- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 18-04-2017.

(index / closing price / change items /% change)

Nikkei +63.33 18418.59 +0.35%

TOPIX +5.84 1471.53 +0.40%

Hang Seng -337.12 23924.54 -1.39%

CSI 300 -17.19 3462.63 -0.49%

Euro Stoxx 50 -38.48 3409.78 -1.12%

FTSE 100 -180.09 7147.50 -2.46%

DAX -108.56 12000.44 -0.90%

CAC 40 -80.85 4990.25 -1.59%

DJIA -113.64 20523.28 -0.55%

S&P 500 -6.82 2342.19 -0.29%

NASDAQ -7.31 5849.47 -0.12%

S&P/TSX -62.32 15622.57 -0.40%

Major US stock indexes declined on Tuesday, as corporate heavyweights Goldman Sachs and Johnson & Johnson disappoint investors with their quarterly results, while geopolitical tensions continued to affect the sentiment of market participants.

In addition, as it became known, in March, US housing construction fell, as the construction of single-family houses in the Midwest recorded the largest decline in three years, probably due to bad weather. The laying of new houses fell by 6.8% to an annual rate of 1.22 million units, the Commerce Ministry said on Tuesday. The laying of new homes for February was revised to 1.30 million units from the previously reported 1.29 million units.

At the same time, the demand for heating increased industrial production in March. The Federal Reserve said that industrial production rose by 0.5% in March, with the increase attributable to record growth in the volume of public utilities. The release of utility services in March rose by a record 8.6%, as colder temperatures returned after warm weather in the first two months of the year, the Fed said.

Quotes of oil moderately decreased, reaching a 2-week low, which was due to news that the volume of oil shale in the US is likely to increase sharply in May. According to the forecasts of the US Energy Ministry, the production of shale oil in the fields of the largest oil and gas producing regions of the USA in May will grow by 124 thousand barrels per day in comparison with April - up to 5.193 million barrels.

Components of the DOW index finished the session in different directions (16 in negative territory, 14 in positive territory). The Goldman Sachs Group, Inc. fell more than the rest. (GS, -4.72%). The leader of growth was shares UnitedHealth Group Incorporated (UNH, + 1.06%).

Most sectors of the S & P index showed a decline. The main materials sector fell most of all (-0.8%). The growth leader was the conglomerate sector (+ 0.4%).

At closing:

DJIA -0.55% 20,523.96 -112.96

Nasdaq -0.12% 5,849.47 -7.32

S & P -0.29% 2,342.22 -6.79

U.S. stock-index fell as investors weighed a possible delay in tax reforms, while keeping an eye on quarterly earnings and global politics.

Stocks:

Nikkei 18,418.59 +63.33 +0.35%

Hang Seng 23,924.54 -337.12 -1.39%

Shanghai 3,196.60 -25.57 -0.79%

FTSE 7,194.96 -132.63 -1.81%

CAC 5,008.08 -63.02 -1.24%

DAX 12,035.85 -73.15 -0.60%

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 190 | -0.36(-0.19%) | 105 |

| ALCOA INC. | AA | 31.13 | -0.18(-0.57%) | 4167 |

| Amazon.com Inc., NASDAQ | AMZN | 900.01 | -1.98(-0.22%) | 16312 |

| AMERICAN INTERNATIONAL GROUP | AIG | 59.71 | -0.22(-0.37%) | 100 |

| Apple Inc. | AAPL | 141.5 | -0.33(-0.23%) | 52126 |

| AT&T Inc | T | 40.32 | 0.02(0.05%) | 3899 |

| Barrick Gold Corporation, NYSE | ABX | 19.88 | 0.04(0.20%) | 44392 |

| Boeing Co | BA | 179 | -0.02(-0.01%) | 1053 |

| Cisco Systems Inc | CSCO | 32.5 | -0.11(-0.34%) | 1100 |

| Citigroup Inc., NYSE | C | 58.69 | -0.30(-0.51%) | 26677 |

| Exxon Mobil Corp | XOM | 81.28 | -0.30(-0.37%) | 2390 |

| Facebook, Inc. | FB | 141.15 | -0.27(-0.19%) | 32724 |

| Ford Motor Co. | F | 11.15 | 0.02(0.18%) | 84609 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.53 | -0.22(-1.73%) | 135437 |

