- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 16-12-2015.

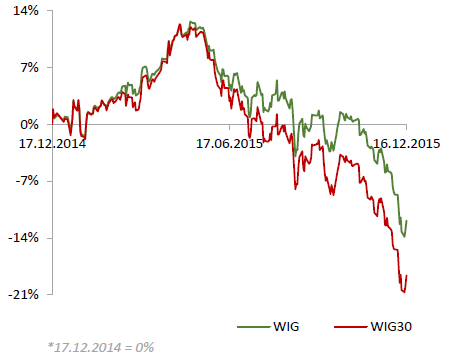

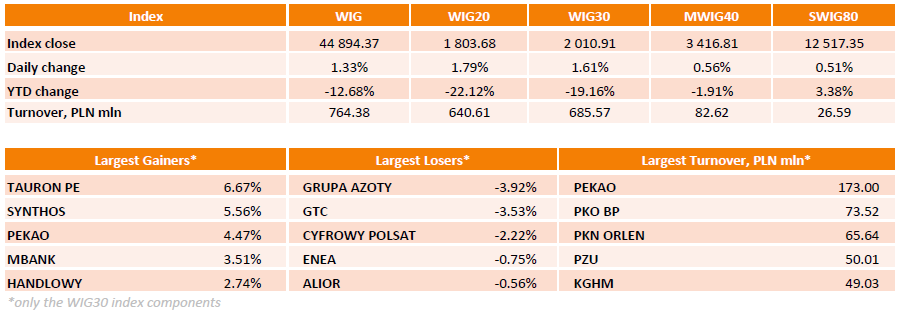

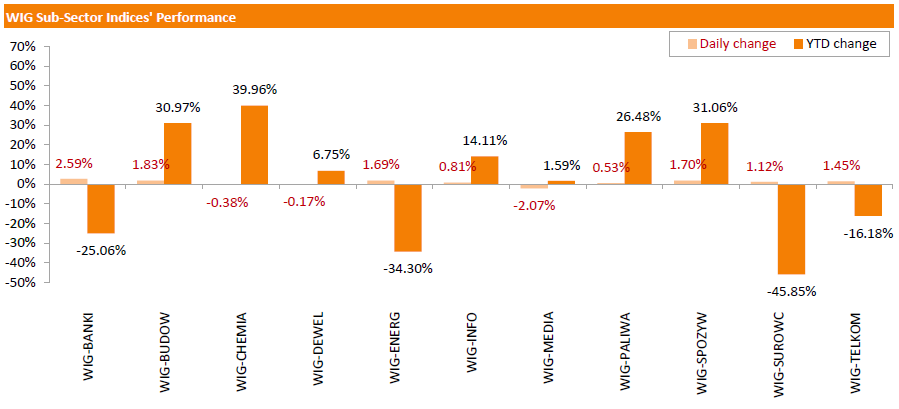

Polish equities advanced on Wednesday. The broad market measure, the WIG Index, added 1.33%. Sector-wise, media sector (-2.07%) was the day's biggest laggard, while banking sector (+2.59%) benefited the most.

The large-cap stocks' measure, the WIG30 Index, advanced by 1.61%. In the index basket, utilities name TAURON PE (WSE: TPE) and chemicals name SYNTHOS (WSE: SNS) were the strongest performers, jumping by 6.67% and 5.56%. Other major outperformers were stocks from banking sector, namely stocks PEKAO (WSE: PEO), MBANK (WSE: MBK) and HANDLOWY (WSE: BHW), which added 4.47%, 3.51% and 2.74% respectively. On the other side of the ledger, chemicals name GRUPA AZOTY (WSE: ATT) and developing sector name GTC (WSE: GTC) fared the worst, retreating 3.92% and 3.53% respectively. They were followed by media name CYFROWY POLSAT (WSE: CPS), which fell by 2.22%, following report that Poland might impose a fee on private TV and radio broadcasters to finance public media.

Major U.S. stock-indexes slightly rose for the third straight day on Wednesday as investors prepare for a widely anticipated interest rate hike by the Federal Reserve later in the day. An increase in the Fed's benchmark rate from near zero would be the first since June 29, 2006. After more than a year of posturing and a couple of false starts, the U.S. central bank is seen raising rates by a token 25 basis points.

