- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 10-02-2016.

(index / closing price / change items /% change)

Nikkei 225 15,713.39 -372.05 -2.31 %

Topix 1,264.96 -39.37 -3.02 %

FTSE 100 5,672.3 +40.11 +0.71 %

CAC 40 4,061.2 +63.66 +1.59 %

Xetra DAX 9,017.29 +137.89 +1.55 %

S&P 500 1,851.86 -0.35 -0.02 %

NASDAQ Composite 4,283.59 +14.83 +0.35 %

Dow Jones 15,914.74 -99.64 -0.62 %

Major U.S. stock-indexes gained on Wednesday after Federal Reserve Chair Janet Yellen said conditions in the United States would allow for gradual rate hikes, and as technology stocks rebounded. However, Yellen acknowledged that the weakness in the global economy could knock the U.S. economy off track from an otherwise solid course. Fears of a China-led global economic slowdown, along with oil's steep slide since the Fed raised rates in December have dampened the market's expectations for a hike in coming months.

Most of Dow stocks in positive area (17 of 30). Top looser - The Walt Disney Company (DIS, -4,61%). Top gainer - NIKE, Inc. (NKE, +3,28%).

Most of all S&P sectors in positive area. Top looser - Conglomerates (-2,8%). Top gainer - Healthcare (+1,6%).

At the moment:

Dow 15980.00 +21.00 +0.13%

S&P 500 1861.25 +13.00 +0.70%

Nasdaq 100 4001.75 +57.50 +1.46%

Oil 27.96 +0.02 +0.07%

Gold 1193.70 -4.90 -0.41%

U.S. 10yr 1.73 +0.00

The Fed Chairwoman Janet Yellen testified before the House Financial Services Committee on Wednesday that it is unlikely that the Fed will cut its interest rate soon as the risk of recession is low.

"We've not yet seen a sharp drop-off in growth, either globally or in the United States, but we certainly recognize that global market developments bear close watching," the Fed chairwoman noted.

Yellen was not sure if negative rate are legal as she was asked about the implementation of negative interest rates.

"We didn't fully look at the legal issues around that. I would say that remains a question that we still would need to investigate more thoroughly," she said.

Stock indices closed higher on the Fed Chairwoman Janet Yellen's testimony. Yellen said in her prepared remarks before the House Financial Services Committee on Wednesday that further interest rate hikes will depend on the incoming economic data, adding that interest rate hikes will be gradual.

She noted that there is a risk from developments abroad to the U.S. economy.

"The economic outlook is uncertain. Foreign economic developments, in particular, pose risks to U.S. economic growth," Yellen said.

The Fed chairwoman also said that "financial conditions in the United States have recently become less supportive of growth".

She expects inflation to reach 2% target over the medium term, while the labour market is expected to continue to strengthen. Regarding the U.S. labour market, Yellen added that there remained some slack in labour markets.

Meanwhile, the economic data from Eurozone was weak. The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France declined 1.6% in December, missing expectations for a 0.2% increase, after a 0.9% fall in November. It was the biggest drop since May 2014.

Manufacturing output decreased 0.8% in December, while construction output slid 1.6%.

On a yearly basis, the French industrial production climbed 2.0% in December, after a 2.8% gain in November.

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.7% in December, after a 0.5% decline in November.

On a yearly basis, industrial production in Italy slid at a seasonally-adjusted rate of 1.0% in December, after a 1.1% increase in November. November's figure was revised up from a 0.9% gain.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.4% in three months to January, after a 0.5% growth in three months to December. December's figure was revised down from a 0.6% rise.

A softer growth was driven by a weakness in the production sector.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. fell 0.2% in December, missing expectations for a 0.1% gain, after a 0.3% decrease in November.

Manufacturing output was mainly driven by a drop in the manufacture of wood, paper products and printing, which plunged by 2.1% in December.

On a yearly basis, manufacturing production in the U.K. decreased 1.7% in December, missing forecast of a 1.4% fall, after a 1.2% drop in November.

Industrial production in the U.K. slid 1.1% in December, missing forecasts of a 0.1% fall, after a 0.8% rise in November. It was the biggest monthly drop since 2012.

The decline was driven by falls in mining, oil and gas extraction and manufacturing.

