- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 07-04-2016.

(index / closing price / change items /% change)

Nikkei 225 15,749.84 +34.48 +0.22%

Hang Seng 20,266.05 +59.38 +0.29%

S&P/ASX 200 4,964.08 +18.17 +0.37%

Shanghai Composite 3,009.51 -41.08 -1.35%

FTSE 100 6,136.89 -24.74 -0.40%

CAC 40 4,245.91 -38.73 -0.90%

Xetra DAX 9,530.6 -93.89 -0.98%

S&P 500 2,041.91 -24.75 -1.20%

NASDAQ Composite 4,848.37 -72.35 -1.47%

Dow Jones 17,541.96 -174.09 -0.98%

Major U.S. stock-indexes lower on Thursday as oil prices slid and investors worried that measures taken by central banks may not be enough to put the global economy back on track. Crude fell more than 2% as a rise in Iraqi exports offset gains from an unexpected fall in U.S. inventories. Minutes from the Fed's March meeting released on Wednesday pointed to concerns about the central bank's limited ability to tackle a global economic slowdown, reducing the odds of a rate increase before June.

Most of Dow stocks in negative area (24 of 30). Top looser - Verizon Communications Inc. (VZ, -2,42%). Top gainer - United Technologies Corporation (UTX, +0,91%).

All S&P sectors in negative area. Top looser - Conglomerates (-1,8%).

At the moment:

Dow 17508.00 -120.00 -0.68%

S&P 500 2040.75 -19.50 -0.95%

Nasdaq 100 4489.00 -46.00 -1.01%

Oil 36.84 -0.91 -2.41%

Gold 1236.90 +13.10 +1.07%

U.S. 10yr 1.71 -0.05

Stock indices closed lower on the European Central Bank's (ECB) March minutes. The minutes showed that most members of the Governing Council supported the monetary policy easing.

The ECB considered a sharper cut in deposit rate.

"On the one hand, a sharper rate cut could be considered, together with indications that the effective lower bound would have been reached for all practical purposes. On the other hand, the proposed limited rate cut could be judged as appropriate for now, given the current assessment, while it would also not rule out the possibility and prospect of further cuts if warranted by the outlook for price stability," the minutes said.

According to the minutes, the downside risks to inflation in the Eurozone and the risks of second-round effects increased.

The ECB President Mario Draghi said in a speech in Portugal on Thursday that the Eurozone's economy recovered moderately, supported by the central bank's monetary policy and low energy prices. He noted that investment remained weak.

Draghi pointed out that the ECB was ready to act to preserve price stability, noted that there was "no shortage of tools available".

The ECB president also said that structural and fiscal policies were needed for a sustainable growth.

Draghi noted that the central bank's monetary policy easing was effective and the recent stimulus measures would take time to start working.

ECB Vice President Vitor Constancio said before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday that the central bank was doing and would continue to do everything to fulfil its mandate.

ECB Executive Board member Peter Praet said in a speech on Thursday that the central bank's monetary policy adopted since June 2014 was effective. He pointed out that the ECB could add further stimulus measures if the downside risks increase.

Praet noted that the central bank did not discussed helicopter money.

Lower oil prices also weighed on stocks. Oil prices fell on concerns over the global oil oversupply.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. climbed 2.6% in March, after a 1.5% decline in February. February's figure was revised down from a 1.4% fall.

On a yearly basis, house prices jumped 10.1% in the three months to March, after a 9.7% increase in the three months to February.

"Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months," Halifax's housing economist Martin Ellis said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,136.89 -24.74 -0.40 %

DAX 9,530.62 -93.89 -0.98 %

CAC 40 4,245.91 -38.73 -0.90 %

The European Central Bank (ECB) Governing Council member Benoit Coeure on Thursday defended the central bank's latest stimulus measures, saying that the central bank had to act to boost inflation and growth in the Eurozone.

He said that he was confident the stimulus measures would be effective.

