- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 02-06-2015.

(index / closing price / change items /% change)

Nikkei 225 20,543.19 -26.68 -0.13 %

Hang Seng 27,466.72 -130.44 -0.47 %

S&P/ASX 200 5,636 -99.39 -1.73 %

Shanghai Composite 4,911.57 +82.84 +1.72 %

FTSE 100 6,928.27 -25.31 -0.36 %

CAC 40 5,004.46 -20.84 -0.41 %

Xetra DAX 11,328.8 -107.25 -0.94 %

S&P 500 2,109.6 -2.13 -0.10 %

NASDAQ Composite 5,076.52 -6.40 -0.13 %

Dow Jones 18,011.94 -28.43 -0.16 %

U.S. stocks ended Tuesday slightly lower, as earlier gains faded by the end of the trading session. Investors remained cautious ahead of the important jobs report on Friday and a looming deadline for Greece and its lenders to find a solution to the debt crisis.

Treasury notes fell, pushing yields higher, on signs that global inflation may be rising from a low level. A report from Europe showed that consumer prices are rising there for the first time in six months.

Utilities led the declines as bond yields rose. The energy sector gained as oil prices climbed.

Сomponents of The Dow Jones Industrial Average closed mixed. Intel Corporation (INTC, -2.03%) was an outsider. The Boeing Company (BA, +1.40%) rose more than other.

Sectors of the S&P showed mixed dinamics too. Basic Materials grew more than other (+1.2%). Utilities fell 1.1%.

At the close:

Dow -0.16% 18,011.84 -28.53

Nasdaq -0.13% 5,076.53 -6.40

S&P -0.10% 2,109.59 -2.14

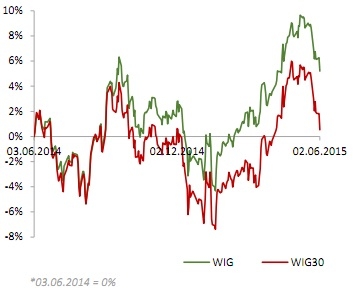

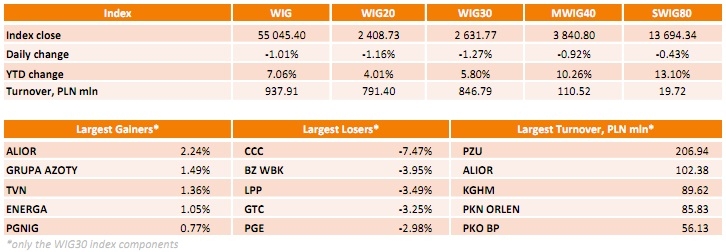

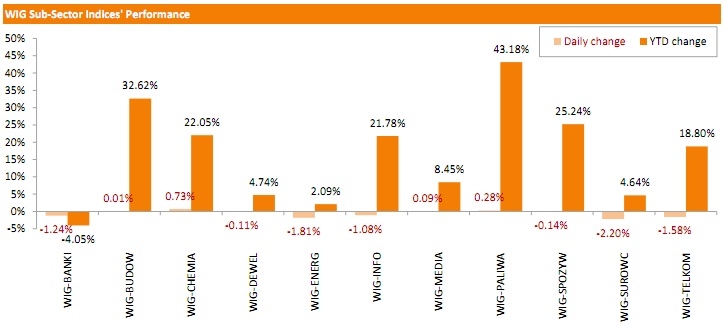

Polish equity market declined on Tuesday. The broad market benchmark - the WIG index went down by 1.01%. Most of the sectors recorded losses, with materials (-2.20%), utilities (-1.81%) and telecommunications (-1.58%) lagging behind. At the same time, chemicals sector (+0.73%) appeared to be the strongest group.

