- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 10-07-2015.

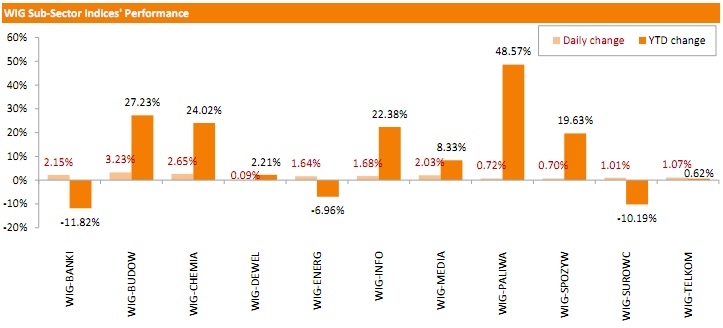

The mood in the Polish equity market was upbeat on Friday. The broad-market measure, the WIG Index, gained 1.80%. Sector performance was uniformly positive. Construction sector and chemicals fared the best, adding 3.23% and 2.65% respectively.

The large-cap stocks' measure, the WIG30 Index, added 1.78%. Almost all index components generated positive returns. The exception were GTC (WSE: GTC) and PGNIG (WSE: PGN), falling 1.67% and 0.44% respectively. At the same time, MBANK (WSE: MBK) became the biggest gainer with a 4.43% advance, followed by its peers from banking sector ALIOR (WSE: ALR) and ING BSK (WSE: ING), which quotations went up by 4.17% and 4.15% respectively.

Stock indices closed higher on hopes for a deal between Athens and its lenders. Athens sent new reform proposals to its lenders two hours before the deadline on Thursday. New proposals includes VAT reforms, other tax policies, pension and public sector reforms, higher corporate tax and the privatization of the port and the railway companies.

Greece's creditors will make a decision on Greek reform proposals tomorrow.

Meanwhile, the economic data from the Eurozone was mixed. German wholesale prices declined 0.2% in June, after a 0.5% increase in May.

On a yearly basis, wholesale prices in Germany fell 0.5% in June, after a 0.4% drop in May.

The fall was largely driven by a 10.5% decline in the wholesale prices of solid fuels and related products.

Industrial production in France rose 0.4% in May, in line with expectations, after a 0.7% decline in April.

The increase was driven by a rise in in output in the transport and automobile sector, which climbed 2.3% in May.

France's current account surplus decreased to €0.3 billion in May from €0.4 billion in April.

The decline in current account surplus was driven by a higher goods deficit.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £8.0 billion in May from £9.8 billion in April. It was the lowest level since June 2013.

April's figure was revised down from a deficit of £8.56 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 5.5% in May, while exports of goods rose 0.1%.

The total trade deficit, including services, narrowed to £393 million in May from £1.834 billion in April. It was the lowest total trade deficit since June 2013.

April's figure was revised down from a deficit of £1.202 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,673.38 +91.75 +1.39 %

DAX 11,315.63 +319.22 +2.90 %

CAC 40 4,903.07 +145.85 +3.07 %

Major U.S. stock-indexes rose on Friday on hopes that Greece will be able secure fresh funding to avert bankruptcy and allow it to remain in the euro zone. Greece has made substantial concessions in its latest proposal to lenders, including tax hikes, in hopes of receiving $59 billion to help it cover debts until 2018. Euro zone finance ministers will meet on Saturday to decide on a third bailout for Athens. U.S. markets fell sharply earlier in the week as concerns over a slowdown in China, a drop in commodity prices and the Greek debt crisis spooked investors.

All of Dow stocks in positive area (30 of 30). Top gainer - Apple Inc. (AAPL, +2.35).

All of S&P index sectors also in positive area. Top gainer - Consumer goods (+1.6%).

At the moment:

Dow 17642.00 +190.00 +1.09%

S&P 500 2066.50 +25.25 +1.24%

Nasdaq 100 4405.25 +65.75 +1.52%

10-year yield 2.38% +0.08

Oil 52.14 -0.64 -1.21%

Gold 1159.60 +0.40 +0.03%

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Tuesday. On a seasonally adjusted basis, Greek industrial production declined 4.9% in May.

On a yearly basis, industrial production in Greece plunged at an adjusted rate of 4.0% in May, after a 1.0% gain in April. April's figure was revised up from a 0.4% increase.

Production in the manufacturing sector fell at an annual rate of 2.7% in May, output in the mining sector slid 15.0%, while electricity production plunged by 7.5%.

The Italian statistical office Istat released its industrial production data on Friday. Industrial production in Italy climbed at a seasonally-adjusted rate of 0.9% in May, after a 0.3% decline in April.

Output in the energy sector jumped 1.7% in May, while production in the capital goods sector was up 2.3%.

