- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 11-12-2017.

(index / closing price / change items /% change)

Nikkei +127.65 22938.73 +0.56%

TOPIX +9.61 1813.34 +0.53%

Hang Seng +325.44 28965.29 +1.14%

CSI 300 +66.12 4069.50 +1.65%

Euro Stoxx 50 -9.24 3582.21 -0.26%

FTSE 100 +59.52 7453.48 +0.80%

DAX -30.05 13123.65 -0.23%

CAC 40 -12.26 5386.83 -0.23%

DJIA +56.87 24386.03 +0.23%

S&P 500 +8.49 2659.99 +0.32%

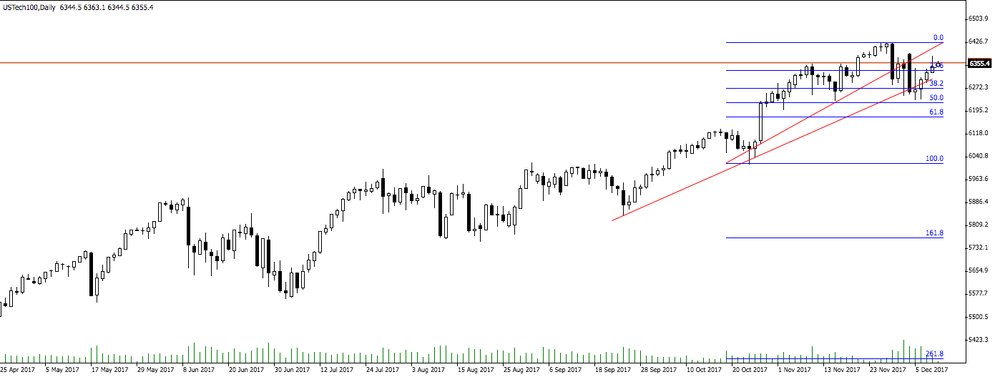

NASDAQ +35.00 6875.08 +0.51%

S&P/TSX +7.44 16103.51 +0.05%

Major US stock indices grew moderately on Monday, while DJIA and S & P finished the session at record highs, helped by the appreciation of shares in the technology and energy sectors.

The focus was also on the United States. As the survey of vacancies and labor turnover (JOLTS), published by the Bureau of Labor Statistics showed, in October the number of vacancies dropped to 5.996 million. Meanwhile, the indicator for September was revised upwards to 6.177 million from 6.093 million. Analysts had expected that the number of vacancies will decrease to 6,030 million. The vacancy level was 3,9%, decreasing by 0,1% relative to September. The number of vacancies declined in the private sector, and little has changed in the government segment. In October, hiring amounted to 5.552 million against 5.32 million in September. The level of hiring in October increased by 0.2%, and amounted to 3.8%.

Oil prices rose after the explosion in New York reoriented the market to geopolitical risk. On Monday morning, an explosion occurred near the Port Authority of New York and New Jersey, one of the city's busiest suburban hubs. "The explosion caused an increase in oil quotations," said Olivier Jacob, Managing Director of PetroMatrix, "However, prices are still within the recent range."

Most components of the DOW index finished trading in positive territory (19 out of 30). The leader of growth was the shares of The Walt Disney Company (DIS, + 2.37%). Outsider were shares of The Boeing Company (BA, -1.05%).

Most sectors of the S & P index recorded an increase. The raw materials sector grew most (+ 0.8%). The sector of industrial goods showed the greatest decrease (-0.4%).

At closing:

DJIA + 0.23% 24,386.03 +56.87

Nasdaq + 0.51% 6,875.08 +35.00

S & P + 0.32% 2,659.99 +8.49

U.S. stock-index futures were marginally higher on Wednesday, weighed down by reports of an explosion in New York's busy Port Authority commuter hub.