The large-cap stock universe's measure - the WIG30 index posted a 1.27% drop. CCC (WSE: CCC) led the decliners, losing 7.47% on the announcement the company's major shareholder agreed to sell a 7.8-percent stake in the company at PLN 170 per share, representing a discount of 8.6% to the Monday market value. BZ WBK (WSE: BZW) and GTC (WSE: GTC) corrected down by 3.95% and 3.25% respectively after yesterday's growth. Besides, LPP (WSE: LPP) extended its losses by 3.49% despite releasing positive outlook for the second half of 2015. On the contrary, ALIOR (WSE: ALR) was the biggest advancer, posting a 2.24% growth. It was followed by GRUPA AZOTY (WSE: ATT), TVN (WSE: TVN) and ENERGA (WSE: ENG), gaining 1.49%, 1.36% and 1.05% respectively.

Major U.S. stock-indexes slightly rose on Tuesday, paring some of their losses earlier in the session because weak factory orders data fell. New orders for U.S. factory goods unexpectedly fell in April as demand for transportation equipment and other goods weakened, suggesting that manufacturing remained constrained by a strong dollar and spending cuts in the energy sector. The data is the latest that shows the economy might not be rebounding strongly enough in the second quarter, after a first-quarter slump, to permit a rate hike earlier rather than later in the year.

Most of Dow stocks in positive area (18 of 30). Top looser - Intel Corporation (INTC, -1.74%). Top gainer - The Boeing Company (BA, +1.86%).

Most of S&P index sectors also in positive area. Top gainer - Basic Materials (+1,3%). Top looser - Utilities (-1.3%).

At the moment:

Dow 18045.00 +22.00 +0.12%

S&P 500 2111.50 +2.25 +0.11%

Nasdaq 100 4519.00 -2.50 -0.06%

10-year yield 2.27% +0.08

Oil 61.08 +0.88 +1.46%

Gold 1192.60 +3.90 +0.33%

Stock indices closed lower as the Greek debt problem weighed on markets. The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that the progress in debt talks between Greece and its creditors would not be enough to sign an agreement this week.

"As long as it doesn't meet economic conditions, we can't come to an agreement. It's not right to think that we can meet half way," he noted.

Dijsselbloem believes that a deal between Greece and its creditors could be reached.

Earlier, Greek Prime Minister Alexis Tsipras said that the government had submitted realistic proposals to its lenders. He added that the decision rests on the European Union's leaders.

In total, Athens has to repay almost €1.6 billion in June, starting with repayment of €300 million on Friday.

The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April. April's figure was revised up from a 8,000 fall.

The number of unemployed people in Germany was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in new orders, which grew for the first time in three months.

Residential building activity rose in May, commercial construction slowed to the lowest level since August 2013, while civil engineering work grew.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,928.27 -25.31 -0.36 %

DAX 11,328.8 -107.25 -0.94 %

CAC 40 5,004.46 -20.84 -0.41 %

The Bank of Japan (BoE) Governor Haruhiko Kuroda said after his meeting with Japanese Prime Minister Shinzo Abe that the exchange rate should be stable and should reflect the economic fundamentals.

He declined to comment the recent movement of the yen.

Kuroda also said that the central bank's monetary policy is targeted at price stability, not at directly weakening the yen.

The U.S. Commerce Department released factory orders data on Tuesday. Factory orders in the U.S. declined 0.4% in April, missing expectations for a flat reading, after a 2.2% gain in March. March's figure was revised up from a 2.1% rise.

The drop was driven by lower orders for durable goods, which declined by 1.0% in April.

Non-durable goods orders were up 0.2% in April.

Orders for transportation equipment plunged by 2.4% in April, after a 15.1% rise in March.

Federal Reserve Governor Lael Brainard said in Washington on Tuesday that there are no signs of a significant bounce-back in the U.S. economy in the second quarter. She added that it might better to delay the interest rate hike. But the Fed governor did not rule out the interest rate hike this year.

"If continued labor market strengthening is confirmed and inflation readings continue to improve, liftoff could come before the end of the year," she said.

Brainard noted that she was concerned that the recent economic weakness might be not entirely transitory.

Brainard is a voting member of the Federal Open Market Committee this year.

Greek Prime Minister Alexis Tsipras said on Tuesday morning that the government had submitted realistic proposals to its lenders. He added that the decision rests on the European Union's leaders.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that the progress in debt talks between Greece and its creditors would not be enough to sign an agreement this week.

