- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 16-02-2016.

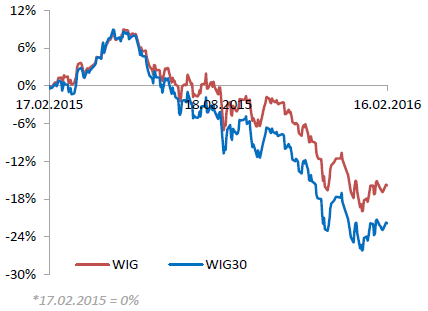

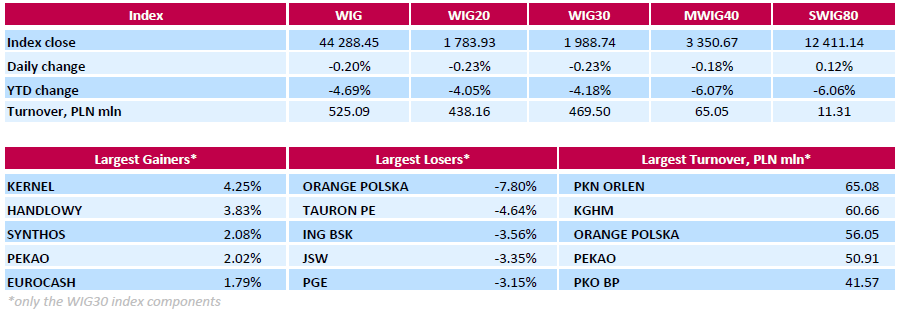

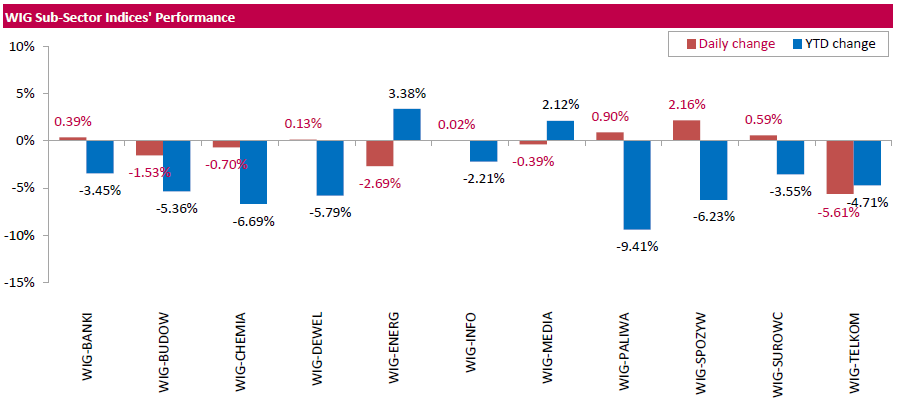

Polish equity market closed lower on Tuesday. The broad market measure, the WIG index, lost 0.2%. Sector-wise, telecommunications sector (-5.61%) was the weakest, while food sector (+2.16%) outperformed.

The large-cap stocks' measure, the WIG30 Index, declined by 0.23%. Within the WIG30 Index components, telecommunication services provider ORANGE POLSKA (WSE: OPL) fared the worst, slumping by 7.8% after the company reported a bigger-than-expected Q4 net loss and pessimistic forecast for 2016. It was followed by genco TAURON PE (WSE: TPE), which fell by 4.64% after the company announced it expects to take a PLN 4.931 bln hit from asset impairments on its 2015 net profit. Bank ING BSK (WSE: ING), coking coal producer JSW (WSE: JSW), genco PGE (WSE: PGE) and chemical producer GRUPA AZOTY (WSE: ATT) also generated solid losses, tumbling by 3%-3.56%. On the other side of the ledger, agricultural producer KERNEL (WSE: KER) and bank HANDLOWY (WSE: BHW) were the best performers, advancing 4.25% and 3.83% respectively.

Stock indices closed mixed as oil prices fell again. Oil prices traded lower on news that Russia and Saudi Arabia on Tuesday agreed to freeze the oil production at the level of January if other oil producers join.

