- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 08-02-2017.

(index / closing price / change items /% change)

Nikkei +96.82 19007.60 +0.51%

TOPIX +8.00 1524.15 +0.53%

Hang Seng +153.56 23485.13 +0.66%

CSI 300 +17.61 3383.29 +0.52%

Euro Stoxx 50 +2.33 3238.04 +0.07%

FTSE 100 +2.60 7188.82 +0.04%

DAX -6.06 11543.38 -0.05%

CAC 40 +12.13 4766.60 +0.26%

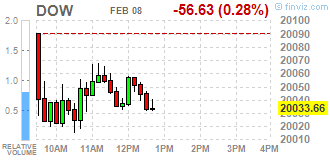

DJIA -35.95 20054.34 -0.18%

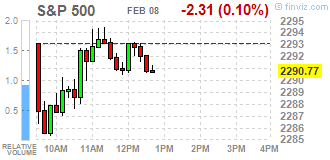

S&P 500 +1.59 2294.67 +0.07%

NASDAQ +8.24 5682.45 +0.15%

S&P/TSX +55.24 15554.04 +0.36%

Major U.S. stock-indexes slightly fell on Wednesday as investors assessed a flood of quarterly earnings reports. More than half of the S&P 500 companies have reported results so far, with their combined earnings estimated to have risen 8,2% - the most in nine quarters.

Most of Dow stocks in positive area (18 of 30). Top loser - The Boeing Company (BA, -1.55%). Top gainer - NIKE, Inc. (NKE, +1.61%).

Most of S&P sectors in negative area. Top gainer - Utilities (+0.8%). Top loser - Conglomerates (-0.8%).

At the moment:

Dow 19985.00 -33.00 -0.16%

S&P 500 2286.75 -1.75 -0.08%

Nasdaq 100 5183.25 +6.50 +0.13%

Oil 52.37 +0.20 +0.38%

Gold 1244.70 +8.60 +0.70%

U.S. 10yr 2.34 -0.05

Polish equity market closed flat on Wednesday. The broad market measure, the WIG Index, edged up 0.05%. Sector performance within the WIG Index was mixed. Clothes sector (+1.25%) outperformed, while telecoms (-1.05%) lagged behind.

The large-cap WIG30 Index inched up 0.05%. Within the index components, bank MBANK (WSE: MBK) was the best-performing name, climbing by 4.9% on the back of better-than-expected Q4 FY 2016 earnings. The bank reported its net profit fell by 5% y/y to PLN 292.5 mln in Q4, but was above analysts' consensus estimate of PLN 263.4 mln. In addition, MBANK's CEO Cezary Stypulkowski stated that the bank is unlikely to pay out dividend from its 2016 profit. Other largest outperformers were videogame developer CD PROJEKT (WSE: CDR), coking coal producer JSW (WSE: JSW) and footwear retailer CCC (WSE: CCC), gaining 2.75%, 1.86% and 1.85% respectively. On the other side of the ledger, media group CYFROWY POLSAT (WSE: CPS) and three gencos TAURON PE (WSE: TPE), ENERGA (WSE: ENG) and ENEA (WSE: ENA) were biggest decliners, tumbling by 1.96%-2.41%.

U.S. stock-index futures were flat as investors focused on corporate earnings reports.

Global Stocks:

Nikkei 19,007.60 +96.82 +0.51%

Hang Seng 23,485.13 +153.56 +0.66%

Shanghai 3,167.45 +14.36 +0.46%

FTSE 7,167.57 -18.65 -0.26%

CAC 4,763.85 +9.38 +0.20%

DAX 11,528.46 -20.98 -0.18%

Crude $51.75 (-0.81%)

Gold $1,241.90 (+0.47%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 37.99 | 0.02(0.0527%) | 4890 |

| ALTRIA GROUP INC. | MO | 72.09 | -0.11(-0.1524%) | 2550 |

| AMERICAN INTERNATIONAL GROUP | AIG | 65 | 0.12(0.185%) | 152 |

| Apple Inc. | AAPL | 131.5 | -0.03(-0.0228%) | 77459 |

| AT&T Inc | T | 41.19 | 0.07(0.1702%) | 4272 |

| Barrick Gold Corporation, NYSE | ABX | 19.52 | 0.19(0.9829%) | 102762 |

| Boeing Co | BA | 165.12 | 0.04(0.0242%) | 3017 |

| Caterpillar Inc | CAT | 93.1 | -0.21(-0.2251%) | 6495 |

| Chevron Corp | CVX | 111.05 | -0.34(-0.3052%) | 656 |

| Citigroup Inc., NYSE | C | 56.9 | -0.29(-0.5071%) | 4742 |

| Exxon Mobil Corp | XOM | 81.97 | -0.05(-0.061%) | 17104 |

| Facebook, Inc. | FB | 132.28 | 0.44(0.3337%) | 77789 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.4 | -0.12(-0.7732%) | 169281 |

