p.m. local time yesterday and drove floodwaters to life-threatening levels in a region with 60 million residents. Phillips 66 (PSX), Hess Corp. (HES), NuStar Energy LP (NS) and PBF Energy Inc. (PBF) reduced refinery operations on the U.S. East Coast because of Sandy.

Six refineries curbed production because of Sandy, accounting for 1.22 million barrels of the area’s crude- processing capacity of 1.29 million barrels a day, according to data. The storm may cut East Coast gasoline supplies to the lowest level since at least 1990, based on Energy Department data.

Crude oil for December delivery rose to $86.24 a barrel on the New York Mercantile Exchange. The contract settled at $85.54 yesterday, the lowest since July 10. Prices are down 13 percent this year.

Brent oil for December settlement slipped 24 cents to $109.20 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude premium to West Texas Intermediate contract narrowed to $23.25. The spread widened for a sixth day yesterday to $23.90.

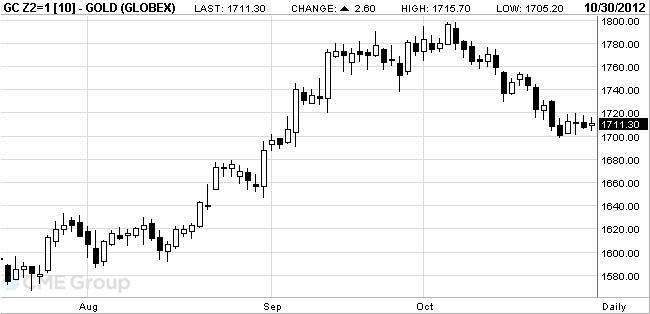

Gold is slightly more expensive due to the weaker dollar, but holding back growth expectations employment report in the U.S..

According to analysts, the number of jobs in the U.S. in September grew by 125,000 and the unemployment rate rose to 7.9 percent from 7.8 percent in August. Rising unemployment is cause for optimism for the gold, because it increases the likelihood of further stimulus measures.

The Bank of Japan on Tuesday expanded the program of buying up assets and lending by 11 trillion yen to 91 trillion yen, and launched a program of unlimited long-term loans to banks at low rates. According to experts, the actions of the central bank, as any incentives, support gold, though not unexpected.

Importers of gold in India - the world's largest consumer of the precious metal - increase purchases in November, on the eve of the upcoming Hindu festival of light Diwali and on the background of wedding season.

December futures price of gold on COMEX today rose to 1715.70 dollars an ounce and is now trading at 1711.30 dollars per ounce.

Change % Change Last

Gold 1,710 -2 -0.11%

Oil 85.29 -0.99 -1.15%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.