- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 17-07-2015.

Stock indices closed mixed despite news that the German parliament voted for negotiations on the Greek bailout programme.

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

European Commission Vice President Valdis Dombrovskis said on Friday that he hoped that a new Greek bailout programme could be reached within a few weeks. He added that talks will include debt restructuring.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,775.08 -21.37 -0.31 %

DAX 11,673.42 -43.34 -0.37 %

CAC 40 5,124.39 +2.89 +0.06 %

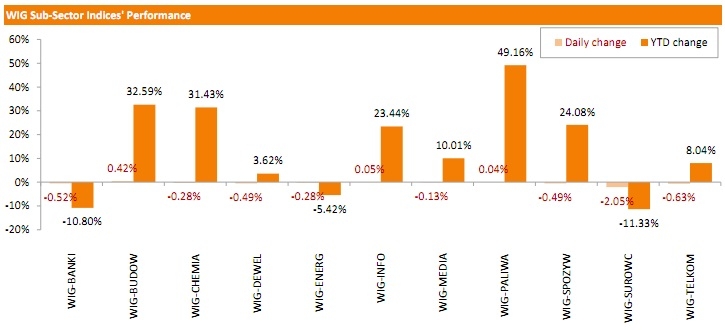

Polish equity market retreated on Friday. The broad market measure, the WIG Index, declined by 0.30%. Sector-wise, constructions (+0.42%), technologies (+0.05%) and oil and gas industry (+0.04%) were the only sectors, which posted positive results. At the same time, materials (-2.05%) recorded the sharpest drop.

The large-cap stocks lost 0.50%, as measured by the WIG30 Index. Within the index components, KGHM (WSE: KGH) led the decliners with a 2.49% drop. It was followed by ORANGE POLSKA (WSE: OPL) and ENERGA (WSE: ENG), plunging 1.52% and 1.41% respectively. On the other side of the ledger, CCC (WSE: CCC) became the best-performer, advancing 2.37%. Other noticeable gainers included PGNIG (WSE: PGN), SYNTHOS (WSE: SNS) and ENEA (WSE: ENA), which added over 1% each.

Major U.S. stock-indexes are mixed. The Nasdaq composite index opened at a record high on Friday on strong results from Google (GOOGL, GOOG), while Boeing (BA) kept a check on the Dow. Strong consumer price index data, rebounding housing starts numbers and surging building permits could give the Federal Reserve confidence that inflation will gradually rise toward its 2 percent target. Google jumped as much as 14.5 percent to a record high of $688.81, a day after its profit beat forecasts for the first time in six quarters and the company said it would be more disciplined on spending.

Most of Dow stocks in negative area (26 of 30). Top looser - Intel Corporation (INTC, -2.46%). Top gainer - Apple Inc. (AAPL, +0.61).

Almost all S&P index sectors in negative area. Top gainer - Basic materials (-1.3%). Top gainer - Technology (+1.7%).

At the moment:

Dow 17965.00 -55.00 -0.31%

S&P 500 2115.25 -1.75 -0.08%

Nasdaq 100 4633.25 +35.50 +0.77%

10 Year yield 2,34% -0,01

Oil 50.68 -0.56 -1.09%

Gold 1131.10 -12.80 -1.12%

European Commission Vice President Valdis Dombrovskis said on Friday that he hoped that a new Greek bailout programme could be reached within a few weeks. He added that talks will include debt restructuring.

"On debt I would expect this being a part of negotiations, because this is also something the IMF insists on. There is also a clear conclusion of the Euro Summit that the IMF should be a part of the third programme. It means certainly also that debt sustainability issue is going to be a part of negotiations," Dombrovskis said.

The Bank of Italy upgraded its economic growth forecast for 2015 on Friday. Italy's economy is expected to expand 0.7% this year, up from the previous forecast of a 0.5% growth.

The upward revision was driven by low oil prices, a weaker euro and "a more positive evolution of the external context, in large part attributable to the effects of monetary policy".

Growth forecast for 2016 remained unchanged at 1.5%.

