- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 14-05-2015.

(index / closing price / change items /% change)

Hang Seng 27,286.55 +37.27 +0.14 %

S&P/ASX 200 5,696.5 -18.58 -0.33 %

Shanghai Composite 4,378.93 +3.17 +0.07 %

FTSE 100 6,973.04 +23.41 +0.34 %

CAC 40 5,029.31 +67.45 +1.36 %

Xetra DAX 11,559.82 +208.36 +1.84 %

S&P 500 2,121.1 +22.62 +1.08 %

NASDAQ Composite 5,050.8 +69.10 +1.39 %

Dow Jones 18,252.24 +191.75 +1.06 %

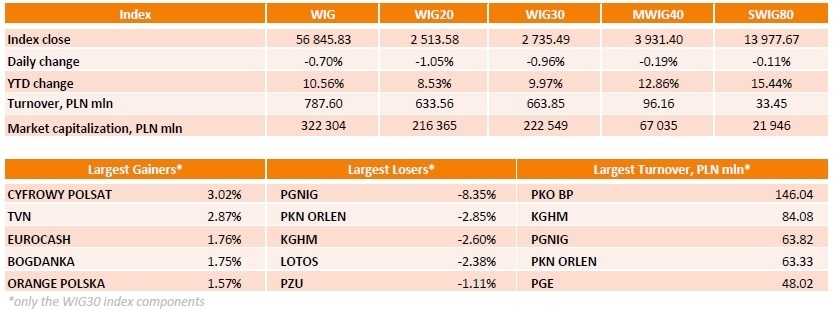

Polish equity market continued its decline on Thursday. The broad market benchmark - the WIG index declined by 0.70%, while the large liquid companies' indicator - the WIG30 index lost 0.96%.

PGNIG (WSE: PGN) posted the largest decline (8.35%), weighted down by the announcement the company failed to achieve a price cut in six months of negotiations with Russian Gazprom and filed for arbitration with the Stockholm Arbitration Tribunal concerning a long-term supply contract. Aside from that, PKN ORLEN (WSE: PKN), KGHM (WSE: KGH) and LOTOS (WSE: LTS) also saw substantial selling pressure, losing 2.85%, 2.60% and 2.38% respectively. On the contrary, CYFROWY POLSAT (WSE: CPS) gained 3.02% and topped the list of the best performers among the WIG30 index basket's components on the back of strong quarterly results. It was followed by its peer TVN (WSE: TVN), which went up 2.87%. In addition, good first-quarter earnings report uplifted quotations of TAURON PE (WSE: TPE), up 1.04%.

Turning to the performance of the WIG sub-sector indices, the benchmarks for the oil and gas companies (the WIG-PALIWA index) and the basic material producers (the WIG-SUROWC index) were the laggards, declining a respective 4.46% and 1.93%. At the same time, the measures for the media sector names (the WIG-MEDIA index) and the construction sector stocks (the WIG-BUDOW index) were the strongest performers, climbing up 2.55% and 1.72% respectively.

Major U.S. stock-indexes rose on Thursday as weekly jobless claims fell and the dollar slid to its lowest in nearly four months. Initial claims for state unemployment benefits slipped by 1,000 to a seasonally adjusted 264,000 last week, while the 4-week jobless average stayed near a 15-year low. In the same time, the dollar was at its lowest since January against a basket of currencies of major U.S. trading partners.

Almost all of the Dow stocks are trading in positive area (29 of 30). Top looser - Cisco Systems, Inc. (CSCO, -0.42%) Top gainer - Microsoft Corporation (MSFT, +2.03%).

All S&P index sectors in positive area. Top gainer - Utilities (+1,5%).

At the moment:

Dow 18176.00 +161.00 +0.89%

S&P 500 2110.75 +16.25 +0.78%

Nasdaq 100 4474.75 +51.00 +1.15%

10-year yield 2.25% -0.04

Oil 59.68 -0.82 -1.36%

Gold 1222.60 +4.40 +0.36%

U.S. index futures advanced, signaling the Standard & Poor's 500 Index will rise for the first time this week, as the dollar fell to a four-month low.