| General Electric Co | GE | 29.57 | -0.07(-0.24%) | 5194 |

| General Motors Company, NYSE | GM | 33.8 | -0.10(-0.30%) | 1041 |

| Goldman Sachs | GS | 220.22 | -6.04(-2.67%) | 324768 |

| Home Depot Inc | HD | 147.3 | -0.01(-0.01%) | 136 |

| Intel Corp | INTC | 35.45 | -0.03(-0.08%) | 1074 |

| International Business Machines Co... | IBM | 170.55 | -0.55(-0.32%) | 868 |

| Johnson & Johnson | JNJ | 123.92 | -1.80(-1.43%) | 56488 |

| JPMorgan Chase and Co | JPM | 85.39 | -0.47(-0.55%) | 27017 |

| McDonald's Corp | MCD | 131.95 | 0.60(0.46%) | 1928 |

| Merck & Co Inc | MRK | 62.82 | 0.02(0.03%) | 1096 |

| Microsoft Corp | MSFT | 65.3 | -0.18(-0.27%) | 6278 |

| Nike | NKE | 55.93 | -0.31(-0.55%) | 3534 |

| Procter & Gamble Co | PG | 90.3 | -0.09(-0.10%) | 236 |

| Starbucks Corporation, NASDAQ | SBUX | 58.1 | 0.02(0.03%) | 625 |

| Tesla Motors, Inc., NASDAQ | TSLA | 299.46 | -1.98(-0.66%) | 24635 |

| The Coca-Cola Co | KO | 42.83 | -0.24(-0.56%) | 5035 |

| UnitedHealth Group Inc | UNH | 171 | 3.82(2.29%) | 17515 |

| Verizon Communications Inc | VZ | 48.85 | 0.04(0.08%) | 952 |

| Yahoo! Inc., NASDAQ | YHOO | 47.25 | -0.14(-0.30%) | 1400 |

| Yandex N.V., NASDAQ | YNDX | 24 | -0.27(-1.11%) | 985 |

Upgrades:

McDonald's (MCD) upgraded to Outperform from Mkt Perform at Bernstein; target raised to $160 from $129

Downgrades:

Other:

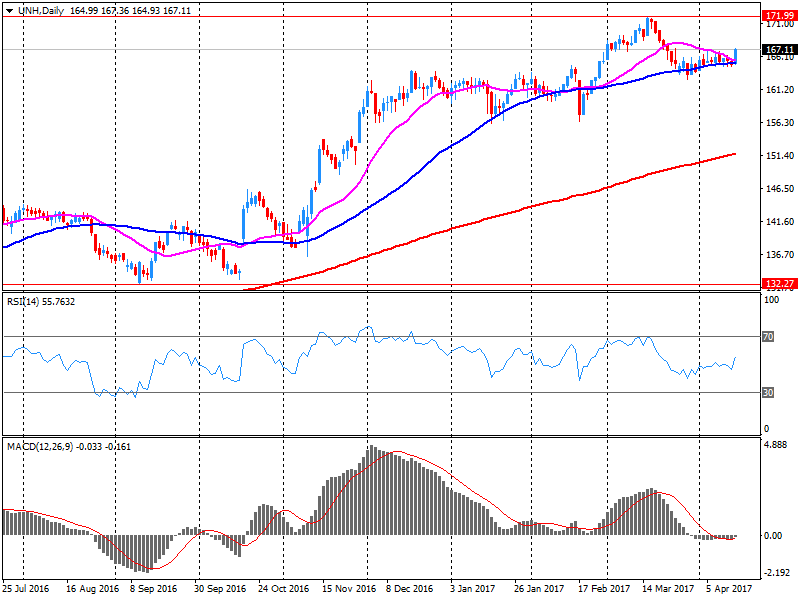

UnitedHealth (UNH) target raised to $200 from $178 at Mizuho

UnitedHealth reported Q1 FY 2017 earnings of $2.37 per share (versus $1.81 in Q1 FY 2016), beating analysts' consensus estimate of $2.17.