Market participants also eyed the weak ZEW economic sentiment data from Germany and the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,862.17 +37.89 +0.65 %

DAX 9,135.11 -71.73 -0.78 %

CAC 40 4,110.66 -4.59 -0.11 %

Major U.S. stock-indexes higher on Tuesday morning, extending a rally from Friday, as cautious investors looked for bargains among beaten-down stocks. Banks again gained. The S&P financial index posted its largest daily percentage gain since November 2011 on Friday. Consumer discretionary, technology and health stocks are down more than 9 percent this year. Only the financials' 13 percent drop is worse.

Most of Dow stocks in positive area (18 of 30). Top looser - Chevron Corporation (CVX, -2,22%). Top gainer - The Boeing Company (BA, +2,29%).

All of S&P sectors in positive area. Top gainer - Conglomerates (+2,8%).

At the moment:

Dow 16007.00 +94.00 +0.59%

S&P 500 1872.00 +13.75 +0.74%

Nasdaq 100 4051.25 +45.00 +1.12%

Oil 28.86 -0.58 -1.97%

Gold 1215.80 -23.60 -1.90%

U.S. 10yr 1.76 +0.02

According to the Reserve Bank of New Zealand's survey published on Tuesday, New Zealand's inflation expectations for the next 12 months dropped to 1.09% in the three months to February from 1.51% the previous quarter.

Inflation expectations for the next 24 months slid to 1.63% from 1.85%. It was the lowest reading since the second quarter of 1994.

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index fell at a seasonally adjusted rate of 0.2% in December, after a 1.0% increase in November.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 6.7% in December, after a 7.7% in November.

The higher house price inflation England was mainly driven by an increase in prices in the East, the South East and London.

The average mix-adjusted house price was £288,000 in December, unchanged from November.

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index declined to 58 in February from 61 in January, missing expectations for a decrease to 60. January's figure was revised up from 60.

A level above 50.0 is considered positive, below indicates a negative outlook.

The buyer traffic sub-index decreased to 39 in February from 44 in January, the current sales conditions sub-index fell to 65 from 68, while the sub-index measuring sales expectations in the next six months increased to 65 from 64.

"Builders reported more consumer concern over the price of new homes relative to existing homes as builders face higher costs for labour, land and materials," the NAHB Chief Economist David Crowe said.

"Historically low mortgage rates, steady job gains, improved household formations and significant pent up demand all point to a gradual upward trend for housing in the year ahead," he added.

U.S. stock-index futures rose.

Global Stocks:

FTSE 5,847.16 +22.88 +0.39%

CAC 4,114.63 -0.62 -0.02%

DAX 9,130.14 -76.70 -0.83%

Nikkei 16,054.43 +31.85 +0.20%

Hang Seng 19,122.08 +203.94 +1.08%

Shanghai Composite 2,837.41 +91.21 +3.32%

Crude oil $29.54 (+0.34%)

Gold $1215.40 (-1.94%)

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose to -16.64 in February from -19.37 in January, missing expectations for an increase to -10.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The February 2016 Empire State Manufacturing Survey indicates that business activity continued to decline for New York manufacturers," the New York Federal Reserve said in its report.

The new orders index increased to -11.63 in February from -23.54 in January, while the shipments index climbed to -11.56 from -14.39.

The general business conditions expectations index for the next six months jumped to 14.48 in February from 9.51 in January.

The price-paid index dropped to 2.97 in February from 16.00 in January.

The index for the number of employees rose to -0.99 in February from -13.00 in January.