On a yearly basis, industrial production in the U.K. decreased 0.4% in December, missing expectations for a 1.0% rise, after a 0.7% increase in November.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,672.3 +40.11 +0.71 %

DAX 9,017.29 +137.89 +1.55 %

CAC 40 4,061.2 +63.66 +1.59 %

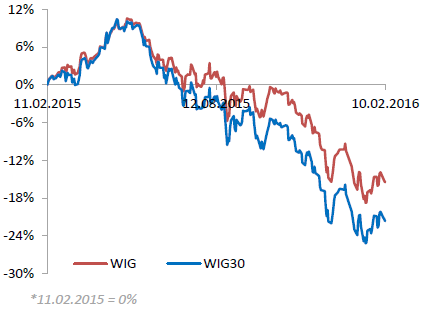

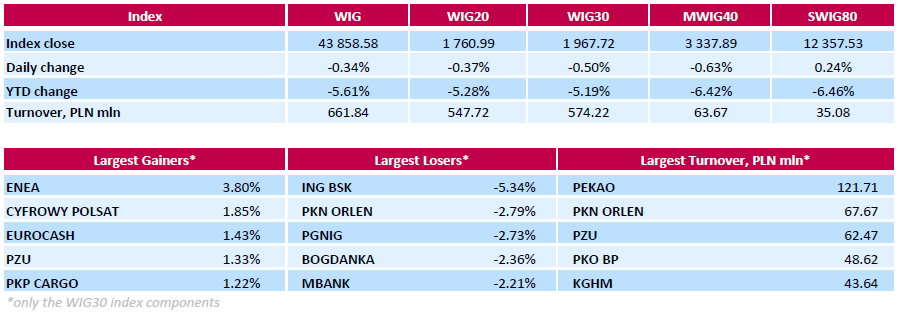

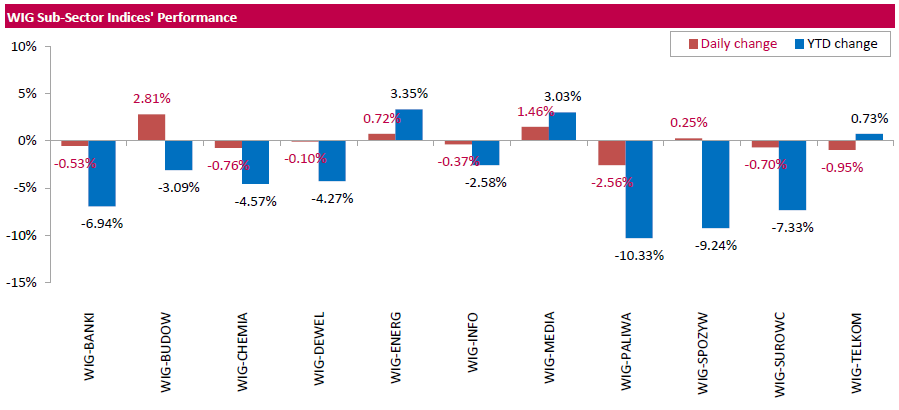

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, dropped by 0.34%. Sector performance within the WIG Index was mixed. Construction sector (+2.81%) was the strongest group, while oil and gas sector (-2.56%) lagged behind.

The large-cap benchmark, the WIG30 Index, fell by 0.5%. In the index basket, bank ING BSK (WSE: ING) recorded the biggest drop, down 5.34%. It was followed by oil refiner PKN ORLEN (WSE: PKN), oil and gas producer PGNIG (WSE: PGN) and thermal coal miner BOGDANKA (WSE: LWB), declining by 2.79%, 2.73% and 2.36% respectively. On the other side of the ledger, genco ENEA (WSE: ENA) was the strongest performer, advancing 3.8%. Other major gainers were media- and telecom-group CYFROWY POLSAT (WSE: CPS), FMCG wholesaler EUROCASH (WSE: EUR), insurer PZU (WSE: PZU) and railway freight transport operator PKP CARGO (WSE: PKP), adding between 1.22% and 1.85%.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.4% in three months to January, after a 0.5% growth in three months to December. December's figure was revised down from a 0.6% rise.

A softer growth was driven by a weakness in the production sector.

According to the NIESR, the U.K. economy is expected to expand 2.3% in 2016 and 2.7% in 2017.

"Despite our estimates indicating a subdued start to 2016, we do expect the economy to grow by 2.3 per cent this year, primarily driven by consumer spending. However, negative contributions from net trade are expected to weigh heavily on growth. There exist a number of downside risks that have the potential to exacerbate this, should they materialise," James Warren, NIESR Research Fellow, said.