| General Electric Co | GE | 29.55 | -0.01(-0.0338%) | 3675 |

| Goldman Sachs | GS | 238.23 | -1.39(-0.5801%) | 7767 |

| Google Inc. | GOOG | 807.44 | 0.47(0.0582%) | 2138 |

| Home Depot Inc | HD | 137.5 | 0.85(0.622%) | 1500 |

| Intel Corp | INTC | 36.4 | 0.05(0.1376%) | 1765 |

| International Business Machines Co... | IBM | 177.15 | 0.09(0.0508%) | 4556 |

| JPMorgan Chase and Co | JPM | 86.3 | -0.42(-0.4843%) | 11191 |

| Merck & Co Inc | MRK | 64.15 | -0.05(-0.0779%) | 3165 |

| Microsoft Corp | MSFT | 63.45 | 0.02(0.0315%) | 6812 |

| Pfizer Inc | PFE | 32.18 | 0.10(0.3117%) | 565 |

| Tesla Motors, Inc., NASDAQ | TSLA | 256.98 | -0.50(-0.1942%) | 4544 |

| Travelers Companies Inc | TRV | 117.6 | -0.16(-0.1359%) | 375 |

| Twitter, Inc., NYSE | TWTR | 18.66 | 0.40(2.1906%) | 327843 |

| Verizon Communications Inc | VZ | 48.1 | 0.06(0.1249%) | 1116 |

| Visa | V | 86 | 0.22(0.2565%) | 5979 |

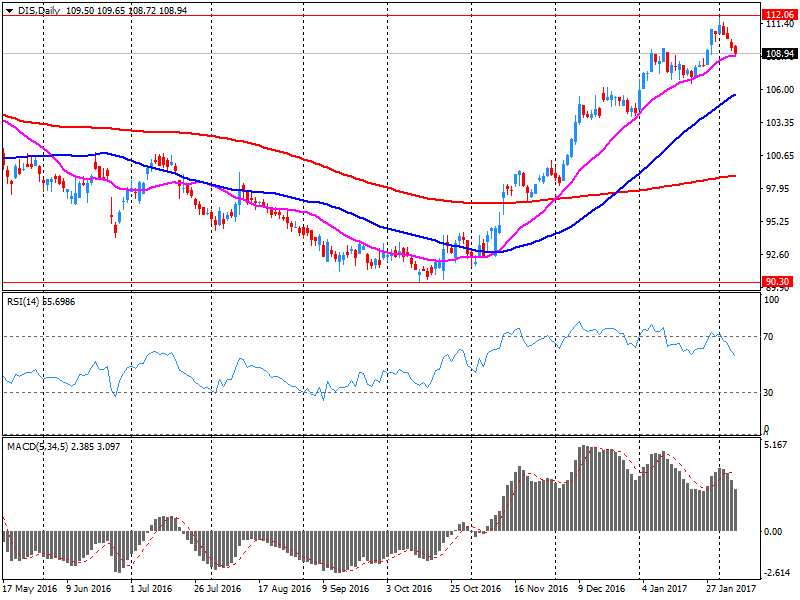

| Walt Disney Co | DIS | 108.95 | -0.05(-0.0459%) | 130399 |

| Yahoo! Inc., NASDAQ | YHOO | 44.56 | 0.19(0.4282%) | 980 |

Upgrades:

Twitter (TWTR) upgraded to Buy at BTIG Research

Downgrades:

Other:

Facebook (FB) added to US 1 List at BofA/Merrill

Walt Disney (DIS) reiterated with an Outperform at RBC Capital Mkts; target $130

Walt Disney (DIS) reiterated with a Hold at Stifel; target $100

Walt Disney (DIS) reiterated with a Hold at Needham

Walt Disney reported Q1 FY 2017 earnings of $1.55 per share (versus $1.63 in Q1 FY 2016), beating analysts' consensus estimate of $1.49.

The company's quarterly revenues amounted to $14.784 bln (-3% y/y), missing analysts' consensus estimate of $15.298 bln.

DIS rose to $109.10 (+0.09%) in pre-market trading.

U.K. stocks closed higher Tuesday, with Rio Tinto PLC among the notable advancers, but BP PLC shares tumbled after some disappointing financial figures from the oil heavyweight.

U.S. stocks closed slightly higher Tuesday, but off session highs, with the Nasdaq notching a new record while oil prices declined and the U.S. trade deficit hit its highest level in four years. The Nasdaq Composite Index COMP, +0.19% rose 10.67 points, or 0.2%, to close at a record of 5,674.22. The index hit an intraday all-time high of 5,689.60 during the session.

Global investors reeled in their risk taking on Wednesday, with many stock markets across Asia drifting lower under the pressure of falling oil prices. Equities in the region kicked off the week positively, but that momentum has flatlined as political uncertainty in Europe and the U.S. lingers.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.