The Thomson Reuters/University of Michigan preliminary consumer sentiment index dropped to 93.3 in July from a final reading of 96.1 in June, missing expectations for an increase to 96.4.

"Consumer confidence continued to meander sidewards with no indication of a potential break in the prevailing positive trend in sentiment. The small loss in early July reflected a slight rise in concerns about international developments which was partially offset by continued news of job gains," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The drop in the index was mainly driven by declines in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions declined to 106.0 in July from 108.9 in June, while the index of consumer expectations decreased to 85.2 from 87.2.

The one-year inflation expectations in July was up to 2.8% from 2.7% in May.

The European Central Bank (ECB) released its Survey of Professional Forecasters on Friday. Respondents expect the inflation in the Eurozone to rise 0.2% in 2015, up from the previous quarter's estimate of a 0.1% gain.

Inflation in 2016 is expected to increase 1.3%, up from the previous estimate of a 1.2% rise.

The upward revision was driven by the impact of quantitative easing.

GDP forecast for 2015 remained unchanged at 1.4%, while the forecast for 2016 was upgraded to 1.8% from the previous estimate of 1.7%.

The unemployment rate is expected to be 11% in 2015, 10.5% in 2016, and 10% in 2017.

The Spanish statistical office INE released its new orders data on Friday. New orders in Spain rose a seasonally adjusted 3.3% in May, after a flat reading in April.

New orders in the capital goods sector jumped 10.4% in May, orders in the energy sector rose by 4.5%, durable consumer goods sector declined 0.9%.

On a yearly basis, industrial new orders climbed a seasonally adjusted 5.6% in May, after a 0.5% increase in April.

Nikkei 20,650.92 +50.80 +0.25%

Hang Seng 25,415.27 +252.49 +1.00%

Shanghai Composite 3,957.35 +134.18 +3.51%

FTSE 6,779.98 -16.47 -0.24%

CAC 5,131.78 +10.28 +0.20%

DAX 11,704.16 -12.60 -0.11%

Crude oil $50.31 (-1.18%)

Gold $1138.60 (-0.42%)The U.S. Labor Department released consumer price inflation data on Friday. The U.S. consumer price inflation rose 0.3% in June, in line with expectations, after a 0.4% gain in May.

The increase was partly driven by higher gasoline prices, which climbed 3.4% in June.

On a yearly basis, the U.S. consumer price index increased to 0.1% in June from 0.0% in May, in line with expectations.

The U.S. consumer price inflation excluding food and energy gained 0.2% in June, in line with expectations, after a 0.1% rise in May.

On a yearly basis, the U.S. consumer price index excluding food and energy rose to 1.8% in June from 1.7% in May, in line with expectations.

Food prices increased 0.3% in June, the largest rise since September 2014.

Increasing inflation could support the Fed's decision to start raising interest rates this year.

(company / ticker / price / change, % / volume)

