- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 10-11-2014.

(index / closing price / change items /% change)

Nikkei 225 16,780.53 -0.59%

Hang Seng 23,744.7 +194.46 +0.83%

Shanghai Composite 2,473.67 +55.50 +2.30%

FTSE 100 6,611.25 +44.01 +0.67%

CAC 40 4,222.82 +32.93 +0.79%

Xetra DAX 9,351.87 +60.04 +0.65%

S&P 500 2,038.26 +6.34 +0.31%

NASDAQ Composite 4,651.62 +19.08 +0.41%

Dow Jones 17,613.74 +39.81 +0.23%

Stock indices closed higher as investors weighed corporate earnings reports.

The European Central Bank (ECB) slowed purchases of covered bonds in the week ending November 7, 2014. The European Central Bank increased by 2.629 billion euros its amount of covered bonds in the week ending November 7, 2014. The ECB held covered bonds in the value of 7.408 billion euros on Monday. The central bank bought 3.075 billion euros in the second week and 1.704 billion euros in the first week as the central bank started its covered bond-buying programme.

Eurozone's Sentix investor confidence index increased to -11.9 in November from -13.7 in October, missing expectations for a rise to -6.9.

Carlsberg A/S shares were up 3.1% after reporting the better-than-estimated third-quarter profit.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,611.25 +44.01 +0.67%

DAX 9,351.87 +60.04 +0.65%

CAC 40 4,222.82 +32.93 +0.79%

U.S. stock futures were little changed as investors watched corporate results and speculated the economy is strong enough to withstand a global slowdown.

Global markets:

Nikkei 16,780.53 -99.85 -0.59%

Hang Seng 23,744.7 +194.46 +0.83%

Shanghai Composite 2,473.18 +55.01 +2.27%

FTSE 6,596.09 +28.85 +0.44%

CAC 4,197.53 +7.64 +0.18%

DAX 9,304.99 +13.16 +0.14%

Crude oil $79.40 (+0.93%)

Gold $1167.20 (-0.22%)

(company / ticker / price / change, % / volume)

| Visa | V | 252.50 | +0.03% | 0.5K |

| Wal-Mart Stores Inc | WMT | 78.80 | +0.04% | 1.1K |

| JPMorgan Chase and Co | JPM | 61.50 | +0.05% | 0.3K |

| Boeing Co | BA | 124.56 | +0.09% | 4.9K |

| Microsoft Corp | MSFT | 48.76 | +0.16% | 7.5K |

| Pfizer Inc | PFE | 29.99 | +0.23% | 7.0K |

| Johnson & Johnson | JNJ | 108.50 | +0.28% | 0.2K |

| Procter & Gamble Co | PG | 89.39 | +0.29% | 0.5K |

| Walt Disney Co | DIS | 90.29 | +0.32% | 0.3K |

| Caterpillar Inc | CAT | 102.10 | +0.33% | 0.9K |

| Chevron Corp | CVX | 119.25 | +0.38% | 3.8K |

| Exxon Mobil Corp | XOM | 97.20 | +0.63% | 0.3K |

| AT&T Inc | T | 35.17 | +0.74% | 9.0K |

| McDonald's Corp | MCD | 96.00 | +0.95% | 34.8K |

| General Electric Co | GE | 26.41 | 0.00% | 11.2K |

| Intel Corp | INTC | 33.58 | 0.00% | 0.9K |

| International Business Machines Co... | IBM | 162.00 | -0.04% | 0.8K |

| The Coca-Cola Co | KO | 42.30 | -0.05% | 0.1K |

| Verizon Communications Inc | VZ | 50.79 | -0.14% | 6.4K |

| Cisco Systems Inc | CSCO | 25.05 | -1.11% | 31.6K |

| Merck & Co Inc | MRK | 57.70 | -2.76% | 64.7K |

Upgrades:

Downgrades:

Other:

Walt Disney (DIS) reiterated at Outperform at RBC Capital Mkts, target raised from $92 to $96

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30Australia Home Loans September -0.9% -0.3% -0.7%

01:30China PPI y/y October -1.8% -1.9% -2.2%

01:30China CPI y/y October +1.6% +1.6% +1.6%

09:30Eurozone Sentix Investor Confidence November -13.7 -6.9 -11.9

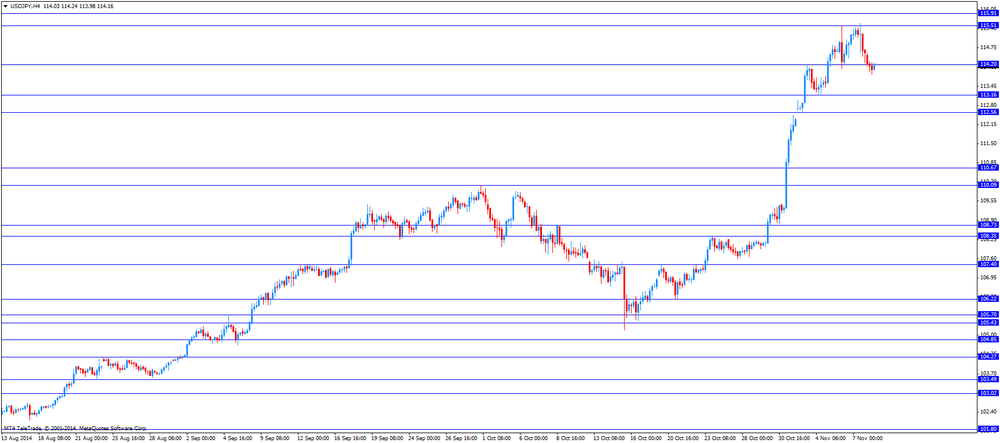

The U.S. dollar traded mixed to lower against the most major currencies due to profit taking. The greenback came under pressure on Friday after the mixed labour market data from the U.S. The U.S. economy added 214,000 jobs in October, missing expectations for a rise of 229,000 jobs, after a gain of 256,000 jobs in September.

