- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 04-03-2016.

Stock indices closed higher after the release of the U.S. labour market data later in the day. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs.

The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services.

The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations.

Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

Higher oil prices also supported stock markets.

No major economic reports from the Eurozone were released today.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,199.43 +68.97 +1.13 %

DAX 9,824.17 +72.25 +0.74 %

CAC 40 4,456.62 +40.54 +0.92 %

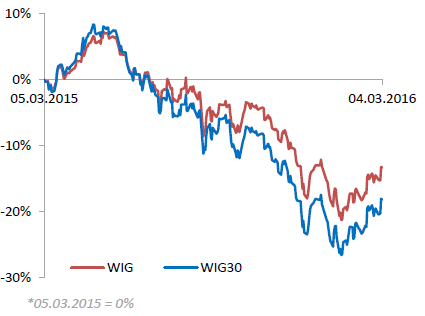

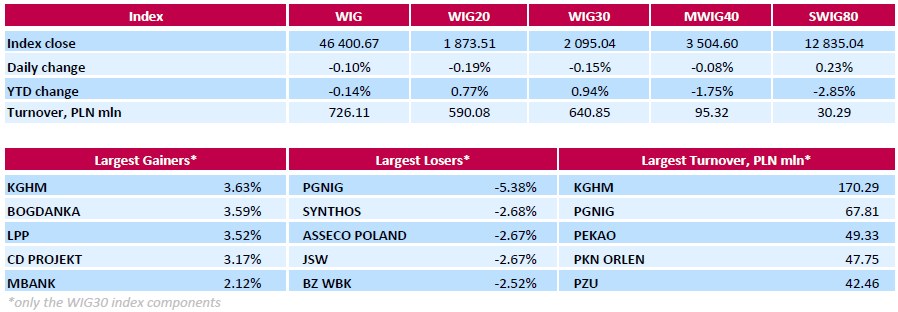

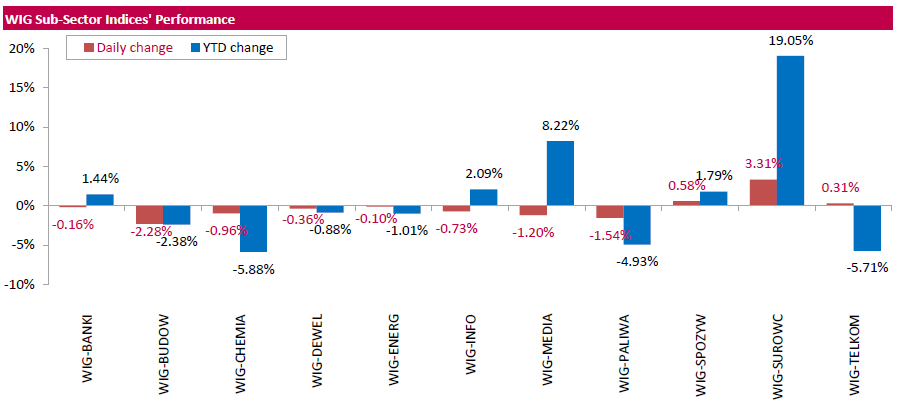

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, edged down 0.1%. Sector performance within the WIG Index was mixed. Materials sector (+3.31%) was the strongest group, while construction sector (-2.28%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 0.15%. The decliners were led by oil and gas producer PGNIG (WSE: PGN), which went down 5.38%. It was followed by chemical producer SYNTHOS (WSE: SNS), coking coal producer JSW (WSE: JSW), IT-company ASSECO POLAND (WSE: ACP) and bank BZ WBK (WSE: BZW), which lost between 2.52% and 2.68%. At the same time, copper producer KGHM (WSE: KGH) recorded the strongest daily result, climbing by 3.63%. Other major gainers were thermal coal miner BOGDANKA (WSE: LWB), clothing retailer LPP (WSE: LPP) and videogame developer CD PROJEKT (WSE: CDR), advancing by 3.59%, 3.52% and 3.17% respectively.

Major U.S. stock-indexes higher in choppy trading on Friday as data showing the economy added more jobs than expected last month was tempered by a drop in wages and hours worked. Nonfarm payrolls increased by a 242,000 jobs last month, the Labor Department said on Friday. However, wages and hours worked fell, keeping a lid on inflation, a key factor in the Federal Reserve's decision to raise rates.

Most of Dow stocks in positive area (20 of 30). Top looser - Pfizer Inc. (PFE, -0,94%). Top gainer - Caterpillar Inc. (CAT, +2,44%).