On a yearly basis, industrial production in Italy rose at a seasonally-adjusted rate of 0.3% in May, after a 0.1% increase in April.

The U.S. Commerce Department released wholesale inventories on Friday. Wholesale inventories in the U.S. rose 0.8% in May, beating expectations for a 0.3% gain, after a 0.4% increase in April.

The increase was partly driven by a rise inventories of non-durable goods. Inventories of non-durable goods increased 1.2% in May, while inventories of durable goods gained 0.6%.

Wholesale sales climbed by 0.3% in May, after a 1.7% rise in April.

Athens sent new reform proposals to its lenders two hours before the deadline on Thursday. These are some reform proposals:

- Tax increases for shipping and railways companies;

- €300 million defence spending cuts by 2016;

- The raising of the retirement age to 67 by 2022;

- Unifying VAT rates at 23%, including restaurants and catering, scrapping tax breaks for the Greek islands;

- Phasing out solidarity grants for pensioners by 2019;

- The privatisation of ports and regional airports.

U.S. Treasury Secretary Jacob Lew in New York on Friday that a deal between Athens and its lenders is getting closer. He added that it would be better for the world economy if a deal is reached.

"It would be a better thing for the global economy if this thing gets resolved," Lew said.

He pointed that Athens should reduce its budget deficit and make its economy more efficient. Greece's creditors should restructure Greece's debt, Lew added.

The head of the Eurogroup Jeroen Dijsselbloem said in Friday that Greek reform proposals were "extensive". He did not comment on Greek proposal, adding that the decision will be made tomorrow.

Whichever way we go, we have to take a very far-reaching decision tomorrow, so let's do it carefully," Dijsselbloem said.

U.S. stock-index futures rose, signaling equities will trim their third consecutive weekly drop, amid optimism that proposals Greece submitted to its creditors will pave the way for a bailout.

Nikkei 19,779.83 -75.67 -0.38%

Hang Seng 24,901.28 +508.49 +2.08%

Shanghai Composite 3,878.94 +169.61 +4.57%

FTSE 6,676.26 +94.63 +1.44%

CAC 4,919.25 +162.03 +3.41%

DAX 11,279.52 +283.11 +2.57%

Crude oil $52.93 (+0.27%)

Gold $1158.90 (-0.03%)

French Economy Minister Emmanuel Macron said in Madrid on Friday that Greek reform proposals could meet expectation of Greece's creditors.

"There have been several significant changes that have been proposed by the Greek government that allow us to think that the level of reforms are of a nature that could meet expectations," he said.

Macron added that there is a need of discussions about restructuring Greece's sovereign debt.

(company / ticker / price / change, % / volume)

