- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 05-05-2016.

(index / closing price / change items /% change)

Hang Seng 20,449.82 -76.01 -0.37 %

S&P/ASX 200 5,279.06 +7.92 +0.15 %

Shanghai Composite 2,998.14 +6.87 +0.23 %

FTSE 100 6,117.25 +5.23 +0.09 %

CAC 40 4,319.46 -4.77 -0.11 %

Xetra DAX 9,851.86 +23.61 +0.24 %

S&P 500 2,050.63 -0.49 -0.02 %

NASDAQ Composite 4,717.09 -8.55 -0.18 %

Dow Jones 17,660.71 +9.45 +0.05 %

Major U.S. stock indexes slightly rose on Thursday as a rise in oil boosted energy shares, but gains on Nasdaq were limited as Tesla (TSLA) dragged. The electric carmaker's shares reversed premarket gains to trade down 3,4% after analysts expressed doubts about the company's ability to deliver vehicles ahead of schedule. Oil prices jumped about 2,5% as a huge wildfire in Canada's oil sands region and escalating tensions in Libya stoked concerns among investors of a near-term shortage in supply.

Most of Dow stocks in positive area (21 of 30). Top looser - Merck & Co. Inc. (MRK, -1,61%). Top gainer - International Business Machines Corporation (IBM, +1,55%).

Almost of S&P sectors in positive area. Top looser - Conglomerates (-1,9%). Top gainer - Basic Materials (+0,6%).

At the moment:

Dow 17620.00 +39.00 +0.22%

S&P 500 2049.75 +2.75 +0.13%

Nasdaq 100 4318.00 +8.25 +0.19%

Oil 44.78 +1.00 +2.28%

Gold 1277.00 +2.60 +0.20%

U.S. 10yr 1.77 -0.01

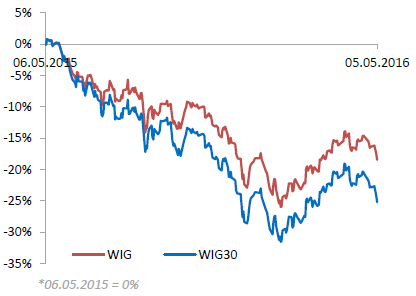

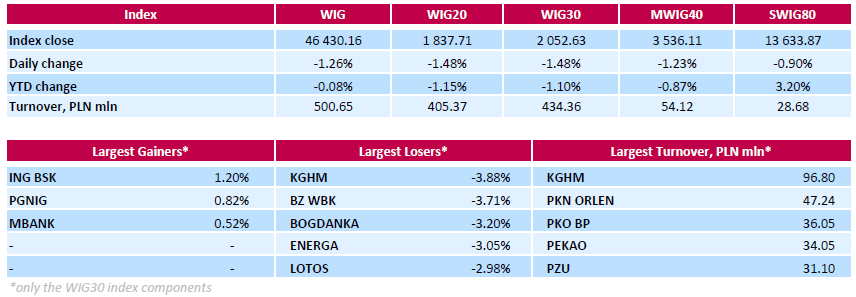

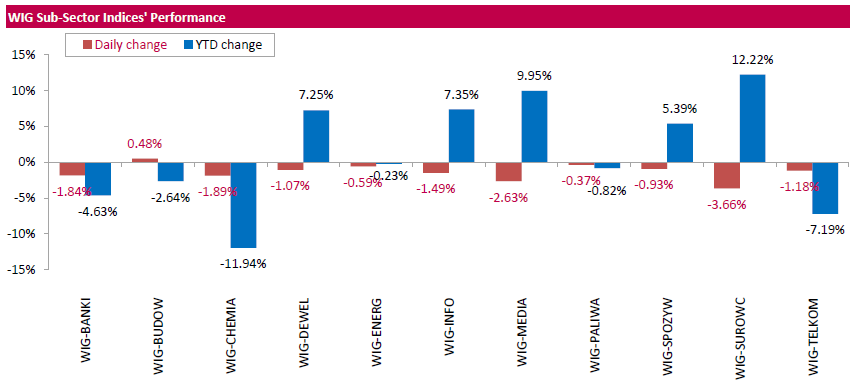

Polish equities closed lower on Thursday. The broad-market measure, the WIG index, lost 1.26%. Construction sector (+0.48%) was sole riser within the WIG Index, while materials (-3.66%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, fell by 1.48%. Only three index constituents managed to generate positive returns: bank ING BSK (WSE: ING), gained 1.2%, oil and gas producer PGNIG (WSE: PGN) added 0.82% and bank MBANK (WSE: MBK) advanced 0.52%. At the same time, copper producer KGHM (WSE: KGH) and bank BZ WBK (WSE: BZW) suffered the steepest declines, plunging by 3.88% and 3.71% respectively. Other biggest laggards were thermal coal miner BOGDANKA (WSE: LWB), genco ENERGA (WSE: ENG), oil refiner LOTOS (WSE: LTS) and media group CYFROWY POLSAT (WSE: CPS), sliding down in the range between 2.88% and 3.2%.

