- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-04-2016.

(index / closing price / change items /% change)

HANG SENG 21,383.86 +222.36 +1.05%

S&P/ASX 200 5,188.8 +51.74 +1.01%

TOPIX 1,363.03 +42.88 +3.25%

SHANGHAI COMP 3,042.95 +9.29 +0.31%

FTSE 100 6,405.35 +51.83 +0.82 %

CAC 40 4,566.48 +59.64 +1.32 %

Xetra DAX 10,349.59 +229.28 +2.27 %

S&P 500 2,100.8 +6.46 +0.31 %

NASDAQ Composite 4,940.33 -19.69 -0.40 %

Dow Jones 18,053.6 +49.44 +0.27 %

Stock indices closed higher on an increase in oil prices. Oil prices rose as Kuwait's oil production declined on the strike in the oil sector.

Positive economic data from the Eurozone also supported stocks. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 11.2 in April from 4.3 in March, exceeding expectations for a rise to 8.0.

"Surprisingly positive economic news from China seem to have improved the sentiment amongst financial market experts. On balance, however, the continued poor growth in China and other important emerging markets continues to be a burden for the German export industry. Furthermore, concern about Great Britain's possible exit from the EU seems to be having a negative impact," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index climbed to 21.5 in April from 10.6 in March, beating expectations for a decline to 8.8.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus declined to a seasonally adjusted €19.0 billion in February from €27.5 billion in January. January's figure was revised up from a surplus of €25.4 billion.

The trade surplus fell to €24.6 billion in February from €30.4 billion in January. The surplus on services increased to €6.8 billion in February from €3.8 billion in January.

The ECB said in a survey on Tuesday that the negative deposit rate had a positive impact on lending volumes.

"Regarding the impact of the ECB's negative deposit facility rate, banks reported a positive impact on lending volumes, specifically for loans to households, but a negative impact on their net interest income and loan margins for the last quarter of 2015 and the first quarter of 2016," the ECB said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,405.35 +51.83 +0.82 %

DAX 10,349.59 +229.28 +2.27 %

CAC 40 4,566.48 +59.64 +1.32 %

The European Central Bank (ECB) said in a survey on Tuesday that the negative deposit rate had a positive impact on lending volumes.

"Regarding the impact of the ECB's negative deposit facility rate, banks reported a positive impact on lending volumes, specifically for loans to households, but a negative impact on their net interest income and loan margins for the last quarter of 2015 and the first quarter of 2016," the ECB said.

Spain's Finance Minister Luis de Guindos said on Tuesday that the country would miss its budget deficit target this year. He noted that the deficit was expected to be 3.6% of GDP in 2016, higher than the European Commission's target of below 3%.

de Guindos also said that the deficit was expected to be 2.9% of GDP in 2017.

The Bank of Canada (BoC) Governor Stephen Poloz said before the House of Commons Standing Committee on Finance on Tuesday that the recent economic data was encouraging but also quite variable.

He noted that there was no evidence of higher investment.

"We have not yet seen concrete evidence of higher investment and strong firm creation. These are some of the ingredients needed for a return to natural, self-sustaining growth with inflation sustainably on target," Poloz said.

The BoC governor also said that the Canadian economy was hit by a drop in oil prices.