| Barrick Gold Corporation, NYSE | ABX | 10.20 | +0.49% | 6.0K |

| Starbucks Corporation, NASDAQ | SBUX | 54.34 | +0.54% | 1.0K |

| ALTRIA GROUP INC. | MO | 51.23 | +0.55% | 0.4K |

| Deere & Company, NYSE | DE | 95.10 | +0.59% | 0.1K |

| McDonald's Corp | MCD | 97.10 | +0.63% | 1.3K |

| Wal-Mart Stores Inc | WMT | 73.25 | +0.65% | 3.7K |

| HONEYWELL INTERNATIONAL INC. | HON | 101.85 | +0.66% | 0.2K |

| Hewlett-Packard Co. | HPQ | 30.61 | +0.72% | 1.7K |

| Nike | NKE | 110.25 | +0.74% | 1.4K |

| AT&T Inc | T | 34.65 | +0.76% | 29.8K |

| Merck & Co Inc | MRK | 57.83 | +0.78% | 5.2K |

| Procter & Gamble Co | PG | 81.30 | +0.79% | 2.6K |

| Exxon Mobil Corp | XOM | 82.25 | +0.80% | 16.9K |

| Chevron Corp | CVX | 94.55 | +0.82% | 1.4K |

| Intel Corp | INTC | 29.18 | +0.86% | 15.2K |

| International Business Machines Co... | IBM | 165.30 | +0.88% | 1.7K |

| The Coca-Cola Co | KO | 40.29 | +0.93% | 4.1K |

| Verizon Communications Inc | VZ | 46.70 | +0.95% | 7.8K |

| Home Depot Inc | HD | 112.45 | +0.96% | 3.7K |

| Johnson & Johnson | JNJ | 99.35 | +0.97% | 0.6K |

| Pfizer Inc | PFE | 34.19 | +0.97% | 0.9K |

| United Technologies Corp | UTX | 110.00 | +0.99% | 0.9K |

| Caterpillar Inc | CAT | 82.52 | +1.02% | 2.5K |

| FedEx Corporation, NYSE | FDX | 169.42 | +1.02% | 0.3K |

| Boeing Co | BA | 144.30 | +1.05% | 1.3K |

| Ford Motor Co. | F | 14.48 | +1.05% | 12.1K |

| General Motors Company, NYSE | GM | 31.34 | +1.06% | 7.1K |

| Microsoft Corp | MSFT | 45.00 | +1.08% | 24.1K |

| Google Inc. | GOOG | 526.50 | +1.12% | 1.1K |

| General Electric Co | GE | 26.32 | +1.15% | 15.2K |

| Walt Disney Co | DIS | 116.95 | +1.17% | 5.2K |

| Amazon.com Inc., NASDAQ | AMZN | 439.58 | +1.19% | 2.7K |

| Twitter, Inc., NYSE | TWTR | 34.78 | +1.22% | 35.5K |

| Cisco Systems Inc | CSCO | 27.25 | +1.26% | 10.9K |

| Apple Inc. | AAPL | 121.62 | +1.29% | 465.7K |

| Goldman Sachs | GS | 207.56 | +1.34% | 5.4K |

| Visa | V | 67.98 | +1.39% | 0.5K |

| American Express Co | AXP | 77.43 | +1.43% | 0.1K |

| Citigroup Inc., NYSE | C | 54.50 | +1.47% | 1.5K |

| Facebook, Inc. | FB | 87.20 | +1.54% | 85.3K |

| Tesla Motors, Inc., NASDAQ | TSLA | 262.00 | +1.58% | 42.6K |

| AMERICAN INTERNATIONAL GROUP | AIG | 62.75 | +1.60% | 0.2K |

| JPMorgan Chase and Co | JPM | 67.18 | +1.62% | 5.1K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 17.08 | +1.79% | 17.0K |

| ALCOA INC. | AA | 10.79 | +1.89% | 9.6K |

| Yahoo! Inc., NASDAQ | YHOO | 38.42 | +2.15% | 27.4K |

| Yandex N.V., NASDAQ | YNDX | 15.22 | +2.77% | 1.4K |

Chancellor Angela Merkel's spokesman Steffen Seibert did not want to comment Greek reform proposals on Friday.

"We cannot comment on their content yet. We will wait until the institutions examine them and express their opinion," he said.

French President Francois Hollande said on Friday that Greece's reform proposals were "serious and credible".

"The Greeks have just shown their determination to remain in the euro zone, since the programme they are putting forward is serious and credible," he said.

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.8% in June. Analysts had expected the unemployment rate to rise to 6.9%.

Employment rose by 33,000 in the second quarter, after an increase by 63,000 in the first quarter.

The number of employed people fell by 6,400 jobs in June, beating expectations for a fall of 10,000 jobs, after a 58,900 rise in May.

The decline was driven by a drop in part-time employment. Part-time employment in May fell by 71,000 jobs, while full-time work climbed by 65,000.

The labour participation rate decreased to 65.7% in June from 65.9 in May.

The Bank of Canada monitors closely the labour participation rate.

Stock indices traded higher on hopes for a deal between Athens and its lenders. Athens sent new reform proposals to its lenders two hours before the deadline on Thursday. New proposals includes VAT reforms, other tax policies, pension and public sector reforms, higher corporate tax and the privatization of the port and the railway companies.

Greece's creditors will likely make a decision on Greek reform proposals today.

Meanwhile, the economic data from the Eurozone was mixed. German wholesale prices declined 0.2% in June, after a 0.5% increase in May.

On a yearly basis, wholesale prices in Germany fell 0.5% in June, after a 0.4% drop in May.

The fall was largely driven by a 10.5% decline in the wholesale prices of solid fuels and related products.

Industrial production in France rose 0.4% in May, in line with expectations, after a 0.7% decline in April.

The increase was driven by a rise in in output in the transport and automobile sector, which climbed 2.3% in May.

France's current account surplus decreased to €0.3 billion in May from €0.4 billion in April.

The decline in current account surplus was driven by a higher goods deficit.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £8.0 billion in May from £9.8 billion in April. It was the lowest level since June 2013.

April's figure was revised down from a deficit of £8.56 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 5.5% in May, while exports of goods rose 0.1%.

The total trade deficit, including services, narrowed to £393 million in May from £1.834 billion in April. It was the lowest total trade deficit since June 2013.

April's figure was revised down from a deficit of £1.202 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,658.8 +77.17 +1.17 %

DAX 11,206.39 +209.98 +1.91 %

CAC 40 4,893.17 +135.95 +2.86 %

The Bank of France released its current account data on Friday. France's current account surplus decreased to €0.3 billion in May from €0.4 billion in April.

The decline in current account surplus was driven by a higher goods deficit.

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices declined 0.2% in June, after a 0.5% increase in May.

On a yearly basis, wholesale prices in Germany fell 0.5% in June, after a 0.4% drop in May. Wholesale prices have been declining since July 2013.

