- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 03-11-2016.

(index / closing price / change items /% change)

Nikkei 225 17,134.68 -307.72 -1.76%

Shanghai Composite 3,128.67 +25.94 +0.84%

S&P/ASX 200 5,225.55 0.00 0.00%

FTSE 100 6,790.51 -54.91 -0.80%

CAC 40 4,411.68 -2.99 -0.07%

Xetra DAX 10,325.88 -45.05 -0.43%

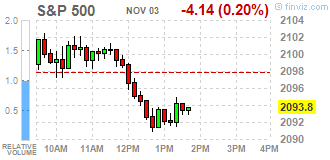

S&P 500 2,088.66 -9.28 -0.44%

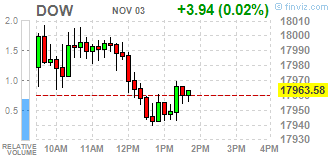

Dow Jones Industrial Average 17,930.67 -28.97 -0.16%

S&P/TSX Composite 14,583.42 -11.30 -0.08%

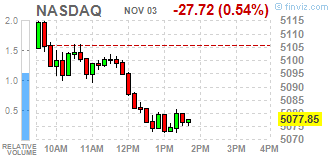

Major U.S. stock-indexes reversed course to trade lower on Thursday as concerns over the tightening race for the White House and a fall in Facebook's shares weighed on sentiment. Facebook (FB) fell as much as 5,9% to a more than three-month low of $119.61 after the social media giant warned that revenue growth would slow this quarter. The stock was the biggest drag on the S&P and the Nasdaq.

Most of Dow stocks in negative area (18 of 30). Top gainer - The Walt Disney Company (DIS, +1.72%). Top loser - Intel Corporation (INTC, -1.68%).

Almost all S&P sectors also in negative area. Top gainer - Utilities (+0.7%). Top loser - Conglomerates (-1.1%).

At the moment:

