- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 16-11-2017.

(index / closing price / change items /% change)

Nikkei +322.80 22351.12 +1.47%

TOPIX +17.70 1761.71 +1.01%

Hang Seng +167.07 29018.76 +0.58%

CSI 300 +31.34 4105.01 +0.77%

Euro Stoxx 50 +19.08 3564.80 +0.54%

FTSE 100 +14.33 7386.94 +0.19%

DAX +70.85 13047.22 +0.55%

CAC 40 +35.14 5336.39 +0.66%

DJIA +187.08 23458.36 +0.80%

S&P 500 +21.02 2585.64 +0.82%

NASDAQ +87.09 6793.29 +1.30%

S&P/TSX +56.89 15935.37 +0.36%

As we can see on daily chart, DAX has been correcting its price since it reached new highs at 13511.

On the previous day, we watched the rejection of the price in the support level (12892.6).

If that rejections confirms, then we might expect an appreciation of DAX until the last high or even a formation of a new higher high.

U.S. stock-index futures were higher on Thursday, rebounding after two straight days of losses on the back of strong earnings from Cisco (CSCO) and Wal-Mart (WMT), while investors awaited a House vote on tax reform and analyzed another large batch of economic data

Global Stocks:

Nikkei 22,351.12 +322.80 +1.47%

Hang Seng 29,018.76 +167.07 +0.58%

Shanghai 3,399.86 -2.66 -0.08%

S&P/ASX 5,943.51 +9.28 +0.16%

FTSE 7,378.44 +5.83 +0.08%

CAC 5,334.90 +33.65 +0.63%

DAX 13,042.97 +66.60 +0.51%

Crude $55.21 (-0.22%)

Gold $1,279.50 (+0.14%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 42.6 | 0.39(0.92%) | 17415 |

| ALTRIA GROUP INC. | MO | 65.78 | 0.52(0.80%) | 205 |

| Amazon.com Inc., NASDAQ | AMZN | 1,131.50 | 4.81(0.43%) | 24596 |

| Apple Inc. | AAPL | 170.7 | 1.62(0.96%) | 289058 |

| AT&T Inc | T | 33.93 | 0.12(0.35%) | 18846 |

| Barrick Gold Corporation, NYSE | ABX | 13.97 | 0.02(0.14%) | 7750 |

| Boeing Co | BA | 264.2 | 1.34(0.51%) | 1362 |

| Caterpillar Inc | CAT | 135 | 0.90(0.67%) | 2186 |

| Chevron Corp | CVX | 115.01 | -0.36(-0.31%) | 21620 |

| Cisco Systems Inc | CSCO | 36.32 | 2.21(6.48%) | 853289 |

| Citigroup Inc., NYSE | C | 72.24 | 0.51(0.71%) | 29677 |

| Deere & Company, NYSE | DE | 132.68 | 0.41(0.31%) | 200 |

| Exxon Mobil Corp | XOM | 80.88 | -0.33(-0.41%) | 6781 |

| Facebook, Inc. | FB | 179.25 | 1.30(0.73%) | 61544 |

| Ford Motor Co. | F | 12.01 | 0.01(0.08%) | 20530 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.8 | 0.17(1.25%) | 22586 |

