- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 06-09-2016.

(index / closing price / change items /% change)

Nikkei 225 17,081.98 +44.35 +0.26%

Shanghai Composite 3,091.45 +19.35 +0.63%

S&P/ASX 200 5,413.63 -15.95 -0.29%CAC 40

CAC 4,529.96 -11.12 -0.24%

Xetra DAX 10,687.14 +14.92 +0.14%

FTSE 100 6,826.05 -53.37 -0.78%

S&P 500 2,186.48 +6.50 +0.30%

Dow Jones Industrial Average 18,538.12 +46.16 +0.25%

S&P/TSX Composite 14,813.02 +17.32 +0.12%

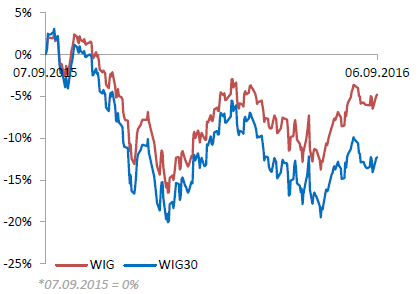

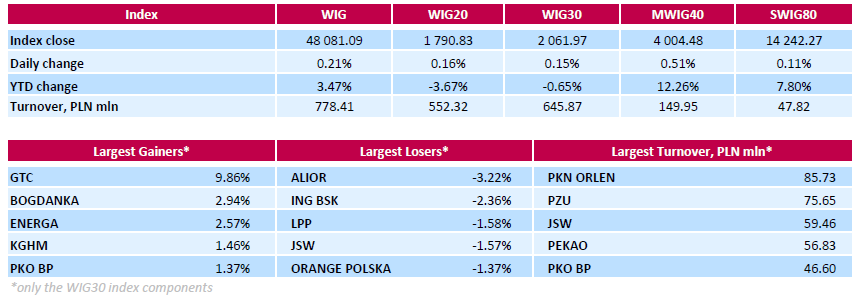

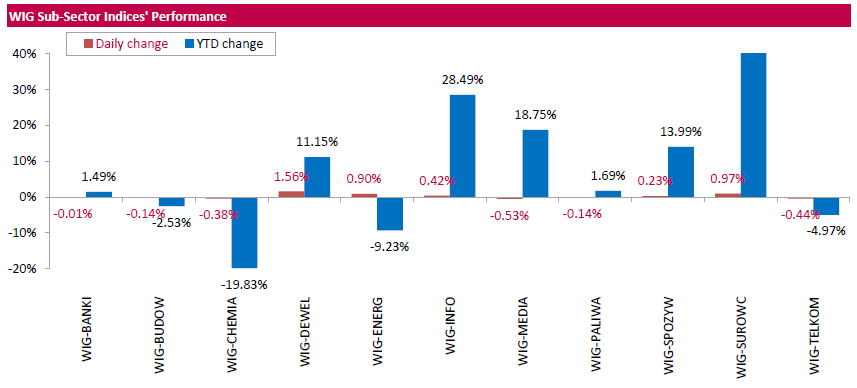

Polish equity market closed higher on Tuesday. The broad market measure, the WIG Index, rose by 0.21%. Sector performance within the WIG Index was mixed. Developing sector (+1.56%) outperformed, while media (-0.53%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, added 0.15%. Within the index components, property developer GTC (WSE: GTC) led the gainers, jumping by 9.86%, supported by an analyst recommendation upgrade. It was followed by thermal coal miner BOGDANKA (WSE: LWB), genco ENERGA (WSE: ENG) and copper producer KGHM (WSE: KGHM), growing by 2.94%, 2.57% and 1.46% respectively. At the same time, the session's largest losers were two banking names ALIOR (WSE: ALR) and ING BSK (WSE: ING), which quotations fell by 3.22% and 2.36% respectively.

Major U.S. stock-indexes little changed on Tuesday as lower chances of an interest rate hike and a host of multi-billion dollar takeover deals boosted investor sentiment. Top Federal Reserve officials, encouraged by a string of strong economic data, had hinted that a rate hike could come as early as this month. However, Friday's disappointing employment numbers dampened those expectations.

Dow stocks mixed (17 in negative area, 13 in positive area). Top gainer - Verizon Communications Inc. (VZ, +1.57%). Top loser - General Electric Company (GE, -1.41%).

S&P sectors also mixed. Top gainer - Utilities (+0.5%). Top loser - Financial (-0.6%).