Global markets:

Nikkei 19,570.24 -194.48 -0.98%

Hang Seng 27,286.55 +37.27 +0.14%

Shanghai Composite 4,378.93 +3.17 +0.07%

FTSE 6,960.88 +11.25 +0.16%

CAC 4,991.14 +29.28 +0.59%

DAX 11,437.69 +86.23 +0.76%

Crude oil $60.18 (-0.53%)

Gold $1216.30 (-0.17%)

(company / ticker / price / change, % / volume)

| American Express Co | AXP | 79.95 | +0.11% | 1.0K |

| International Paper Company | IP | 52.70 | +0.27% | 23.2K |

| Exxon Mobil Corp | XOM | 86.81 | +0.29% | 6.3K |

| General Electric Co | GE | 27.30 | +0.33% | 16.1K |

| Chevron Corp | CVX | 108.08 | +0.35% | 0.2K |

| Home Depot Inc | HD | 111.58 | +0.35% | 5.2K |

| Yahoo! Inc., NASDAQ | YHOO | 44.55 | +0.35% | 1.0K |

| Nike | NKE | 102.54 | +0.37% | 0.1K |

| Wal-Mart Stores Inc | WMT | 78.45 | +0.37% | 3.5K |

| Verizon Communications Inc | VZ | 49.93 | +0.40% | 0.2K |

| Boeing Co | BA | 146.25 | +0.43% | 1.4K |

| International Business Machines Co... | IBM | 173.02 | +0.43% | 1.4K |

| Johnson & Johnson | JNJ | 101.00 | +0.45% | 1.0K |

| UnitedHealth Group Inc | UNH | 116.40 | +0.47% | 0.7K |

| Citigroup Inc., NYSE | C | 54.46 | +0.48% | 27.4K |

| McDonald's Corp | MCD | 97.84 | +0.50% | 1.1K |

| Pfizer Inc | PFE | 33.70 | +0.51% | 44.8K |

| Intel Corp | INTC | 32.81 | +0.52% | 1.9K |

| Ford Motor Co. | F | 15.49 | +0.52% | 23.5K |

| General Motors Company, NYSE | GM | 34.98 | +0.52% | 6.5K |

| Tesla Motors, Inc., NASDAQ | TSLA | 244.47 | +0.53% | 2.4K |

| Procter & Gamble Co | PG | 80.13 | +0.54% | 0.2K |

| JPMorgan Chase and Co | JPM | 65.88 | +0.55% | 31.8K |

| Walt Disney Co | DIS | 109.80 | +0.56% | 0.3K |

| Facebook, Inc. | FB | 78.88 | +0.56% | 31.3K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 22.74 | +0.57% | 11.1K |

| Goldman Sachs | GS | 202.59 | +0.58% | 2.1K |

| AT&T Inc | T | 34.10 | +0.59% | 0.6K |

| Microsoft Corp | MSFT | 47.91 | +0.60% | 23.1K |

| Caterpillar Inc | CAT | 89.00 | +0.63% | 1.0K |

| Starbucks Corporation, NASDAQ | SBUX | 49.90 | +0.63% | 1.3K |

| Visa | V | 69.10 | +0.66% | 2.5K |

| Hewlett-Packard Co. | HPQ | 33.53 | +0.69% | 0.1K |

| ALTRIA GROUP INC. | MO | 51.35 | +0.69% | 0.2K |

| Merck & Co Inc | MRK | 59.61 | +0.73% | 0.9K |

| Amazon.com Inc., NASDAQ | AMZN | 430.00 | +0.73% | 1.9K |

| Google Inc. | GOOG | 533.69 | +0.77% | 0.2K |

| Twitter, Inc., NYSE | TWTR | 38.02 | +0.80% | 33.1K |

| Apple Inc. | AAPL | 127.09 | +0.86% | 342.4K |

| ALCOA INC. | AA | 13.76 | +0.95% | 0.1K |

| E. I. du Pont de Nemours and Co | DD | 70.09 | +1.10% | 126.7K |

| Barrick Gold Corporation, NYSE | ABX | 13.24 | -0.08% | 1.7K |

| Yandex N.V., NASDAQ | YNDX | 19.25 | -0.93% | 18.7K |

| Cisco Systems Inc | CSCO | 29.04 | -1.06% | 200.0K |

Upgrades:

DuPont (DD) upgraded to Neutral from Underperform at BofA/Merrill

Downgrades:

Other:

Company reported Q3 profit of $0.54 per share versus $0.53 consensus. Revenues rose 5.1% year/year to $12.14 bln versus $12.07 bln consensus.

CSCO fell to $29.10 (-0.85%) on the premarket.

S&P/ASX 200 5,696.6 -18.50 -0.32%

TOPIX 1,591.49 -12.72 -0.79%

SHANGHAI COMP 4,378.93 +3.17 +0.07%

HANG SENG 27,232.52 -16.76 -0.06%

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.