- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 10-05-2017.

(index / closing price / change items /% change)

Nikkei +57.09 19900.09 +0.29%

TOPIX +3.42 1585.19 +0.22%

Hang Seng +126.39 25015.42 +0.51%

CSI 300 -14.83 3337.70 -0.44%

Euro Stoxx 50 -3.34 3645.74 -0.09%

FTSE 100 +43.03 7385.24 +0.59%

DAX +8.34 12757.46 +0.07%

CAC 40 +2.45 5400.46 +0.05%

DJIA -32.67 20943.11 -0.16%

S&P 500 +2.71 2399.63 +0.11%

NASDAQ +8.56 6129.15 +0.14%

S&P/TSX +64.01 15633.21 +0.41%

Major US stock indexes finished trading without a single dynamic, as investors evaluated the batch of weak corporate reports and the step of US President Donald Trump to dismiss the head of the FBI.

The president said that he fired Komi, who led the investigation into the possible collusion of representatives of his presidential campaign with Russia in 2016, for a bad investigation of the scandal with the publication of the electronic correspondence of US presidential candidate Hillary Clinton.

In addition, the Ministry of Labor reported that import prices in the US rose more than expected in April, due to rising prices for petroleum products and a number of other goods, which could contribute to the growth of domestic inflation. Import prices jumped 0.5 percent after a revised increase of 0.1 percent in March (originally reported a fall of 0.2 percent). Economists predicted that import prices will rise by 0.2 percent. During the 12 months to April, import prices increased by 4.1 percent, slowing from 4.3 percent in March. Export prices rose 0.2 percent after an increase of 0.1 percent in March. In annual terms, export prices increased by 3.0 percent after an increase of 3.4 percent in March.

The cost of oil futures jumped about 3.2% after Iraq and Algeria joined Saudi Arabia, supporting the extension of the oil production agreement. Additional support for prices was provided by data from the US Energy Ministry, indicating a sharp drop in oil reserves over the past week.

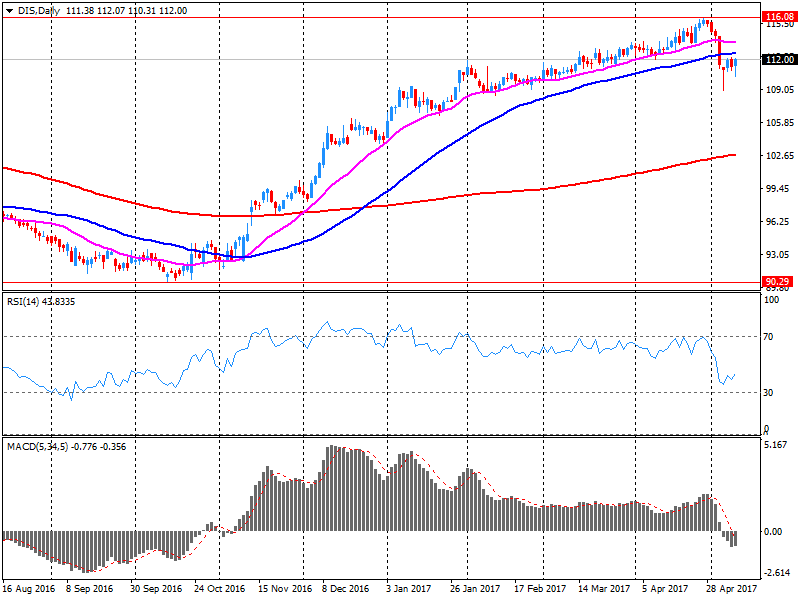

Components of the DOW index finished trading mixed (15 in positive territory, 15 in negative territory). More shares fell The Walt Disney Company (DIS, -2.43%). The leader of growth was shares of Chevron Corporation (CVX, + 1.40%).

Most sectors of the S & P index showed an increase. The leader of growth was the sector of basic materials (+ 1.2%). The sector of industrial goods fell most of all (-0.3%).

At closing:

DJIA -0.16% 20.941.96 -33.82

Nasdaq + 0.14% 6.129.14 + 8.55

S & P + 0.11% 2,399.48 + 2.56

U.S. stock-index futures were flat as President Donald Trump's firing of his FBI chief set off a political storm that could make passage of his pro-growth plans more difficult.