At the moment:

Dow 18470.00 -10.00 -0.05%

S&P 500 2177.50 -0.50 -0.02%

Nasdaq 100 4812.75 +17.50 +0.36%

Oil 44.30 -0.14 -0.32%

Gold 1344.40 +17.70 +1.33%

U.S. 10yr 1.56 -0.04

The market in the US after an extended weekend opened with a slight increase. At the same time the volatility remains at low level, which is supported by a modest amount of information that may influence the prices. Only data from the services sector may slightly affect the behavior of investors.

The Warsaw market started growing after the beginning of trading on Wall Street and an hour before the end of trading the WIG20 index almost touched the level of 1,800 points (1,799 points + 0.63%).

U.S. stock-index futures edged higher amid speculation the Federal Reserve will hold off raising interest rates this month.

Global Stocks:

Nikkei 17,081.98 +44.35 +0.26%

Hang Seng 23,787.68 +138.13 +0.58%

Shanghai 3,091.45 +19.35 +0.63%

FTSE 6,852.79 -26.63 -0.39%

CAC 4,548.51 +7.43 +0.16%

DAX 10,715.00 +42.78 +0.40%

Crude $44.17 (-0.61%)

Gold $1338.60 (+0.90%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 10.15 | 0.02(0.1974%) | 23350 |

| 3M Co | MMM | 181.09 | 0.28(0.1549%) | 177 |

| ALTRIA GROUP INC. | MO | 66.88 | -0.00(-0.00%) | 990 |

| Amazon.com Inc., NASDAQ | AMZN | 774.02 | 1.58(0.2045%) | 9228 |

| Apple Inc. | AAPL | 108.06 | 0.33(0.3063%) | 138047 |

| AT&T Inc | T | 41 | 0.05(0.1221%) | 3670 |

| Barrick Gold Corporation, NYSE | ABX | 18.63 | 0.47(2.5881%) | 107419 |

| Chevron Corp | CVX | 101.1 | 0.17(0.1684%) | 5373 |

| Cisco Systems Inc | CSCO | 31.82 | -0.01(-0.0314%) | 1878 |

| Citigroup Inc., NYSE | C | 47.53 | 0.02(0.0421%) | 600 |

| Deere & Company, NYSE | DE | 84.47 | 0.42(0.4997%) | 200 |

| Exxon Mobil Corp | XOM | 87.6 | 0.18(0.2059%) | 3039 |

| Facebook, Inc. | FB | 126.55 | 0.04(0.0316%) | 67414 |

| Ford Motor Co. | F | 12.49 | -0.01(-0.08%) | 1515 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.61 | 0.13(1.2405%) | 121244 |

| General Electric Co | GE | 31.34 | 0.05(0.1598%) | 21217 |

| General Motors Company, NYSE | GM | 32.2 | 0.04(0.1244%) | 4850 |

| Google Inc. | GOOG | 772.88 | 1.42(0.1841%) | 2512 |

| Home Depot Inc | HD | 135.17 | 0.02(0.0148%) | 303 |

| Intel Corp | INTC | 36.4 | 0.32(0.8869%) | 32395 |

| Johnson & Johnson | JNJ | 119.66 | 0.34(0.285%) | 583 |

| JPMorgan Chase and Co | JPM | 67.6 | 0.11(0.163%) | 1022 |

| McDonald's Corp | MCD | 116.63 | 0.80(0.6907%) | 9716 |

| Microsoft Corp | MSFT | 57.7 | 0.03(0.052%) | 3165 |

| Nike | NKE | 57.87 | -0.15(-0.2585%) | 495 |

| Pfizer Inc | PFE | 34.89 | 0.12(0.3451%) | 630 |

| Procter & Gamble Co | PG | 88.43 | 0.23(0.2608%) | 2496 |

| Starbucks Corporation, NASDAQ | SBUX | 56.46 | 0.28(0.4984%) | 609 |

| Tesla Motors, Inc., NASDAQ | TSLA | 199.31 | 1.53(0.7736%) | 21094 |

| Twitter, Inc., NYSE | TWTR | 19.75 | 0.20(1.023%) | 185075 |

| Verizon Communications Inc | VZ | 53.15 | 0.27(0.5106%) | 2383 |

| Wal-Mart Stores Inc | WMT | 72.56 | 0.06(0.0828%) | 3200 |

| Walt Disney Co | DIS | 94.7 | 0.28(0.2965%) | 1021 |

| Yahoo! Inc., NASDAQ | YHOO | 43.65 | 0.37(0.8549%) | 7476 |

| Yandex N.V., NASDAQ | YNDX | 22.74 | 0.35(1.5632%) | 656 |

Upgrades:

Intel (INTC) upgraded to Buy at Evercore ISI

Downgrades:

Other:

Apple (AAPL) reiterated at an Outperform at Cowen; target $117

Today, Wall Street is back in the game, however past behavior of contracts for US indices does not indicate any breakthrough.

