- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 17-07-2018.

| Index | Change items | Closing price | % change |

| Nikkei | +100.01 | 22697.36 | +0.44% |

| TOPIX | +14.98 | 1745.05 | +0.87% |

| Hang Seng | -357.98 | 28181.68 | -1.25% |

| CSI 300 | -22.71 | 3449.38 | -0.65% |

| Euro Stoxx 50 | +8.42 | 3457.50 | +0.24% |

| FTSE 100 | +25.88 | 7626.33 | +0.34% |

| DAX | +100.52 | 12661.54 | +0.80% |

| CAC 40 | +13.11 | 5422.54 | +0.24% |

| DJIA | +55.53 | 25119.89 | +0.22% |

| S&P 500 | +11.12 | 2809.55 | +0.40% |

| NASDAQ | +49.40 | 7855.12 | +0.63% |

| S&P/TSX | +24.51 | 16519.24 | +0.15% |

Major US stock indexes finished trading in positive territory, which was supported by the publication by large companies of their quarterly reports, as well as statements by Federal Reserve Chairman Powell

Powell said that strong economic growth and stable inflation are likely to allow the Fed to continue a gradual increase in short-term interest rates. He added that he wants to keep inflation at 2%, and added that the economy is "very close" to this mark.

The focus of investors' attention was also data on the United States. The Fed said production of such goods as new trucks, airplanes, drilling rigs and consumer electronics recovered in June after the economy slowed in the spring. Industrial production in June rose by 0.6%, which compensated for a 0.5% decrease in May, production increased by 6% year on year in the second quarter and by 3.8% compared to the previous year, reflecting a large increase after the dim beginning of 2018. If you exclude utilities and mining, the production of goods by US producers increased by 0.8%. The use of capacity - a measure that tracks how efficient factories operate - has grown to 78% from 77.7%. Although this is approximately 1.8% below the historical average, the rate of use is still at a multi-year high.

Meanwhile, the confidence of builders in the market for newly built houses for one family remained unchanged at a high level of 68 points in July, according to the housing market index from the National Association of Housing Developers / Wells Fargo. "Consumer demand for single-family homes remains strong this summer, supported by sustained job growth, rising incomes and low unemployment in many parts of the country," said NAHB chairman Randy Noel.

Most components of DOW have finished trading in positive territory (21 out of 30). The leader of growth was the shares of Johnson & Johnson (JNJ, + 3.56%). Outsider were shares UnitedHealth Group Incorporated (UNH, -2.73%).

Almost all sectors of S & P recorded a rise. The technological sector grew most (+ 0.8%). The largest decrease was shown by the sector of conglomerates (-0.6%).

At closing:

Dow 25,119.89 +55.53 +0.22%

S&P 500 2,809.58 +11.15 +0.40%

Nasdaq 100 7,855.12 +49.40 +0.63%

U.S. stock-index futures fell slightly on Tuesday, as tech stocks witnessed pressure after Netflix's (NFLX) Q2 membership growth numbers came in well below analysts' forecasts. In addition, investors remained cautious ahead of Federal Reserve Chairman Jerome Powell's Senate testimony.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,697.36 | +100.01 | +0.44% |

| Hang Seng | 28,181.68 | -357.98 | -1.25% |

| Shanghai | 2,798.62 | -15.42 | -0.55% |

| S&P/ASX | 6,203.60 | -37.90 | -0.61% |

| FTSE | 7,599.01 | -1.44 | -0.02% |

| CAC | 5,392.80 | -16.63 | -0.31% |

| DAX | 12,543.62 | -17.40 | -0.14% |

| Crude | $68.18 | | +0.18% |

| Gold | $1,240.00 | | +0.02% |

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 57.01 | -0.13(-0.23%) | 4153 |

| Amazon.com Inc., NASDAQ | AMZN | 1,810.70 | -11.79(-0.65%) | 74062 |

| Apple Inc. | AAPL | 190 | -0.91(-0.48%) | 79819 |

| AT&T Inc | T | 31.85 | -0.05(-0.16%) | 14220 |

| Barrick Gold Corporation, NYSE | ABX | 12.8 | -0.02(-0.16%) | 2509 |

| Boeing Co | BA | 358.5 | 2.40(0.67%) | 12534 |

| Caterpillar Inc | CAT | 137.5 | -0.58(-0.42%) | 8795 |

| Cisco Systems Inc | CSCO | 42.43 | -0.07(-0.16%) | 9004 |

| Citigroup Inc., NYSE | C | 69.52 | 0.06(0.09%) | 15378 |

| Deere & Company, NYSE | DE | 134.9 | -1.37(-1.01%) | 2159 |

| Exxon Mobil Corp | XOM | 82.47 | -0.02(-0.02%) | 632 |

| Facebook, Inc. | FB | 204.66 | -2.57(-1.24%) | 179160 |

| Ford Motor Co. | F | 10.88 | 0.03(0.28%) | 17732 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 16.8 | 0.03(0.18%) | 28461 |

