- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 13-05-2016.

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Friday that the central bank was ready to add further stimulus measures to boost inflation.

"It [the BoJ] will carefully consider how to make the best use of the policy scheme in order to achieve the price stability target of 2 percent, and will act decisively as we move on," he said.

Kuroda added that there were still tools to boost inflation.

"There is no doubt that ample space for additional easing," the BoJ governor noted.

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Friday that Britain's exit from the European Union (EU) would be "very bad".

The IMF released its report on the U.K. economy. The lender said that the biggest risk to the U.K. economy was the referendum on Britain's membership in the EU.

"The long-run effects on UK output and incomes would also likely be negative and substantial," the IMF said.

Stock closed higher despite the weak gross domestic product (GDP) data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,138.5 +34.31 +0.56 %

DAX 9,952.9 +90.78 +0.92 %

CAC 40 4,319.99 +26.72 +0.62 %

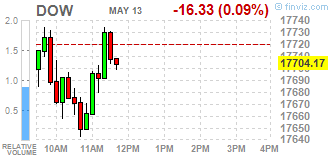

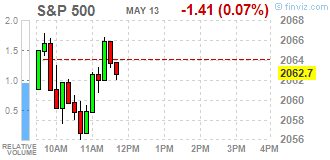

Major U.S. stock-indexes little changed on Friday as a drop in consumer stocks after another set of weak retail reports was offset by a bounce in Apple shares and strong retails sales data that suggested the economy recovery was gaining traction. The U.S. Commerce Department said retail sales jumped 1,3% last month, the largest gain since March 2015 and a bigger rise than the 0,8% economists were expecting.

Dow stocks mixed (15 in positive area vs 15 in negative). Top looser - Wal-Mart Stores Inc. (WMT, -2,27). Top gainer - Apple Inc. (AAPL, +1,37%).

S&P sectors also mixed. Top looser - Financial (-0,4%). Top gainer - Conglomerates (+0,7%).

At the moment:

Dow 17657.00 -11.00 -0.06%

S&P 500 2059.50 +0.75 +0.04%

Nasdaq 100 4353.00 +18.25 +0.42%

Oil 46.22 -0.48 -1.03%

Gold 1271.20 0.00 0.00%

U.S. 10yr 1.74 -0.02

Polish equity market closed slightly higher on Friday. The broad market measure, the WIG Index, edged up 0.09%. From a sector perspective, information technology (-0.93%) fared the worst, while banking sector (+1.19%) was best-performer.

The large-cap stocks' measure, the WIG30 Index, fell by 0.14%. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) was hit the hardest, down 4.47%, as the company announced its Q1 net profit was PLN 1.2 mln ($309 ths), below analysts' consensus estimate of PLN 1.9 mln. It was followed by clothing retailer LPP (WSE: LPP), railway freight transport operator PKP CARGO (WSE: PKP) and oil and gas producer PGNIG (WSE: PGN), plunging by 2.6%, 2.26% and 2.15% respectively. Elsewhere, IT-company ASSECO POLAND (WSE: ACP) and bank MILLENNIUM (WSE: MIL) fell by 1.98% and 1.89% respectively as their Q1 earnings didn't meet the analysts' expectations. On the other side of the ledger, coking coal producer JSW (WSE: JSW) recorded the strongest daily performance, jumping by 7.15%, after the company reported a significant decrease in net loss to PLN 59.8 mln in Q1 compared to net loss of PLN 198.1 mln in the corresponding period of the previous year. Other major outperformers were three banking sector names PEKAO (WSE: PEO), PKO BP (WSE: PKO) and BZ WBK (WSE: BZW), soaring by 2.06%, 1.86% and 1.71% respectively.

The People's Bank of China (PBoC) released its new loans data on Friday. New loans in local currency in China were 555.6 billion yuan in April, down from March's 1,370.0 billion yuan.

M2 money supply jumped by 12.8% year-on-year in April.

Total social financing decreased to 751 billion yuan in April from 2.34 trillion yuan in March.

Statistics New Zealand released retail sales data on late Thursday evening. Retail sales in New Zealand climbed 0.8% in the first quarter, missing expectations for a 1.0% rise, after a 1.1% gain in the fourth quarter. The fourth quarter's figure was revised down from a 1.2% increase.

The increase was mainly driven by a rise in electrical and electronic goods sales, which jumped 3.8% in the first quarter.

"Consumers continued to spend-up on electrical and electronic goods this quarter. There has been sustained growth in this industry for some time, with the trend rising over the past eight years," business indicators senior manager Neil Kelly said

On a yearly basis, retail sales rose 4.8% in the first quarter, after a 5.3% increase in the fourth quarter.

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Friday. The index decreased 0.7% in March, missing expectations for a 0.2% decline, after a 0.1% fall in February.