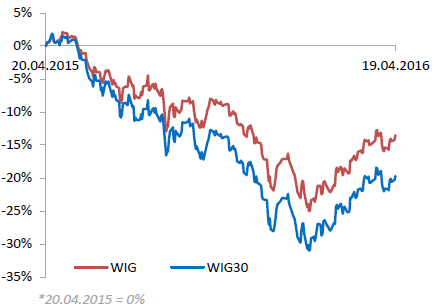

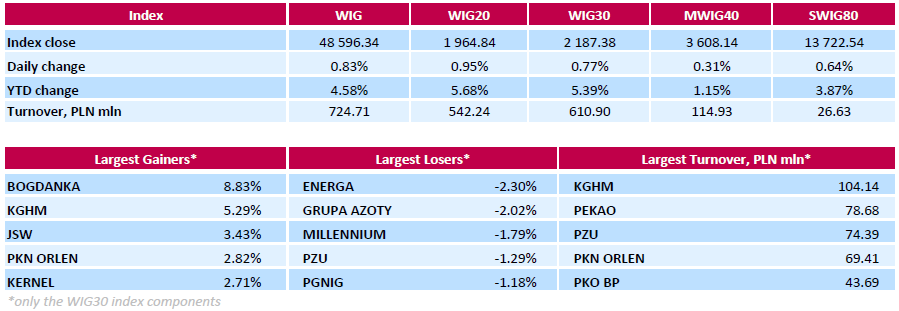

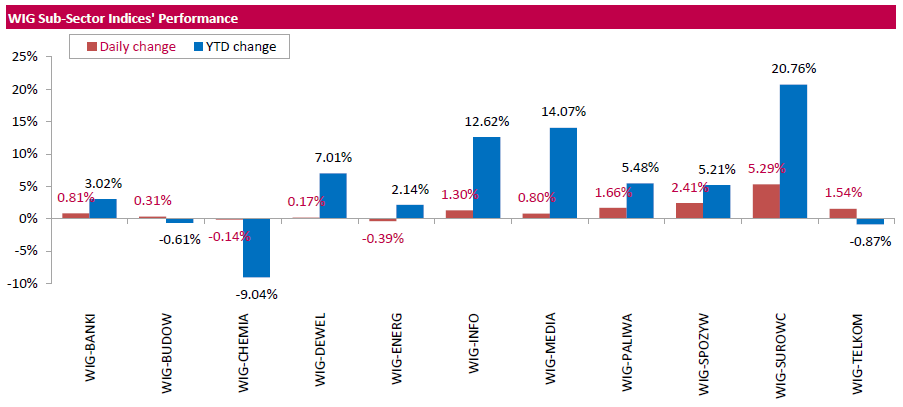

Polish equity market closed slightly higher on Tuesday. The broad market measure, the WIG index, added 0.83%. Except for chemicals (-0.14%) and utilities (-0.39%), every sector in the WIG Index rose, with materials (+5.29%) outperforming.

The large-cap benchmark, the WIG30 Index, surged by 0.77%. Within the index components, copper producer KGHM (WSE: KGH) and coal miners BOGDANKA (WSE: LWB) and JSW (WSE: JSW) led the gainers, skyrocketing by 5.29%, 8.83% and 3.43% respectively, supported by rallies in commodities. Other major advancers were oil refiner PKN ORLEN (WSE: PKN), agricultural producer KERNEL (WSE: KER) and bank PEKAO (WSE: PEO), climbing by 2.82%, 2.71% and 2.13% respectively. On the other side of the ledger, genco ENERGA (WSE: ENG), chemical producer GRUPA AZOTY (WSE: ATT) and bank MILLENNIUM (WSE: MIL) were among the weakest performers, dropping by 2.3%, 2.02% and 1.79% respectively.

The Bank of England (BoE) Governor Mark Carney said before the House of Lords economic affairs committee on Tuesday that the uncertainty about the results of the referendum on Britain's membership in the European Union (EU) seemed to weigh on Britain's economy.

He noted that Britain's exit from the EU could have a negative impact on Britain's financial stability, property markets, market liquidity, and on the rest of the EU.

"Some elements of these risks may be beginning to manifest," Carney said.

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in a speech on Tuesday that central banks' inability to boost the global growth was the biggest risk to the global financial system.

"Our inability, so far, durably to lift growth prospects is arguably the biggest vulnerability the global financial system faces today. This needs to be our focus," he said.

Stevens also said that ultra-low interest rates for a longer period was a big problem for savers.

Referring to helicopter money, the RBA governor noted that it was easier to start doing helicopter money than to stop.

"Desperate times call for desperate measures, perhaps. Are we that desperate?" he added.

Major U.S. stock-indexes moxed. Dow Jones industrial average were slightly higher on Tuesday as crude rose after an oil workers' strike in Kuwait hurt output. The Nasdaq composite edged lower, weighed by a 23% slide in Illumina. The diagnostic test maker's shares were trading at $138.50 after its preliminary results fell short of expectations.