The Fed Chairwoman Janet Yellen said in her prepared remarks before the House Financial Services Committee that further interest rate hikes will depend on the incoming economic data, adding that interest rate hikes will be gradual.

She noted that there is a risk from developments abroad to the U.S. economy.

"The economic outlook is uncertain. Foreign economic developments, in particular, pose risks to U.S. economic growth," Yellen said.

The Fed chairwoman also said that "financial conditions in the United States have recently become less supportive of growth".

Yellen pointed out that a drop in stock markets, higher borrowing rates for riskier borrowers, and a further appreciation of the U.S. dollar could weigh on the outlook for economic activity and the labour market in the U.S.

She expects inflation to reach 2% target over the medium term, while the labour market is expected to continue to strengthen. Regarding the U.S. labour market, Yellen added that there remained some slack in labour markets.

U.S. stock-index futures rose.

Global Stocks:

Nikkei 15,713.39 -372.05 -2.31%

Hang Seng Closed

Shanghai Composite Closed

FTSE 5,682.22 +50.03 +0.89%

CAC 4,080.52 +82.98 +2.08%

DAX 9,074.25 +194.85 +2.19%

Crude oil $27.90 (-0.14%)

Gold $1191.30 (-0.61%)

(company / ticker / price / change, % / volume)

| Citigroup Inc., NYSE | C | 38.30 | 2.11% | 40.0K |

| Visa | V | 69.50 | 1.92% | 0.1K |

| Twitter, Inc., NYSE | TWTR | 14.66 | 1.81% | 44.7K |

| Starbucks Corporation, NASDAQ | SBUX | 55.34 | 1.69% | 5.2K |

| Facebook, Inc. | FB | 101.13 | 1.60% | 103.9K |

| Apple Inc. | AAPL | 96.44 | 1.53% | 256.5K |

| Yandex N.V., NASDAQ | YNDX | 12.69 | 1.52% | 6.1K |

| Amazon.com Inc., NASDAQ | AMZN | 489.00 | 1.44% | 13.4K |

| JPMorgan Chase and Co | JPM | 57.00 | 1.42% | 1.9K |

| ALCOA INC. | AA | 7.92 | 1.41% | 5.6K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 5.07 | 1.40% | 70.1K |

| Google Inc. | GOOG | 687.00 | 1.31% | 2.7K |

| Yahoo! Inc., NASDAQ | YHOO | 27.17 | 1.30% | 6.9K |

| HONEYWELL INTERNATIONAL INC. | HON | 103.99 | 1.24% | 0.7K |

| Home Depot Inc | HD | 115.22 | 1.19% | 0.3K |

| Goldman Sachs | GS | 150.00 | 1.18% | 1.9K |

| Tesla Motors, Inc., NASDAQ | TSLA | 150.00 | 1.18% | 32.1K |

| Cisco Systems Inc | CSCO | 22.90 | 1.10% | 2.1K |

| Boeing Co | BA | 119.00 | 1.03% | 2.6K |

| International Business Machines Co... | IBM | 125.35 | 1.03% | 0.6K |

| Microsoft Corp | MSFT | 49.79 | 1.03% | 17.9K |

| General Motors Company, NYSE | GM | 28.15 | 1.00% | 3.3K |

| ALTRIA GROUP INC. | MO | 61.00 | 0.91% | 2.7K |

| Nike | NKE | 56.18 | 0.90% | 23.5K |

| Merck & Co Inc | MRK | 49.60 | 0.90% | 0.3K |

| American Express Co | AXP | 53.10 | 0.89% | 0.2K |

| Ford Motor Co. | F | 11.45 | 0.88% | 7.7K |

| 3M Co | MMM | 154.76 | 0.74% | 2.3K |

| Intel Corp | INTC | 29.02 | 0.73% | 9.4K |

| International Paper Company | IP | 35.38 | 0.71% | 0.5K |

| Johnson & Johnson | JNJ | 102.68 | 0.70% | 0.5K |

| Pfizer Inc | PFE | 29.30 | 0.69% | 61.4K |

| McDonald's Corp | MCD | 117.75 | 0.63% | 0.7K |

| General Electric Co | GE | 28.45 | 0.60% | 8.7K |

| E. I. du Pont de Nemours and Co | DD | 59.00 | 0.51% | 0.7K |

| AT&T Inc | T | 36.80 | 0.41% | 7.5K |

| Verizon Communications Inc | VZ | 50.32 | 0.34% | 1.1K |

| Procter & Gamble Co | PG | 82.81 | 0.21% | 1.3K |

| Chevron Corp | CVX | 83.00 | 0.10% | 0.5K |

| Exxon Mobil Corp | XOM | 80.10 | 0.02% | 16.7K |

| The Coca-Cola Co | KO | 43.20 | -0.23% | 7.2K |

| Barrick Gold Corporation, NYSE | ABX | 11.09 | -1.16% | 62.4K |

| Walt Disney Co | DIS | 88.00 | -4.68% | 161.9K |

Upgrades:

Coca-Cola (KO) upgraded to Hold from Sell at Societe Generale

Downgrades:

Other:

Freeport-McMoRan (FCX) target lowered to $10 from $20 at Cowen

Twitter (TWTR) target lowered to $17 from $26 at Cowen

Walt Disney (DIS) target lowered to $101 from $110 at FBR Capital

Walt Disney (DIS) target lowered to $130 from $131 at Topeka

Walt Disney (DIS) target lowered to $118 from $120 at JP Morgan

Stock indices traded higher ahead of the Fed Chairwoman Janet Yellen's testimony before the House Financial Services Committee later in the day. Market participants will closely monitor her speech for hints regarding further interest rate hikes. They speculate that it is unlikely that the Fed will raise its interest rate at its March monetary policy meeting.

A rise in oil prices also supported stock markets.

Meanwhile, the economic data from Eurozone was weak. The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France declined 1.6% in December, missing expectations for a 0.2% increase, after a 0.9% fall in November. It was the biggest drop since May 2014.

Manufacturing output decreased 0.8% in December, while construction output slid 1.6%.

On a yearly basis, the French industrial production climbed 2.0% in December, after a 2.8% gain in November.

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.7% in December, after a 0.5% decline in November.

On a yearly basis, industrial production in Italy slid at a seasonally-adjusted rate of 1.0% in December, after a 1.1% increase in November. November's figure was revised up from a 0.9% gain.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. fell 0.2% in December, missing expectations for a 0.1% gain, after a 0.3% decrease in November.

Manufacturing output was mainly driven by a drop in the manufacture of wood, paper products and printing, which plunged by 2.1% in December.

On a yearly basis, manufacturing production in the U.K. decreased 1.7% in December, missing forecast of a 1.4% fall, after a 1.2% drop in November.

Industrial production in the U.K. slid 1.1% in December, missing forecasts of a 0.1% fall, after a 0.8% rise in November. It was the biggest monthly drop since 2012.

The decline was driven by falls in mining, oil and gas extraction and manufacturing.

On a yearly basis, industrial production in the U.K. decreased 0.4% in December, missing expectations for a 1.0% rise, after a 0.7% increase in November.

Current figures:

Name Price Change Change %

FTSE 100 5,699.54 +67.35 +1.20 %

DAX 9,084.09 +204.69 +2.31 %

CAC 40 4,090.41 +92.87 +2.32 %

The Bank of Japan (BoJ) released its Corporate Goods Price Index (CGPI) data on late Tuesday evening. Producer prices in Japan declined 0.9% in January, after a 0.3% fall in December.

Export prices fell 0.6% in January, while import prices declined 3.0%.

On a yearly basis, producer prices slid 3.1% in January, after a 3.4% drop in December.

Export prices dropped 5.6% year-on-year in January, while import prices plunged 16.6%.

The Housing Industry Association (HIA) released its new home sales data for Australia on Wednesday. New home sales jumped 6.0% in December, after a 2.7% drop in November.

Sales of detached homes increased 2.2% in December, while sales for multi-units climbed 21.1%.

"Key leading indicators of new home building such as HIA-ACI New Home Sales and ABS Building Approvals and new housing finance are consistent with very healthy national construction volumes persisting throughout the first half of 2016. These indicators are also signalling a continuation in 2016 of very large differences in new housing conditions across the states," the HIA's chief economist Harley Dale said.

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy fell at a seasonally-adjusted rate of 0.7% in December, after a 0.5% decline in November.

On a yearly basis, industrial production in Italy slid at a seasonally-adjusted rate of 1.0% in December, after a 1.1% increase in November. November's figure was revised up from a 0.9% gain.

Output of capital goods declined 1.6% year-on-year in December, output of consumer goods slid 1.0%, output of energy rose 0.4%, while output of intermediate goods decrease 2.6%.

In 2015 as whole, industrial production rose 1.0%.

