- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 17-04-2015.

Major U.S. indexes falling more than one percent on investor concerns over a clamp-down on margin trading in China and a lot of disappointing earnings results from U.S. corporations. Chinese authorities lifted restrictions on short-selling while also warning against excessive borrowing on margin, two developments that could pressure that market.

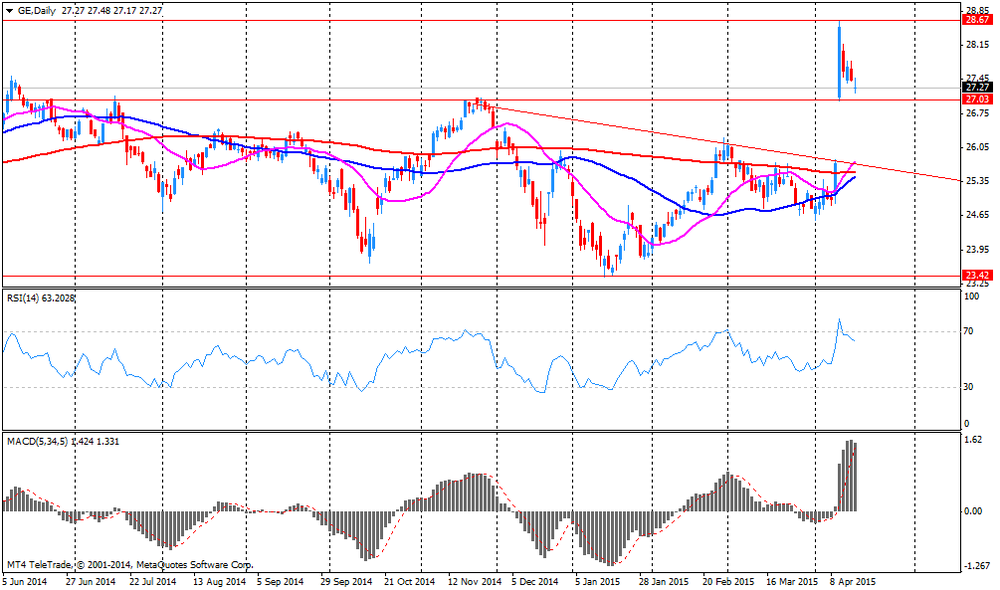

Almost all of the Dow stocks are trading in negative area (29 of 30). Top looser - American Express Company (AXP,-4.75%). Top gainer - General Electric Company (GE, +0.34%).

S&P index sectors are moving down. Top looser - Utilities (-0.6%).

At the moment:

Dow 18038.00 +16.00 +0.09%

S&P 500 2099.25 -0.50 -0.02%

Nasdaq 100 4413.00 -8.75 -0.20%

10-year yield 1.92% +0.02

Oil 56.08 -0.31 -0.55%

Gold 1196.80 -4.50 -0.37%

U.S. stock-index futures retreated as Chinese futures tumbled after regulators updated rules on margin trading and short selling in a market where equities have led global advances for the past year.

Reports from American Express (AXP), General Electric (GE) and Honeywell (HON) are in focus of the market.

Global markets:

Nikkei 19,652.88 -232.89 -1.17%

Hang Seng 27,653.12 -86.59 -0.31%

Shanghai Composite 4,288.35 +93.53 +2.23%

FTSE 6,984.2 -76.25 -1.08%

CAC 5,149.26 -75.23 -1.44%

DAX 11,766.76 -232.10 -1.93%

Crude oil $56.23 (-0.86%)

Gold $1203.10 (+0.43%)

(company / ticker / price / change, % / volume)