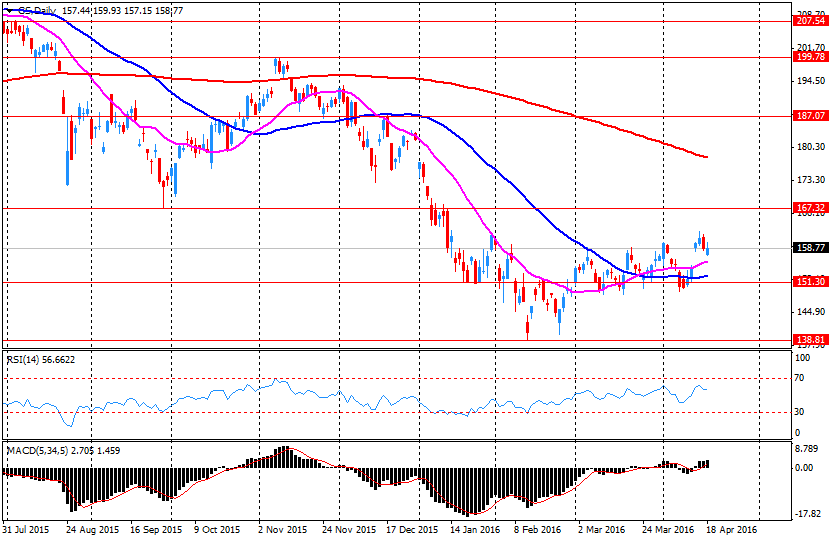

Most if Dow stocks in positive are (22 of 30). Top looser - International Business Machines Corporation (IBM, -5,32%). Top gainer - The Goldman Sachs Group, Inc. (GS +2,36%).

All S&P sectors in positive area. Top gainer - Basic Materials (+1,9%).

At the moment:

Dow 17981.00 +53.00 +0.30%

S&P 500 2095.00 +8.25 +0.40%

Nasdaq 100 4545.50 -1.00 -0.02%

Oil 42.63 +1.44 +3.50%

Gold 1255.30 +20.30 +1.64%

U.S. 10yr 1.80 +0.02

Business NZ released its performance of services index for New Zealand on late Monday evening. The index fell to 54.8 in March from 56.7 in February. It was the lowest level since November 2014It was

February's figure was revised down from 56.9.

A reading above 50.0 indicates the expansion of activity.

The fall was driven by declines in all sub-indexes.

The afternoon March data on construction permits and commenced construction projects were disappointing. Despite on a y/y basis there's some increase in the permits, the latter declined slightly in relation to the previous month and are at the lowest level of the year so far.

The market in the US starts trading from cautious growth -

The Warsaw market, due to the favourable developments on the copper market, posted a noticeable upward move on KGHM shares which drove up the WIG20 index to the level of 1,960 points.

The Italian statistical office Istat released its industrial production data on Tuesday. Industrial production in Italy climbed at a seasonally-adjusted rate of 0.3% in February, after a 1.6% decline in January. January's figure was revised down from a 1.9% rise.

On a yearly basis, industrial production in Italy jumped at a seasonally-adjusted rate of 0.3% in February, after a 1.7% decrease in January.

The construction cost index for residential buildings remained unchanged in February compared with the previous month, the cost index for road construction with tunnel section fell by 0.3%, while the cost index for road construction without tunnel section declined by 0.3%.

The Bank of Italy released its current account on Tuesday. Italy's current account surplus rose €1.38 billion in February from €1.09 billion in February last year.

The goods trade surplus rose to €4.36 billion in February from €4.25 billion in February last year.

The deficit on services increased to €1.13 billion in February from €972 million in February last year.

The primary income surplus was €282 million in February, while the secondary income deficit was €2.13 billion.

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 16,874.44 +598.49 +3.68%

Hang Seng 21,436.21 +274.71 +1.30%

Shanghai Composite 3,042.95 +9.29 +0.31%

FTSE 6,381.12 +27.60 +0.43%

CAC 4,558.3 +51.46 +1.14%

DAX 10,347.57 +227.26 +2.25%

Crude oil $40.25 (+1.18%)

