- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 06-02-2019.

Major US stock indices fell slightly, as investors analyzed the mixed quarterly results of the corporate segment, as well as the report of the US President to Congress on the situation in the country.

In his report, Donald Trump mentioned issues such as infrastructure costs, drug prices and trade. He also raised the issue of financing the border wall along the border of the United States and Mexico. Trump reaffirmed his conviction that the United States needed a wall, but did not declare a state of emergency, as he had previously threatened to do. Thus, the president has softened his tone around the financing of the wall on the border with Mexico, but this does not exclude the possibility that the federal government may again suspend work if its demand for financing its construction is not met.

The president also said that China and the United States are working on a new trade deal, but noted that it should “include real structural changes to put an end to unfair trade practices, reduce our chronic trade deficit, and protect American jobs.”

The focus of market participants was also the report of the Ministry of Commerce, which showed that the US trade balance deficit sharply declined in November amid a decline in imports of mobile phones and petroleum products. According to the report, the trade deficit fell in November by 11.5% to $ 49.3 billion. The data for October were revised - $ 55.5 billion by - $ 55.7 billion. Economists had forecast a trade deficit of $ 54.0 billion.

Most of the components of DOW finished trading in positive territory (16 of 30). The growth leader was UnitedHealth Group (UNH, + 1.16%). The outsider was DowDuPont Inc. (DWDP, -1.81%).

Most sectors of the S & P recorded a decline. The largest decline was shown by the base materials sector (-0.7%), the largest growth was by the conglomerates sector (+ 0.3%).

At the time of closing:

Dow 25,389.90 -21.62 -0.09%

S & P 500 2,731.62 -6.08 -0.22%

Nasdaq 100 7,375.28 -26.80 -0.36%

U.S. stock-index were flat on Wednesday after President Donald Trump at his State of the Union speech raised the prospect of another shutdown should his demand for border wall funding not be met. Meanwhile, a raft of upbeat corporate earnings and trade balance data supported the market sentiment.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 20,874.06 | +29.61 | +0.14% |

Hang Seng | - | - | - |

Shanghai | - | - | - |

S&P/ASX | 6,026.10 | +20.20 | +0.34% |

FTSE | 7,163.24 | -14.13 | -0.20% |

CAC | 5,075.18 | -8.16 | -0.16% |

DAX | 11,325.81 | -42.17 | -0.37% |

Crude | $53.57 | -0.17% | |

Gold | $1,317.70 | -0.11% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 201.5 | 0.38(0.19%) | 570 |