The fall was driven by declines in finance and Insurance, wholesale trade, information and communications, real estate, living and amusement-related services.

On a yearly basis, the tertiary industry activity index fell 0.1% in March, after a 2.5% rise in February.

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.4% in March, beating expectations for a 0.2% gain, after a 0.1% decrease in February.

Retail inventories climbed 1.0% in March, wholesale inventories were up 0.1%, while manufacturing inventories increased 0.2%.

Retail sales declined 0.3% in March, while total business sales were up 0.3%.

The business inventories/sales ratio remained unchanged at 1.41 months in March. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index jumped to 95.8 in May from a final reading of 89.0 in March. Analysts had expected the index to rise to 91.0.

"Consumer sentiment rebounded in early May due to more frequent income gains, an improved jobs outlook, and the expectation of lower inflation and interest rates. The largest gains were recorded among lower income and younger households, although the gains were recorded among all income and age subgroups as well as across all regions," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The index of current economic conditions climbed to 108.6 in May from 106.7 in April, while the index of consumer expectations increased to 87.5 from 77.6.

The one-year inflation expectations declined to 2.5% in May from 2.8% in April.

U.S. Stocks open: Dow -0.11%, Nasdaq -0.06%, S&P -0.13%

Wall Street started the session due to indication of derivatives. Changes of indices are modest and may not be a surprise for European markets. They do not threaten the WSE as well - at least until there will be some serious movement. If we do not happen to have anything to change the mood, the WIG20 will have a chance to bring a good result to the final.

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Final consumer prices in Italy decreased 0.1% in April, down from the preliminary reading of 0.0%, after a 0.2% increase in March.

The monthly decrease was driven by a drop in prices of non-regulated energy products.

On a yearly basis, consumer prices declined 0.5% in April, down with preliminary reading of -0.4%, after a 0.2% decline in March.

The declines was mainly driven by a faster decline of prices of non-regulated energy products and electricity. Prices of non-regulated energy products slid 6.4% year-on-year in April, while prices for electricity declined 1.9%.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in April from 0.6% in March.

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 16,412.21 -234.13 -1.41%

Hang Seng 19,719.29 -196.17 -0.99%

Shanghai Composite 2,827.37 -8.49 -0.30%

FTSE 6,091.39 -12.80 -0.21%

CAC 4,300.31 +7.04 +0.16%

DAX 9,903.57 +41.45 +0.42%

Crude $46.06 (-1.35%)

Gold $1267.00 (-0.33%)

The Italian statistical office Istat released its preliminary gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.3% in the first quarter, after a 0.2% rise in the fourth quarter. The fourth quarter's figure was revised up from a 0.1% gain.

On a yearly basis, Italy's GDP declined to 1.0% in the first quarter from 1.1% in the fourth quarter. The fourth quarter's figure was revised up from a 1.0% rise.

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index rose 0.2% in April, missing expectations for a 0.3% rise, after a 0.1% drop in March.

The increase was mainly driven by a rise in services prices.

Energy prices increased 0.2% in April, wholesale food prices decreased 0.3%.

Services prices were up 0.1% in April, while prices for goods rose 0.2%.

On a yearly basis, the producer price index was flat in April, after a 0.1% decline in March.

The producer price index excluding food and energy increased 0.1% in April, in line with expectations, after a 0.1% fall in March.

On a yearly basis, the producer price index excluding food and energy climbed 0.9% in April, after a 1.0% rise in March.

These figures could mean that the Fed will raise its interest rate cautiously and gradually.

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 1.3% in April, exceeding expectations for a 0.7% rise, after a 0.3% fall in March. It was the biggest rise since March 2015.

March's figure was revised up from a 0.4% decline.

The increase was mainly driven by a rise in sales at auto dealerships.

Sales at clothing retailers were up 1.0% in April, sales at building material and garden equipment stores decreased 1.0%, while sales at auto dealerships jumped 3.2%.

Retail sales excluding automobiles rose 0.8% in April, beating expectations for a 0.3% increase, after a 0.4% gain in March. March's figure was revised up from a 0.1% rise.

Sales at service stations climbed 2.2% in April, while sales at furniture stores rose 0.7%.

These figures indicates that the U.S. economy could rebound in the second quarter after the weak growth in the first quarter.