All S&P sectors in positive area. Top gainer - Basic Materials (+2,5%).

At the moment:

Dow 16977.00 +58.00 +0.34%

S&P 500 1997.75 +7.25 +0.36%

Nasdaq 100 4326.00 +5.75 +0.13%

Oil 35.59 +1.02 +2.95%

Gold 1274.90 +16.70 +1.33%

U.S. 10yr 1.90 +0.06

Canada's seasonally adjusted Ivey purchasing managers' index dropped to 53.4 in February from 66.0 in January. Analysts had expected the index to decline to 59.0.

A reading above 50 indicates a rise in the pace of activity, below 50 indicates a contraction in the pace of activity.

The supplier deliveries index was down to 49.4 in February from 51.1 in January, while employment index fell to 50.3 in 55.1.

The prices index was slid to 57.8 in February from 71.6 in January, while inventories plunged to 49.9 from 61.4.

Statistics Canada released labour productivity data of Canadian businesses on Friday. The labour productivity of Canadian businesses rose by 0.1% in the fourth quarter, exceeding expectations for a flat reading, after a 0.4% rise in the third quarter. The third quarter's figure was revised up from a 0.1% gain.

The increase was driven by a rise in productivity of service-producing businesses, which was up 0.4% in the fourth quarter.

Productivity of goods-producing businesses fell 0.6%.

For 2015 as a whole, the labour productivity in Canadian businesses climbed by 0.2%, after a 2.5% rise in 2014.

The U.S. Commerce Department released the trade data on Friday. The U.S. trade deficit widened to $45.68 billion in January from a deficit of $44.7 billion in December. December's figure was revised down from a deficit of $43.36 billion.

Analysts had expected a trade deficit of $44.0 billion.

The rise of a deficit was driven by a drop in exports. A stronger U.S. dollar and a weak demand abroad weighed on exports.

Exports fell by 2.1% in January, while imports decreased by 1.3%.

The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 242,000 jobs in February, exceeding expectations for a rise of 190,000 jobs, after a gain of 172,000 jobs in January. January's figure was revised up from a rise of 151,000 jobs.

The increase was driven by rises in health care and social assistance, retail trade, food services and drinking places, and private educational services.

The services sector added 245,000 jobs in February, while the manufacturing sector shed 16,000 jobs.

Construction added 19,000 in February, while mining sector shed 18,000 jobs.

The U.S. unemployment rate remained unchanged at 4.9% in February, the lowest level since February 2008, in line with expectations.

Average hourly earnings dropped 0.1% in February, missing forecasts of a 0.2% gain, after a 0.5% rise in January.

The labour-force participation rate increased to 62.9% in February from 62.7% in January.

A drop in wages could lead to a delay in further interest rate hikes by the Fed.

U.S. stock-index futures rose.

Global Stocks:

Nikkei 17,014.78 +54.62 +0.32%

Hang Seng 20,176.7 +234.94 +1.18%

Shanghai Composite 2,874.06 +14.30 +0.50%

FTSE 6,188.93 +58.47 +0.95%

CAC 4,471.21 +55.13 +1.25%

DAX 9,873.83 +121.91 +1.25%

Crude oil $34.91 (+0.98%)

Gold $1257.90 (-0.02%)

(company / ticker / price / change, % / volume)