The fall was largely driven by a 10.5% decline in the wholesale prices of solid fuels and related products.

The French statistical office Insee its industrial production figures on Friday. Industrial production in France rose 0.4% in May, in line with expectations, after a 0.7% decline in April.

The increase was driven by a rise in in output in the transport and automobile sector, which climbed 2.3% in May.

Manufacturing output was up 0.6% in May, while construction output increased 1.0%.

On a yearly basis, the French industrial production rose 1.6% in May, after a 1.1% gain in April.

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Friday. The U.K. trade deficit in goods narrowed to £8.0 billion in May from £9.8 billion in April. It was the lowest level since June 2013.

April's figure was revised down from a deficit of £8.56 billion.

The decline in the trade deficit was driven by a drop in imports. Imports dropped by 5.5% in May, while exports of goods rose 0.1%.

The total trade deficit, including services, narrowed to £393 million in May from £1.834 billion in April. It was the lowest total trade deficit since June 2013.

April's figure was revised down from a deficit of £1.202 billion.

Federal Reserve Bank of Kansas City President Esther George Thursday urged the Fed to raise its interest rate.

"We would be wise to act modestly but act now. Starting now to move rates up slowly and deliberately will allow the economy to adjust to a more normal and, in my view, appropriate stance of monetary policy," she said.

George noted that low interest rate could lead unstable markets and to a surge in inflation. But she acknowledged that low interest rate may be needed "for some time."

George is not a voting member of the Federal Open Market Committee this year.

International Monetary Fund (IMF) Chief Economist Olivier Blanchard said on Thursday that Greece may need more debt relief and financing from its Eurozone creditors than estimated in IMF's report last week.

"We believe that current developments may well imply the need for even more financing, not least in support of the banks, and for even more debt relief," he said.

Blanchard warned that a Greek exit from the Eurozone would be "extremely costly" for Greece and its creditors.

The Organization for Economic Cooperation and Development (OECD) released its unemployment report on Thursday. The OECD said that the number of unemployed declined to 42 million from 45 million in 2014, remaining well above its pre-crisis level.

According to the OECD's report, long-term unemployment remains "unacceptably high", especially in Europe. More than one in three jobseekers in the 34 OECD countries have been out of work for 12 months or more, the OECD said.

"Time is running out to prevent the scars of the crisis becoming permanent, with millions of workers trapped at the bottom of the economic ladder. If that happens, the long-run legacy of the crisis would be to ratchet inequality up yet another notch from levels that were already far too high," OECD secretary-general Angel Gurria said.

The OECD projects unemployment in its 34 OECD countries to fall to 6.6% in the last quarter of 2016 from 7.1% at the end of 2014.

Unemployment rate in both Greece and Spain is expected to remain above 20%.

The Australian Bureau of Statistics released its home loans data on Friday. Home loans in Australia dropped 6.1% in May, missing expectations for a 3.5% decline, after 0.7% rise in April. April's figure was revised down from 1.0% gain.

The value of home loans fell 5.3% in May, investment lending decreased 3.2%, while the value of total dwelling loans plunged 4.4%.

Chicago Federal Reserve President Charles Evans said on Thursday that he wants that the Fed delay its interest rate hike until mid-2016.

"There is value to delaying" given the risks from Europe, China and emerging markets," he said.

Evans expressed concerns about low inflation in the U.S.

Chicago Fed president is one of only two Fed officials who think the Fed should delay its first rate hike. Other officials think the Fed should raise its interest rate before the end of the year.

Evans is a voting member of the Federal Open Market Committee this year.

U.S. stocks finished Thursday session with moderate gains after traders felt relieved about China's stock market. Recently the country's securities regulator prohibited shareholders with large stakes in listed companies to sell stocks for the next six months. Hopes for a Greek deal also supported stocks as Greek government offered new measures (including sales-tax increases and cuts in public spending) in the latest proposal.

The Dow Jones Industrial Average rose 33.2 points, or 0.19%, to end at 17,548.62. The S&P 500 gained 4.63 points, or 0.23%, to 2,051.31 and the Nasdaq Composite advanced by 12.64 points, or 0.26%, to 4,922.40. At the beginning of the session all three indices traded at least 1% higher, but retreated as the day went on.

In Asia this morning Hong Kong Hang Seng rose 2.11%, or 514.88 points, to 24,907.67. China Shanghai Composite Index gained 4.94%, or 183.39 points, to 3,892.72. Meanwhile the Nikkei fell by 0.46%, or 91.91 points, to 19,763.59.

Gains in Chinese stocks support equity markets worldwide after concerns about China's markets eased due to governmental steps including opportunities to take a loan to buy stocks and prohibition for shareholders of 5% and more in listed companies to sell in the coming six months.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.