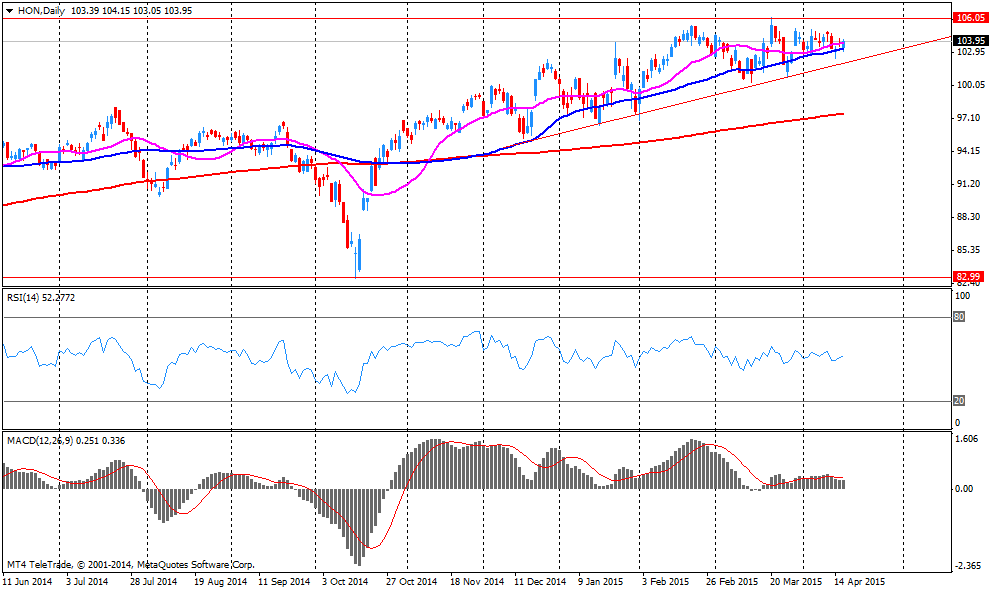

| HONEYWELL INTERNATIONAL INC. | HON | 104.00 | +0.08% | 29.3K |

| General Electric Co | GE | 27.48 | +0.73% | 394.4K |

| Barrick Gold Corporation, NYSE | ABX | 12.75 | +0.79% | 14.7K |

| ALTRIA GROUP INC. | MO | 52.05 | 0.00% | 12.3K |

| FedEx Corporation, NYSE | FDX | 169.15 | -0.05% | 0.1K |

| Apple Inc. | AAPL | 125.99 | -0.14% | 236.4K |

| Ford Motor Co. | F | 15.91 | -0.19% | 44.5K |

| Procter & Gamble Co | PG | 83.32 | -0.22% | 0.8K |

| Walt Disney Co | DIS | 107.85 | -0.23% | 3.6K |

| AT&T Inc | T | 32.67 | -0.24% | 27.9K |

| Verizon Communications Inc | VZ | 49.15 | -0.24% | 0.4K |

| Exxon Mobil Corp | XOM | 87.49 | -0.27% | 3.1K |

| Johnson & Johnson | JNJ | 99.50 | -0.29% | 4.8K |

| Wal-Mart Stores Inc | WMT | 79.00 | -0.30% | 0.3K |

| Boeing Co | BA | 151.50 | -0.31% | 0.1K |

| Starbucks Corporation, NASDAQ | SBUX | 48.08 | -0.34% | 11.3K |

| McDonald's Corp | MCD | 95.30 | -0.35% | 0.2K |

| ALCOA INC. | AA | 13.40 | -0.36% | 38.8K |

| Home Depot Inc | HD | 112.87 | -0.44% | 0.2K |

| The Coca-Cola Co | KO | 40.42 | -0.44% | 0.1K |

| Merck & Co Inc | MRK | 57.58 | -0.45% | 1.2K |

| Facebook, Inc. | FB | 81.94 | -0.45% | 69.0K |

| UnitedHealth Group Inc | UNH | 121.00 | -0.49% | 152.7K |

| Cisco Systems Inc | CSCO | 28.45 | -0.52% | 11.0K |

| General Motors Company, NYSE | GM | 36.88 | -0.54% | 13.3K |

| International Business Machines Co... | IBM | 162.20 | -0.57% | 3.4K |

| Pfizer Inc | PFE | 34.99 | -0.57% | 4.3K |

| Yahoo! Inc., NASDAQ | YHOO | 45.50 | -0.61% | 66.3K |

| Chevron Corp | CVX | 109.46 | -0.64% | 3.4K |

| Nike | NKE | 99.25 | -0.65% | 2.3K |

| Intel Corp | INTC | 32.65 | -0.67% | 9.4K |

| Citigroup Inc., NYSE | C | 53.66 | -0.67% | 18.7K |

| JPMorgan Chase and Co | JPM | 63.37 | -0.69% | 10.2K |

| Twitter, Inc., NYSE | TWTR | 51.67 | -0.69% | 79.7K |

| 3M Co | MMM | 164.73 | -0.70% | 0.9K |

| Visa | V | 65.19 | -0.70% | 0.1K |

| AMERICAN INTERNATIONAL GROUP | AIG | 57.75 | -0.70% | 0.1K |

| Google Inc. | GOOG | 529.88 | -0.73% | 0.4K |

| Microsoft Corp | MSFT | 41.84 | -0.76% | 16.5K |

| Amazon.com Inc., NASDAQ | AMZN | 383.10 | -0.76% | 2.5K |

| Hewlett-Packard Co. | HPQ | 32.56 | -0.76% | 1.4K |

