- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 03-06-2014.

Nikkei 15,034.25 +98.33 +0.66%

Hang Seng 23,291.04 +209.39 +0.91%

Shanghai Composite 2,038.31 -0.91 -0.04%

S&P 1,924.24 -0.73 -0.04%

NASDAQ 4,234.08 -3.12 -0.07%

Dow 16,722.34 -21.29 -0.13%

FTSE 1,374.78 -5.68 -0.41%

CAC 4,503.69 -12.20 -0.27%

DAX 9,919.74 -30.38 -0.31%

Stock

indices declined due to the weaker-than-expected inflation data in the Eurozone

and increasing expectations for further stimulus measures by the European

Central Bank (ECB). Eurozone’s inflation increased 0.5% in May, after a 0.7%

gain in March. Analysts had expected a 0.7% rise. Inflation target by the

European Central Bank (ECB) is 2%.

Investors

are awaiting the ECB will cut interest rates and announce measures to boost

lending to smaller businesses.

The

unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March.

Analysts had expected the unemployment rate remains unchanged.

The number

of unemployed people in Spain decreased by 111,900 in May, after a 111,600

decline in April. Analysts had forecasted a 112,300 drop.

Indexes on

the close:

Name Price Change Change %

FTSE

100 6,836.30 -27.80 -0.41%

DAX 9,919.74 -30.38 -0.31%

CAC 40 4,503.69 -12.20 -0.27%

U.S. stock-index futures are mixed as investors awaited data to gauge the strength of the recovery in the world’s biggest economy.

Global markets:

Nikkei 15,034.25 +98.33 +0.66%

Hang Seng 23,291.04 +209.39 +0.91%

Shanghai Composite 2,038.31 -0.91 -0.04%

FTSE 6,818.12 -45.98 -0.67%

CAC 4,501.59 -14.30 -0.32%

DAX 9,907.33 -42.79 -0.43%

Crude oil $102.51 (+0.04%)

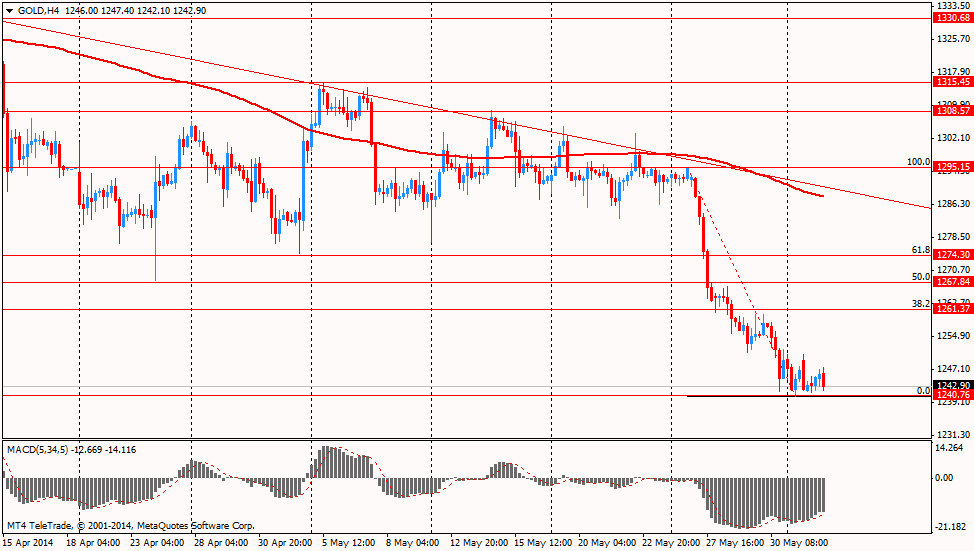

Gold $1245.20 (+0.09%)

(company / ticker / price / change, % / volume)

Nike | NKE | 76.90 | +0.23% | 0.6K |

United Technologies Corp | UTX | 117.68 | +0.24% | 4.0K |

Travelers Companies Inc | TRV | 94.38 | +0.71% | 0.1K |

Chevron Corp | CVX | 122.21 | 0.00% | 0.1K |

Home Depot Inc | HD | 80.37 | 0.00% | 0.1K |

Pfizer Inc | PFE | 29.70 | -0.03% | 0.7K |

Walt Disney Co | DIS | 84.23 | -0.05% | 0.1K |

Boeing Co | BA | 135.78 | -0.09% | 0.1K |

International Business Machines Co... | IBM | 185.45 | -0.13% | 0.5K |

Microsoft Corp | MSFT | 40.71 | -0.20% | 1.6K |

3M Co | MMM | 142.00 | -0.22% | 0.1K |

Exxon Mobil Corp | XOM | 99.71 | -0.23% | 1.0K |

Merck & Co Inc | MRK | 57.79 | -0.24% | 1.2K |

The Coca-Cola Co | KO | 40.76 | -0.24% | 2.3K |

Procter & Gamble Co | PG | 80.16 | -0.25% | 2.8K |

Johnson & Johnson | JNJ | 101.90 | -0.26% | 0.9K |

Goldman Sachs | GS | 159.60 | -0.27% | 1.4K |

JPMorgan Chase and Co | JPM | 55.15 | -0.36% | 0.1K |

Intel Corp | INTC | 27.16 | -0.37% | 1.2K |

Verizon Communications Inc | VZ | 49.85 | -0.40% | 42.9K |

General Electric Co | GE | 26.72 | -0.41% | 11.6K |

Cisco Systems Inc | CSCO | 24.67 | -0.44% | 0.1K |

AT&T Inc | T | 35.25 | -0.54% | 227.7K |

Caterpillar Inc | CAT | 103.15 | -0.59% | 0.8K |

Upgrades:

Downgrades:

Other:

Apple (AAPL) target raised from $660 to $710 at Canaccord Genuity

Stock

indices declined due to the weaker-than-expected inflation data in the Eurozone.

Eurozone’s inflation increased 0.5% in May, after a 0.7% gain in March.

Analysts had expected a 0.7% rise. Inflation target by the European Central

Bank (ECB) is 2%.

Market participants

expect the European Central Bank will add further stimulus measures on

Thursday. Investors are awaiting the ECB will cut interest rates and announce

measures to boost lending to smaller businesses.

The

unemployment rate in the Eurozone fell to 11.7% in April from 11.8% in March.

Analysts had expected the unemployment rate remains unchanged.

The number

of unemployed people in Spain decreased by 111,900 in May, after a 111,600 decline

in April. Analysts had forecasted a 112,300 drop.

Current

figures:

Name Price Change Change %

FTSE

100 6,831.72 -32.38 -0.47%

DAX 9,925.00 -25.12 -0.25%

CAC 40 4,509.94 -5.95 -0.13%

Most Asian

stock indices increased due to weaker yen and economic data from China. The

Japanese stock index Nikkei was supported by the weaker yen. The stock indices

in China were supported by Chinese economic data.

China’s

final HSBC manufacturing purchasing managers’ index increased to 49.4 in May from 48.1 in

April, missing expectation of a gain to 49.7.

Chinese

non-manufacturing purchasing managers’ index climbed to 55.5 in May from 54.8

in April. That was the highest figure since November 2013.

Indexes on

the close:

Nikkei

225 15,034.25 +98.33 +0.66%

Hang

Seng 23,291.04 +209.39 +0.91%

Shanghai

Composite 2,038.31 -0.91

-0.04%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.