- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 17-08-2016.

(index / closing price / change items /% change)

Nikkei 225 16,745.64 +149.13 +0.90%

Shanghai Composite 3,110.23 +0.1886 +0.01%

S&P/ASX 200 5,535.05 +3.06 +0.06%

FTSE 100 6,859.15 -34.77 -0.50%

CAC 40 4,417.68 -42.76 -0.96%

S&P 500 2,182.22 +4.07 +0.19%

Dow Jones Industrial Average 18,573.94 +21.92 +0.12%

S&P/TSX Composite 14,697.60 -5.84 -0.04%

Major US stock indexes finished trading with a slight increase. Investors analyzed the protocols of the Fed meeting and followed the dynamics of the oil market.

The minutes of the Fed meeting, which was held on 26-27 July, it was reported that the leaders of the Central Bank in July, tried to leave the door open for a rate hike. They also tried to come to a unified assessment of prospects for the economy, as well as to coordinate as possible raising short-term interest rates. In general, reports signaled that rates could be raised as early as September, but the Central Bank will not act as long as the majority of its leaders will not come to a consensus regarding the outlook for the economy, employment and inflation.

Meanwhile, today the President of St. Louis Fed Bullard said that short-term interest rates the Fed is very close to the proper level. He also noted that the US economy is growing at a moderate pace, inflation and employment rates are stable. Bullard believes that in such circumstances, the current target range for the Fed's short-term rates (0.25% -0.50%) should be increased about once so that he has reached a level that corresponds to the current state of the economy and that in which it is It expected to be in the future.

Quotes of oil rose moderately, supported by on US petroleum inventories report. US Department of Energy reported that in the week of August 6-12 crude oil inventories fell by 2.5 million barrels to 521.1 million barrels. Analysts predicted that inventories will rise by 500,000 barrels. Oil reserves in Cushing terminal fell 724,000 barrels to 64.5 million barrels. Gasoline inventories fell by 2.7 million barrels to 232.7 million barrels. Analysts had expected inventories fell by 1.7 million barrels.

Most DOW components of the index closed in positive territory (19 of 30). Most remaining shares rose Pfizer Inc. (PFE, + 1.03%). Outsider were shares of Cisco Systems, Inc. (CSCO, -1.49%).

Sector S & P Index showed mixed trends. The leader turned utilities sector (+ 1.2%). conglomerates (-1.1%) sectors fell most.

At the close:

Dow + 0.11% 18,572.57 +20.55

Nasdaq + 0.03% 5,228.66 +1.55

S & P + 0.18% 2,182.09 +3.94

Major U.S. stock-indexes trading at their lowest in one week on Wednesday as investors held off from making big bets ahead of the release of the minutes of the Federal Reserve's July policy meeting. The Fed left interest rates unchanged at its meeting last month but said near-term risks to the economy had diminished, leaving the door open for a possible rate hike this year.

Most of all Dow stocks in negative area (25 of 30). Top gainer - Pfizer Inc. (PFE, +0.22%). Top loser - Cisco Systems, Inc. (CSCO, -1.74%).

Most of S&P sectors also in negative area. Top gainer - Utilities (+0.1%). Top loser - Conglomerates (-1.0%).

At the moment:

Dow 18495.00 -29.00 -0.16%

S&P 500 2172.75 -4.00 -0.18%

Nasdaq 100 4791.25 -7.25 -0.15%

Oil 46.43 -0.15 -0.32%

Gold 1349.20 -7.70 -0.57%

U.S. 10yr 1.58 +0.00

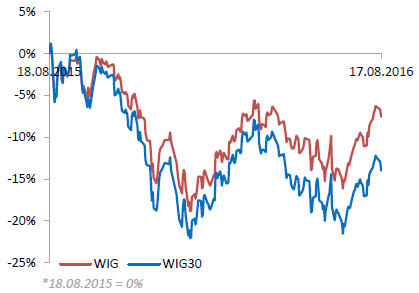

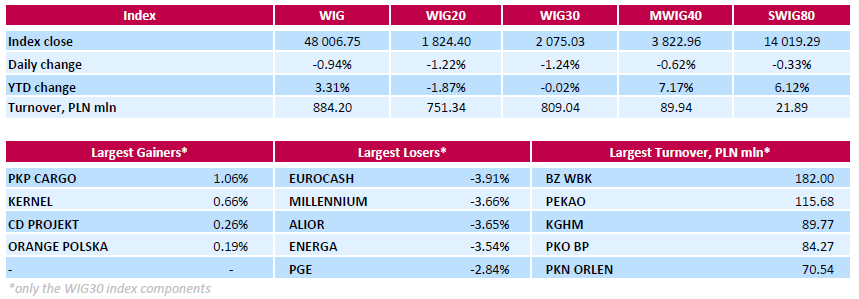

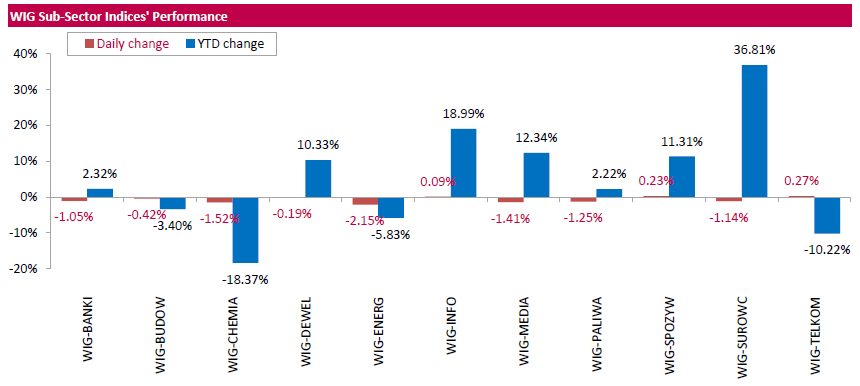

Polish equity market plunged on Wednesday. The broad market measure, the WIG Index, declined by 0.94%. Sector-wise, utilities names (-2.15%) were the worst-performing group, while telecommunication sector stocks (+0.27%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 1.24%. A majority of the index components recorded losses. FMCG-wholesaler EUROCASH (WSE: EUR) topped the decliners' list, dropping by 3.91% on analyst downgrade. It was followed by two banking sector stocks MILLENNIUM (WSE: MIL) and ALIOR (WSE: ALR) and two utilities names ENERGA (WSE: ENG) and PGE (WSE: PGE), slumping between 2.84% and 3.66%. At the same time, the handful advancers included railway freight transport operator PKP CARGO (WSE: PKP), agricultural producer KERNEL (WSE: KER), videogame developer CD PROJEKT (WSE: CDR) and telecommunication services provider ORANGE POLSKA (WSE: OPL), gaining between 0.19% and 1.06%.

The first bars of trade on Wall Street may be a disappointment for those investors who several minutes ago were guided by quotations of contracts. The latter showed in fact a neutral start, while in the first minutes of the trading bears gain an advantage. The opening on the S&P500 was neutral but already in the first minutes of the session bears manage to bring the index below the minimum of yesterday's session, which naturally opens the way to a deeper decline.

The continues problem remains the underlying markets, which - as the DAX - cannot break away from the bottom of the session and still create downward pressure. Also, other emerging markets will end today's quotations strengthening correction signals from the last session.

U.S. stock-index futures were little changed as investors awaited minutes from the Federal Reserve's last meeting for clues on the path of monetary policy.

Global Stocks:

Nikkei 16,745.64 +149.13 +0.90%

Hang Seng 22,799.78 -111.06 -0.48%

Shanghai 3,110.23 +0.1886 +0.01%

FTSE 6,873.56 -20.36 -0.30%

CAC 4,433.31 -27.13 -0.61%

DAX 10,566.93 -109.72 -1.03%

Crude $46.33 (-0.54%)

Gold $1349.10 (-0.57%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 179.6 | 1.46(0.8196%) | 294 |