The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France declined 1.6% in December, missing expectations for a 0.2% increase, after a 0.9% fall in November. It was the biggest drop since May 2014.

Manufacturing output decreased 0.8% in December, while construction output slid 1.6%.

Output in mining and quarrying, energy, water supply and waste management dropped 5.2% in December.

On a yearly basis, the French industrial production climbed 2.0% in December, after a 2.8% gain in November.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. fell 0.2% in December, missing expectations for a 0.1% gain, after a 0.3% decrease in November. November's figure was revised up from a 0.4% drop.

Manufacturing output was mainly driven by a drop in the manufacture of wood, paper products and printing, which plunged by 2.1% in December.

On a yearly basis, manufacturing production in the U.K. decreased 1.7% in December, missing forecast of a 1.4% fall, after a 1.2% drop in November.

Industrial production in the U.K. slid 1.1% in December, missing forecasts of a 0.1% fall, after a 0.8% rise in November. It was the biggest monthly drop since 2012.

November's figure was revised down from a 0.7% decrease.

The decline was driven by falls in mining, oil and gas extraction and manufacturing.

On a yearly basis, industrial production in the U.K. decreased 0.4% in December, missing expectations for a 1.0% rise, after a 0.7% increase in November. November's figure was revised down from a 0.9% gain.

The White House downgraded growth and inflation forecasts. The U.S. economy is expected to expand 2.6% in 2016, down from its previous forecast of a 3.0% rise, and 2.6% in 2017, down from its previous forecast of a 2.8% growth.

Inflation is expected to rise 1.5% in 2016, down from its previous forecast of 1.9%, and 2.1% in 2017 and 2018.

The White House forecasts the budget deficit to be 3.3% of GDP in 2016, down from its previous forecast of 2.3%, and 2.6% of GDP in 2017, down from its previous forecast of 2.2%.

The unemployment rate is expected to be 4.7% in 2016, 4.5% in 2017, and 4.6% in 2018.

Japanese Prime Minister Shinzo Abe on Wednesday defended before the parliament the Bank of Japan's (BoJ) monetary policy decisions. He noted that he trusted the BoJ Governor Haruhiko Kuroda and he believe that inflation will reach 2% target.

Abe also said that a drop in markets was driven by overseas factors.

Westpac Bank released its consumer confidence index for Australia on late Tuesday evening. The index climbed 4.2% in February, beating expectations for a 1.0% fall, after a 3.5% drop in January.

The index was mainly driven by a rise in the index tracking views on 'family finances vs a year ago', which jumped by 11.3% in February.

"The Reserve Bank Board next meets on March 1. Following the recent turmoil, markets are convinced that the Reserve Bank will be cutting rates by May, if not earlier," Westpac Chief Economist Bill Evans said.

"Today's report highlights that one of the Bank's most significant concerns of whether international developments will weigh on domestic demand will need more time to resolve," he added.

U.S. stock indices posted minor declines on Tuesday as gains in materials stocks were offset by heavy declines in the energy sector.

The Dow Jones Industrial Average declined 12.67 points, or less than 0.1%, to 16,014. The S&P 500 lost 1 point, or less than 0.1%, to 1,852 (the energy sector fell by 2.5%). The Nasdaq Composite fell 14.99 points, or 0.4%, to 4,268.

Small business confidence declined to the lowest level in almost two years in the U.S. in January because of concerns over short-term business conditions outlook. The National Federation of Independent Business reported that the index of small business confidence fell by 1.3 points to 93.9 points in January (the lowest level since February 2014). Nevertheless small businesses remained optimistic about the labor market.

This morning in Asia the Nikkei fell 3.05%, or 491.23, to 15,594.21. Markets in China and Hong Kong are closed due to Lunar New Year.

Japanese stocks continued falling amid concerns over the global economic growth and ongoing declines in oil prices. Meanwhile the yen continued rising harming the country's exporters.

(index / closing price / change items /% change)

Nikkei 225 16,085.44 -918.86 -5.40 %

Topix 1,304.33 -76.08 -5.51 %

FTSE 100 5,632.19 -57.17 -1.00 %

CAC 40 3,997.54 -68.77 -1.69 %

Xetra DAX 8,879.4 -99.96 -1.11 %

S&P 500 1,852.21 -1.23 -0.07 %

NASDAQ Composite 4,268.76 -14.99 -0.35 %

Dow Jones 16,014.38 -12.67 -0.08 %

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.