- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 15-12-2011.

Currently:

Dow 11,893.56 +70.08 +0.59%

Nasdaq 2,549.59 +10.28 +0.40%

S&P 1,221.35 +9.53 +0.79%

-U.S. stocks gained after investors took heart from stronger U.S. economic data, but were off session highs after the head of the International Monetary Fund stoked fears that Europe's sovereign-debt crisis is worsening. Stocks rose after a seasonally adjusted 366,000 workers filed initial jobless claims in the week ended Dec. 10, the Labor Department said, well below forecasts and the lowest since May 2008. The figures were the latest indication that the weak jobs market is slowly building strength. The four-week moving average of new jobless claims fell to the lowest level since July 2008. But stocks lost some steam after IMF Managing Director Christine Lagarde said that the sovereign-debt crisis requires action by countries outside of the European Union and called the global economic outlook "quite gloomy." The comments put some of the focus back on Europe's sovereign-debt crisis.

Jobless claims dropped by 19,000 to 366,000 in the week ended Dec. 10, the fewest since May 2008, Labor Department figures showed today in Washington. The median forecast of economists was 390,000.

Manufacturing in the New York region expanded more than forecast to the highest level in seven months in December, as measures of employment and new orders improved. The Federal Reserve Bank of New York’s general economic index rose to 9.5, from 0.6 in November.

Nikkei 8,377 -141.76 -1.66%

Hang Seng 18,027 -327.59 -1.78%

Shanghai Composite 2,181 -47.63 -2.14%

FTSE 5,424 +57.43 +1.07%

CAC 3,015 +39.15 +1.32%

DAX 5,779 +104.24 +1.84%

Crude oil: $95.21 (+0,3%).

Gold: $1587,60 (+0,1%).

European stocks advanced, with the benchmark Stoxx Europe 600 Index rebounding from a two-week low, amid speculation that this year’s slump in equities isn’t commensurate with the outlook for corporate earnings. U.S. index futures rose, while Asian shares fell.

CAC 2,982 +5.85 +0.20%

FTSE 5,384 +17.61 +0.33%

DAX 5,718 +42.68 +0.75%

Old Mutual Plc (OML) rallied 9.4 percent after saying it will sell its Nordic business for 2.1 billion pounds ($3.3 billion). TUI AG, the owner of Europe’s largest travel company, climbed after analysts upgraded the stock. Telefonica SA (TEF) dropped after cutting its dividend forecast for the first time in a decade.

Nikkei 225 8,377 -141.76 -1.66%

Hang Seng 18,027 -327.59 -1.78%

S&P/ASX 200 4,140 -50.65 -1.21%

Shanghai Composite 2,181 -47.63 -2.14%

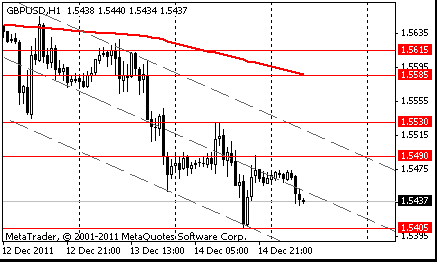

Resistance 3 : $1.5585 (MA (233) H1)

Resistance 2 : $1.5530 (Dec 14 high)

Resistance 1 : $1.5490 (high of the American session on Dec 14)

The current price: $1.5440

Support 1 : $1.5405 (Dec 14 low)

Support 2 : $1.5375 (support line from Dec 9)

Support 3 : $1.5325 (Sep 22 low)

Comments: the pair is on downtrend. In focus support $1.5405.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.