ALCOA INC. | AA | 28.93 | -0.14(-0.48%) | 401 |

ALTRIA GROUP INC. | MO | 49 | -0.04(-0.08%) | 84754 |

Amazon.com Inc., NASDAQ | AMZN | 1,671.50 | 12.69(0.77%) | 49178 |

Apple Inc. | AAPL | 174.85 | 0.67(0.38%) | 162635 |

AT&T Inc | T | 29.7 | 0.07(0.24%) | 14775 |

Boeing Co | BA | 414.79 | 4.61(1.12%) | 48367 |

Caterpillar Inc | CAT | 131.55 | -0.45(-0.34%) | 3628 |

Cisco Systems Inc | CSCO | 47.16 | -0.10(-0.21%) | 277766 |

Citigroup Inc., NYSE | C | 63.77 | -0.04(-0.06%) | 53042 |

Exxon Mobil Corp | XOM | 75.51 | -0.08(-0.11%) | 6160 |

Facebook, Inc. | FB | 171.3 | 0.14(0.08%) | 78724 |

FedEx Corporation, NYSE | FDX | 183.24 | -0.49(-0.27%) | 610 |

Ford Motor Co. | F | 8.8 | 0.05(0.57%) | 225736 |

General Electric Co | GE | 10.68 | 0.05(0.47%) | 323744 |

General Motors Company, NYSE | GM | 40.77 | 1.47(3.74%) | 466062 |

Google Inc. | GOOG | 1,146.48 | 0.49(0.04%) | 4377 |

Intel Corp | INTC | 49.99 | 0.30(0.59%) | 50954 |

International Business Machines Co... | IBM | 135.89 | 0.34(0.25%) | 1233 |

Johnson & Johnson | JNJ | 132.4 | -0.48(-0.36%) | 47197 |

Merck & Co Inc | MRK | 77.12 | -0.03(-0.04%) | 13686 |

Microsoft Corp | MSFT | 106.96 | -0.26(-0.24%) | 64412 |

Nike | NKE | 82.66 | -0.20(-0.24%) | 945 |

Pfizer Inc | PFE | 42.04 | -0.07(-0.17%) | 71776 |

Procter & Gamble Co | PG | 97.32 | -0.12(-0.12%) | 1159 |

Starbucks Corporation, NASDAQ | SBUX | 69.15 | 0.17(0.25%) | 3044 |

Tesla Motors, Inc., NASDAQ | TSLA | 319.25 | -2.10(-0.65%) | 48895 |

The Coca-Cola Co | KO | 49 | -0.26(-0.53%) | 1724 |

Twitter, Inc., NYSE | TWTR | 35.08 | 0.71(2.07%) | 222937 |

Verizon Communications Inc | VZ | 54.25 | 0.11(0.20%) | 2621 |

Visa | V | 142.38 | -0.15(-0.11%) | 4187 |

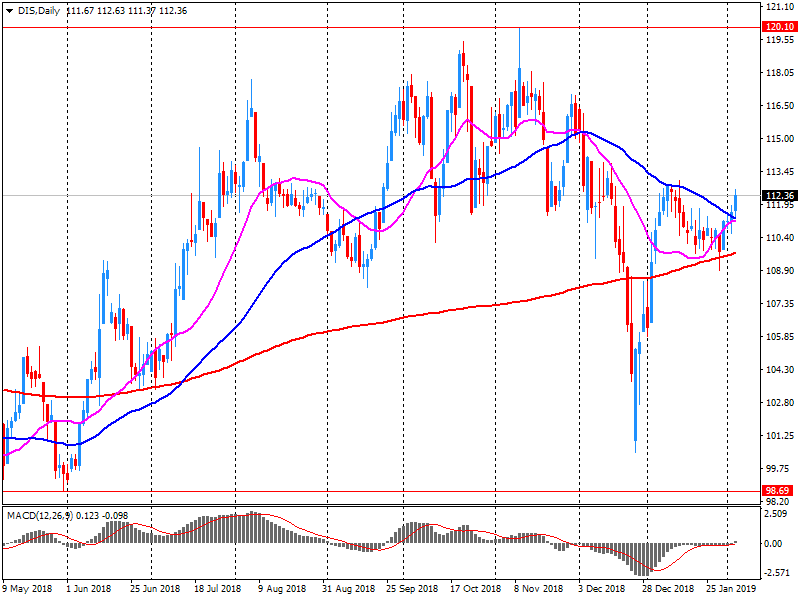

Walt Disney Co | DIS | 113.65 | 0.99(0.88%) | 98327 |

Yandex N.V., NASDAQ | YNDX | 34.14 | -0.28(-0.81%) | 12172 |

DowDuPont (DWDP) downgraded from Outperform to Market Perform at Cowen

Walt Disney (DIS) reported Q4 FY 2018 earnings of $1.84 per share (versus $1.89 in Q4 FY 2017), beating analysts’ consensus estimate of $1.57.

The company’s quarterly revenues amounted to $15.303 bln (-0.3% y/y), generally in line with analysts’ consensus estimate of $15.203 bln.

DIS rose to $113.35 (+0.61%) in pre-market trading.

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -39.32 | 20844.45 | -0.19 |

| ASX 200 | 114.7 | 6005.9 | 1.95 |

| FTSE 100 | 143.24 | 7177.37 | 2.04 |

| DAX | 191.4 | 11367.98 | 1.71 |

| Dow Jones | 172.15 | 25411.52 | 0.68 |

| S&P 500 | 12.83 | 2737.7 | 0.47 |

| NASDAQ Composite | 54.54 | 7402.08 | 0.74 |

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.