The World Trade Organization (WTO) said on Thursday that the world trade expected to climb 2.8% in 2016, down from its previous estimate of a 3.9% growth, and 3.6% in 2017. The WTO pointed out that uncertainties weigh on global demand.

According to the WTO, downside risks to the forecast are a faster than expected slowdown in the Chinese economy, higher financial market volatility, and exposure of countries with large foreign debts to sharp exchange rate movements, while upside potential is a faster growth in the Eurozone if the European Central Bank's monetary policy is effective.

"Trade is still registering positive growth, albeit at a disappointing rate," WTO Director-General Roberto Azevêdo said.

The WTO expects the world economy to expand 2.4% in 2016 and 2.7% in 2017.

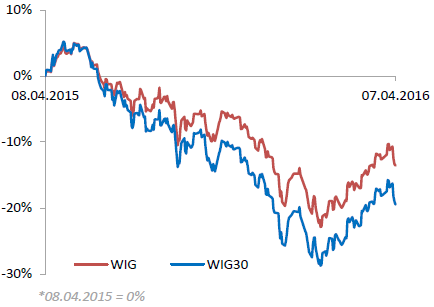

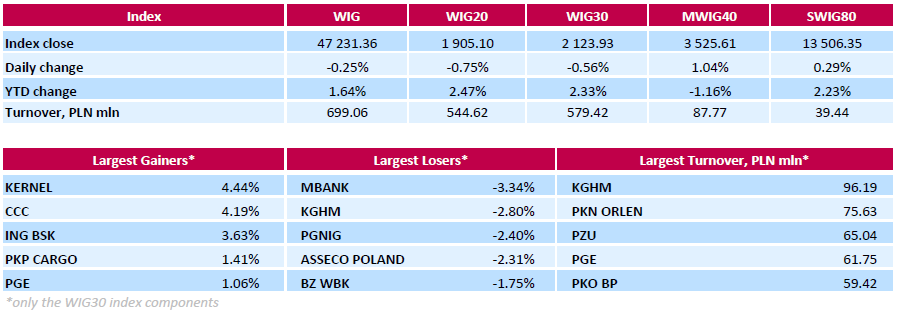

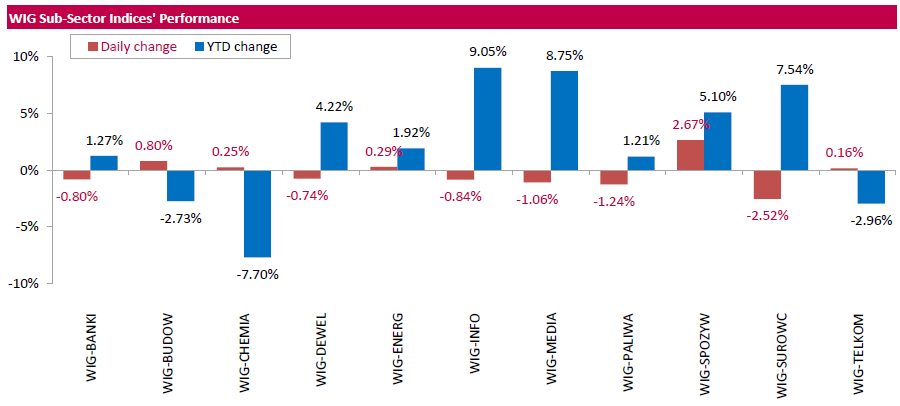

Polish equity market continued to decline on Thursday. The broad market measure, the WIG index, lost 0.25%. From a sector perspective, materials (-2.52%) fared the worst, while food sector (+2.67%) was the best-performing group.