Gold $1252.10 (+1.38%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 170 | 0.45(0.2654%) | 1406 |

| ALCOA INC. | AA | 10.21 | 0.12(1.1893%) | 49635 |

| ALTRIA GROUP INC. | MO | 61.74 | -0.43(-0.6916%) | 7374 |

| Amazon.com Inc., NASDAQ | AMZN | 637.11 | 1.76(0.277%) | 20913 |

| American Express Co | AXP | 62.87 | 0.28(0.4474%) | 2000 |

| Apple Inc. | AAPL | 108 | 0.52(0.4838%) | 118312 |

| AT&T Inc | T | 38.77 | 0.12(0.3105%) | 7400 |

| Barrick Gold Corporation, NYSE | ABX | 16.2 | 0.38(2.402%) | 227857 |

| Boeing Co | BA | 132.77 | 0.80(0.6062%) | 1370 |

| Caterpillar Inc | CAT | 79.64 | 0.39(0.4921%) | 2250 |

| Chevron Corp | CVX | 99.02 | 0.32(0.3242%) | 2399 |

| Cisco Systems Inc | CSCO | 28.38 | 0.19(0.674%) | 9306 |

| Citigroup Inc., NYSE | C | 45.4 | 0.29(0.6429%) | 76112 |

| E. I. du Pont de Nemours and Co | DD | 64.7 | -0.00(-0.00%) | 751 |

| Exxon Mobil Corp | XOM | 85.99 | 0.21(0.2448%) | 4705 |

| Facebook, Inc. | FB | 111.15 | 0.70(0.6338%) | 154437 |

| Ford Motor Co. | F | 13.36 | 0.11(0.8302%) | 35525 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.23 | 0.21(1.9056%) | 313352 |

| General Electric Co | GE | 31.15 | 0.09(0.2898%) | 15290 |

| General Motors Company, NYSE | GM | 31.4 | 0.09(0.2874%) | 3656 |

| Goldman Sachs | GS | 157.5 | -1.52(-0.9559%) | 111662 |

| Google Inc. | GOOG | 769.99 | 3.38(0.4409%) | 5001 |

| Home Depot Inc | HD | 137 | 0.20(0.1462%) | 3695 |

| Intel Corp | INTC | 31.75 | 0.10(0.316%) | 31021 |

| International Business Machines Co... | IBM | 146.45 | -6.08(-3.9861%) | 128942 |

| Johnson & Johnson | JNJ | 111.2 | 0.27(0.2434%) | 45346 |

| JPMorgan Chase and Co | JPM | 62.45 | 0.18(0.2891%) | 9939 |

| McDonald's Corp | MCD | 129.3 | 0.45(0.3492%) | 13555 |

| Microsoft Corp | MSFT | 56.76 | 0.30(0.5313%) | 48094 |

| Nike | NKE | 59.86 | 0.29(0.4868%) | 2190 |

| Pfizer Inc | PFE | 32.75 | 0.14(0.4293%) | 7067 |

| Procter & Gamble Co | PG | 82.96 | 0.13(0.1569%) | 2007 |

| Starbucks Corporation, NASDAQ | SBUX | 61.16 | 0.27(0.4434%) | 2987 |

| Tesla Motors, Inc., NASDAQ | TSLA | 255 | 1.12(0.4412%) | 14895 |

| The Coca-Cola Co | KO | 46.29 | 0.07(0.1515%) | 1902 |

| Travelers Companies Inc | TRV | 116.64 | 0.63(0.5431%) | 685 |

| Twitter, Inc., NYSE | TWTR | 17.44 | 0.13(0.751%) | 40259 |

| United Technologies Corp | UTX | 105.47 | 0.34(0.3234%) | 200 |

| UnitedHealth Group Inc | UNH | 129.9 | 2.09(1.6352%) | 26185 |

| Verizon Communications Inc | VZ | 51.95 | 0.22(0.4253%) | 1300 |

| Visa | V | 81.66 | 0.21(0.2578%) | 3603 |

| Wal-Mart Stores Inc | WMT | 69.91 | 0.05(0.0716%) | 882 |

| Walt Disney Co | DIS | 101.86 | 0.38(0.3745%) | 12358 |

| Yahoo! Inc., NASDAQ | YHOO | 36.52 | 0.00(0.00%) | 19743 |

| Yandex N.V., NASDAQ | YNDX | 17.37 | 0.20(1.1648%) | 1619 |

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. dropped 8.8% to 1.089 million annualized rate in March from a 1.194 million pace in February, missing expectations for a decrease to 1.170 million. It was the lowest level since October 2015.