| Goldman Sachs | GS | 211.20 | +0.01% | 1.6K |

| United Technologies Corp | UTX | 111.27 | +0.01% | 0.6K |

| ALCOA INC. | AA | 10.52 | +0.10% | 2.3K |

| JPMorgan Chase and Co | JPM | 69.66 | +0.14% | 1.1K |

| Citigroup Inc., NYSE | C | 58.68 | +0.15% | 6.9K |

| Ford Motor Co. | F | 14.61 | +0.27% | 3.2K |

| Walt Disney Co | DIS | 119.49 | +0.35% | 11.5K |

| UnitedHealth Group Inc | UNH | 125.50 | +0.46% | 1.8K |

| General Motors Company, NYSE | GM | 30.75 | +0.46% | 1.2K |

| Apple Inc. | AAPL | 129.12 | +0.47% | 284.3K |

| Amazon.com Inc., NASDAQ | AMZN | 478.78 | +0.69% | 17.1K |

| Yahoo! Inc., NASDAQ | YHOO | 39.30 | +1.00% | 9.7K |

| Twitter, Inc., NYSE | TWTR | 36.55 | +1.25% | 22.5K |

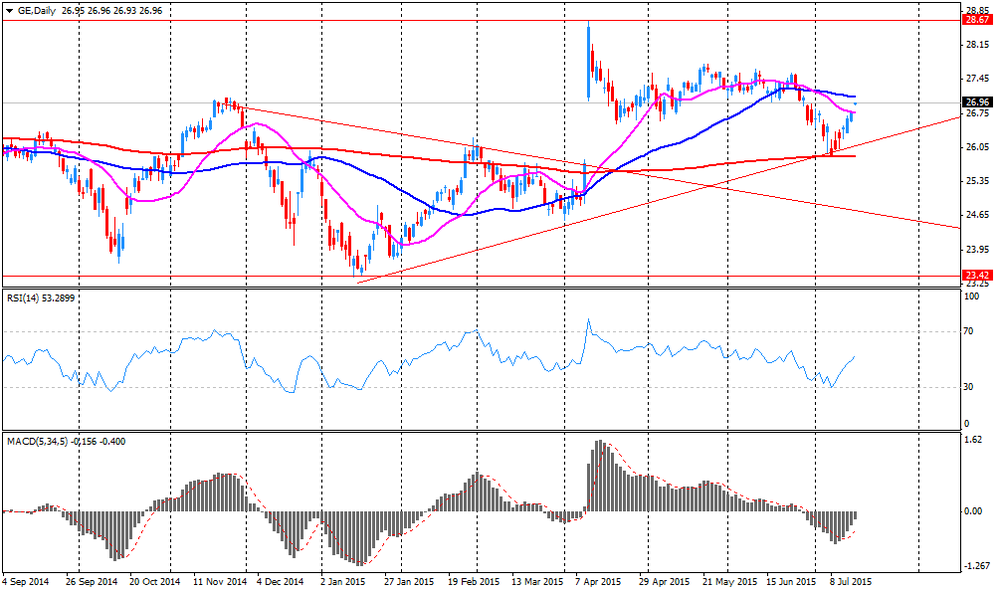

| General Electric Co | GE | 27.41 | +1.37% | 398.6K |

| Yandex N.V., NASDAQ | YNDX | 15.71 | +1.68% | 0.6K |

| HONEYWELL INTERNATIONAL INC. | HON | 105.45 | +1.82% | 20.5K |

| Facebook, Inc. | FB | 92.63 | +1.96% | 390.4K |

| Google Inc. | GOOG | 653.25 | +12.66% | 216.6K |

| Tesla Motors, Inc., NASDAQ | TSLA | 272.85 | +2.31% | 27.3K |

| Johnson & Johnson | JNJ | 101.11 | 0.00% | 0.1K |

| AT&T Inc | T | 35.15 | -0.03% | 11.5K |

| ALTRIA GROUP INC. | MO | 52.89 | -0.04% | 2.4K |

| International Business Machines Co... | IBM | 170.90 | -0.06% | 1.1K |

| 3M Co | MMM | 157.06 | -0.07% | 0.6K |

| Visa | V | 70.52 | -0.07% | 4.3K |

| American Express Co | AXP | 78.86 | -0.08% | 1.8K |

| Home Depot Inc | HD | 114.60 | -0.11% | 16.6K |

| Pfizer Inc | PFE | 35.06 | -0.11% | 2.2K |

| Nike | NKE | 112.16 | -0.16% | 0.1K |

| The Coca-Cola Co | KO | 41.41 | -0.17% | 0.4K |

| Cisco Systems Inc | CSCO | 28.27 | -0.18% | 9.7K |

| Chevron Corp | CVX | 94.25 | -0.24% | 14.6K |

| Procter & Gamble Co | PG | 82.07 | -0.28% | 3.4K |

| Verizon Communications Inc | VZ | 47.69 | -0.29% | 1.3K |

| Caterpillar Inc | CAT | 83.50 | -0.31% | 0.9K |

| Exxon Mobil Corp | XOM | 82.60 | -0.37% | 3.9K |

| McDonald's Corp | MCD | 97.50 | -0.37% | 0.9K |

| Intel Corp | INTC | 29.75 | -0.50% | 22.5K |

| Microsoft Corp | MSFT | 46.42 | -0.51% | 27.7K |

| Travelers Companies Inc | TRV | 102.74 | -0.53% | 0.6K |

| Starbucks Corporation, NASDAQ | SBUX | 55.35 | -0.70% | 6.4K |

| Barrick Gold Corporation, NYSE | ABX | 09.17 | -0.76% | 6.5K |

| Boeing Co | BA | 147.20 | -0.87% | 2.2K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.15 | -0.92% | 5.1K |