| ALCOA INC. | AA | 10.34 | 0.05(0.4859%) | 11825 |

| ALTRIA GROUP INC. | MO | 66.2 | -0.06(-0.0906%) | 140546 |

| Amazon.com Inc., NASDAQ | AMZN | 764.81 | 0.77(0.1008%) | 47522 |

| American Express Co | AXP | 65.3 | 0.00(0.00%) | 74646 |

| AMERICAN INTERNATIONAL GROUP | AIG | 59.59 | 0.28(0.4721%) | 28303 |

| Apple Inc. | AAPL | 109.25 | -0.13(-0.1189%) | 103156 |

| AT&T Inc | T | 41.95 | -0.01(-0.0238%) | 6668 |

| Barrick Gold Corporation, NYSE | ABX | 21.16 | -0.16(-0.7505%) | 14618 |

| Boeing Co | BA | 135 | 0.00(0.00%) | 39293 |

| Caterpillar Inc | CAT | 84.29 | 0.00(0.00%) | 30313 |

| Chevron Corp | CVX | 101.55 | 0.00(0.00%) | 515 |

| Cisco Systems Inc | CSCO | 31.26 | 0.14(0.4499%) | 91159 |

| Citigroup Inc., NYSE | C | 46.59 | -0.03(-0.0643%) | 23600 |

| Deere & Company, NYSE | DE | 78.15 | 0.00(0.00%) | 19069 |

| E. I. du Pont de Nemours and Co | DD | 68.3183 | 0.2883(0.4238%) | 67509 |

| Exxon Mobil Corp | XOM | 87.92 | -0.00(-0.00%) | 1498 |

| Facebook, Inc. | FB | 123.45 | 0.15(0.1217%) | 31703 |

| FedEx Corporation, NYSE | FDX | 166.73 | 0.00(0.00%) | 5634 |

| Ford Motor Co. | F | 12.36 | 0.02(0.1621%) | 912 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12 | -0.08(-0.6623%) | 86993 |

| General Electric Co | GE | 31.25 | 0.06(0.1924%) | 300 |

| General Motors Company, NYSE | GM | 31.7 | -0.01(-0.0315%) | 441523 |

| Goldman Sachs | GS | 165.71 | 0.06(0.0362%) | 600 |

| Google Inc. | GOOG | 777.14 | 0.00(0.00%) | 21021 |

| Hewlett-Packard Co. | HPQ | 14.07 | -0.34(-2.3595%) | 1050 |

| Home Depot Inc | HD | 135.32 | -0.91(-0.668%) | 24512 |

| HONEYWELL INTERNATIONAL INC. | HON | 116.23 | 0.595(0.5146%) | 62198 |

| Intel Corp | INTC | 35.19 | -0.02(-0.0568%) | 5832 |

| International Business Machines Co... | IBM | 160.98 | 0.28(0.1742%) | 400 |

| International Paper Company | IP | 46.66 | 0.00(0.00%) | 33449 |

| Johnson & Johnson | JNJ | 120.33 | 0.00(0.00%) | 3345 |

| JPMorgan Chase and Co | JPM | 65.62 | -0.09(-0.137%) | 300 |

| McDonald's Corp | MCD | 118 | 0.06(0.0509%) | 200 |

| Merck & Co Inc | MRK | 63.04 | 0.00(0.00%) | 572 |

| Microsoft Corp | MSFT | 57.44 | -0.00(-0.00%) | 2409 |

| Nike | NKE | 56.89 | 0.01(0.0176%) | 66854 |

| Pfizer Inc | PFE | 34.79 | 0.00(0.00%) | 400 |

| Procter & Gamble Co | PG | 86.6851 | 0.1051(0.1214%) | 171522 |

| Starbucks Corporation, NASDAQ | SBUX | 55.7 | 0.33(0.596%) | 3808 |

| Tesla Motors, Inc., NASDAQ | TSLA | 223.95 | 0.34(0.152%) | 8100 |

| The Coca-Cola Co | KO | 43.83 | 0.00(0.00%) | 181348 |

| Travelers Companies Inc | TRV | 116.98 | 0.00(0.00%) | 17165 |

| Twitter, Inc., NYSE | TWTR | 20.44 | 0.04(0.1961%) | 58060 |

| United Technologies Corp | UTX | 109.16 | 0.66(0.6083%) | 54717 |

| UnitedHealth Group Inc | UNH | 141.08 | 0.00(0.00%) | 160235 |

| Verizon Communications Inc | VZ | 53 | 0.24(0.4549%) | 1074 |

| Visa | V | 80.81 | 0.14(0.1735%) | 196977 |

| Wal-Mart Stores Inc | WMT | 71.8 | -1.09(-1.4954%) | 33666 |

| Walt Disney Co | DIS | 97.09 | 0.21(0.2168%) | 1108 |

| Yahoo! Inc., NASDAQ | YHOO | 42.37 | -0.12(-0.2824%) | 12938 |

| Yandex N.V., NASDAQ | YNDX | 23.4 | 0.05(0.2141%) | 900 |

Upgrades:

Downgrades:

Other:

Home Depot (HD) target raised $155 from $150 at RBC Capital Mkts

Home Depot (HD) target raised to $145 from $140 at Wedbush

Cisco Systems (CSCO) target raised to $35 from $30.75 at Jefferies

Hewlett Packard Enterprise (HPE) initiated with a Mkt Perform at Raymond James

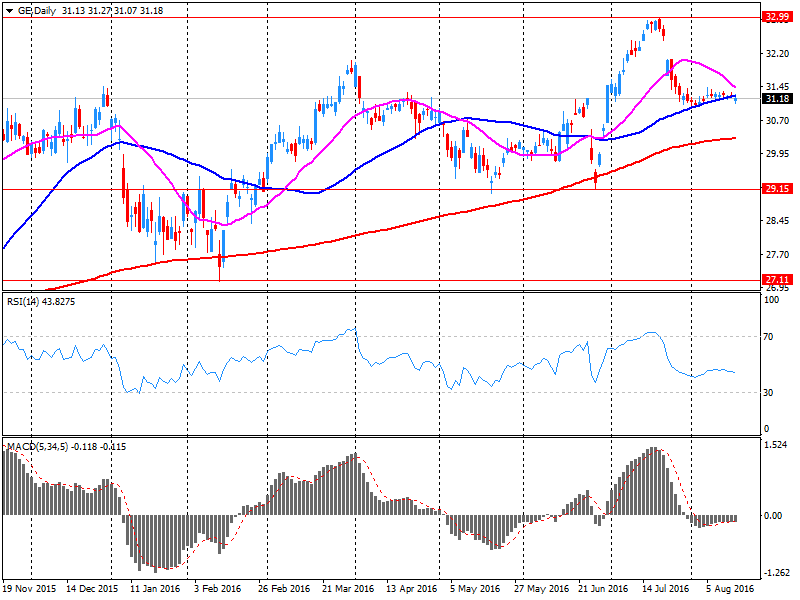

According to the WSJ, GE Capital has agreed to sell 3.2 million Townsquare Media shares Inc., which is 12% of the total issued shares of the company. The market value of Townsquare is about $ 230 mln., The value of the share is estimated at nearly $ 30 million. The companies are expected to report on the deal on Wednesday.

GE shares at the end of trading on Tuesday close at $ 31.19 (-0.16%).

European stocks mostly lower after the stock prices of oil and technology companies declined.

Statistical data on the UK economy, published on Wednesday, pointed to the preservation of the country's labor market flexibility, despite Brexit, and offer support to the British stock markets.

The number of applications for unemployment benefits in the UK fell unexpectedly in July, by 8.6 thousand., after rising 900 applications in June, according to the country's National Statistical Management (ONS).

In the second quarter of 2016 the number of employees in the UK has increased by 172 thousand persons to a record 31.8 million people. Unemployment rate was 4.9% in April-June, as well as in March-May, the rwage growth accelerated to 2.3% from 2.2%.

At the same time, investors await the FOMC minutes in the search for clues on the timing of the next rate hike.

Investors remain cautious after the head of the Federal Reserve Bank of New York William Dudley said the Fed is approaching the point where it would be appropriate to raise interest rates.

In addition, the Federal Reserve Bank of Atlanta President Dennis Lockhart declared the possibility of two rate increases in 2016.

The composite index of the largest companies in the region Stoxx Europe 600 fell during trading 0,4% - to 341.97 points.

Shares of BP, Royal Dutch Shell and Total fell 0.1%, 0.2% and 0.6% on renewed decline of oil prices.

Shares of ASML Holding NV, Europe's largest manufacturer of equipment for the production of semiconductors, dropped by 6%.

Shares of the Dutch bank ABN Amro jumped 4.9%. The bank, which reduced net income in the second quarter by 35%, announced its intention to reduce costs in the area of support and control of operations by 25%, or 200 million euros next year.

Securities of mining companies show mixed results: BHP Billiton shares rose 1%, Antofagasta - fell by 0.7%.

The capitalization of the British insurer Admiral Group fell by 8%. The company increased its pre-tax profit in the first half by 4.3% and raised its dividend by 23%, but warned that market volatility after the British decision to withdraw from the European Union (Brexit) have a negative impact on its creditworthiness.

Wienerberger Shares fell 8.2%, as the company warned of the negative impact of the currency against the background of the weakness of the pound sterling.

Carlsberg Shares slipped 4.1% as the Danish brewer introduced semi-annual results, which were below analysts' expectations, but said that will keep the forecast for 2016 due to the progress in the implementation of the cost reduction strategies.

Meanwhile, shares of Balfour Beatty rose by 7.7%, as the construction company resumed dividend payments.