"As long as it doesn't meet economic conditions, we can't come to an agreement. It's not right to think that we can meet half way," he noted.

Dijsselbloem believes that a deal between Greece and its creditors could be reached.

The European Union's economics commissioner Pierre Moscovici said on Tuesday that there is "real progress" in debt talks between Greece and its creditors, but it is not enough to reach a deal.

"These discussions are beginning to bear fruit, I think that there is real progress, a better understanding between the Greek government and its creditors. There are solid foundations for progress to be made, but we're not there yet," he noted.

U.S. stock-index futures fell as investors weighed the possibility of progress in Greece's debt talks before data on factory orders.

Global markets:

FTSE 6,947.5 -6.08 -0.09%

CAC 5,025.51 +0.21 0.00%

DAX 11,366.59 -69.46 -0.61%

Nikkei 20,543.19 -26.68 -0.13%

Hang Seng 27,466.72 -130.44 -0.47%

Shanghai Composite 4,911.57 +82.84 +1.72%

Crude oil $60.57 (+0.63%)

Gold $1190.90 (+0.19%)

Eurostat released its producer price index for the Eurozone on Tuesday. Eurozone's producer price index declined 0.1% in April, missing expectations for a 0.1% increase, after a 0.2% rise in March.

On a yearly basis, Eurozone's producer price index dropped 2.2% in April, missing expectations for a 2.0% decrease, after a 2.3% decline in March.

Eurozone's producer prices excluding energy fell 0.5% year-on-year in April. Energy prices dropped 6.4%.

Intermediate goods prices declined 1% in April, non-durable consumer goods prices decreased by 1.1%, and capital goods prices rose 0.85%, while durable consumer goods prices climbed 0.9%.

(company / ticker / price / change, % / volume)

| Ford Motor Co. | F | 15.37 | +0.07% | 1.7K |

| Exxon Mobil Corp | XOM | 85.20 | +0.08% | 4.5K |

| Chevron Corp | CVX | 102.85 | +0.21% | 2.6K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 19.39 | +0.21% | 4.7K |