The U.S. Commerce Department released the housing market data on Friday. Housing starts in the U.S. rose 9.8% to 1.174 million annualized rate in June from a 1.069 million pace in May, missing expectations for a rise to 1.110 million. May's figure was revised up from 1.036 million units.

The increase was driven by an increase in starts of multi-family homes.

Building permits in the U.S. climbed 7.4% to 1.343 million annualized rate in June from a 1.250 million pace in May. May's figure was revised down from 1.275 million. It was the highest level since July 2007.

Analysts had expected building permits to decline to 1.150 million units.

Starts of single-family homes rose 0.9% in June. Building permits for single-family homes rose 0.9%.

Starts of multifamily buildings jumped 29.4% in June. Permits for multi-family housing soared 15.3%.

Housing market activity may accelerate this year due to the improvements in the labour market.

Upgrades:

Google (GOOGL) upgraded from Hold to Buy at Axiom Capital, target raised from $615 to $850

Downgrades:

Other:

Travelers (TRV) initiated at Neutral at Piper Jaffray

UnitedHealth (UNH) initiated at Buy at Mizuho, target $150

Google (GOOG) target raised from $700 to $750 at Credit Suisse, from $675 to $740 at Needham, from $625 to $720 at Cantor Fitzgerald, from $631 to $723 at Piper Jaffray, from $672 to $749 at FBR Capital, from $640 to $750 at RBC Capital Mkts, from $595 to $715 at Mizuho

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.2% in June, in line with expectations, after a 0.6% gain in May.

On a yearly basis, the consumer price index rose to 1.0% in June from 0.9% in April, in line with expectations.

The consumer price index was partly driven by higher food prices, which climbed 3.4% in June.

The energy index plunged 9.0% in June from the same month a year earlier as gasoline price dropped 14.1% in June from the same month a year earlier.

Canadian core consumer price index, which excludes some volatile goods, was flat in June, after a 0.4% gain in May.

On a yearly basis, core consumer price index in Canada was up to 2.3% in June from 2.2% in May. Analysts had expected the index to remain unchanged at 2.2%.

The Bank of Canada's inflation target is 2.0%.

The Italian statistical office Istat released its construction production data for Italy on Friday. Construction production in Italy decreased 0.6% in May, after a flat reading in April.

On a yearly basis, construction output plunged 2.5% in May, after a 2.8% drop in April.

The Eurostat released its construction production data for the Eurozone on Friday. Construction production in the Eurozone increased 0.3% in May, after a 0.2% decline in April. April's figure was revised down from a 0.3% gain.

Civil engineering output climbed 1.3% in May, while production in the building sector was up 0.2%.

On a yearly basis, construction output increased 0.3% in May, after a 1.1% drop in April. April's figure was revised down from a flat reading.

Stock indices traded slightly lower ahead the German parliament's vote on a new Greek bailout programme.

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

Current figures:

Name Price Change Change %

FTSE 100 6,783.12 -13.33 -0.20 %

DAX 11,674.18 -42.58 -0.36 %

CAC 40 5,120.37 -1.13 -0.02 %

International Monetary Fund (IMF) Managing Director Christine Lagarde said in an interview with French radio station Europe1 on Friday that the IMF will participate in the third Greek bailout programme it includes debt restructuring and government reforms.

"This complete package has two legs, a Greek leg that entails an in-depth reform of the Greek economy. That means holding a budgetary position that is sound and gives the country solidity; and the second leg is that of the lenders, which entails supplying financing and restructuring the debt to ease its burden," she said.