The large-cap stocks' measure, the WIG30 Index, declined by 0.56%. Within the WIG30 Index components, banking sector name MBANK (WSE: MBK) fared the worst, slumping by 3.34%. It was followed by copper producer KGHM (WSE: KGH), oil and gas company PGNIG (WSE: PGN) and IT-company ASSECO POLAND (WSE: ACP), which fell by 2.8%, 2.4% and 2.31% respectively. On the other side of the ledger, agricultural producer KERNEL (WSE: KER) and footwear retailer CCC (WSE: CCC) were the best performers, advancing 4.44% and 4.19% respectively.

Rating agency Fitch Ratings on Thursday affirmed Japan's sovereign debt rating at 'A'. The outlook is 'stable'.

"The key factor constraining the rating is high and rising government debt," Fitch said.

The agency expects Japan's gross general government debt to reach 245% of GDP by end-2016.

Japan's general government budget deficit is forecasted to be 4.8% of GDP in 2016.

"The Stable Outlooks reflect Fitch's assessment that upside and downside risks to the ratings are currently broadly balanced," the agency said.

The U.K. Office for National Statistics (ONS) released its labour productivity data on Thursday. Labour productivity in the U.K. measured by output per hour declined by 1.2% in the fourth quarter of 2015, after a 0.6% rise in the third quarter.

Output per worker and output per job were broadly unchanged in the fourth quarter.

Output per hour in services decreased by 0.7% in the fourth quarter, while output per hour in manufacturing dropped by 2.0%.

On a yearly basis, labour productivity increased by 0.4% in the fourth quarter, after a 1.5% in the third quarter.

Dallas Fed President Robert Kaplan said on Wednesday that the Fed should be patient and cautious in hiking its interest rate, noting that gradual interest rate hikes would appropriate. He added that he would vote for an interest rate hike if the U.S. economic data remained strong.

He expects the U.S. economy to expand 1.9% this year.

Kaplan is not a voting member of the Federal Open Market Committee (FOMC) this year.

Chicago Fed President Charles Evans said on Thursday that the Fed should be cautious in raising its interest rate further.

"It's best to be proactive and keep inflation closer to target," he noted.

Evans pointed out the Fed will discuss Britain's vote on the membership in the European Union at its monetary meeting.

Evans is not a voting member of the Federal Open Market Committee (FOMC) this year.

The Australian Industry Group (AiG) released its construction data for Australia on late Wednesday evening. The Ai Group/HIA Australian Performance of Construction Index fell to 45.2 in March from 46.1 in February, reaching the 13-month low.

A reading above 50 indicates expansion in the sector, a reading below 50 indicates contraction.

The decline was mainly driven by a drop in house building and apartment building activity, and employment.

The European Central Bank (ECB) President Mario Draghi said in a speech in Portugal on Thursday that the Eurozone's economy recovered moderately, supported by the central bank's monetary policy and low energy prices. He noted that investment remained weak.

Draghi pointed out that the ECB was ready to act to preserve price stability, noted that there was "no shortage of tools available".

The ECB president also said that structural and fiscal policies were needed for a sustainable growth.

Draghi noted that the central bank's monetary policy easing was effective and the recent stimulus measures would take time to start working.

The European Central Bank (ECB) Governing Council member Ignazio Visco said on Thursday that the central bank's credibility was at stake if the central bank failed to reach its inflation target. He pointed out that helicopter money was risky from a legal and practical point of view, adding that the ECB did not discussed the introduction of helicopter money.

The European Central Bank (ECB) President Mario Draghi wrote in the foreword to the central bank's annual report that 2016 would a challenging year for the central bank.

"We face uncertainty about the outlook for the global economy. We face continued disinflationary forces. And we face questions about the direction of Europe and its resilience to new shocks. In that environment, our commitment to our mandate will continue to be an anchor of confidence for the people of Europe," he wrote.

Draghi noted that the ECB was ready to act to boost inflation in the Eurozone.

"Even when faced with global disinflationary forces, the ECB does not surrender to excessively low inflation," the ECB president said.