The company's quarterly revenues amounted to $48.723 bln (+9.4% y/y), beating analysts' consensus estimate of $48.211 bln.

The company also sued raised guidance for FY 2017, projecting EPS of $9.65-9.85 (versus previously forecast $9.30-9.60 and analysts' consensus estimate of $9.51) and revenues of $200 bln (versus previously forecast $197-199 bln and analysts' consensus estimate of $198.94 bln).

UNH rose to $171.00 (+2.29%) in pre-market trading.

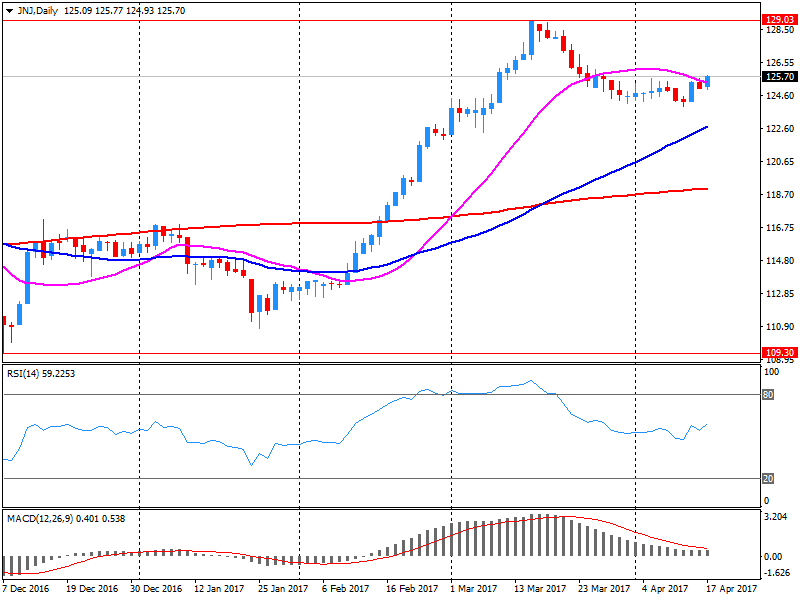

Johnson & Johnson reported Q1 FY 2017 earnings of $1.83 per share (versus $1.68 in Q1 FY 2016), beating analysts' consensus estimate of $1.77.

The company's quarterly revenues amounted to $17.766 bln (+1.6% y/y), missing analysts' consensus estimate of $18.020 bln.

The company also issued guidance for FY 2017, projecting EPS of $7.00-7.15 versus analysts' consensus estimate of $7.08 and revenues of $75.4-76.1 bln versus analysts' consensus estimate of $75.21 bln.

JNJ fell to $124.20 (-1.21%) in pre-market trading.

Goldman Sachs reported Q1 FY 2017 earnings of $5.15 per share (versus $2.68 in Q1 FY 2016), missing analysts' consensus estimate of $5.19.

The company's quarterly revenues amounted to $8.026 bln (+26.6% y/y), missing analysts' consensus estimate of $8.329 bln.

GS fell to $219.25 (-3.10%) in pre-market trading.

Bank of America reported Q1 FY 2017 earnings of $0.41 per share (versus $0.21 in Q1 FY 2016), beating analysts' consensus estimate of $0.35.

The company's quarterly revenues amounted to $22.445 bln (+6.9% y/y), beating analysts' consensus estimate of $21.766 bln.

BAC rose to $23.00 (+0.83%) in pre-market trading.

European stocks slid Thursday, with banks leading the charge south after President Donald Trump's comments about the dollar and interest rates.

U.S. stocks bounced back on Monday to close near session highs, halting three straight sessions of declines for major benchmarks, as banks enjoyed their best daily rally in six weeks.

A stronger dollar and overnight gains in U.S. stocks helped many Asia-Pacific equities as trading returned in full following the Easter Monday holiday. Chinese steel mills are hunting for higher-grade product to minimize their coking-coal needs after prices of metallurgical coal surged because Cyclone Debbie curbed shipments from Australia. Fortescue responded by offering deeper discounts on its iron ore.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.