In the mid-session the WIG20 index was at the level of 1,784 points (-0.22%) and reached the turnover of PLN 187 million.

European stocks traded mostly in positive territory, near 8-month high, as investors awaited the outcome of ECB's meeting.

Analysts expect that the outcome of the September meeting will be a monetary policy unchanged, but the central bank may hint at expanding bond purchase program. At the last ECB meeting in July, the head of the Central Bank Draghi said officials have shown that they can adjust the program of quantitative easing (QE) in the case of need, and there should be no doubt that they can extend the life of QE after March 2017 .

Today's data show that in the second quarter euro-zone's GDP grew in line with expectations, while German manufacturing orders in July rose less than forecast.

Eurostat Statistical Office reported that the gross domestic product of the 19 countries of the eurozone increased by 0.3 percent in quarterly terms and by 1.6 percent over the previous year, in line with previous estimates and forecasts of experts. In the 1st quarter the economy expanded by 0.6 percent and 1.7 percent respectively. The largest contribution to GDP growth was from net trade - it has added 0.4 percentage points to the final result. Falling inventories took away 0.2 percentage points of GDP, slowing investment, in contrast to previous quarters. The data also showed that q/q growth of the economy slowed sharply in France - from 0.7 percent to zero and in Italy from 0.3 percent to zero. In Germany, the rate of expansion eased to 0.4 percent from 0.7 percent.

The composite index of the largest companies in the region Stoxx Europe 600 up 0.1 percent. The trading volume today is 34 percent less than the average over the past 30 days.

Volatility declined by 1.1 percent, reaching a month low.

Fresenius capitalization increased by 3.7 per cent after the pharmaceutical company said it will pay $ 6.42 billion for IDC Holding Salud, the largest network of private hospitals in Spain.

Ingenico Group SA shares fell 13 percent, as the manufacturer of payment terminals downgraded its forecasts for annual profit and revenue growth.

OCI NV cost decreased by 7 percent after the fertilizer producer reported a decline in revenues in the first half.

At the moment:

FTSE -20.77 6858.65 -0.30%

DAX +21.66 10693.88 + 0.20%

CAC 40 +2.06 4543.14 + 0.05%

WIG20 index opened at 1792.02 points (+0.22%)*

WIG 48140.10 0.33%

WIG30 2067.10 0.40%

mWIG40 3991.03 0.17%

*/ - change to previous close

The futures market (WSE: FW20U1620) started the day with a rise of 0.22% to 1,792 points. The same gained contract on the German DAX.

The cash market by its increase works out only slightly lower yesterday's closing and is close to the psychological resistance level at 1,800 points, which probably will cool a bit appetite to growth.

After higher opening noticeable is growing, stronger since yesterday, the energy sector. For the record, the inspiration was provided by information from the Treasury about change their mind on raising the nominal value of shares of PGE.

Yesterday lack of trading on Wall Street caused that this morning we do not refer to changes in these markets. While the behavior of the Asian parquets is tranquil and slightly upward. Contracts in the US are stable and this should also be morning in Europe.

During today's session, there is no important macro publications from the domestic market. On the broad market it is worth to pay attention, among others, to orders in German industry, the final lecture to GDP for the second quarter for the euro zone and the ISM for August in the US service sector, although traditionally it does not cause such reactions, as in case of the industrial sector. The only new event is the end of the two-day G20 summit in China. Although these meetings are virtually ignored by investors, because do not bring anything concrete.

On Tuesday morning, trading on the currency market brings a slight stabilization of the Polish currency. The Polish zloty is valued by the market as follows: PLN 4.3385 per euro, PLN 3.8912 against the US dollar. Yields on domestic debt amounts to 2,879% for 10-year bonds.

U.S. stock futures switched between small gains and small losses on Monday, with markets closed for the Labor Day holiday and investors digesting an oil agreement between Russia and Saudi Arabia.

U.K. stocks retreated Monday, feeling the pinch from ratings downgrades for Royal Bank of Scotland PLC and Lloyds Banking Group PLC, as well as from dampened expectations for more monetary easing from the Bank of England after a stronger-than-expected services-sector update.

Shares in Asia were broadly higher Monday, as weaker-than-expected U.S. jobs data eased worries over an imminent interest-rate increase by the Federal Reserve. The U.S. added about 151,000 jobs in August, a number unlikely to be strong enough for the U.S. Federal Reserve to move toward raising interest rates in September, analysts say. The data helped lift stocks in the U.S. and Europe late Friday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.