(company / ticker / price / change, % / volume)

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 5.86 | 5.97% | 36.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 156.7 | 3.75% | 38.0K |

| ALCOA INC. | AA | 7.87 | 2.34% | 1.1K |

| Nike | NKE | 57.66 | 2.20% | 1.0K |

| Yahoo! Inc., NASDAQ | YHOO | 27.6 | 2.07% | 4.0K |

| Citigroup Inc., NYSE | C | 38.3 | 2.02% | 40.5K |

| Caterpillar Inc | CAT | 64.3 | 1.82% | 1.1K |

| Facebook, Inc. | FB | 103.74 | 1.70% | 116.3K |

| Amazon.com Inc., NASDAQ | AMZN | 515.4 | 1.64% | 13.8K |

| Goldman Sachs | GS | 148.5 | 1.62% | 10.7K |

| Procter & Gamble Co | PG | 82.3 | 1.62% | 4.8K |

| General Motors Company, NYSE | GM | 28.13 | 1.52% | 0.2K |

| Hewlett-Packard Co. | HPQ | 9.56 | 1.49% | 9.6K |

| Ford Motor Co. | F | 11.72 | 1.47% | 15.5K |

| Google Inc. | GOOG | 692 | 1.41% | 6.3K |

| Twitter, Inc., NYSE | TWTR | 16.1 | 1.39% | 105.0K |

| Visa | V | 71.37 | 1.35% | 0.7K |

| Microsoft Corp | MSFT | 50.8 | 1.32% | 28.2K |

| Walt Disney Co | DIS | 92.3 | 1.26% | 1.4K |

| Apple Inc. | AAPL | 95.15 | 1.23% | 126.8K |

| Starbucks Corporation, NASDAQ | SBUX | 56.53 | 1.20% | 3.7K |

| JPMorgan Chase and Co | JPM | 58.15 | 1.15% | 39.1K |

| International Business Machines Co... | IBM | 122.4 | 1.12% | 0.6K |

| United Technologies Corp | UTX | 86.9 | 1.11% | 0.2K |

| General Electric Co | GE | 28.57 | 1.10% | 19.2K |

| Chevron Corp | CVX | 85.25 | 1.06% | 11.9K |

| American Express Co | AXP | 53.2 | 1.03% | 2.5K |

| Yandex N.V., NASDAQ | YNDX | 13.07 | 0.93% | 5.8K |

| Pfizer Inc | PFE | 29.63 | 0.92% | 6.8K |

| Exxon Mobil Corp | XOM | 81.75 | 0.89% | 23.4K |

| Boeing Co | BA | 109.5 | 0.80% | 1K |

| Wal-Mart Stores Inc | WMT | 66.7 | 0.79% | 1.8K |

| Merck & Co Inc | MRK | 49.4 | 0.75% | 2.7K |

| The Coca-Cola Co | KO | 43.43 | 0.74% | 7.7K |

| Cisco Systems Inc | CSCO | 25.29 | 0.72% | 7.5K |

| AT&T Inc | T | 36.7 | 0.63% | 14.2K |

| Home Depot Inc | HD | 117.05 | 0.63% | 0.3K |

| UnitedHealth Group Inc | UNH | 112.5 | 0.61% | 0.6K |

| Verizon Communications Inc | VZ | 50.38 | 0.54% | 1.4K |

| McDonald's Corp | MCD | 118.5 | 0.48% | 3.4K |

| Johnson & Johnson | JNJ | 102.19 | 0.36% | 8.5K |

| Intel Corp | INTC | 28.7 | 0.21% | 7.3K |

| ALTRIA GROUP INC. | MO | 60.09 | 0.20% | 1.4K |

| Barrick Gold Corporation, NYSE | ABX | 11.63 | -5.06% | 89.7K |

Upgrades:

Goldman Sachs (GS) upgraded to Overweight from Underweight at JP Morgan; target raised to $180 from $170

Procter & Gamble (PG) upgraded to Buy from Neutral at Sterne Agee CRT

Downgrades:

Other:

Barrick Gold (ABX) initiated with a Neutral at Clarkson Platou

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments rose 1.2% in December, beating expectations for a 0.7% increase, after a 1.2% increase in November. November's figure was revised up from a 1.0% rise.

The increase was mainly driven by higher motor vehicle and wood products sales. Motor vehicle rose 3.6% in December, while sales of wood products climbed 5.5%.

Inventories decreased 1.6% in December, driven by drops in in aerospace products and parts, petroleum and coal.