Most of Dow stocks in positive area (22 of 30). Top looser - E. I. du Pont de Nemours and Company (DD, -3.96%). Top gainer - Verizon Communications Inc. (VZ, +1.32%).

Almost all S&P index sectors also in positive area. Top looser - Basic Materials (-0.6%). Top gainer - Utilities (+1,5%).

At the moment:

Dow 17474.00 +4.00 +0.02%

S&P 500 2041.00 +4.00 +0.20%

Nasdaq 100 4599.25 -1.75 -0.04%

Oil 35.80 -1.55 -4.15%

Gold 1075.30 +13.70 +1.29%

U.S. 10yr 2.30 +0.03

Stock indices closed higher as market participants are awaiting the release of the Fed's monetary policy meeting results later in the day. Analysts expect the Fed to raise its interest rate by 25 basis points to 0.50% or to the range 0.25% - 0.50% from 0.00% - 0.25%.

Meanwhile, the economic data from Eurozone was mixed. Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index fell 0.1% in November, beating expectations for a 0.2% drop, after a 0.1% increase in October.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.2% in November from 0.1% in October, exceeding the preliminary reading of a 0.1% rise.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.9% in November from 1.1% in October, in line with the preliminary reading.

Eurozone's unadjusted trade surplus rose to €24.1 billion in October from €20.5 billion in September, exceeding expectations for a rise €21.5 billion.

Exports rose at an annual rate of 1.0% in October, while imports were flat.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI rose to 53.1 in December from 52.8 in November. Analysts had expected the index to remain unchanged at 52.8.

Eurozone's preliminary services PMI fell to 53.9 in December from 54.2 in November, missing expectations for a fall to 54.1.

Growth of new business supported both indexes.

"The Eurozone economy enjoyed a comfortably solid end to 2015, though policymakers are likely to remain disappointed by the relatively modest pace of expansion and lack of inflationary pressures, given the stage of the recovery and the amount of stimulus already in place", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter, meaning that the economy grew 1.5% in 2015.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.2% in the August to October quarter from 5.3% in the July to September quarter. It was the lowest reading since three months to January 2006.

Analysts had expected the unemployment rate to remain unchanged at 5.3%.

The claimant count rose by 3,900 people in November, beating expectations for a rise by 1,500, after an increase of 200 people in October. October's figure was revised down from a 3,300 increase.

U.K. unemployment in the July to September period dropped by 110,000 to 1.71 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the August to October quarter, missing expectations for a 2.0% rise, after a 2.4% gain in the July to September quarter. The previous quarter's figure was revised down from a 2.5% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the August to October quarter, missing expectations for a gain of 2.5%, after a 3.0% increase in the July to September quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,061.19 +43.40 +0.72 %

DAX 10,469.26 +18.88 +0.18 %

CAC 40 4,624.67 +10.27 +0.22 %

The People's Bank of China (PBoC) said in a working paper on Wednesday that it expects the Chinese economy to expand 6.9% this year and 6.8% next year.

The central bank noted that industrial overcapacity, weak demand for Chinese goods and rising non-performing loans from banks weigh on the Chinese economy.

Inflation is expected to be 1.5% year-on-year in 2015, exports are expected to drop 2.9% this year from a year earlier, while imports are expected to slide 14.8%.

According to the working paper, the governments' stimulus measures should take effect from the fourth quarter of 2015 to the first half of 2016.

The Greek parliament on Tuesday approved a bill to receive next €1 billion of bailout funds. All 153 lawmakers of the government coalition voted in favour of the bill.

Markit Economics and financial information provider Ipsos Mori released its household finance index (HFI) for the U.K. on Wednesday. The household finance index increased to 45.0 in December from 44.1 in November.

The increase was partly driven by a rise in workplace activity and income from employment.

The index measuring the outlook for financial well-being over the coming twelve months decreased to 49.4 in December from 50.4 in November.

The current inflation perceptions index declined to 61.7 in December.

The index measuring expected living costs over the twelve months was down to 78.4 in December from 80.0 in November.

61% of respondents expects the Bank of England's monetary policy to tighten in 2015.

"Markit's HFI survey painted a mixed picture in December. On the one hand, the strain on current finances eased to one of the weakest in the series history, helped by relatively low inflation perceptions and further improvements in the labour market. In particular, growth of workplace activity quickened, while worries about job security abated," economist at Markit, Philip Leake, said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Wednesday. The U.S. preliminary manufacturing purchasing managers' index (PMI) dropped to 51.3 in December from 52.8 in November, missing expectations for a decline to 52.6. It was the lowest level since October 2012.