Dow 17878.00 -3.00 -0.02%

S&P 500 2088.25 -4.00 -0.19%

Nasdaq 100 4691.75 -25.00 -0.53%

Oil 44.51 -0.83 -1.83%

Gold 1303.40 -4.80 -0.37%

U.S. 10yr 1.82 +0.02

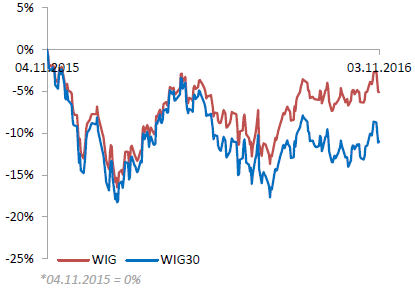

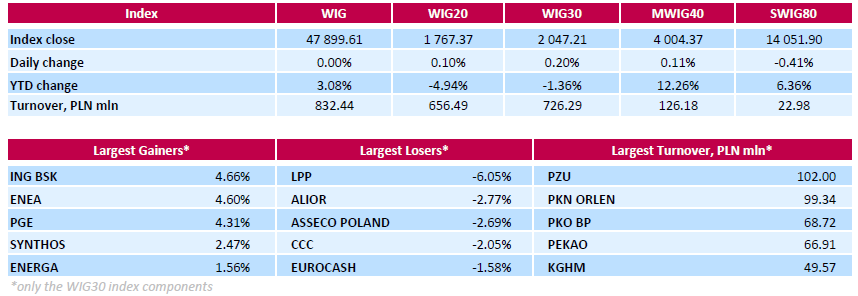

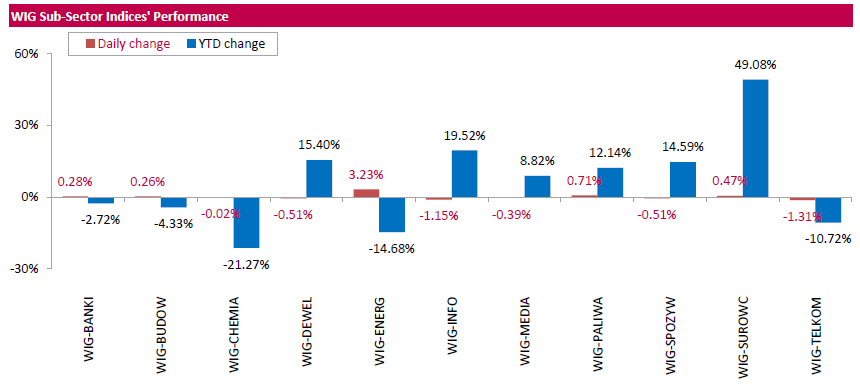

Polish equity market closed flat on Thursday, as measured by the WIG Index. Sector performance within the WIG Index was mixed. Telecoms (-1.31%) tumbled the most, while utilities (+3.23%) fared the best.

The large-cap companies' measure, the WIG30 Index, added 0.2%. In the index basket, bank ING BSK (WSE: ING) and genco ENEA (WSE: ENA) topped the list of advancers, jumping by 4.66% and 4.6% respectively, supported by stronger-than-expected Q3 financials. ING BSK reported net profit of PLN 0.332 bln versus analysts' consensus estimate of PLN 0.284 bln. ENEA posted net profit of PLN 0.249 bln versus analysts' consensus estimate of PLN 0.196 bln and net revenues of PLN 2.705 bln versus analysts' consensus estimate of PLN 2.603 bln. Other major gainers were chemical producer SYNTHOS (WSE: SNS) and three utilities names PGE (WSE: PGE), TAURON PE (WSE: TPE) and ENERGA (WSE: ENG), which rose by 1.16%-4.31%. At the same time, clothing retailer LPP (WSE: LPP) recorded the biggest drop, retreating by 6.05% after four consecutive sessions of growth. It was followed by bank ALIOR (WSE: ALR), IT-company ASSECO POLAND (WSE: ACP) and footwear retailer CCC (WSE: CCC), which fell by 2.05%-2.77%.

U.S. stock-index futures advanced as as oil prices rebounded.

Global Stocks:

Nikkei Closed

Hang Seng 22,683.51 -126.99 -0.56%

Shanghai 3,128.67 +25.94 +0.84%

FTSE 6,820.57 -24.85 -0.36%

CAC 4,443.47 +28.80 +0.65%

DAX 10,389.06 +18.13 +0.17%

Crude $45.67 (+0.73%)

Gold $1,292.60 (-1.19%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 22.62 | -0.29(-1.2658%) | 511 |

| Amazon.com Inc., NASDAQ | AMZN | 767 | 1.44(0.1881%) | 36694 |

| Apple Inc. | AAPL | 110.92 | -0.10(-0.0901%) | 71643 |

| AT&T Inc | T | 36.38 | 0.01(0.0275%) | 7889 |

| Boeing Co | BA | 141.88 | 1.13(0.8028%) | 555 |

| Cisco Systems Inc | CSCO | 30.42 | 0.03(0.0987%) | 747 |

| Citigroup Inc., NYSE | C | 48.6 | 0.22(0.4547%) | 10428 |

| Facebook, Inc. | FB | 121.57 | -5.60(-4.4036%) | 2911626 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.74 | 0.12(1.1299%) | 55275 |

| Goldman Sachs | GS | 176.07 | -0.51(-0.2888%) | 730 |

| Google Inc. | GOOG | 767.07 | -1.63(-0.212%) | 10525 |

| JPMorgan Chase and Co | JPM | 68.97 | 0.29(0.4222%) | 909 |

| McDonald's Corp | MCD | 112.16 | -0.23(-0.2046%) | 401 |

| Microsoft Corp | MSFT | 59.45 | 0.02(0.0337%) | 14031 |

| Nike | NKE | 49.82 | 0.10(0.2011%) | 1189 |

| Pfizer Inc | PFE | 30.71 | 0.08(0.2612%) | 1013 |

| Starbucks Corporation, NASDAQ | SBUX | 53.05 | 0.07(0.1321%) | 3753 |

| Tesla Motors, Inc., NASDAQ | TSLA | 188.23 | 0.21(0.1117%) | 13258 |

| Twitter, Inc., NYSE | TWTR | 17.52 | -0.09(-0.5111%) | 53597 |

| United Technologies Corp | UTX | 101.5 | -0.04(-0.0394%) | 100 |

| Verizon Communications Inc | VZ | 47.12 | 0.18(0.3835%) | 1382 |

| Yahoo! Inc., NASDAQ | YHOO | 40.43 | -0.25(-0.6146%) | 6475 |

| Yandex N.V., NASDAQ | YNDX | 19.01 | 0.32(1.7121%) | 2814 |

Upgrades:

Downgrades:

Other:

Facebook (FB) target lowered to $146 from $150 at Mizuho

Facebook (FB) target raised to $160 from $155 at Axiom Capital

Facebook reported Q3 FY 2016 earnings of $1.09 per share (versus $0.57 in Q3 FY 2015), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $7.011 bln (+55.8% y/y), beating analysts' consensus estimate of $6.920 bln.

FB fell to $121.45 (-4.50%). in pre-market trading.

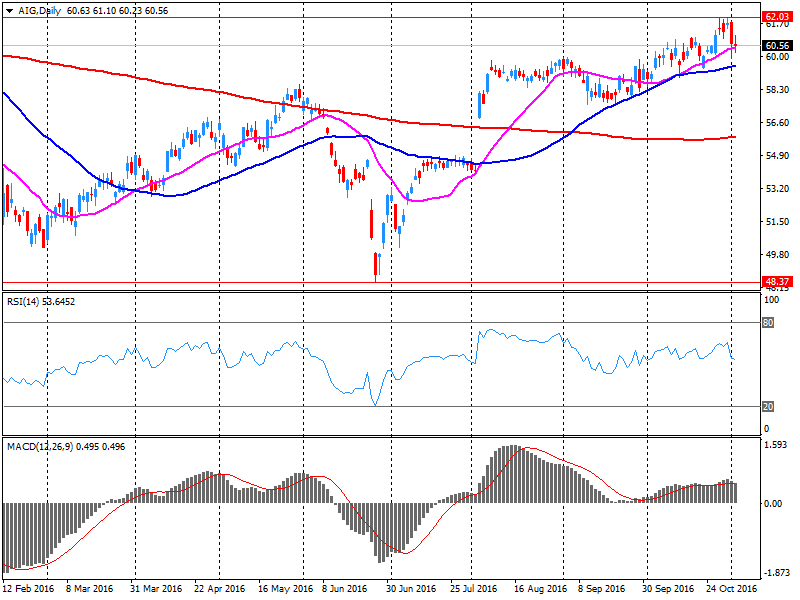

American Intl reported Q3 FY 2016 earnings of $1.23 per share (versus $0.52 in Q3 FY 2015), beating analysts' consensus estimate of $1.20.

In addition, the company announced its Board of Directors authorized an additional increase to its previous repurchase authorization of AIG common stock of $3.0 bln, resulting in an aggregate remaining authorization on such date of approximately $4.4 bln. AIG's Board of Directors also declared a cash dividend on AIG Common Stock of $0.32 per share, payable on December 22, 2016 to shareholders of record on December 8, 2016.

AIG closed Wednesday's trading session at $60.55 (-0.21%).

European stocks ended sharply lower on Tuesday, as several major companies turned in disappointing financial results and as investors fretted over the U.S. presidential election. "An initial boost from positive Chinese economic data fizzled out on Tuesday as attention turned to the rising possibility of a Trump presidency," said Jasper Lawler, market analyst at CMC Markets, in a note.

U.S. stocks extended losses on Wednesday, with the S&P 500 recording its longest losing streak in five years after the Federal Reserve, as expected, kept interest rates unchanged.

Asian markets edged up Thursday as Chinese and Australian markets were lifted by positive economic news. However, uncertainty about the outcome about the U.S. presidential race continues to keep traders on edge in Asia. Activity in China's service sector expanded at a faster pace in October, a private gauge showed Thursday, adding to recent signs of firmness in China's economy. The Caixin China services purchasing managers index rose to 52.4 in October from 52.0 in September.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.