After yesterday's optimistic session on Wall Street, continuation of the bullish spirit has been at a question from the outset. Contracts on the S&P500 index lost 0.5 percent and there were no signals that would suggest any further improvement, which made declines in the early phase of the session almost a foregone conclusion that illustrates the fragility of yesterday's gains and persistence of correction sentiment.

U.S. Stocks opened at: Dow -0.61%, Nasdaq -0.56%, S&P -0.54%

Wall Street's sliding into the red area of at the moment does not give additional arguments for bears on the Warsaw market. The level of 1,900 points is still defended.

According to data released by the People's Bank of China (PBoC) on Thursday, China's foreign-exchange reserves increased by $10.26 billion to $3.21 trillion in March, after a drop by $28.57 billion in February. It was the first rise in five months.

The European Central Bank's (ECB) its minutes of March meeting on Thursday. The minutes showed that most members of the Governing Council supported the monetary policy easing.

"A large majority of voting members supported the proposed policy package," the ECB said in its minutes.

The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion).

The ECB considered a sharper cut in deposit rate.

"On the one hand, a sharper rate cut could be considered, together with indications that the effective lower bound would have been reached for all practical purposes. On the other hand, the proposed limited rate cut could be judged as appropriate for now, given the current assessment, while it would also not rule out the possibility and prospect of further cuts if warranted by the outlook for price stability," the minutes said.

According to the minutes, the downside risks to inflation in the Eurozone and the risks of second-round effects increased.

U.S. stock-index futures fell.

Global Stocks:

Nikkei 15,749.84 +34.48 +0.22%

Hang Seng 20,266.05 +59.38 +0.29%

Shanghai Composite 3,009.51 -41.08 -1.35%

FTSE 6,146.91 -14.72 -0.24%

CAC 4,275.13 -9.51 -0.22%

DAX 9,602.55 -21.96 -0.23%

Crude oil $37.47 (-0.74%)

Gold $1240.60 (+1.37%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.4 | -0.10(-1.0526%) | 20102 |

| Amazon.com Inc., NASDAQ | AMZN | 599 | -3.08(-0.5116%) | 11596 |

| Apple Inc. | AAPL | 110.48 | -0.48(-0.4326%) | 197912 |

| AT&T Inc | T | 38.49 | -0.15(-0.3882%) | 12082 |

| Barrick Gold Corporation, NYSE | ABX | 14.25 | 0.28(2.0043%) | 67836 |

| Caterpillar Inc | CAT | 74.91 | -0.31(-0.4121%) | 526 |

| Chevron Corp | CVX | 94.14 | -0.70(-0.7381%) | 509 |

| Cisco Systems Inc | CSCO | 27.85 | -0.15(-0.5357%) | 1161 |

| Citigroup Inc., NYSE | C | 41.57 | -0.29(-0.6928%) | 14453 |

| Exxon Mobil Corp | XOM | 82.94 | -0.37(-0.4441%) | 4304 |

| Facebook, Inc. | FB | 113.59 | -0.12(-0.1055%) | 121263 |

| Ford Motor Co. | F | 12.76 | -0.06(-0.468%) | 22073 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 9.38 | -0.23(-2.3933%) | 268955 |