A reading above 50 indicates expansion in economic activity.

The decline was partly driven by a slower pace of expansion in new orders and production volumes. New orders grew at weakest pace weakest since September 2009, while production volumes rose at softest pace since October 2013.

"Just as the Fed looks set to hike interest rates for the first time since 2006, the manufacturing sector shows signs of stalling. The flash PMI results show factories ending the year with the weakest inflow of new orders since the global financial crisis," Markit Chief Economist Chris Williamson.

"Low oil prices are hurting the energy sector, feeding through to reduced investment demand for plant and machinery, while the stronger dollar is hitting exports and encouraging import substitution. These are major headwinds that show no sign of easing any time soon," he added.

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production fell 0.6% in November, missing expectations for a 0.1% decrease, after a 0.4% decline in October. It was the fastest drop since March 2012.

October's figure was revised down from a 0.2% fall.

The drop was mainly driven by a fall in the mining output and utilities. Mining output plunged by 1.1% in November, while utilities production slid 4.3%.

Manufacturing output was flat in November, after a 0.3% rise in October. October's figure was revised down from a 0.4% increase.

Capacity utilisation rate decreased to 77.0% in November from 77.5% in October, missing expectations for a decline to 77.4%.

U.S. stock-index futures rose.

Global Stocks:

Nikkei 19,049.91 +484.01 +2.61%

Hang Seng 21,701.21 +426.84 +2.01%

Shanghai Composite 3,517.05 +6.70 +0.19%

FTSE 6,083.86 +66.07 +1.10%

CAC 4,652.67 +38.27 +0.83%

DAX 10,554.64 +104.26 +1.00%

Crude oil $37.19 (-0.43%)

Gold $1070.30 (+0.82%)

Westpac Bank and the Melbourne Institute released its leading index for Australia on late Tuesday. The index declined 0.2% in November, after a 0.1% in October.

"This result is a little disappointing. In the two previous months we had seen some modest improvement in the growth rate raising hopes that growth in the Leading Index might exceed trend by year's end," Westpac Bank said in its statement.

Westpac expects the Australian economy to expand 2.8% in 2015-16 and 2.7% in 2016-17.

(company / ticker / price / change, % / volume)