The U.S. unemployment rate declined to 5.8% in October from 5.9% in September. Analysts had expected the unemployment rate to remain unchanged.

There will be released no major economic reports in the U.S.

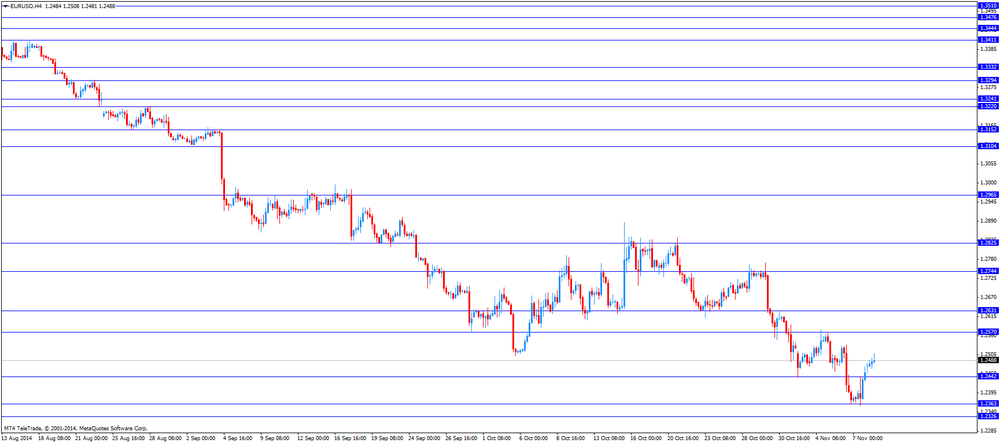

The euro traded higher against the U.S. dollar after the weaker-than-expected Sentix investor confidence index for the Eurozone. Eurozone's Sentix investor confidence index increased to -11.9 in November from -13.7 in October, missing expectations for a rise to -6.9.

A reading above 0.0 indicates optimism, below 0.0 indicates pessimism.

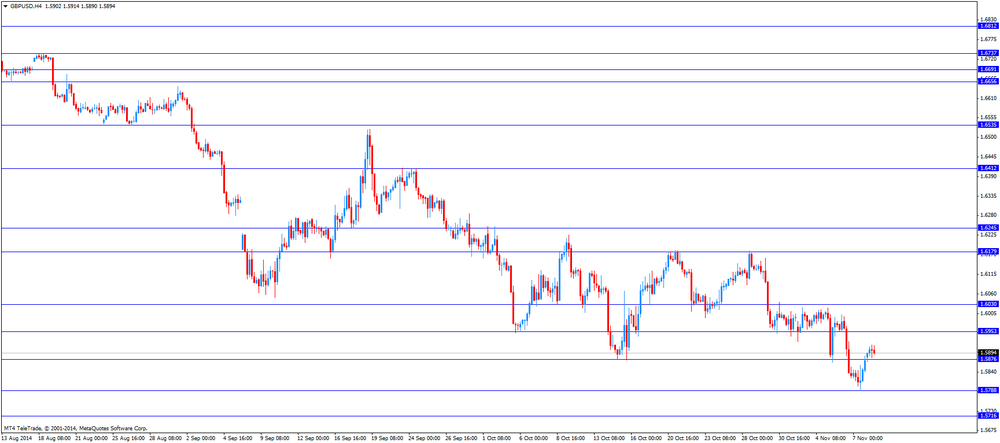

The British pound traded mixed against the U.S. dollar in the absence of any major reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian housing starts. Housing starts in Canada are expected to rise by 200,000 units in October, after 197,000 units in September.

EUR/USD: the currency pair rose to $1.2508

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

13:15 Canada Housing Starts October 197 200

European stock indices are trading higher amid good corporate earnings reports and last week's ECB announcements that measures will have an "sizeable impact". UK's FTSE 100 index is up 0.34% currently trading at 6,589.70 points. Germany's DAX 30 gained 0.16% at 9,306.86 points and France's CAC 40 gained 10.70 points, a plus of 0.26% currently trading at 4,20.59 points.

About three quarters of European companies have reported results so far this earnings season, of which 60 percent have met or beaten profit forecasts, according to Thomson Reuters.

European stock indices are trading higher at the start after last week's losses helped by ECB President Mario Draghi's announcement from last week that the ECB would soon begin purchasing asset-backed securities to help the economy grow and good corporate results. Eurozone's Sentix Investor Confidence will be published at 09:30 GMT. UK's FTSE 100 index is up 0.48% trading at 6598.55 points, Germany's DAX 30 is currently up 0.16% currently trading at 9,306.68 points and France's CAC 40 with a plus of 0.60% trading at 4,217.13 points.

The DOW Jones and S&P 500 continued to rise in Friday's trading session. The DOW Jones was up +0.11% closing at 17,573.47 points, the S&P500 +0.03% closing at 2,031.92 after solid but weaker-than-predicted U.S. nonfarm payrolls and a weaker unemployment rate showing a recovery of the world's leading economy.

Hong Kong's Hang Seng is up 0.65% at 23,703.72, China's Shanghai Composite gained 2.27% closing at 2,473.18. Regulators announced that the long-awaited pilot cross-border investment between the Shanghai and Hong Kong stock markets will launch on November 17. China's annual consumer inflation remained close to a five-year low of 1.6% in October, the producer price index declined to a lower-than-expected 2.2% in October.

Japan's Nikkei closed weaker with a loss of -0.59% at 16,780.53 points as the yen rebounded further from his new lows on profit-taking in the dollar following the U.S. payrolls data.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.