| General Electric Co | GE | 30.81 | -0.09(-0.2913%) | 2193 |

| Goldman Sachs | GS | 154.64 | -0.55(-0.3544%) | 182 |

| Google Inc. | GOOG | 744.44 | -1.25(-0.1676%) | 2944 |

| Home Depot Inc | HD | 135.16 | -0.28(-0.2067%) | 651 |

| Intel Corp | INTC | 31.95 | -0.13(-0.4052%) | 24136 |

| International Business Machines Co... | IBM | 149.5 | -0.52(-0.3466%) | 243 |

| Johnson & Johnson | JNJ | 109.29 | -0.13(-0.1188%) | 102 |

| JPMorgan Chase and Co | JPM | 58.47 | -0.34(-0.5781%) | 6909 |

| Microsoft Corp | MSFT | 54.84 | -0.28(-0.508%) | 2708 |

| Nike | NKE | 60 | -0.31(-0.514%) | 601 |

| Pfizer Inc | PFE | 32.61 | -0.32(-0.9718%) | 65342 |

| Procter & Gamble Co | PG | 83.55 | -0.26(-0.3102%) | 506 |

| Starbucks Corporation, NASDAQ | SBUX | 60.47 | -0.36(-0.5918%) | 2517 |

| Tesla Motors, Inc., NASDAQ | TSLA | 268.11 | 2.69(1.0135%) | 83184 |

| Twitter, Inc., NYSE | TWTR | 16.78 | -0.48(-2.781%) | 263790 |

| Verizon Communications Inc | VZ | 52.72 | -0.80(-1.4948%) | 12706 |

| Walt Disney Co | DIS | 97.1 | -0.38(-0.3898%) | 3987 |

| Yahoo! Inc., NASDAQ | YHOO | 35.79 | -0.87(-2.3732%) | 169799 |

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending April 02 in the U.S. decreased by 9,000 to 267,000 from 276,000 in the previous week. Analysts had expected jobless claims to decline to 270,000.

Jobless claims remained below 300,000 the 57th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 19,000 to 2,191,000 in the week ended March 26.

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Hold from Buy at Jefferies

Verizon (VZ) downgraded to Mkt Perform from Outperform at Bernstein

Other:

Intel (INTC) initiated with a Buy at Brean Capital

Hewlett Packard Enterprise (HPE) target raised to $23 from $20 at BMO Capital; maintain Outperform

Apple (AAPL) target lowered to $130 from $141 at BTIG Research; maintain Buy

Pfizer (PFE) resumed with a Overweight at JP Morgan; target $38

Pfizer (PFE) resumed with a Equal-Weight at Morgan Stanley; target $35

Twitter (TWTR) target lowered to $16 from $18 at Morgan Stanley; maintain Underweight

Walt Disney (DIS) target raised to $102 from $96 at Guggenheim

Statistics Canada released housing market data on Thursday. Building permits in Canada jumped 15.5% in February, exceeding expectations for a 4.8% rise, after a 9.5% drop in January. January's figure was revised up from a 9.8% decrease.

The increase was driven by a rise in building permits for commercial buildings in Alberta, single-family dwellings in Ontario and institutional structures in Quebec.

Building permits for non-residential construction were up 33.1% in February, while permits in the residential sector climbed 5.0%.

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece rose to 24.4% in January from 24.3% in December. December's figure was revised up from 24.0%.

The number of unemployed increased by 3,570 persons compared with December 2015.

The youth unemployment rate was up to 51.9% in January from 50.5% compared with January 2015.

The Warsaw market remains today weaker compared to the environment. Both in France and in Germany, local markets declined as well, but not to the extent of Poland. Despite the morning momentum, the Wig20 index descended to the support level of 1,900 points. Declines in copper prices resulted in shares of KGHM (WSE: KGH) plummeting, which laid the foundation for further downward trend in shares trading.

The second line, the mWIG40 index, performed much better compared to the blue chips. Some shares in the mWIG40 group - e.g. Emperia (WSE: EMP), Kernel (WSE: KER), ING (WSE:ING) and Ciech (WSE: CIE) - appreciated for about a few percent. As a result of these changes, mWIG40 index is on the rise, by approx. 1.2 percent.

Stock indices traded lower on a fall in oil prices. Market participants are awaiting the release of the European Central Bank's (ECB) March minutes later in the day. The central bank cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% in March. The ECB also expanded its monthly purchases to €80 billion from €60 billion).

ECB Vice President Vitor Constancio said before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday that the central bank was doing and would continue to do everything to fulfil its mandate.

ECB Executive Board member Peter Praet said in a speech on Thursday that the central bank's monetary policy adopted since June 2014 was effective.