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 6.74 | 3.37% | 26.3K |

| Walt Disney Co | DIS | 115.25 | 2.75% | 18.0K |

| HONEYWELL INTERNATIONAL INC. | HON | 101.00 | 2.57% | 0.7K |

| Merck & Co Inc | MRK | 53.82 | 1.74% | 15.8K |

| Barrick Gold Corporation, NYSE | ABX | 7.21 | 1.55% | 4.4K |

| JPMorgan Chase and Co | JPM | 66.89 | 1.20% | 14.8K |

| Citigroup Inc., NYSE | C | 53.14 | 1.18% | 4.0K |

| Visa | V | 79.49 | 1.11% | 8.6K |

| Goldman Sachs | GS | 183.98 | 1.08% | 2.0K |

| McDonald's Corp | MCD | 118.14 | 1.03% | 4.1K |

| Boeing Co | BA | 147.99 | 1.00% | 18.8K |

| International Business Machines Co... | IBM | 139.00 | 0.88% | 0.6K |

| ALCOA INC. | AA | 9.20 | 0.88% | 6.4K |

| Chevron Corp | CVX | 93.54 | 0.84% | 0.6K |

| Amazon.com Inc., NASDAQ | AMZN | 664.00 | 0.81% | 19.1K |

| Hewlett-Packard Co. | HPQ | 12.30 | 0.74% | 2.4K |

| General Motors Company, NYSE | GM | 34.42 | 0.70% | 0.1K |

| Verizon Communications Inc | VZ | 45.86 | 0.68% | 20.5K |

| Microsoft Corp | MSFT | 55.56 | 0.65% | 11.5K |

| Tesla Motors, Inc., NASDAQ | TSLA | 222.50 | 0.64% | 0.9K |

| Nike | NKE | 129.41 | 0.62% | 0.1K |

| Google Inc. | GOOG | 747.95 | 0.61% | 1.1K |

| Pfizer Inc | PFE | 32.45 | 0.59% | 1.7K |

| United Technologies Corp | UTX | 93.80 | 0.58% | 3.7K |

| Ford Motor Co. | F | 13.95 | 0.58% | 18.1K |

| Facebook, Inc. | FB | 105.15 | 0.57% | 67.5K |

| Cisco Systems Inc | CSCO | 27.00 | 0.56% | 1.0K |

| Starbucks Corporation, NASDAQ | SBUX | 60.31 | 0.55% | 0.3K |

| Twitter, Inc., NYSE | TWTR | 24.08 | 0.54% | 12.4K |

| Home Depot Inc | HD | 131.99 | 0.53% | 5.9K |

| The Coca-Cola Co | KO | 43.30 | 0.53% | 0.3K |

| AMERICAN INTERNATIONAL GROUP | AIG | 60.25 | 0.52% | 7.7K |

| 3M Co | MMM | 148.87 | 0.50% | 403.2K |

| AT&T Inc | T | 33.98 | 0.50% | 4.0K |

| Johnson & Johnson | JNJ | 104.64 | 0.49% | 0.2K |

| Intel Corp | INTC | 35.35 | 0.48% | 3.1K |

| Exxon Mobil Corp | XOM | 79.80 | 0.47% | 22.7K |

| Apple Inc. | AAPL | 111.00 | 0.46% | 182.9K |

| Procter & Gamble Co | PG | 79.99 | 0.39% | 2.2K |

| ALTRIA GROUP INC. | MO | 57.56 | 0.38% | 0.5K |

| General Electric Co | GE | 30.43 | 0.36% | 10.5K |

| Yahoo! Inc., NASDAQ | YHOO | 33.01 | -0.06% | 0.3K |

| Wal-Mart Stores Inc | WMT | 59.46 | -0.30% | 13.6K |

| Caterpillar Inc | CAT | 65.95 | -1.20% | 1.5K |

Upgrades:

Chevron (CVX) upgraded to Buy from Hold at Argus; target $100

Downgrades:

Caterpillar (CAT) downgraded to Hold from Buy at Deutsche Bank

Other:

Apple (AAPL) target lowered to $130 from $140 at UBS

3M (MMM) target lowered to $136 from $140 at RBC Capital Mkts

UnitedHealth (UNH) initiated with a Outperform at Credit Suisse

MasterCard (MA) initiated with a Buy at UBS

Visa (V) initiated with a Buy at UBS

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. soared 10.5% to 1.173 million annualized rate in November from a 1,062 million pace in October, exceeding expectations for an increase to 1.135 million.

October's figure was revised up from 1.160 million units.

The increase was driven by rises in starts of single-family and multifamily homes.

Housing market benefits from the strengthening of the labour market. But there is a shortage of houses available for sale.

Building permits in the U.S. climbed 11.0% to 1.289 million annualized rate in November from a 1.161 million pace in October, beating expectations for a 1,150 pace.

Starts of single-family homes increased 7.6% in November. Building permits for single-family homes were up 1.1%.

Starts of multifamily buildings climbed 16.4% in November. Permits for multi-family housing rose 26.9%.

Statistics Canada released foreign investment figures on Wednesday. Foreign investors added C$22.1 billion of Canadian securities in October, after an investment of C$3.35 billion in September.

Canadian investors added C$3.2 billion of foreign securities in October, led by non-US foreign bonds.

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 52.5 in December from 52.6 in November.

A reading below 50 indicates contraction of activity.

The index was partly driven by a rise in new orders and backlogs of work.

"Operating conditions at Japanese manufacturers continued to improve at a solid rate in the final month of 2015. Despite easing, the rate of expansion in production was robust overall," economist at Markit, Amy Brownbill, said.

Stock indices traded higher as market participants are awaiting the release of the Fed's monetary policy meeting results. Analysts expect the Fed to raise its interest rate.

Meanwhile, the economic data from Eurozone was mixed. Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index fell 0.1% in November, beating expectations for a 0.2% drop, after a 0.1% increase in October.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.2% in November from 0.1% in October, exceeding the preliminary reading of a 0.1% rise.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.9% in November from 1.1% in October, in line with the preliminary reading.

Eurozone's unadjusted trade surplus rose to €24.1 billion in October from €20.5 billion in September, exceeding expectations for a rise €21.5 billion.