| AMERICAN INTERNATIONAL GROUP | AIG | 58.98 | +0.51% | 3.0K |

| 3M Co | MMM | 158.98 | 0.00% | 0.2K |

| Microsoft Corp | MSFT | 47.23 | 0.00% | 4.4K |

| Verizon Communications Inc | VZ | 49.22 | 0.00% | 46.5K |

| Walt Disney Co | DIS | 110.96 | 0.00% | 1.3K |

| Deere & Company, NYSE | DE | 92.64 | 0.00% | 8.0K |

| Yahoo! Inc., NASDAQ | YHOO | 43.35 | 0.00% | 1.9K |

| Wal-Mart Stores Inc | WMT | 74.71 | -0.03% | 19.0K |

| Starbucks Corporation, NASDAQ | SBUX | 52.20 | -0.04% | 0.3K |

| Boeing Co | BA | 141.13 | -0.08% | 0.7K |

| Barrick Gold Corporation, NYSE | ABX | 11.81 | -0.08% | 1.6K |

| General Motors Company, NYSE | GM | 36.15 | -0.08% | 29.6K |

| Cisco Systems Inc | CSCO | 29.15 | -0.10% | 2.7K |

| Johnson & Johnson | JNJ | 99.94 | -0.10% | 39.0K |

| JPMorgan Chase and Co | JPM | 66.00 | -0.12% | 2.7K |

| The Coca-Cola Co | KO | 40.89 | -0.12% | 40.2K |

| Procter & Gamble Co | PG | 78.75 | -0.13% | 1.3K |

| Twitter, Inc., NYSE | TWTR | 36.58 | -0.14% | 25.8K |

| Goldman Sachs | GS | 207.50 | -0.15% | 0.3K |

| AT&T Inc | T | 34.30 | -0.15% | 9.3K |

| Visa | V | 69.00 | -0.16% | 16.5K |

| International Business Machines Co... | IBM | 169.91 | -0.16% | 6.6K |

| Apple Inc. | AAPL | 130.32 | -0.16% | 213.5K |

| Pfizer Inc | PFE | 34.50 | -0.17% | 2.0K |

| General Electric Co | GE | 27.23 | -0.18% | 0.9K |

| Hewlett-Packard Co. | HPQ | 33.70 | -0.18% | 8.4K |

| E. I. du Pont de Nemours and Co | DD | 71.50 | -0.20% | 0.1K |

| Home Depot Inc | HD | 110.86 | -0.20% | 1.3K |

| Citigroup Inc., NYSE | C | 54.34 | -0.20% | 52.7K |

| Merck & Co Inc | MRK | 60.60 | -0.25% | 0.8K |

| Google Inc. | GOOG | 532.68 | -0.25% | 0.2K |

| Facebook, Inc. | FB | 80.07 | -0.27% | 27.8K |

| Amazon.com Inc., NASDAQ | AMZN | 429.70 | -0.28% | 2.8K |

| American Express Co | AXP | 79.20 | -0.34% | 0.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 248.60 | -0.34% | 18.1K |

| McDonald's Corp | MCD | 95.84 | -0.39% | 1.3K |

| ALTRIA GROUP INC. | MO | 51.00 | -0.39% | 0.2K |

| Caterpillar Inc | CAT | 85.06 | -0.55% | 1.7K |

| ALCOA INC. | AA | 12.33 | -0.72% | 3.2K |

| Intel Corp | INTC | 33.65 | -0.75% | 60.5K |

Upgrades:

Downgrades:

Other:

American Intl (AIG) initiated at Overweight at Piper Jaffray

Markit Economics released its manufacturing purchasing managers' index (PMI) for Greece on Tuesday. The Greek manufacturing PMI climbed to 48.0 in May from 46.5 in April.

A reading below 50 indicates a contraction in the sector.

The PMI remained below 50 due to lower output and new orders.

The Reserve Bank of Australia (RBA) kept unchanged its interest rate at 2.00% on Tuesday. This decision was expected by analysts.

The RBA said that the decision was appropriate after the interest rate cut in June.

The central bank noted that the Australian dollar declined against a US dollar and against a basket of currencies, and the further interest rate cut is "both likely and necessary" as the Australian dollar fell due to lower key commodity prices.

The RBA also said that global economy grew moderately, and "global financial conditions remain very accommodative."

The RBA cut its interest rate to 2.00% from 2.25% in May.

Stock indices traded lower on the Greek debt problem. The European Union's economics chief said on Tuesday that the Greek government has put forward first proposals for pension reform.

The news agency Dow Jones reported yesterday that Greece's creditors are preparing the final proposal. Negotiations on this issue were held between Angela Merkel, Francois Hollande, Christine Lagarde and Mario Draghi late Monday. Details of the talks were not disclosed.

In total, Athens has to repay almost €1.6 billion in June, starting with repayment of €300 million on Friday.

The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April. April's figure was revised up from a 8,000 fall.

The number of unemployed people in Germany was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in new orders, which grew for the first time in three months.

Residential building activity rose in May, commercial construction slowed to the lowest level since August 2013, while civil engineering work grew.

Current figures:

Name Price Change Change %

FTSE 100 6,897.15 -56.43 -0.81 %

DAX 11,340.02 -96.03 -0.84 %

CAC 40 4,999.42 -25.88 -0.51 %

Markit's and the Chartered Institute of Purchasing & Supply's construction purchasing managers' index (PMI) for the U.K. increased to 55.9 in May from 54.2 in April, exceeding expectations for a rise to 55.0.

A reading above 50 indicates expansion in the construction sector.

The increase was driven by a rise in new orders, which grew for the first time in three months.

Residential building activity rose in May, commercial construction slowed to the lowest level since August 2013, while civil engineering work grew.

Eurostat released its consumer price inflation data for the Eurozone on Tuesday. The preliminary consumer price inflation in the Eurozone rose to an annual rate of 0.3% in May from 0.0% in April, exceeding expectations for a 0.2% gain. It was the first positive reading since November 2014.