He pointed out that the ECB could add further stimulus measures if the downside risks increase.

"If further adverse shocks were to materialise, our measures could be recalibrated once more commensurate with the strength of the headwind, also taking into account possible side-effects," Praet said.

He noted that the central bank did not discussed helicopter money.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. climbed 2.6% in March, after a 1.5% decline in February. February's figure was revised down from a 1.4% fall.

On a yearly basis, house prices jumped 10.1% in the three months to March, after a 9.7% increase in the three months to February.

"Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months," Halifax's housing economist Martin Ellis said.

Current figures:

Name Price Change Change %

FTSE 100 6,158.57 -3.06 -0.05 %

DAX 9,603.21 -21.30 -0.22 %

CAC 40 4,269.09 -15.55 -0.36 %

European Central Bank (ECB) Vice President Vitor Constancio said before the Committee on Economic and Monetary Affairs of the European Parliament on Thursday that the central bank was doing and would continue to do everything to fulfil its mandate.

He defended the recent monetary policy easing by the ECB.

"In discussing our recent monetary policy measures, it is essential to consider the global environment in which they were taken. This environment was characterised by subdued growth, historically weak trade developments and low inflationary pressures reflecting sharp falls in energy prices," the ECB vice president said.

European Central Bank (ECB) Executive Board member Peter Praet said in a speech on Thursday that the central bank's monetary policy adopted since June 2014 was effective.

"It has led to a substantial easing of financial conditions, and this has in turn led to an improvement in both output and inflation relative to counterfactual scenarios," he noted, adding that higher structural growth and employment could not depend on monetary policy.

Praet pointed out that the ECB could add further stimulus measures if the downside risks increase.

"If further adverse shocks were to materialise, our measures could be recalibrated once more commensurate with the strength of the headwind, also taking into account possible side-effects," he said.

Praet noted that the central bank did not discussed helicopter money.

Destatis released its manufacturing turnover data for Germany on Thursday. Manufacturing turnover declined on seasonally adjusted and on adjusted for working days basis by 0.5% in February, after a revised 0.8% rise in January.

Domestic turnover decreased by 0.8% in February, while the business with foreign customers dropped 0.3%.

Sales to euro area countries declined 0.6% in February, while sales to other countries were down 0.1%.

On a yearly basis, real manufacturing turnover in Germany rose on seasonally adjusted and on adjusted for working days basis by 1.3% in February.

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. climbed 2.6% in March, after a 1.5% decline in February. February's figure was revised down from a 1.4% fall.

On a yearly basis, house prices jumped 10.1% in the three months to March, after a 9.7% increase in the three months to February.

"Worsening sentiment regarding the prospects for the UK economy and uncertainty ahead of the European referendum in June could result in some softening in the housing market over the next couple of months," Halifax's housing economist Martin Ellis said.

The Bank of France released its current account data on Thursday. France's current account deficit was €3.90 billion in February, down from a deficit of €2.20 billion in January. January's figure was revised down from a deficit of €1.40 billion.

The trade goods deficit widened to €3.9 billion in February from €2.4 billion in January, while the surplus on services rose to €0.3 billion from €0.1 billion.

According to the French Customs, France's trade deficit widened to €5.18 billion in February from €3.91 billion in January, missing expectations for a decline to a deficit of €3.8 billion. January's figure was revised down from a deficit of €3.70 billion.

The increase in deficit was driven by lower imports and higher imports. Exports decreased 0.2% in February, while imports were up 2.8%.

Spanish statistical office INE released its industrial production figures for Spain on Thursday. Industrial production in Spain declined 0.2% in February, after a 0.1% drop in January.

On a yearly basis, industrial production in Spain climbed at adjusted 2.2% in February, after a 3.4% increase in January. January's figure was revised down from a 3.5% gain.