In 2015 as whole, manufacturing shipments fell 1.5%. It was the first annual decline since 2009.

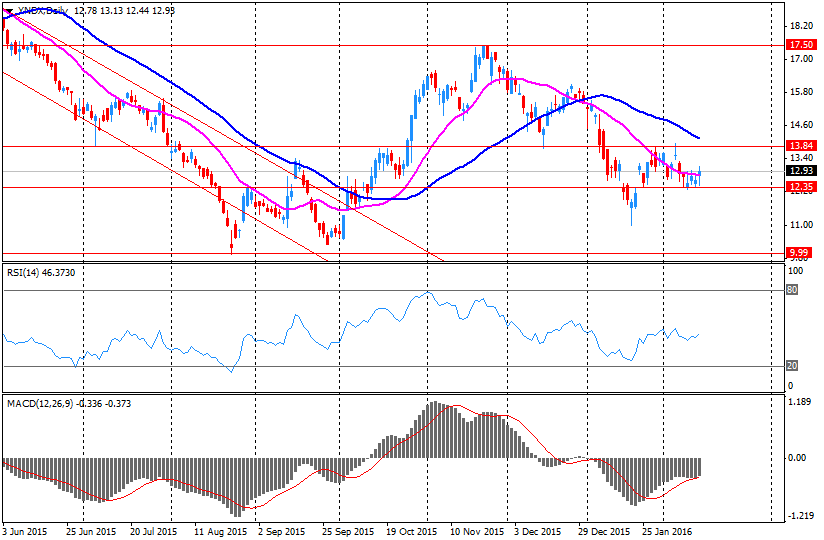

Yandex reported Q4 FY 2015 earnings of RUB 11.24 per share versus RUB 23.44 in Q4 FY 2014 and analysts' consensus of RUB 11.97.

The company's quarterly revenues amounted to RUB 18.094 bln (+23.4% y/y) versus consensus estimate of RUB 17.331 bln.

Yandex also announced the company's ruble-based revenue is expected to grow in the range of 12% to 18% in the full year 2016 compared to 2015.

YNDX rose to $13.07 (+0.93%) in pre-market trading.

Stock indices traded mixed after the release of the weak ZEW economic sentiment data from Germany and the Eurozone. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 5,825.84 +1.56 +0.03 %

DAX 9,142.93 -63.91 -0.69 %

CAC 40 4,105.58 -9.67 -0.23 %

The Italian statistical office Istat released its trade data for Italy on Tuesday. Italy' trade surplus widened to €6.02 billion in December from €4.00 billion in November. November's figure was revised down €4.41 billion.

Exports climbed 3.0% year-on-year in December, while imports increased 2.6%.

On a monthly basis, exports fell a seasonally-adjusted 2.2% in December, while imports were down 3.5%.

The seasonally-adjusted trade surplus with the EU was €1.18 billion in December, while the trade surplus with non-EU countries was €3.41 billion.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.3% year-on-year in January from 0.2% in December, in line with expectations. It was the highest reading since January 2015.

The rise was driven by a softer decline in food and fuel prices.

On a monthly basis, U.K. consumer prices dropped 0.8% in January, missing expectations for a 0.7% fall, after a 0.1% gain in December.

The monthly decline was driven by a drop in air fare prices.

Consumer price inflation excluding food, energy, alcohol and tobacco prices decreased to 1.2% year-on-year in January from 1.4% in December, missing expectations for a 1.3% gain.

The Retail Prices Index climbed to 1.3% year-on-year in January from 1.2% in December, missing expectations for an increase to 1.4%.

The consumer price inflation is below the Bank of England's 2% target.

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 1.0 in February from 10.2 in January, beating expectations for a fall to 0.0.

The assessment of the current situation in Germany declined by 7.4 points to 52.3 points.

"The looming slowdown of the world economy and the uncertain consequences of the falling oil price put a strain on the ZEW Indicator of Economic Sentiment. In view of these developments, the concern over an increased credit default risk has already caused stock and bond prices for many banks in Europe, Japan and the US to slump," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index dropped to 13.6 in February from 22.7 in January, beating expectations for a decline to 10.3.