She added that Greece needs a debt relief that could be a significant extension of loan maturities, stretching of repayment schedules, and reducing interests charged.

Eurozone finance ministers agreed on Thursday to provide a third bailout programme to Greece.

"The Eurogroup welcomes the adoption by the Greek Parliament of all the commitments specified in the Euro Summit statement of 12 July. We reached today a decision to grant in principle a 3-year ESM stability support to Greece, subject to the completion of relevant national procedures," the Eurogroup said in its statement.

The Bank of England (BoE) Governor Mark Carney said on Thursday that the central bank could start raising its interest rate by the end of the year. He expects the interest rate to increase to about 2.0% over the next three years.

"It would not seem unreasonable to me to expect that once normalisation begins, interest rate increases would proceed slowly and rise to a level in the medium term that is perhaps about half as high as historic averages," Carney said.

The BoE governor noted that the central bank could change the timing and the size of any interest rate hike if there are shocks to the U.K. economy.

Carney added that skills shortages will lead to higher wage inflation.

Greek Deputy Finance Minister Dimitris Mardas said that Greek banks will reopen on Monday.

"From Monday, the services offered will be widened. All the banks everywhere will be open. There might be a weekly limit on withdrawals, rather than a daily one. This is a proposal we are processing and we think it's technically possible," he said.

According to The Wall Street Journal survey, about 82% of economists expect the Fed to start raising its interest rate in September. 15% expect that the Fed would wait until December.

72% of economists expected last month that the Fed to start raising its interest rate in September, while 9% expected the first interest rate hike in December.

"The Federal Reserve continues to message that it intends to normalize rates this year, and with rebounding activity in the coming months, September continues to be the leading candidate," National Association of Manufacturers chief economist Chad Moutray said.

The Bank of Japan (BoJ) released its Senior Loan Officer Opinion Survey on Friday. The balance of demand for loans from companies increased to 2 in July from 1 in April.

Demand for loans from large companies climbed to 6 in July from zero in April, while demand for loans from medium-sized companies and small companies remained unchanged at 1.

The Conference Board (CB) released its leading economic index for Australia on Friday. The leading economic index increased 0.2% in May, after a 0.3% fall in April.

The increase was driven by higher inventory sales, rural goods exports, yield spread, building approvals and gross operating surplus.

The coincident index was up 0.3% in May, after a 0.1% gain in April.

The rise was driven by employment, household disposable income and industrial production.

The Conference Board (CB) released its leading economic index for the U.K. on Thursday. The leading economic index decreased 0.4% in May, after a 0.3% rise in April. Three of seven subindexes were positive.

The coincident index was up 0.1% in May, after a 0.2% gain in April. All four subindexes climbed. The CB said that the index indicates that the U.K. economy is likely to expand in the near term.

U.S. stock indices advanced with the Nasdaq leading the gains amid earnings reports from various companies. Shares of Netflix Inc. rose 18% and eBay Inc. shares jumped 3.4% on better-than-expected reports.

Investor confidence advanced after Greece's parliament voted for austerity reforms.

The U.S. Department of Labor reported Thursday that the number of initial jobless claims fell for the first time in three weeks. The seasonally adjusted index fell by 15,000 to 281,000 in a week ended July 11. Economists expected 285,000 claims.

The Dow Jones Industrial Average gained 70.08 points, or 0.4%, to 18120.25. The S&P 500 added 16.89 points, or 0.8%, to 2124.29. The Nasdaq Composite Index rose 64.24 points, or 1.3%, to 5163.18.

In Asia this morning Hong Kong Hang Seng rose 0.98%, or 246.31 points, to 25,409.09. China Shanghai Composite Index rose 1.57%, or 60.01 points, to 3,883.18. Meanwhile the Nikkei advanced by 0.17%, or 34.01 points, to 20,634.13.

Asian stock indices advanced amid gains in U.S. stock markets. Investors are less worried about Chinese stocks and Greece's debt situation. A weaker yen supported Japanese stocks as it is favorable for exporters.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.