The increase was driven by ECB's quantitative easing programme.

The preliminary consumer price inflation excluding food, energy, alcohol, and tobacco increased to an annual rate of 0.9% in May from 0.6% in April, beating expectations for a decline to 0.1%.

Food, alcohol and tobacco prices were up 1.2% in May, non-energy industrial goods prices gained 0.3%, and services prices climbed 1.3%, while energy prices dropped 5.0%.

The Bank of England (BoE) released its number of mortgages approvals for the U.K. on Tuesday. The number of mortgages approvals in the U.K. rose to 68,076 in April from 61,945 in March, exceeding expectations for an increase to 63,000. It was the highest level since February2014 and the biggest monthly rise since February 2009.

The reading indicates a bounce-back in the U.K. housing market after the BoE introduced new controls on mortgage lending.

Consumer credit in the U.K. climbed by £1.173 billion in April, after a rise by £1.294 billion in March.

Net lending to individuals in the U.K. increased by £2.9 billion in April, after a £3.3 billion gain in March.

Fed Vice Chairman Stanley Fischer said on Monday that he does not see "a major financial crisis on the horizon".

He noted that central banks should not rule out using interest rates to fight financial instability.

"Most central bankers say they would prefer to use macroprudential tools rather than the interest rate" to maintain financial stability. It is not clear that there are sufficiently strong macroprudential tools to deal with all financial instability problems, and it would make sense not to rule out the possible use of the interest rate for this purpose, particularly when other tools appear to be lacking," the Fed vice chairman said.

Fischer pointed out that banks pushed back against regulations.

"Regulations have been strengthened and the bankers' backlash is both evident and making headway. Often when bankers complain about regulations, they give the impression that financial crises are now a thing of the past, and furthermore in many cases, that they played no role in the previous crisis," he said.

The Fed vice chairman warned that it is a mistake to believe that the financial crisis is over.

Destatis released its unemployment figures for Germany on Tuesday. The number of unemployed people in Germany declined by 6,000 in May, missing expectations for a 10,000 decline, after a 9,000 drop in April.

April's figure was revised up from a 8,000 fall.

The number of unemployed people was 2.786 million in May, the lowest level since December 1991.

Germany's adjusted unemployment rate remained unchanged at 6.4% in May, in line with expectations.

Franklin Templeton Investments' survey showed that most respondents said that equities will be the riskiest asset class this year. 35% of respondents have seen equities as the riskiest asset class, followed by the euro (34%) and non-metal commodities (32%).

On the other hand, 59% of respondents said that stocks would be the most lucrative investment this year, followed by real estate (55&) and precious metals (39%).

32% of respondents said that they plan to increase their exposure to stocks in 2015, while 14% of respondents plan to reduce it.

38% of respondents were concerned over the global economy, followed by concerns over government fiscal policy and the debt crisis in the Eurozone (both 32%).

Franklin Templeton Investments interviewed over 11,500 investors in 23 countries across the Americas, Africa, Asia Pacific and Europe.

The French labour ministry release its labour market figures on Monday. The number of unemployed people rose 0.7% to total 3.536 million in April.

The unemployment in France increased despite the fastest economic growth rate in two years in the first three months of 2015.

"We will need a few months before the economic pick-up translates into jobs," the labour ministry said.

The Australian Bureau of Statistics released its current account data on Tuesday. Australia's current account deficit widened to A$10.7 billion in the first quarter from a deficit of A$10.2 billion in the fourth quarter, beating expectations for a rise to a deficit of A$10.8 billion.

The fourth quarter's figure was revised down from a deficit of A$9.6 billion.

Net exports of GDP rose 0.5% in the first quarter, after a 0.7% increase in the fourth quarter.

The balance on goods and services plunged 37% to a deficit of A$3.701 billion.

Net foreign equity dropped 26% to a deficit of A$76.296 billion, while net foreign debt increased 3% to a surplus of A$954.672 billion.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.