The assessment of the current situation in the Eurozone fell by 0.5 points to -8.0 points.

Japanese Finance Minister Taro Aso said on Tuesday that the government will not implement additional economic policy after the Japanese economy contracted in the fourth quarter of 2015.

He also said that the recent turmoil in financial markets was driven by global risk aversion.

The Reserve Bank of Australia (RBA) released its minutes from February monetary policy meeting on Tuesday. The RBA said that the Australian labour market improved in 2015, while household consumption increased.

The Australian inflation remained at low levels, the RBA said.

According to the central bank, low interest rates supported growth in household consumption and dwelling investment, while the weak Australian dollar boosted demand for domestic production.

Members said that the global growth would be supported by accommodative monetary policies and lower oil prices.

The central bank noted that it could ease monetary policy further if needed, the minutes said.

The RBA kept unchanged its interest rate at 2.00% in February.

Statistics New Zealand released retail sales data on late Monday evening. Retail sales in New Zealand climbed 1.2% in the fourth quarter, missing expectations for a 1.4% rise, after a 1.5% gain in the third quarter. The third quarter's figure was revised down from a 1.6% increase.

The increase was mainly driven by a rise in hardware, building, and garden supplies, which jumped 5.3% in the fourth quarter.

On a yearly basis, retail sales rose 5.3% in the fourth quarter, exceeding expectations for a 5.2% gain, after a 5.7% increase in the third quarter.

The People's Bank of China (PBoC) released its new loans data on Tuesday. New loans in local currency in China were 2,510 billion yuan in January, up from December's 597.8 billion yuan and exceeding expectations of 1,800 billion yuan.

M2 money supply jumped by 14.0% year-on-year in January, after a 13.3% gain in December.

Total social financing increased to 3.42 trillion yuan in January from 1.82 trillion yuan in December.

Bloomberg reported, using data released by the China Banking Regulatory Commission (CBRC) on Monday, that bad-loan ratio in China rose to 1.67% of assets in 2015 from 1.25% in 2014, while the industry's bad-loan coverage ratio fell to 181% from more than 200% a year earlier.

The Bank of England's (BoE) Monetary Policy Committee (MPC) member Ian McCafferty said in an interview with The Wall Street Journal on Monday that there is no urgency to raise interest rates in the U.K. as wage growth slowed.

"I think an immediate rate rise isn't as necessary as I had felt last autumn," he said.

All MPC members voted this month to keep the central bank's monetary policy unchanged. Ian McCafferty, who voted to hike interest rate by 0.25% since August 2015, changed his mind.

McCafferty noted that the U.K. economy is still healthy, while he expected consumer spending to grow solidly.

February 16

Before the Open:

Yandex N.V. (YNDX). Consensus EPS $11.97, Consensus Revenue $17331.03 mln

February 17

After the Close:

Barrick Gold (ABX). Consensus EPS $0.06, Consensus Revenue $2214.79 mln

February 18

Before the Open:

Wal-Mart (WMT). Consensus EPS $1.43, Consensus Revenue $130491.71 mln

February 19

Before the Open:

Deere (DE). Consensus EPS $0.70, Consensus Revenue $4895.59 mln

U.S. stock markets were on holiday on Monday.

This morning in Asia Hong Kong Hang Seng gained 1.78%, or 337.33 points, to 19,255.47. China Shanghai Composite Index surged 3.18%, or 87.36 points, to 2,833.56. Meanwhile the Nikkei rose 0.91%, or 146.41 points, to 16,168.99.

Asian stocks rallied. Higher oil prices and stabilizing Chinese markets improved risk sentiment and persuaded investors to return to stocks.

Japanese stocks declined at the beginning of the session, but started to gain later. Some experts explain this situation by technical factors. By Friday Japanese indices had lost about 20-25% since the beginning of the year, which was enough for supply and demand to start to balance. A weaker yen supported exporters.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.