At the moment:

FTSE 6894.32 0.40 0.01%

DAX 10603.81 -72.84 -0.68%

CAC 4444.40 -16.04 -0.36%

The first half of trading on the Warsaw market was a clear direction down. After a drop in the first hour of the session the market consolidated for the next 90 minutes, indicating better balance. Another piece of trading, however, brought a decline to new lows of the session and the loss of the main market index at the level of 1 percent. Thus our market, which in the first half of August was characterized by the relative strength, today is at the forefront of downward moving parquets. It is also worth to note that the observed declines are not the work of blue chips only but also apply to the broad market, as confirmed by the behavior of the mWIG40 and the sWIG80 indices.

At the halfway point of the session the WIG20 index was at the level of 1,826 points (-1,12%), with the turnover of PLN 285 mln.

WIG20 index opened at 1847.28 points (+0.02%)

WIG 48450.02 -0.03%

WIG30 2100.24 -0.04%

mWIG40 3843.92 -0.08%

*/ - change to previous close

The futures contracts of September series (WSE: FW20U1620) began the day with a discount of 0.05 percent which does not seem to take into account the risk of deepening and markdowns means that players are counting on a shallow correction.

As expected, trading on the spot market (the WIG20 index) also began with small changes, causing that the WIG20 index in the first minutes was recorded at neutral level.

However, after the first transactions market went down, and after the first quarter of trading the WIG20 was on the level of 1841 points (-0,29%).

Tuesday's session on Wall Street ended with declines in major indices in the context of clear correlation. Night did not bring major changes, and the valuation of contracts on the S&P500 and the DAX signal now opening in Europe without significant changes. However the corrective mood on Wall Street will be difficult to ignore.

Today's calendar of economic reports in the world is virtually empty. Global markets are waiting for the publication of the minutes of the last FOMC meeting.

It is reasonable to assume that the core markets have space for correction, which may result for the S&P500 meeting with the region of 2,200 points. In the case of emerging markets - an important point of reference for the WIG20 index and the Warsaw Stock Exchange - the last two sessions are something more than a warning before correction. In recent times, the emerging markets segment had almost euphoric phase of growth and the Tuesday counterattack of supply must be noticed also in Warsaw. There is no doubt that emerging markets are on the verge of correction.

European stocks closed in negative territory Tuesday, but gains within the commodities group kept the decline somewhat in check.

The Stoxx Europe 600 SXXP, -0.79% fell 0.8% to close at 343.32, with only the basic materials SXPR, +1.31% and oil and gas SXER, +0.19% sectors advancing. The index on Monday slipped less than 0.1%, a second straight decline.

European traders apparently failed to take heart from the continued climb in U.S. equities, which hit records Monday as oil prices rallied.

Stocks in the U.K. fell Tuesday, pulling back after eight consecutive advances, but gains for miners limited the loss for the benchmark index.

The FTSE 100 UKX, -0.68% dropped 0.7% to 6,893.92, with only the mining sector finishing higher.

U.S. stocks closed at session lows Tuesday, a day after notching record highs, as investors weighed hawkish comments by Federal Reserve officials against sharp gains for oil futures, a weakening dollar and fresh consumer-price data that showed U.S. inflation remains tepid.

The S&P 500 index SPX, -0.55% fell 12 points, or 0.6%, to close at 2,178.15, as nine out of 10 sectors traded lower, led by a 2% drop in telecom stocks and a 1.2% loss in utility shares. Telecom and utilities are two income-paying stock sectors traditionally viewed as bond alternatives-which take a hit when interest-rate expectations rise.

Energy was the only S&P 500 sector to close in positive territory, up 0.2%, boosted by strong gains in crude-oil futures CLU6, -0.62%

The Dow Jones Industrial Average DJIA, -0.45% closed down 84.03 points, or 0.5%, at 18,552.02, pressured by a 1.6% declines in both Johnson & Johnson Inc. JNJ, -1.62% and Verizon Communications Inc. VZ, -1.59%

Asian shares pulled back from a one-year high and the dollar strengthened on Wednesday, after an influential Federal Reserve official said interest rates could rise as soon as September.

New York Fed President William Dudley said that as the U.S. labour market tightens and as evidence of rising wages builds, "we're edging closer towards the point in time where it will be appropriate I think to raise interest rates further."

Comments from Dudley, a permanent voter on policy and a close ally of Fed Chair Janet Yellen, also included an unusual warning on low bond yields and were seen as more hawkish than a cautious message last month.

Atlanta Federal Reserve Bank President Dennis Lockhart, seen as centrist, concurred saying he did not rule out a September hike - something markets have almost completely priced out.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.