February's figure was revised up from 1.178 million units.

The drop was driven by declines in starts of single-family and multi-family homes.

Housing market benefits from the strengthening of the labour market.

Building permits in the U.S. fell 7.7% to 1.086 million annualized rate in March from a 1.177 million pace in February, missing expectations for a 1,200 million pace. It was the lowest level since March 2015.

Starts of single-family homes slid 9.2% in March. Building permits for single-family homes were down 1.2%.

Starts of multi-family buildings fell 7.9% in March. Permits for multi-family housing slid 18.6%.

Upgrades:

Downgrades:

Freeport-McMoRan (FCX) downgraded to Sell from Underperform at Credit Agricole

Other:

AT&T (T) target raised to $44 from $39 at Nomura

Facebook (FB) target raised to $130 from $115 at Needham

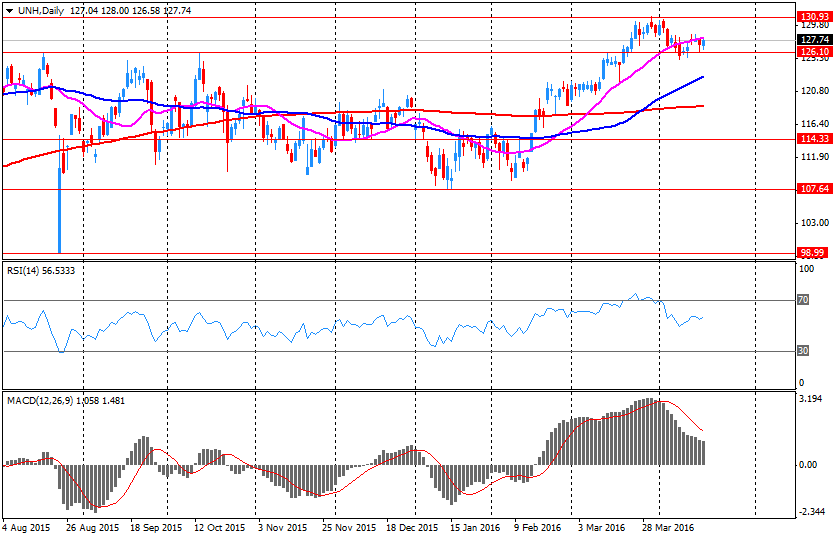

UnitedHealth reported Q1 FY 2016 earnings of $1.81 per share (versus $1.46 in Q1 FY 2015), beating analysts' consensus of $1.72.

The company's quarterly revenues amounted to $44.527 bln (+24.5% y/y), slightly above consensus estimate of $44.279 bln.

UnitedHealth also issued guidance for FY16, raising EPS to $7.75-7.95 from previously projected $7.60-7.80 (versus analysts' consensus estimate of $7.73) and revenues to approx. $182 bln from $180 bln (versus analysts' consensus estimate of $181.59 bln).

UNH rose to $130.00 (+1.71%) in pre-market trading.

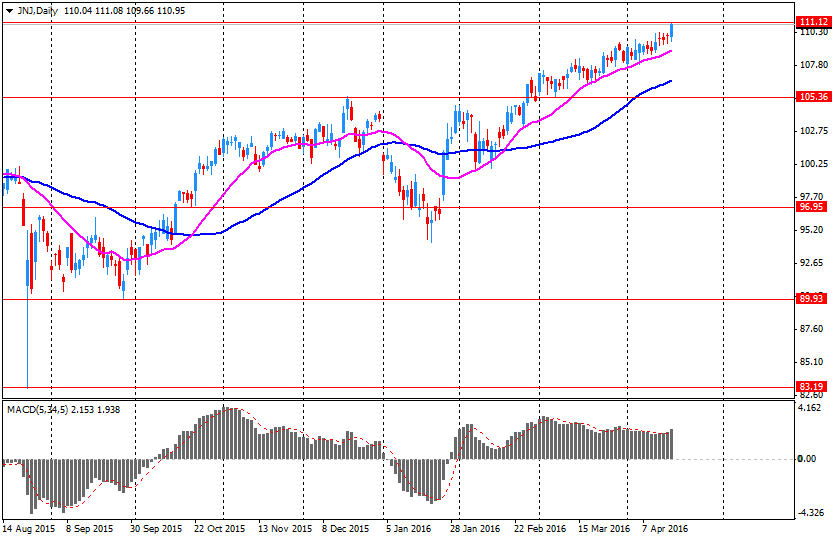

Johnson & Johnson reported Q1 FY 2016 earnings of $1.68 per share (versus $1.56 in Q1 FY 2015), beating analysts' consensus of $1.65.