Stocks:

Nikkei 19,900.09 +57.09 +0.29%

Hang Seng 25,015.42 +126.39 +0.51%

Shanghai 3,051.75 -28.78 -0.93%

S&P/ASX 5,875.44 +35.54 +0.61%

FTSE 7,379.17 +36.96 +0.50%

CAC 5,399.77 +1.76 +0.03%

DAX 12,771.46 +22.34 +0.18%

Crude $46.47 (+1.29%)

Gold $1,222.20 (+0.50%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 70 | -0.29(-0.41%) | 6777 |

| Amazon.com Inc., NASDAQ | AMZN | 952.52 | -0.30(-0.03%) | 9587 |

| Apple Inc. | AAPL | 152.99 | -1.00(-0.65%) | 304720 |

| AT&T Inc | T | 38.16 | -0.06(-0.16%) | 2950 |

| Barrick Gold Corporation, NYSE | ABX | 16.48 | 0.20(1.23%) | 61309 |

| Boeing Co | BA | 185.1 | -0.39(-0.21%) | 2622 |

| Caterpillar Inc | CAT | 99 | -0.29(-0.29%) | 650 |

| Chevron Corp | CVX | 105.63 | 0.55(0.52%) | 1148 |

| Cisco Systems Inc | CSCO | 33.74 | -0.16(-0.47%) | 4600 |

| Citigroup Inc., NYSE | C | 60.15 | -0.08(-0.13%) | 4170 |

| Exxon Mobil Corp | XOM | 82.05 | 0.51(0.63%) | 16857 |

| Facebook, Inc. | FB | 150.2 | -0.28(-0.19%) | 44150 |

| Ford Motor Co. | F | 11.15 | -0.01(-0.09%) | 5834 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.78 | 0.15(1.29%) | 28942 |

| General Electric Co | GE | 28.86 | -0.07(-0.24%) | 4095 |

| General Motors Company, NYSE | GM | 34.15 | -0.11(-0.32%) | 1268 |

| Goldman Sachs | GS | 223.48 | -0.28(-0.13%) | 8242 |

| Home Depot Inc | HD | 157.8 | 0.12(0.08%) | 1878 |

| Intel Corp | INTC | 36.35 | -0.02(-0.06%) | 9031 |

| International Business Machines Co... | IBM | 151.99 | -0.12(-0.08%) | 1160 |

| JPMorgan Chase and Co | JPM | 86.6 | -0.15(-0.17%) | 2203 |

| McDonald's Corp | MCD | 143 | -1.36(-0.94%) | 2739 |

| Microsoft Corp | MSFT | 69.02 | -0.02(-0.03%) | 357 |

| Nike | NKE | 55.35 | 0.46(0.84%) | 112965 |

| Pfizer Inc | PFE | 32.96 | -0.10(-0.30%) | 54229 |

| Tesla Motors, Inc., NASDAQ | TSLA | 321.5 | 0.24(0.07%) | 27215 |

| The Coca-Cola Co | KO | 43.4 | -0.11(-0.25%) | 1140 |

| Twitter, Inc., NYSE | TWTR | 18.3 | -0.07(-0.38%) | 33395 |

| Wal-Mart Stores Inc | WMT | 76.4 | 0.19(0.25%) | 1403 |

| Walt Disney Co | DIS | 109.47 | -2.60(-2.32%) | 59376 |

| Yahoo! Inc., NASDAQ | YHOO | 49.51 | 0.02(0.04%) | 1041 |

| Yandex N.V., NASDAQ | YNDX | 27.47 | 0.09(0.33%) | 910 |

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) reiterated with an Outperform at FBR Capital; target $116

Walt Disney (DIS) reiterated with a Hold at Needham

Walt Disney (DIS) reiterated with an Outperform at RBC Capital Mkts; target $130

Walt Disney (DIS) reported Q2 FY 2017 earnings of $1.50 per share (versus $1.36 in Q2 FY 2016), beating analysts' consensus estimate of $1.41.

The company's quarterly revenues amounted to $13.336 bln (+2.8% y/y), generally in-line with analysts' consensus estimate of $13.445 bln.

DIS fell to $109.20 (-2.56%) in pre-market trading.

European stocks marched higher Tuesday, with the DAX 30 ending at a record after German trade data exceeding expectations. Investors also appeared in the mood to take on more risk in the wake of France's presidential election.

Stocks closed near session lows Tuesday as the Dow industrials and S&P 500 finished lower and the tech-heavy Nasdaq carved out a new record while investors sifted through mostly upbeat earnings reports against a backdrop of falling oil prices and remarks from Federal Reserve speakers.

China's consumer inflation accelerated in April, as higher non-food prices helped outweigh continued falls in food prices, official data showed Wednesday. China's consumer price index increased 1.2% in April from a year earlier, compared with a 0.9% gain in March, the National Bureau of Statistics said.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.