Global Stocks:

Nikkei 22,938.73 +127.65 +0.56%

Hang Seng 28,965.29 +325.44 +1.14%

Shanghai 3,322.24 +32.25 +0.98%

S&P/ASX 5,998.30 +3.90+0.07%

FTSE 7,429.00 +35.04 +0.47%

CAC 5,396.21 -2.88 -0.05%

DAX 13,154.94 +1.24 +0.01%

Crude $57.46 (+0.17%)

Gold $1,249.10 (+0.06%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 238.83 | 0.70(0.29%) | 130 |

| ALTRIA GROUP INC. | MO | 71.64 | 0.10(0.14%) | 654 |

| Amazon.com Inc., NASDAQ | AMZN | 1,164.88 | 2.88(0.25%) | 14549 |

| Apple Inc. | AAPL | 169.55 | 0.18(0.11%) | 58837 |

| AT&T Inc | T | 36.7 | -0.03(-0.08%) | 4431 |

| Barrick Gold Corporation, NYSE | ABX | 13.67 | 0.02(0.15%) | 7700 |

| Boeing Co | BA | 286.99 | 1.09(0.38%) | 5158 |

| Caterpillar Inc | CAT | 144.1 | 0.24(0.17%) | 1867 |

| Cisco Systems Inc | CSCO | 37.5 | -0.11(-0.29%) | 11107 |

| Exxon Mobil Corp | XOM | 82.6 | -0.06(-0.07%) | 1827 |

| Facebook, Inc. | FB | 179.35 | 0.35(0.20%) | 33901 |

| Ford Motor Co. | F | 12.62 | 0.01(0.08%) | 2952 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.03 | 0.06(0.40%) | 19257 |

| General Electric Co | GE | 17.74 | 0.03(0.17%) | 46718 |

| General Motors Company, NYSE | GM | 42.13 | 0.11(0.26%) | 2756 |

| Goldman Sachs | GS | 250.03 | -0.32(-0.13%) | 3085 |

| Google Inc. | GOOG | 1,038.37 | 1.32(0.13%) | 1510 |

| Hewlett-Packard Co. | HPQ | 20.95 | -0.12(-0.57%) | 1202 |

| Intel Corp | INTC | 43.41 | 0.06(0.14%) | 7460 |

| International Business Machines Co... | IBM | 155.5 | 0.69(0.45%) | 1038 |

| JPMorgan Chase and Co | JPM | 105.8 | -0.13(-0.12%) | 10836 |

| Merck & Co Inc | MRK | 55.6 | 0.03(0.05%) | 1257 |

| Microsoft Corp | MSFT | 84.3 | 0.14(0.17%) | 53245 |

| Pfizer Inc | PFE | 35.68 | -0.06(-0.17%) | 77544 |

| Starbucks Corporation, NASDAQ | SBUX | 58.46 | -0.15(-0.26%) | 1323 |

| Tesla Motors, Inc., NASDAQ | TSLA | 313.81 | -1.32(-0.42%) | 17495 |

| The Coca-Cola Co | KO | 45.3 | -0.01(-0.02%) | 86940 |

| Visa | V | 112.99 | 0.39(0.35%) | 1093 |

| Wal-Mart Stores Inc | WMT | 96.65 | 0.10(0.10%) | 31062 |

| Walt Disney Co | DIS | 104.6 | 0.37(0.36%) | 29840 |

| Yandex N.V., NASDAQ | YNDX | 33.25 | 0.36(1.09%) | 8000 |

Freeport-McMoRan (FCX) target raised to $16 at B. Riley FBR

European stocks rose Friday, scoring their highest close in a month, after the U.K. and the European Union came to terms on a Brexit divorce deal, opening the way to a key phase of talks. Bank stocks were in rally mode after news of the Brexit breakthrough and after global financial officials finally signed a deal Thursday to harmonize banking rules.

Stocks ended the week on an positive note Friday, with the S&P 500 and Dow Jones Industrial Average logging record closes, while the Nasdaq Composite also advanced. A stronger-than-expected November jobs report helped buoy stocks in early action.

Asia stocks were trading narrowly mixed in early Monday session, following an upbeat Wall Street last Friday after the release of a stronger-than-expected jobs report.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.