The company's quarterly revenues amounted to $17.482 bln (+0.60% y/y), almost in-line with analysts' consensus estimate of $17.491 bln.

Johnson & Johnson also issued guidance for FY16, raising EPS to $6.53-6.68 from previously expected $6.43-6.58 (versus analysts' consensus of $6.53) and revenues to $71.2-71.9 bln from previously expected $70.8-71.5 bln (versus analysts' consensus of $71.54 bln).

JNJ rose to $112.50 (+1.42%) in pre-market trading.

Today's session seems to unfold into the continuation of yesterday's strong attitude of the market, which would not subside despite the potentially favorable external conditions. The German market has been influenced by the positive ZEW index readings that were just released, and the DAX index is gaining more than 2%.

By the middle of the session, the WIG20 index reached the level of 1963 point (+ 0.90%) on the turnover of PLN 201 mln.

Stock indices traded higher on an increase in oil prices. Oil prices rose as Kuwait's oil production declined on the strike in the oil sector.

Positive economic data from the Eurozone also supported stocks. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 11.2 in April from 4.3 in March, exceeding expectations for a rise to 8.0.

"Surprisingly positive economic news from China seem to have improved the sentiment amongst financial market experts. On balance, however, the continued poor growth in China and other important emerging markets continues to be a burden for the German export industry. Furthermore, concern about Great Britain's possible exit from the EU seems to be having a negative impact," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index climbed to 21.5 in April from 10.6 in March, beating expectations for a decline to 8.8.

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus declined to a seasonally adjusted €19.0 billion in February from €27.5 billion in January. January's figure was revised up from a surplus of €25.4 billion.

The trade surplus fell to €24.6 billion in February from €30.4 billion in January. The surplus on services increased to €6.8 billion in February from €3.8 billion in January.

Current figures:

Name Price Change Change %

FTSE 100 6,394.64 +41.12 +0.65 %

DAX 10,340.48 +220.17 +2.18 %

CAC 40 4,564.75 +57.91 +1.28 %

The European Central Bank (ECB) released its current account on Tuesday. Eurozone's current account surplus declined to a seasonally adjusted €19.0 billion in February from €27.5 billion in January. January's figure was revised up from a surplus of €25.4 billion.

The trade surplus fell to €24.6 billion in February from €30.4 billion in January.

The surplus on services increased to €6.8 billion in February from €3.8 billion in January.

The primary income surplus fell to €1.4 billion in February from €3.2 billion in January, while the secondary income deficit increased to €13.8 billion from €9.9 billion.

Eurozone's unadjusted current account surplus climbed to €11.1 billion in February from €8.3 billion in January. January's figure was revised up from a surplus of €6.3 billion.

The Eurostat released its construction production data for the Eurozone on Tuesday. Construction production in the Eurozone declined 1.1% in February, after a 2.4% rise in January. January's figure was revised down from a 3.6% rise.

Civil engineering output rose 0.9% in February, while production in the building sector was down 1.5%.

On a yearly basis, construction output rose 2.5% in February, after a 4.9% gain in January. January's figure was revised down from a 6.0% increase.

Civil engineering output increased 1.3% year-on-year in February, while production in the building sector climbed 2.8%.

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index increased to 11.2 in April from 4.3 in March, exceeding expectations for a rise to 8.0.

The assessment of the current situation in Germany declined by 3.0 points to 47.7 points.

"Surprisingly positive economic news from China seem to have improved the sentiment amongst financial market experts. On balance, however, the continued poor growth in China and other important emerging markets continues to be a burden for the German export industry. Furthermore, concern about Great Britain's possible exit from the EU seems to be having a negative impact," head of the "International Finance and Financial Management" Research Department at ZEW, Sascha Steffen, said.