| Goldman Sachs | GS | 232.8 | 1.36(0.59%) | 261473 |

| Google Inc. | GOOG | 1,175.00 | -8.86(-0.75%) | 3156 |

| Home Depot Inc | HD | 198.6 | -0.28(-0.14%) | 820 |

| Intel Corp | INTC | 51.31 | -0.70(-1.35%) | 56535 |

| International Business Machines Co... | IBM | 145.88 | 0.42(0.29%) | 428 |

| International Paper Company | IP | 52.35 | -0.11(-0.21%) | 600 |

| Johnson & Johnson | JNJ | 126.3 | 1.61(1.29%) | 95824 |

| JPMorgan Chase and Co | JPM | 110.45 | -0.13(-0.12%) | 30614 |

| McDonald's Corp | MCD | 158.73 | -0.05(-0.03%) | 492 |

| Merck & Co Inc | MRK | 62.49 | -0.10(-0.16%) | 613 |

| Microsoft Corp | MSFT | 104.85 | -0.06(-0.06%) | 40474 |

| Nike | NKE | 77.5 | -0.25(-0.32%) | 1118 |

| Pfizer Inc | PFE | 37.4 | 0.02(0.05%) | 2793 |

| Starbucks Corporation, NASDAQ | SBUX | 50.81 | -0.13(-0.26%) | 4944 |

| Tesla Motors, Inc., NASDAQ | TSLA | 307.5 | -2.60(-0.84%) | 42007 |

| Travelers Companies Inc | TRV | 128.2 | 0.01(0.01%) | 302 |

| Twitter, Inc., NYSE | TWTR | 43.77 | -0.49(-1.11%) | 75178 |

| UnitedHealth Group Inc | UNH | 252.5 | -4.48(-1.74%) | 21710 |

| Verizon Communications Inc | VZ | 51.5 | -0.09(-0.17%) | 640 |

| Visa | V | 138.4 | -0.06(-0.04%) | 7744 |

| Wal-Mart Stores Inc | WMT | 87.72 | 0.08(0.09%) | 1225 |

| Walt Disney Co | DIS | 110.3 | 0.10(0.09%) | 3385 |

| Yandex N.V., NASDAQ | YNDX | 37.25 | -0.30(-0.80%) | 2901 |

Intel (INTC) downgraded to In-line from Outperform at Evercore ISI

Caterpillar (CAT) removed from Conviction Buy List at Goldman; remains Buy rated

Deere (DE) removed from Conviction Buy List at Goldman; remains Buy rated

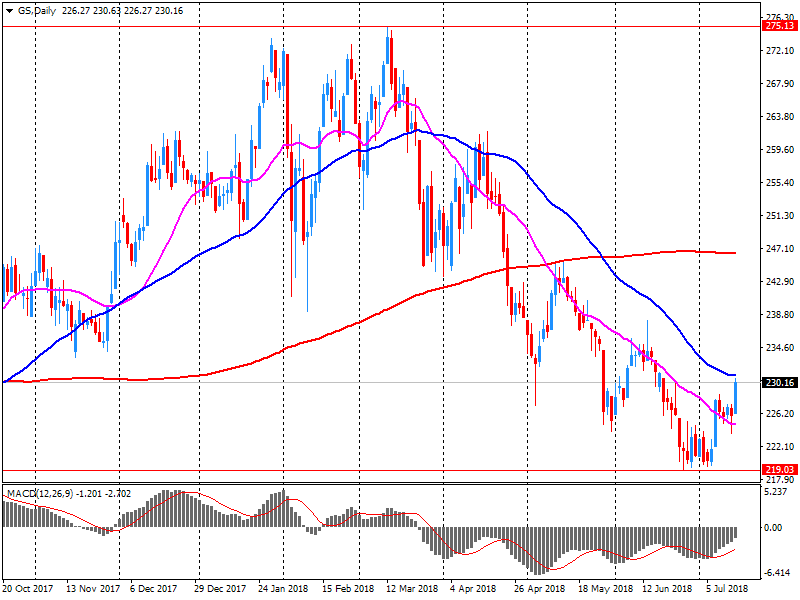

Goldman Sachs (GS) reported Q2 FY 2018 earnings of $5.98 per share (versus $3.95 in Q2 FY 2017), beating analysts' consensus estimate of $4.65.

The company's quarterly revenues amounted to $9.402 bln (+19.2% y/y), beating analysts' consensus estimate of $8.743 bln.

GS fell to $228.95 (-1.08%) in pre-market trading.