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 169.95 | -0.20(-0.1175%) | 2258 |

| ALCOA INC. | AA | 9.4 | -0.04(-0.4237%) | 15163 |

| Amazon.com Inc., NASDAQ | AMZN | 717.05 | -0.88(-0.1226%) | 39550 |

| Apple Inc. | AAPL | 90.07 | -0.27(-0.2989%) | 183615 |

| AT&T Inc | T | 39.46 | -0.09(-0.2276%) | 3574 |

| Barrick Gold Corporation, NYSE | ABX | 18.07 | -0.05(-0.2759%) | 104630 |

| Boeing Co | BA | 134.37 | -0.05(-0.0372%) | 1454 |

| Caterpillar Inc | CAT | 71.28 | -0.42(-0.5858%) | 975 |

| Chevron Corp | CVX | 101.85 | -0.27(-0.2644%) | 7540 |

| Cisco Systems Inc | CSCO | 26.6 | -0.07(-0.2625%) | 102 |

| Citigroup Inc., NYSE | C | 43.95 | -0.05(-0.1136%) | 9680 |

| Deere & Company, NYSE | DE | 83.41 | -0.74(-0.8794%) | 330 |

| E. I. du Pont de Nemours and Co | DD | 64.3 | 0.02(0.0311%) | 685 |

| Exxon Mobil Corp | XOM | 89.38 | -0.29(-0.3234%) | 7466 |

| Facebook, Inc. | FB | 120.2 | -0.08(-0.0665%) | 89987 |

| Ford Motor Co. | F | 13.35 | 0.00(0.00%) | 10809 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11 | -0.03(-0.272%) | 125464 |

| General Electric Co | GE | 30.05 | -0.04(-0.1329%) | 6060 |

| General Motors Company, NYSE | GM | 30.9 | -0.28(-0.898%) | 33363 |

| Home Depot Inc | HD | 133.38 | -0.81(-0.6036%) | 10015 |

| Intel Corp | INTC | 29.7 | -0.06(-0.2016%) | 1202 |

| Johnson & Johnson | JNJ | 113.5 | -0.73(-0.6391%) | 3748 |

| McDonald's Corp | MCD | 129.74 | -0.38(-0.292%) | 6009 |

| Nike | NKE | 57.79 | -0.20(-0.3449%) | 1700 |

| Pfizer Inc | PFE | 33.14 | -0.05(-0.1506%) | 1451 |

| Tesla Motors, Inc., NASDAQ | TSLA | 207.3 | 0.02(0.0097%) | 5526 |

| The Coca-Cola Co | KO | 45.69 | -0.14(-0.3055%) | 6198 |

| Twitter, Inc., NYSE | TWTR | 14.09 | 0.01(0.071%) | 31490 |

| UnitedHealth Group Inc | UNH | 129.64 | -0.10(-0.0771%) | 4213 |

| Verizon Communications Inc | VZ | 51 | -0.47(-0.9132%) | 5350 |

| Visa | V | 77.45 | -0.44(-0.5649%) | 5519 |

| Wal-Mart Stores Inc | WMT | 66.47 | -0.38(-0.5684%) | 4240 |

| Walt Disney Co | DIS | 101.1 | -0.61(-0.5997%) | 5943 |

| Yahoo! Inc., NASDAQ | YHOO | 36.95 | -0.08(-0.216%) | 2320 |

| Yandex N.V., NASDAQ | YNDX | 19.25 | -0.33(-1.6854%) | 351 |

Upgrades:

Downgrades:

Johnson & Johnson (JNJ) downgraded to Neutral from Buy at BTIG Research

Other:

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.4% in the first quarter, after a 0.1% rise in the fourth quarter.

On a yearly basis, Greek preliminary GDP fell 1.3% in the first quarter, after a revised 0.8% decrease in the fourth quarter.

The fact that the possible downgrading or rating by Moody's should not meet with violent negative reaction of the market is evidenced by the fact that in anticipation of this information the WIG20 without complexes overlooks consecutive daily maxima, and we may see green colour among the blue chips. Thus, our market goes up in the same rhythm as the German market. There is no case, if we look further on the zloty - EURPLN descends to the daily minimum falling below the 4.40 level.

Strengthening of the zloty and boosters of the DAX hit on vulnerable ground in a market that was looking for the pulse to rebound from 1,800 points. As a result, at halfway of the session, the value of the WIG20 index is rising by 0.6 percent. The problem, however, is turnover, which barely exceeded PLN 200 mln. With such a technical credibility of today's activity is still low.

Stock indices traded lower on the gross domestic product (GDP) data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,065.87 -38.32 -0.63 %

DAX 9,829.76 -32.36 -0.33 %

CAC 40 4,269.07 -24.20 -0.56 %

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

The French statistical office Insee released its preliminary non-farm employment data on Friday. French non-farm employment increased 0.2% in the first quarter, after a 0.2% increase in the fourth quarter.

Employment excluding temporary work rose by 48,500 jobs in the first quarter.

Temporary employment rose by 0.3% in the first quarter.

Employment in the industry was down by 0.4% in the first quarter, while employment in construction declined by 0.3%.