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.63 | 5.71% | 332.6K |

| Travelers Companies Inc | TRV | 112.44 | 2.40% | 0.5K |

| ALCOA INC. | AA | 9.64 | 1.80% | 22.1K |

| Twitter, Inc., NYSE | TWTR | 19.64 | 1.71% | 3.0K |

| Yandex N.V., NASDAQ | YNDX | 13.96 | 1.60% | 6.1K |

| Citigroup Inc., NYSE | C | 43.40 | 1.33% | 25.8K |

| AMERICAN INTERNATIONAL GROUP | AIG | 52.95 | 1.30% | 0.3K |

| Hewlett-Packard Co. | HPQ | 11.25 | 1.26% | 0.6K |

| Boeing Co | BA | 120.87 | 1.05% | 0.2K |

| Goldman Sachs | GS | 156.70 | 0.88% | 1.1K |

| Apple Inc. | AAPL | 102.34 | 0.83% | 78.6K |

| Visa | V | 74.50 | 0.80% | 12.0K |

| Caterpillar Inc | CAT | 72.31 | 0.78% | 0.7K |

| Ford Motor Co. | F | 13.64 | 0.74% | 0.3K |

| JPMorgan Chase and Co | JPM | 60.40 | 0.73% | 7.8K |

| Nike | NKE | 61.89 | 0.68% | 0.5K |

| American Express Co | AXP | 58.46 | 0.64% | 0.1K |

| Amazon.com Inc., NASDAQ | AMZN | 581.00 | 0.61% | 11.9K |

| General Motors Company, NYSE | GM | 31.26 | 0.61% | 5.0K |

| General Electric Co | GE | 30.40 | 0.60% | 0.3K |

| Tesla Motors, Inc., NASDAQ | TSLA | 196.86 | 0.57% | 6.0K |

| Intel Corp | INTC | 30.75 | 0.56% | 17.0K |

| Walt Disney Co | DIS | 99.32 | 0.51% | 6.4K |

| Google Inc. | GOOG | 716.00 | 0.50% | 0.3K |

| Pfizer Inc | PFE | 30.01 | 0.40% | 13.3K |

| Microsoft Corp | MSFT | 52.55 | 0.38% | 1.4K |

| Facebook, Inc. | FB | 110.00 | 0.38% | 60.0K |

| Exxon Mobil Corp | XOM | 82.68 | 0.34% | 2.8K |

| Home Depot Inc | HD | 127.23 | 0.34% | 0.2K |

| Cisco Systems Inc | CSCO | 26.96 | 0.33% | 3.8K |

| Johnson & Johnson | JNJ | 107.00 | 0.33% | 0.1K |

| McDonald's Corp | MCD | 117.05 | 0.31% | 0.1K |

| Yahoo! Inc., NASDAQ | YHOO | 32.98 | 0.30% | 1.2K |

| Starbucks Corporation, NASDAQ | SBUX | 59.20 | 0.27% | 1.2K |

| Wal-Mart Stores Inc | WMT | 66.28 | 0.21% | 21.5K |

| The Coca-Cola Co | KO | 44.05 | 0.20% | 0.8K |

| Procter & Gamble Co | PG | 83.00 | 0.19% | 4.5K |

| International Business Machines Co... | IBM | 138.00 | 0.15% | 0.1K |

| Verizon Communications Inc | VZ | 51.93 | 0.08% | 1.4K |

| AT&T Inc | T | 38.01 | 0.05% | 0.8K |

| ALTRIA GROUP INC. | MO | 62.26 | 0.05% | 0.3K |

| Merck & Co Inc | MRK | 51.89 | -0.40% | 20.6K |

| Barrick Gold Corporation, NYSE | ABX | 13.60 | -2.23% | 43.1K |

Statistics Canada released the trade data on Friday. Canada's trade deficit widened to C$0.66 billion in January from a deficit of C$0.63 billion in December. December's figure was revised down from a deficit of C$0.59 billion.

Analysts had expected a trade deficit of C$1.05 billion.

The rise in deficit was driven by higher imports.

Exports climbed 1.0% in January.

Exports of aircraft and other transportation equipment and parts dropped by 35.2% in January, exports of consumer goods increased 13.7%, exports of energy products fell by 7.7%, while exports of motor vehicles and parts were up 7.2%.

Imports rose 1.1% in January.

Imports of motor vehicles and parts slid by 16.1% in January, imports of motor vehicles and parts increased by 3.3%, while imports of consumer goods rose 1.8%.

Upgrades:

Hewlett Packard Enterprise (HPE) upgraded to Outperform from Market Perform at Bernstein

Downgrades:

Other:

Microsoft (MSFT) initiated with a Neutral at Macquarie

Hewlett Packard Enterprise reported Q1 FY 2016 earnings of $0.41 per share, beating analysts' consensus of $0.41.

The company's quarterly revenues amounted to $12.72 bln, generally in-line with analysts' consensus estimate of $12.65 bln.

Hewlett Packard Enterprise also issued guidance for Q2 and FY 2016, projecting Q2 EPS of $0.39-0.43 (versus analysts' consensus of $0.42) and FY 2016 EPS of $1.85-1.95 (versus analysts' consensus of $1.87).

HPE rose to $14.80 (+8.82%) in pre-market trading.

Stock indices traded higher ahead of the release of the U.S. labour market data later in the day. Analysts expect that U.S. unemployment rate is expected to remain unchanged at 4.9% in February. The U.S. economy is expected to add 190,000 jobs in February, after adding 151,000 jobs in January.

Today's morning trading session was quiet in the absence of any major economic reports from the Eurozone.