U.S. Stocks open: Dow +0.11%, Nasdaq +0.33%, S&P +0.17%

The first bars on Wall Street indicate a slight increase in line with expectations. However, we may not see any additional enthusiasm bulls out of this, which we have already seen in the previous trading hours on the futures market. Thus, there is no support from the Americans for European markets. On the Warsaw market we already have a new daily lows.

U.S. stock-index futures rose.

Nikkei Closed

Hang Seng 20,449.82 -76.01 -0.37%

Shanghai Composite 2,998.14 +6.87 +0.23%

FTSE 6,114.6 +2.58 +0.04%

CAC 4,323.05 -1.18 -0.03%

DAX 9,834.63 +6.38 +0.06%

Crude $45.69 (+4.36%)

Gold $1285.50 (+0.87%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.36 | 0.12(1.1719%) | 70778 |

| ALTRIA GROUP INC. | MO | 63.14 | -0.09(-0.1423%) | 995 |

| Amazon.com Inc., NASDAQ | AMZN | 675.5 | 4.60(0.6856%) | 38212 |

| Apple Inc. | AAPL | 94.1 | 0.48(0.5127%) | 79264 |

| Barrick Gold Corporation, NYSE | ABX | 17.84 | 0.38(2.1764%) | 100077 |

| Caterpillar Inc | CAT | 73.9 | -0.34(-0.458%) | 5210 |

| Chevron Corp | CVX | 101.76 | 1.17(1.1631%) | 5846 |

| Cisco Systems Inc | CSCO | 26.58 | 0.14(0.5295%) | 10252 |

| Citigroup Inc., NYSE | C | 44.95 | 0.29(0.6494%) | 6571 |

| E. I. du Pont de Nemours and Co | DD | 64.5 | 0.24(0.3735%) | 737 |

| Exxon Mobil Corp | XOM | 88.94 | 1.00(1.1371%) | 14015 |

| Facebook, Inc. | FB | 118.46 | 0.40(0.3388%) | 112694 |

| Ford Motor Co. | F | 13.4 | 0.09(0.6762%) | 224151 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.22 | 0.42(3.5593%) | 543178 |

| General Electric Co | GE | 30.22 | 0.15(0.4988%) | 6635 |

| General Motors Company, NYSE | GM | 31.06 | 0.47(1.5364%) | 75778 |

| Goldman Sachs | GS | 160.72 | 0.65(0.4061%) | 338 |

| Google Inc. | GOOG | 700.5 | 4.80(0.69%) | 1590 |

| Home Depot Inc | HD | 135.35 | 0.19(0.1406%) | 65492 |

| HONEYWELL INTERNATIONAL INC. | HON | 113.2 | 0.27(0.2391%) | 500 |

| Intel Corp | INTC | 30 | 0.15(0.5025%) | 2959 |

| JPMorgan Chase and Co | JPM | 61.75 | 0.18(0.2924%) | 1011 |

| McDonald's Corp | MCD | 129.8 | 0.47(0.3634%) | 46932 |

| Merck & Co Inc | MRK | 54.95 | 0.14(0.2554%) | 6880 |

| Microsoft Corp | MSFT | 50.06 | 0.19(0.381%) | 9505 |

| Nike | NKE | 59.2 | 0.09(0.1523%) | 70402 |

| Pfizer Inc | PFE | 33.5 | 0.10(0.2994%) | 2500 |

| Starbucks Corporation, NASDAQ | SBUX | 56.6 | 0.21(0.3724%) | 78190 |

| Tesla Motors, Inc., NASDAQ | TSLA | 228.45 | 5.89(2.6465%) | 106777 |

| Twitter, Inc., NYSE | TWTR | 14.98 | 0.14(0.9434%) | 142785 |

| United Technologies Corp | UTX | 101.2 | 0.53(0.5265%) | 1000 |

| Verizon Communications Inc | VZ | 50.97 | 0.13(0.2557%) | 910 |

| Visa | V | 77.78 | 0.71(0.9212%) | 300 |

| Wal-Mart Stores Inc | WMT | 67.1 | -0.09(-0.134%) | 3100 |

| Walt Disney Co | DIS | 103.67 | -0.00(-0.00%) | 76555 |

| Yahoo! Inc., NASDAQ | YHOO | 37.33 | 1.33(3.6944%) | 435260 |

| Yandex N.V., NASDAQ | YNDX | 20 | 0.03(0.1502%) | 47568 |

Upgrades:

Downgrades:

Other:

Tesla Motors (TSLA) target raised to $338 from $300 at Robert W. Baird

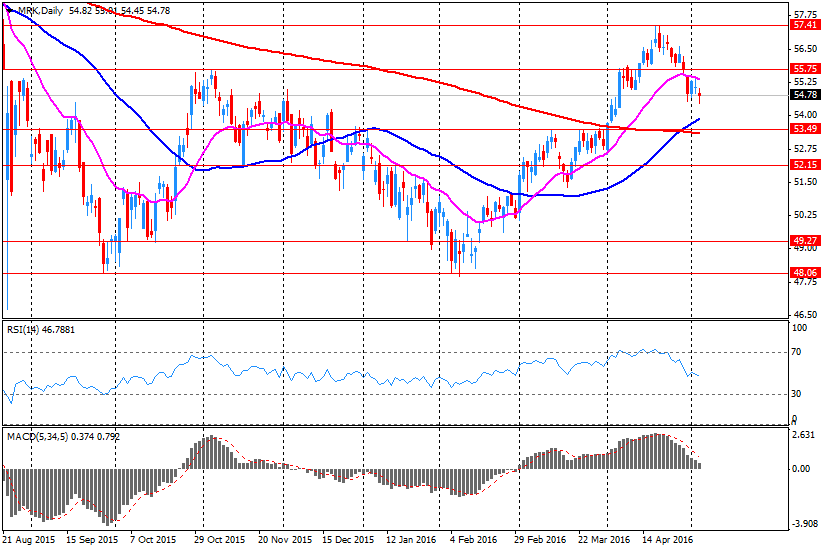

Merck reported Q1 FY 2016 earnings of $0.89 per share (versus $0.85 in Q1 FY 2015), beating analysts' consensus of $0.85.

The company's quarterly revenues amounted to $9.312 bln (-1.2% y/y), slightly missing consensus estimate of $9.445 bln.

Merck issued guidance for FY 2016, raising EPS to $3.65-3.77 from $3.60-3.75 (versus analysts' consensus estimate of $3.72) and revenues to $39-40.2 bln from $38.7-40.2 bln (versus analysts' consensus estimate of $39.85 bln).

MRK rose to $55.25 (+0.8%) in pre-market trading.

Tesla Motors reported Q1 FY 2016 loss of $0.57 per share (versus loss $0.36 in Q1 FY 2015), beating analysts' consensus of -$0.67.

The company's quarterly revenues amounted to $1.602 bln (+45.10% y/y), generally in-line with analysts' consensus estimate of $1.599 bln.

TSLA rose to $232.50 (+4.47%) in pre-market trading.

WIG20 index opened at 1865.17 points (-0.00%)*

WIG 46939.33 -0.17%

WIG30 2078.46 -0.24%

mWIG40 3565.70 -0.40%

*/ - change to previous close

The cash market opened at a neutral level of 1,865 points on the WIG20 index, with modest turnover and with a focus on smaller companies like Próchnik (WSE: PRC), which reported very good sales figures for the month of April. Surrounded openings are slightly increasing, but not as much as a quarter ago was pointed by future contracts. We can see the weakness not only locally, but also abroad. The WIG20 index is on the line of the lower limit of the downtrend channel. The excess of that line will mean willingness to implement a scenario of accelerated decline towards 1,800 points.

Yesterday's session was not successful, where the Warsaw Stock Exchange had to catch up on weaker global sentiment from Tuesday.

Yesterday, the price index of the entire market (the WIG) lost 0.3%, and the sWIG80 went down less than 0.5%, which contrasts sharply with the decline of the WIG20 by almost 2%, which looks like left for good the area of 1,900 pts.

Morning mood so far do not support the scenario of a simple continuation of declines. Discounts dominate in Asia are not large. Posted at night PMI for China's services sector admittedly surprised negatively, but this information does not have the firepower as the disappointing index of industrial from Tuesday. Furthermore, contracts in the US are slightly on the gain, same as oil prices. In the case of copper, we can talk about stability.

European stock markets finished sharply lower on Wednesday, as investors assessed a mixed bag of corporate news, with shares in Dialog Semiconductor PLC and London Stock Exchange Group PLC dropping.

U.S. stocks closed down Wednesday, but off their session lows, as weaker-than-expected private-sector jobs data and a slide in worker productivity eclipsed reports of strength in the services industry.

Asian shares slid for a seventh day, their longest losing streak of the year, and the dollar extended gains versus the yen. Crude rallied after data showed U.S. output fell the most in eight months and as wildfires disrupted production in Canada. Financial markets are shut for holidays in Indonesia, Japan, South Korea and Thailand.

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.