| Travelers Companies Inc | TRV | 107.75 | -0.85% | 0.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 204.72 | -0.96% | 12.6K |

| Caterpillar Inc | CAT | 83.42 | -1.09% | 1.7K |

| Goldman Sachs | GS | 198.00 | -1.10% | 5.4K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.55 | -1.34% | 3.9K |

| American Express Co | AXP | 79.54 | -1.69% | 13.1K |

| Yandex N.V., NASDAQ | YNDX | 20.35 | -2.63% | 10.8K |

Upgrades:

Downgrades:

Travelers Companies Inc (TRV) downgraded to Equal Weight from Overweight at Barclays

Goldman Sachs (GS) downgraded from Outperform to Mkt Perform at Keefe Bruyette, target raised from $195 to $210

Other:

UnitedHealth (UNH) initiated at Buy at Mizuho, target $146

Apple (AAPL) initiated at Outperform at FBR Capital, target $185

American Express (AXP) reiterated at Underperform at RBC Capital Mkts, target lowered from $74 to $69

UnitedHealth (UNH) reiterated at Outperform at Oppenheimer, target raised from $128 to $133

Walt Disney (DIS) reiterated at Buy at Jefferies, target raised from $105 to $120

Company reports Q1 earnings of $1.41 per share versus $1.39 consensus. Revenues fell 4.8% year/year to $9.21 bln versus $9.50 bln consensus.

Company raises EPS guidance for FY15 to $6.00-6.15 from $5.95-6.15 versus $6.09 consensus and lowers guidance on revenues to $39.0-39.6 bln from $40.5-41.1 bln versus $40.52 bln consensus.

HON fell to $103.65 (-0.26%) on the premarket.

Japan's Topix index fell from a seven-year high, posting its first weekly loss this month, as the yen held five days of gains. Retailers led declines.

HANG SENG 27,597.68 -142.03 -0.51%

S&P/ASX 200 5,877.9 -69.57 -1.17%

TOPIX 1,588.69 -10.73 -0.67%

SHANGHAI COMP 4,288.35 +93.53 +2.23%

Sony Corp., a consumer electronics maker that gets more than 70 percent of sales outside Japan, lost 3.7 percent after Wikileaks published company documents.

Discount-store operator Don Quijote Holdings Co. slumped 7.6 percent.

JX Holdings Inc. advanced 2.2 percent as crude oil headed for the biggest weekly gain since 2011 and the Nikkei reported that the energy producer's profit will exceed analyst estimates.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.