Current figures:

Name Price Change Change %

FTSE 100 6,154.28 +23.82 +0.39 %

DAX 9,788.39 +36.47 +0.37 %

CAC 40 4,431.21 +15.13 +0.34 %

Markit Economics released construction purchasing managers' index (PMI) for Germany on Friday. Germany's construction PMI increased to 59.6 in February from 55.5 in. it was the highest level since March 2011.

A reading above 50 indicates expansion in the sector.

The index was driven by a rise in new business and employment.

"Residential building activity remained the main pillar of the upturn, increasing at the strongest rate in the sixteen-and a-half year survey history," an economist at Markit, Oliver Kolodseike, said.

Markit Economics released its retail purchasing managers' index (PMI) for Germany on Friday. Germany's retail PMI climbed to 52.5 in February from 49.5 in January. It was the highest level since September 2015.

The increase was driven by rises in buying activity, inventories and employment.

"February's survey results provided some positive news for German retailers, as sales rose at the strongest rate since last September, suggesting that consumers were willing to open their purse strings again," an economist at Markit, Oliver Kolodseike, said.

Markit Economics released its retail purchasing managers' index (PMI) for Eurozone on Friday. Eurozone's construction purchasing managers' index (PMI) rise to 50.1 in February from 48.9 in January.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

Higher sales in Germany offset lower sales in France and Italy.

"It was once again left to German consumers to support overall retail sales, with a rebound in the euro area's largest economy just enough to counteract continuing weakness in both France and Italy," an economist at Markit, Phil Smith, said.

The Italian statistical office Istat released its final gross domestic product (GDP) data for Italy on Friday. The Italian final GDP increased 0.1% in the fourth quarter, in line with the preliminary reading, after a 0.2% rise in the third quarter.

Final consumption expenditure climbed by 0.3% in the fourth quarter, gross fixed capital formation rose by 0.8%, imports increased by 1.0%, while exports were up 1.3%.

On a yearly basis, Italian final GDP rose 1.0% in the fourth quarter, in line with the preliminary reading, after a 0.8% increase in the third quarter.

Makoto Sakurai, 70, will replace Sayuri Shirai, 53, in the Board of the Bank of Japan (BoJ). Shirai voted against the implementation of negative rates at the central bank's monetary policy meeting in January.

Sakurai is an international finance researcher.

Japan's Ministry of Health, Labour and Welfare released its labour cash earnings data on Friday. Labour cash earnings in Japan rose 0.4% year-on-year in January, exceeding expectations for a 0.2% increase, after a 0.2% decline in December. December's figure was revised down from a 0.1% gain.

Contractual earnings were flat year-on-year in January, while special cash earnings gained 0.1%.

Total real wages climbed 0.4% in January, after a 0.2% drop in December.

The Australian Bureau of Statistics released its retail sales data on Friday. Retail sales in Australia increased 0.3% in January, missing expectations for a 0.4% rise, after a flat reading in December.

Household goods sales were up 1.0% in January, department stores sales dropped 1.3% and food sales declined 0.2%, while clothing, footwear and personal accessory sales climbed 0.1%.

On a yearly basis, retail sales climbed 4.0% in January, after a 4.2% rise in December.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy fell to 43.6 in in the week ended February 28 from 44.2 the prior week.

The drop was driven by declines in 2 of 3 sub-indexes. The measure of views of the economy declined to 35.0 from 35.5, the buying climate index was down to 39.9 from 41.7, while the personal finances index rose to 56.0 from 55.5.

Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Friday that he did not consider further interest rate cuts. He repeated that the central bank could add further stimulus measures if needed.

"The BOJ will use three dimensions of policy choices, which include quantity, quality and rates, effectively," Kuroda noted.

The National People's Congress will begin in Beijing tomorrow. Chinese officials will likely announce their plans for reform.

Market participants speculate that the government will revise its growth forecasts. Observers expect that the government will set its annual GDP target within a range of 6.5% - 7%.

A former adviser to the People's Bank of China (PBoC), Li Daokui, said on Thursday that the Chinese was likely to expand around 6.7% this year.

"The main challenge this year is how to make sure policies and reform get up to speed," he noted.

European stocks finished with modest losses Thursday, as analysts said traders avoided big bets ahead of a key U.S. jobs report. Investors assessed a surprisingly weak Markit reading on U.K. services, which hit its lowest level in three years.

US Stocks swung from early session losses Thursday to close slightly higher for a third day of gains, with energy shares maintaining gains after a rebound by oil futures fizzled and a flurry of economic data pointed to continued lackluster U.S. growth.

A three-week recovery in Asian stocks was cooling on Friday, with investor focus turning to China's annual legislative sessions, a series of meetings that kick off in Beijing on Saturday.

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.