Output of capital goods jumped at seasonally adjusted 6.1% year-on-year in February, output of intermediate goods climbed 3.6%, energy production was down 8.0%, while consumer goods output rose 4.1%.

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Thursday that the central bank was ready to add further stimulus measures if needed to boost inflation toward 2% target. He also said that the Japanese economy continued to recover moderately, adding that there was a weakness in exports and output.

The International Monetary Fund (IMF) said on Wednesday that capital outflows from emerging economies contributed to the slowdown in those economies.

"Both weaker inflows and stronger outflows have contributed to the slowdown. Much of the decline in inflows can be explained by the narrowing differential in growth prospects between emerging market and advanced economies," the IMF said in its World Economic Outlook (WEO).

St. Louis Fed President James Bullard said in a speech on Wednesday that a long-term economic plan in the U.S. was needed to boost the growth.

"The U.S. needs a medium-term growth strategy that is less oriented towards stabilization policy, stimulus, and is more oriented to what kinds of things would improve the long term and medium term growth prospects," he said.

Cleveland Fed President Loretta Mester said in a speech on Wednesday that the Fed should continue to hike its interest rate gradually this year.

"In my view, it will be appropriate for monetary policymakers to continue to gradually reduce the level of accommodation this year," she said.

Mester pointed out that she expected more gradual policy path than in December as she downgraded her growth forecasts.

Mester is a voting member of the Federal Open Market Committee (FOMC) this year.

The Fed released its March monetary policy meeting minutes on Wednesday. The Fed kept its interest rate unchanged in March. Fed officials noted the Fed should be cautious in rising its interest rate further.

"Several members expressed the view that a cautious approach to raising rates would be prudent or noted their concern that raising the target range as soon as April would signal a sense of urgency they did not think appropriate," the minutes said.

According to the minutes, global economic and financial developments posed risks to the U.S. economy.

"A number of participants judged that the headwinds restraining growth and holding down the neutral rate of interest were likely to subside only slowly," the minutes said.

Two Fed officials wanted to hike interest rate in March. The Fed did not identify one official. The other official was Kansas City Fed President Esther George. She wanted a 25 basis point increase.

WIG20 index opened at 1928.52 points (+0.47% to previous close)

WIG 47589.06 +0.50%

WIG30 2148.42 +0.59%

mWIG40 3506.53 +0.49%

After two days of selling on the Warsaw Stock Exchange, today's session starts with attempts to rebound upwards, based on the local support of the minimum of two weeks on the WIG20 index right above the level of 1900 points. Looking at the behavior of core markets, in addition to yesterday's growth in the US markets, the environment doesn't look to be particularly conducive for a strong rebound. Asian market increased only slightly, as now reflected in Euroland.

Yesterday, after the market close in Warsaw, the minutes of the March meeting of the Fed were published. The message sent by the protocol fueled the growth of the S&P500 index by 1% and supported the growth of the oil market, and also weakened of the US dollar. This combination of factors is expected to reward emerging markets and should be well received on the Warsaw Stock Exchange, despite the mixed sentiment in Asia, where the share price discounts of Chinese are interspersed with small increases elsewhere.

The WIG20 index reached the area of 1900 pts., which is an important support. The behavior of stock markets in the US and commodity markets will help to remain or rise above this level.

Future contracts on the US indexes are stable in the morning and it is another light plus before opening in Warsaw.

European stock markets advanced Wednesday, as a rally in oil prices boosted energy companies and upbeat Chinese data calmed nerves about growth in the world's second-largest economy.

U.S. stocks closed with solid gains Wednesday, boosted by soaring oil prices, while minutes from the Federal Reserve's latest policy meeting signaled reluctance to raise rates as early as this month.

Asian stocks outside Japan climbed after Federal Reserve meeting minutes reaffirmed U.S. policy makers aren't rushing to raise interest rates and the yen advanced to a 17-month high as Japanese officials' expressions of concern failed to halt gains.

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.