Eurozone's ZEW economic sentiment index climbed to 21.5 in April from 10.6 in March, beating expectations for a decline to 8.8.

The assessment of the current situation in the Eurozone fell by 0.3 points to -12.1 points.

The Reserve Bank of Australia (RBA) released its minutes from April monetary policy meeting on Tuesday. The RBA said that the Australian economy expanded moderately in the December quarter.

The Australian inflation was likely to remain at low levels over the next year or two, the RBA said.

According to the central bank, the monetary policy should be accommodative, while low interest rates should help to support the consumer demand and the activity in the housing market.

Members said that a stronger Australian dollar could have a negative impact on rebalancing towards the non-mining sectors of the economy.

The central bank noted that it could ease monetary policy further if needed, the minutes said.

The RBA kept unchanged its interest rate at 2.00% in April.

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) fell 0.3% in February, after a 0.5% decline in January.

The coincident index increased 0.1% in February, after a flat reading in January.

Bank of Japan (BoJ) Governor Haruhiko Kuroda said in an interview with the Wall Street Journal over weekend that a stronger yen could weigh on inflation and could lead to further stimulus measures by the central bank.

"If excessive appreciation continues, that could affect not just actual inflation, but even the trend in inflation through its impact on business confidence, business activity, and even through inflation expectations," he said.

Kuroda pointed out that the exchange rate of the yen was the target of the BoJ's monetary policy, adding that the BoJ continued to closely monitor exchange-rate movements.

BoJ governor reiterated that the central bank would add further stimulus measures if needed to reach 2% inflation target.

Kuroda noted that there was room for further cut in interest rates, technically and theoretically speaking.

Boston Fed President Eric Rosengren said in a speech on Monday that the U.S. economy was strong enough for further interest rates.

"The outlook is strong enough to engender further decline in the unemployment rate, even with some gradual normalization of interest rates," he said.

Rosengren noted that markets were too pessimistic regarding the Fed's monetary policy.

"While I believe that gradual federal funds rate increases are absolutely appropriate, I do not see that the risks are so elevated, nor the outlook so pessimistic, as to justify the exceptionally shallow interest rate path currently reflected in financial futures markets," Boston Fed president said.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

Minneapolis Fed President Neel Kashkari said in an interview on Monday that the U.S. economy was in "uncharted waters".

"Even now, with the current economic environment, we're still in somewhat uncharted waters, and Chair Yellen has been bringing real creativity and real open-mindedness to how we approach monetary policy. That's the right thing for the country," he said.

Kashkari noted that developments abroad had an impact on the U.S. economy.

"Clearly what happens in global financial markets, as an example, will affect the U.S. economy. We can't be blind to the fact that actions we take could affect global economic developments, which in turn will have an effect on our economy. We need to think about those feedback loops, and I believe that we do," Minneapolis Fed president said.

Kashkari is not a voting member of the Federal Open Market Committee (FOMC) this year.

Morning mood of market participants in Asia has definitely been better than yesterday, reflecting recent advances of Wall Street's major indexes that rose to the new highs and calmly reacted to the lack of consensus in Doha. Nikkei rose more than 3%, and European indices are likely to be making up for the previous losses either. However, we don't look at this comeback as if it is something coming off a new inspiration to trade. We do not see the latter in the morning, so the beginning of the session in Europe is most likely going to be quiet.

In the macro calendar, today ZEW index will be announced in Germany as well as data on industrial production and retail sales in Poland.

Yesterday's behavior of the Warsaw Stock Exchange showed that the Polish market is still under the influence of the environment and the activity remains relatively subdued. This day should not change anything. From a technical point of view the market today can combat with the level of 1,950 points on the WIG20 index.

European stock markets erased earlier losses and finished in the green on Monday as traders looked beyond the impact of a failed attempt by major oil producers to agree on an output freeze.

U.S. stocks closed higher Monday at their best levels in several months as Wall Street shrugged off a drop in crude futures, after a closely watched meeting of major producers in Doha, Qatar, on Sunday failed to result in a hoped-for freeze of oil output.

Shares in Asia markets rose Tuesday, with Japan leading gains as the yen eased off recent strength. Stock markets rose in most other Asia markets. Investors were less worried about volatility in the price of crude oil, which rebounded after a brief slip overnight.

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.