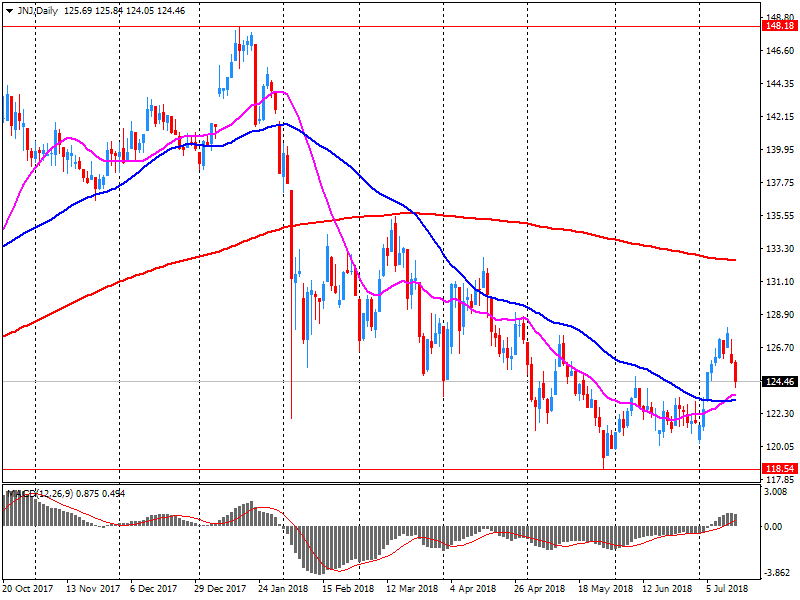

Johnson & Johnson (JNJ) reported Q2 FY 2018 earnings of $2.10 per share (versus $1.83 in Q2 FY 2017), beating analysts' consensus estimate of $2.07.

The company's quarterly revenues amounted to $20.830 bln (+10.6% y/y), beating analysts' consensus estimate of $20.390 bln.

The company also issued guidance for FY 2018, narrowing EPS of $8.07-8.17 to $8.00-8.20 (versus analysts' consensus estimate of $8.12) and lowering revenues to $80.5-81.3 bln from $81.0-81.8 bln (versus analysts' consensus estimate of $81.37 bln).

JNJ fell to $123.10 (-1.28%) in pre-market trading.

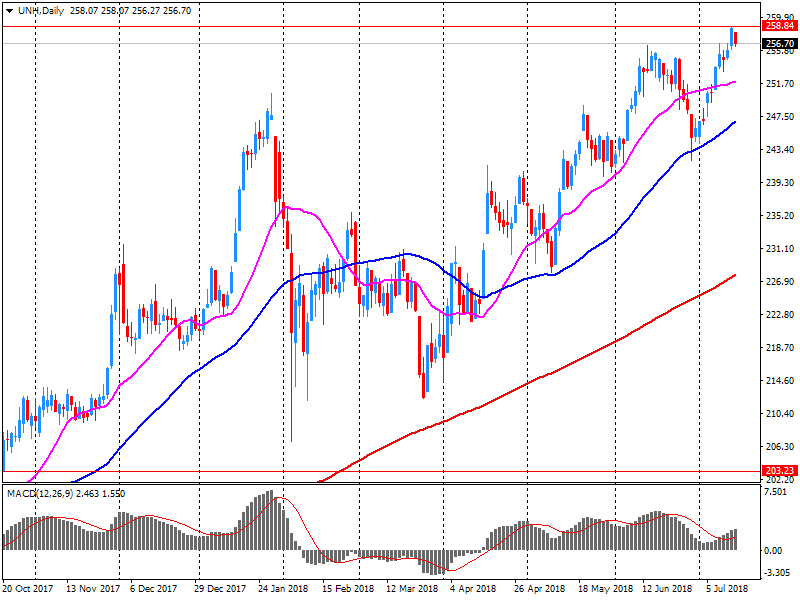

UnitedHealth (UNH) reported Q2 FY 2018 earnings of $3.14 per share (versus $2.46 in Q2 FY 2017), beating analysts' consensus estimate of $3.04.

The company's quarterly revenues amounted to $56.086 bln (+12.1% y/y), generally in-line with analysts' consensus estimate of $56.097 bln.

The company also raised guidance for FY 2018, projecting EPS of $12.50-12.75 versus analysts' consensus estimate of $12.63, and up from prior guidance of $12.40-12.65.

UNH closed Monday's trading session at $256.98 (-0.66%).

Netflix (NFLX) reported Q2 FY 2018 earnings of $0.85 per share (versus $0.15 in Q2 FY 2017), beating analysts' consensus estimate of $0.79.

The company's quarterly revenues amounted to $3.907 bln (+40.3% y/y), generally in-line with analysts' consensus estimate of $3.938 bln.

The report also revealed Netflix missed its Q2 subscriber addition guidance. "This Q2, we over-forecasted global net additions which amounted to 5.2 mln versus a forecast of 6.2 mln and flat compared to Q2 a year ago, as acquisition growth was slightly lower than we projected," it said in the report.

The company issued downside guidance for Q3, projecting EPS of $0.68 versus (analysts' consensus estimate of $0.71), revenues of $3.988 bln (versus analysts' consensus estimate of $4.12 bln) and global net adds of 5.0 mln (versus ~5.6 mln estimates).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.