Exports rose at an annual rate of 1.0% in October, while imports were flat.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI rose to 53.1 in December from 52.8 in November. Analysts had expected the index to remain unchanged at 52.8.

Eurozone's preliminary services PMI fell to 53.9 in December from 54.2 in November, missing expectations for a fall to 54.1.

Growth of new business supported both indexes.

"The Eurozone economy enjoyed a comfortably solid end to 2015, though policymakers are likely to remain disappointed by the relatively modest pace of expansion and lack of inflationary pressures, given the stage of the recovery and the amount of stimulus already in place", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter, meaning that the economy grew 1.5% in 2015.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.2% in the August to October quarter from 5.3% in the July to September quarter. It was the lowest reading since three months to January 2006.

Analysts had expected the unemployment rate to remain unchanged at 5.3%.

The claimant count rose by 3,900 people in November, beating expectations for a rise by 1,500, after an increase of 200 people in October. October's figure was revised down from a 3,300 increase.

U.K. unemployment in the July to September period dropped by 110,000 to 1.71 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the August to October quarter, missing expectations for a 2.0% rise, after a 2.4% gain in the July to September quarter. The previous quarter's figure was revised down from a 2.5% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the August to October quarter, missing expectations for a gain of 2.5%, after a 3.0% increase in the July to September quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Current figures:

Name Price Change Change %

FTSE 100 6,066.52 +48.73 +0.81 %

DAX 10,482.96 +32.58 +0.31 %

CAC 40 4,645.28 +30.88 +0.67 %

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Wednesday. France's preliminary manufacturing PMI rose to 51.6 in December from 50.6 in November, beating forecasts of a decline to 50.5.

France's preliminary services PMI decreased to 50.0 in December from 51.0 in November. Analysts had expected the index to fall to 50.8.

"French private sector output growth nearly ground to a halt at the end of 2015 amid faltering new business intakes. A slowdown in the dominant service sector was the driver, with some panellists indicating that their new business intakes had been impacted following the recent terrorist attacks," the Senior Economist at Markit Jack Kennedy said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Wednesday. Germany's preliminary manufacturing PMI climbed to 53.0 in December from 52.9 in November, in line with forecasts.

Germany's preliminary services PMI was down to 55.4 in December from 55.6 in November. Analysts had expected index to decline to 55.5.

"Germany's private sector companies ended the fourth quarter on a solid footing, with all key barometers of corporate health showing further improvements. While output and new orders increased at slightly weaker rates, growth remained above their respective long-term trends," Markit's economist Oliver Kolodseike noted.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Wednesday. Eurozone's preliminary manufacturing PMI rose to 53.1 in December from 52.8 in November. Analysts had expected the index to remain unchanged at 52.8.

Eurozone's preliminary services PMI fell to 53.9 in December from 54.2 in November, missing expectations for a fall to 54.1.

Growth of new business supported both indexes.

"The Eurozone economy enjoyed a comfortably solid end to 2015, though policymakers are likely to remain disappointed by the relatively modest pace of expansion and lack of inflationary pressures, given the stage of the recovery and the amount of stimulus already in place", Markit's Chief Economist Chris Williamson said.

He noted that data was signalling the Eurozone's economy could expand 0.4% in the fourth quarter, meaning that the economy grew 1.5% in 2015.

Eurostat released its final consumer price inflation data for the Eurozone on Wednesday. Eurozone's harmonized consumer price index fell 0.1% in November, beating expectations for a 0.2% drop, after a 0.1% increase in October.

On a yearly basis, Eurozone's final consumer price inflation increased to 0.2% in November from 0.1% in October, exceeding the preliminary reading of a 0.1% rise.

Restaurants and cafés prices were up 0.10% year-on-year in November, vegetables prices rose by 0.10%, fruit gained 0.08%, fuel prices for transport declined by 0.54%, heating oil prices decreased by 0.21%, while gas prices were down by 0.10%.

Eurozone's final consumer price inflation excluding food, energy, alcohol and tobacco fell to an annual rate of 0.9% in November from 1.1% in October, in line with the preliminary reading.

Eurostat released its trade data for the Eurozone on Wednesday. Eurozone's unadjusted trade surplus rose to €24.1 billion in October from €20.5 billion in September, exceeding expectations for a rise €21.5 billion.