| General Electric Co | GE | 18.38 | 0.12(0.66%) | 436517 |

| Goldman Sachs | GS | 238.75 | 1.14(0.48%) | 446 |

| Google Inc. | GOOG | 1,024.35 | 3.44(0.34%) | 3122 |

| Home Depot Inc | HD | 166.7 | 1.23(0.74%) | 3394 |

| HONEYWELL INTERNATIONAL INC. | HON | 146.5 | 0.88(0.60%) | 870 |

| Intel Corp | INTC | 45.66 | 0.20(0.44%) | 31292 |

| International Business Machines Co... | IBM | 148.23 | 1.13(0.77%) | 2531 |

| Johnson & Johnson | JNJ | 140.05 | 0.95(0.68%) | 350 |

| JPMorgan Chase and Co | JPM | 98.95 | 0.76(0.77%) | 9395 |

| McDonald's Corp | MCD | 168 | 0.68(0.41%) | 515 |

| Merck & Co Inc | MRK | 54.97 | 0.17(0.31%) | 771 |

| Microsoft Corp | MSFT | 83.34 | 0.36(0.43%) | 54068 |

| Pfizer Inc | PFE | 35.33 | -0.03(-0.08%) | 264 |

| Procter & Gamble Co | PG | 89.55 | 1.32(1.50%) | 20269 |

| Starbucks Corporation, NASDAQ | SBUX | 56.64 | -0.06(-0.11%) | 3388 |

| Tesla Motors, Inc., NASDAQ | TSLA | 314.6 | 3.30(1.06%) | 52739 |

| Twitter, Inc., NYSE | TWTR | 20.07 | 0.16(0.80%) | 10801 |

| Verizon Communications Inc | VZ | 44.3 | 0.19(0.43%) | 7905 |

| Visa | V | 110.6 | 0.55(0.50%) | 5388 |

| Wal-Mart Stores Inc | WMT | 94.2 | 4.37(4.86%) | 810593 |

| Yandex N.V., NASDAQ | YNDX | 31.32 | 0.08(0.26%) | 6496 |

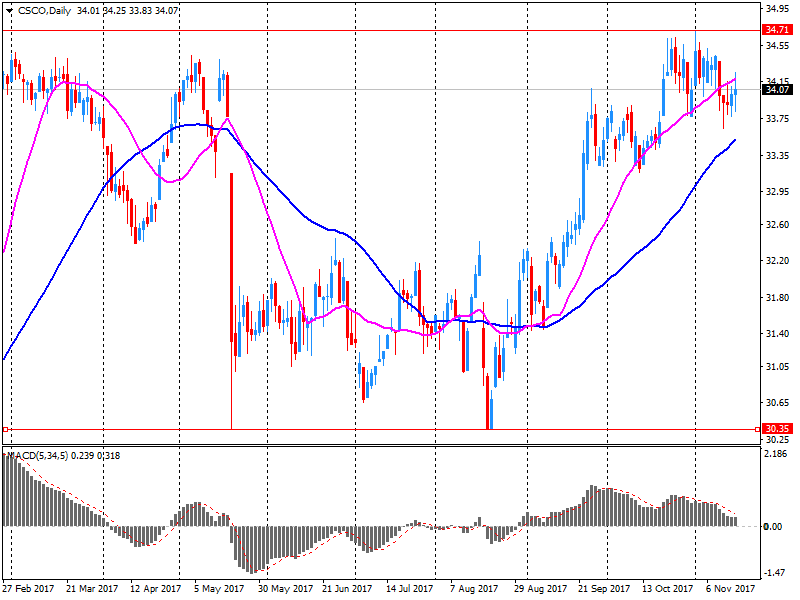

Cisco System (CSCO) target raised to $33 from $29 at Nomura; Neutral

Cisco System (CSCO) target raised to $39 from $33 at KeyBanc Capital Mkts; Overweight

Cisco System (CSCO) target raised to $40 from $37 at Jefferies; Buy

Cisco System (CSCO) target raised to $45 from $40 at Deutsche Bank; Buy

Cisco System (CSCO) target raised to 37 from $34 at Barclays; Overweight

Cisco System (CSCO) target raised to $40 from $36 at Oppenheimer; Outperform

Cisco System (CSCO) target raised to $40 from $36 at Citigroup; Buy

Cisco System (CSCO) target raised to $39 from $37 at UBS; Buy

Exxon Mobil (XOM) target lowered to $85 at RBC Capital Mkts

Cisco Systems (CSCO) reported Q1 FY 2018 earnings of $0.61 per share (versus $0.61 in Q1 FY 2017), beating analysts' consensus estimate of $0.60.

The company's quarterly revenues amounted to $12.136 bln (-1.7% y/y), generally in-line with analysts' consensus estimate of $12.111 bln.

The company also issued upside guidance for Q2 FY2018, projecting EPS of $0.58-0.60 (versus analysts' consensus estimate of $0.58) and revenues of ~$11.70-11.93 bln (+1-3%; versus analysts' consensus estimate of $11.69 bln).

CSCO rose to $36.24 (+6.24%) in pre-market trading.

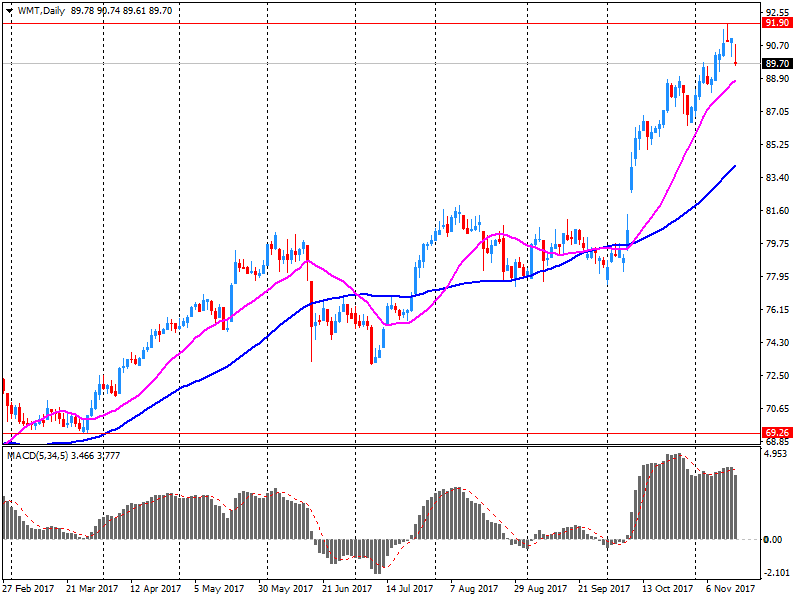

Wal-Mart (WMT) reported Q3 FY 2018 earnings of $1.00 per share (versus $0.98 in Q3 FY 2017), beating analysts' consensus estimate of $0.97.

The company's quarterly revenues amounted to $122.236 bln (+4.2% y/y), beating analysts' consensus estimate of $120.233 bln.

The company also issued upside guidance for FY2018, projecting EPS of $4.38-4.46 (up from $4.30-4.40) versus analysts' consensus estimate of $4.38.

WMT rose to $94.27 (+4.94%) in pre-market trading.

European stocks closed lower on Wednesday, as strength in the euro and a drop in commodity shares drew the regional benchmark near a two-month low. Equities in Europe fell alongside a slide for U.S. stocks, pulled lower in part by jitters over the prospects of success for the U.S. tax overhaul in Washington.

U.S. stocks closed lower Wednesday, with both the Dow and the S&P 500 suffering their biggest one-day percentage drops since September as falling oil prices and worries over the progress of a U.S. tax overhaul left investors increasingly averse to putting more money into assets seen as risky.

Global stock markets stabilized somewhat in Asia on Thursday, following broad weakness since the end of last week, with shares in Japan gaining after six straight sessions in the red. The Nikkei Stock Average NIK, +1.23% was up 0.8%, recovering from Wednesday's 1.6% decline, though the index was still off 3.5% since closing at a 25-year high on Tuesday last week.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.