Overall, job creation in the market services sector climbed by 0.4% in the first quarter.

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.7% in April, in line with the preliminary reading, after a 0.6% rise in March.

The monthly rise was mainly driven by an increase in clothing and footwear, which climbed 10.6% in April.

On a yearly basis, consumer prices fell by 1.1% in April from a year ago, in line with preliminary reading, after a 0.8% decline in March.

The annual decline was mainly driven by a drop in the prices of housing and transport.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.4% in April, in line with the preliminary estimate, after a 0.8% rise in March.

On a yearly basis, German final consumer price index decreased to -0.1% in April from 0.3% in March, in line with the preliminary estimate.

Energy prices dropped 8.5% year-on-year in April, while food prices climbed 0.5%.

Consumer prices excluding energy increased 0.9% year-on-year in April.

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Boston Fed President Eric Rosengren said in a speech on Thursday that the U.S. economy would expand faster in the second quarter after a weak growth in the first quarter. He noted that headwinds from abroad diminished.

Rosengren pointed out that it was appropriate to continue to hike interest rates if the U.S. economy continued to improve.

"In my view, the market remains too pessimistic about the fundamental strength of the U.S. economy, and the likelihood of removing monetary accommodation is higher than is currently priced into financial markets based on current data," Boston Fed president said.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

Kansas City Fed President Esther George said in a speech on Thursday that interest rates in the U.S. were too low.

"I support a gradual adjustment of short-term interest rates toward a more normal level, but I view the current level as too low for today's economic conditions," she said.

"The economy is at or near full employment and inflation is close to the FOMC's target of 2 percent, yet short-term interest rates remain near historic low," George added.

George is a voting member of the Federal Open Market Committee (FOMC) this year. She voted for an interest rate hike in March and April.

Fed Chairwoman Janet Yellen wrote in a letter to Representative Brad Sherman on Thursday that she would not completely rule out negative interest rates, adding that "policymakers would need to consider a wide range of issues" before implementing this tool in the U.S.

She noted that the Fed would analyse the effect of negative interest rates as this tool provided additional monetary policy accommodation.

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 41.7 in in the week ended May 08 from 42.0 the prior week. It was the lowest reading since mid-December 2015.

The decrease was mainly driven by a less favourable assessment of the U.S. economy. The measure of views of the economy was down to 30.6 from 32.6, the buying climate index increased to 39.1 from 38.2, while the personal finances index rose to 55.4 from 55.3.

The WIG20 futures (WSE: FW20M16), as expected, started Friday in the red, although the drop immediately by 11 points below yesterday's closing must be regarded as considerable. In this way, we have adjusted to changes in contracts for other European indices.

WIG20 index opened at 1812.82 points (-0.18%)*

WIG 46020.87 0.00%

WIG30 2018.93 -0.24%

*/ - change to previous close

The first bars on the cash market fully confirm the scale of pessimism from the futures market in early trading. Going below yesterday's minimum by the WIG20 is a fact and it means the continuation of decline started at the end of March. Among blue chips more negative distinction indicates Eurocash (WSE: EUR) after the release of weaker-than-expected first-quarter results.

Yesterday's behavior of US stock indices allows to assess that after the best session in two months on Tuesday and worst one for about a month, quotations on Wednesday brought calm to the market.

Quotations on Wall Street ended better than expected in Europe and in the morning we would think about any attempt to rebound drop in the German DAX.

Unfortunately, the night brought decline of contracts on the S&P500, which weakens the positive note of better-than-expected completion of session in the US.

The decline is also recorded by contract for the DAX and maintain the current atmosphere will lead to rather modest changes in the openings session on European markets.

The macro calendar will announced today the dynamics of PPI and retail sales in the US and readings of GDP in Germany and the euro zone, as well as the dynamics of Polish GDP. Investors are waiting today for the publication of the rating for the Polish debt by Moody's, which may isolate the Warsaw Stock Exchange from the environment.

From the technical analysis, the area of 1,800 points on the WIG20 encouraged to play assuming some recovery of six weeks sell-off. Breaking 1,800 points will start speculating about returning to the area of 1,650 points on the WIG20.

European stocks posted firm losses on Thursday with a crop of lackluster financial results and a slump in oil prices sapped investment appetite. Oil futures, however, slipped into negative territory in the afternoon, dragging European markets down with them.

U.S. stocks finished flat Thursday as an afternoon rebound in oil prices helped shares rise off their session lows. However, a sharp drop in Apple Inc.

Asian stocks dropped as crude oil retreated and technology shares declined after Apple Inc. sank to the lowest since June 2014. Bullish momentum in equities from a February low faltered over the past month, as signs of weakness in the global economy and disappointing corporate earnings heightened concerns over whether central bank officials will be able to effectively boost growth.

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.