Exports rose at an annual rate of 1.0% in October, while imports were flat.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate fell to 5.2% in the August to October quarter from 5.3% in the July to September quarter. It was the lowest reading since three months to January 2006.

Analysts had expected the unemployment rate to remain unchanged at 5.3%.

The claimant count rose by 3,900 people in November, beating expectations for a rise by 1,500, after an increase of 200 people in October. October's figure was revised down from a 3,300 increase.

U.K. unemployment in the July to September period dropped by 110,000 to 1.71 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.0% in the August to October quarter, missing expectations for a 2.0% rise, after a 2.4% gain in the July to September quarter. The previous quarter's figure was revised down from a 2.5% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the August to October quarter, missing expectations for a gain of 2.5%, after a 3.0% increase in the July to September quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index jumped to 16.6 in December from 0.0 in November.

"As in the previous months, the clear majority of survey respondents regard the present state of Switzerland's economy as being "normal". The group of analysts sharing this assessment has increased slightly and now amounts to 86.1 per cent of respondents," the ZEW said.

The current conditions climbed to -2.7 in December from -12.2 points in November.

The Reserve Bank of Australia Governor Glenn Stevens said in an interview with the Financial Review published Wednesday that the central bank could cut its interest rate further.

"The stated position of the board is that inflation is sufficiently low that, if it makes sense to ease a bit further to help the economy, then we can," he said.

He added that interest rate "can fall further if that's helpful".

Statistics New Zealand released its current account data on late Tuesday evening. New Zealand's seasonally adjusted current account deficit was NZ$1.8 billion in the third quarter, down NZ$322 million from the second quarter.

An increase in export earnings offset the rise in the overseas expenditure.

"Overseas visitor spending is driving our services surplus, which has grown each quarter since December 2013. On average, visitors spent more per person this quarter than last, which was the key driver for the increase in total expenditure," international statistics manager Jason Attewell said.

"The falling New Zealand dollar may also have been a factor in attracting visitors to New Zealand as the better exchange rate meant visitors could get more for their money," he added.

The Bank of Canada Governor Stephen Poloz said on Tuesday that the recovery of the Canadian economy was on track.

"Although Q3 was quite good, it was not necessarily the new trend line. We expected Q4 to be a little softer than Q3. So far, things have been more or less in line with the dynamic that we predicted," he said.

"We do think that the positives will be dominant in 2016," Poloz added.

U.S. stock indices rose on Tuesday supported by gains in oil prices.

The Dow Jones Industrial Average added 156.41 points, or 0.9%, to 17,524.91. The S&P 500 climbed 21.47 points, or 1.1%, to 2,043.4 (all of its 10 sectors closed higher; the energy sector gained 2.9%). The Nasdaq Composite rose 43.13 points, or 0.9% to 4,995.36.

Data showed that U.S. consumer prices were unchanged in November due to declines in gas prices. Nevertheless the core inflation showed some strengthening amid rising services prices. The CPI was unchanged in November on a seasonally adjusted basis after a 0.2% increase in October. The so-called core index rose by 0.2% just like in the two previous months. Both readings were in line with expectations.

This morning in Asia Hong Kong Hang Seng rose 2.07%, or 439.65, to 21,714.02. China Shanghai Composite Index climbed 0.38%, or 13.32, to 3.523.67. The Nikkei jumped 2.52%, or 467.88, to 19,033.78.

Asian indices advanced following gains in U.S. stocks. Analysts say that rising stock prices ahead of the Fed's interest rate decision signal that market participants are convinced that the rate hike will take place.

Japanese stocks rose with financial companies leading the gains. Shares of exporters also climbed.

(index / closing price / change items /% change)

Nikkei 225 18,565.9 -317.52 -1.68 %

Hang Seng 21,274.37 -35.48 -0.17 %

Shanghai Composite 3,510.9 -9.76 -0.28 %

FTSE 100 6,017.79 +143.73 +2.45 %

CAC 40 4,614.4 +141.33 +3.16 %

Xetra DAX 10,450.38 +311.04 +3.07 %

S&P 500 2,043.41 +21.47 +1.06 %

NASDAQ Composite 4,995.36 +43.13 +0.87 %

Dow Jones 17,524.91 +156.41 +0.90 %

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.