- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 19-10-2015.

(index / closing price / change items /% change)

Nikkei 225 18,131.23 -160.57 -0.88 %

Hang Seng 23,075.61 +8.24 +0.04 %

S&P/ASX 200 5,269.71 +1.50 +0.03 %

Shanghai Composite 3,387.46 -3.89 -0.11 %

FTSE 100 6,352.33 -25.71 -0.40 %

CAC 40 4,704.07 +1.28 +0.03 %

Xetra DAX 10,164.31 +59.88 +0.59 %

S&P 500 2,033.66 +0.55 +0.03 %

NASDAQ Composite 4,905.47 +18.78 +0.38 %

Dow Jones 17,230.54 +14.57 +0.08 %

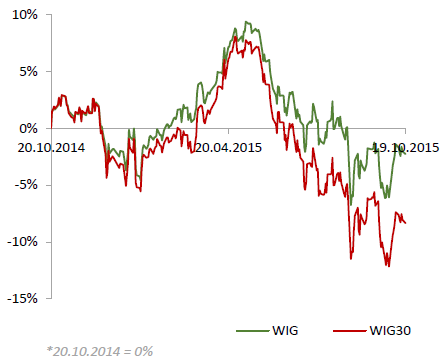

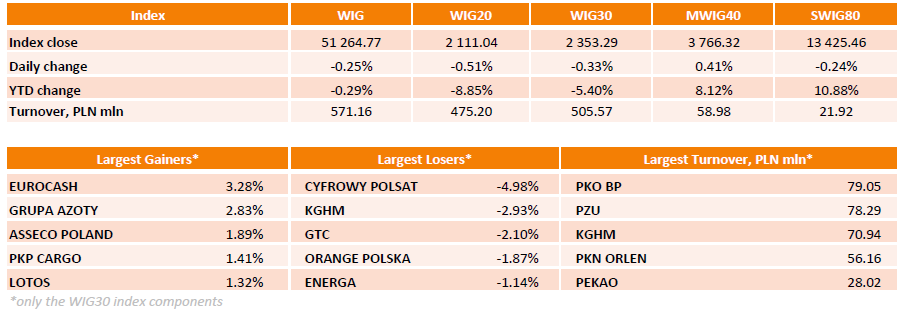

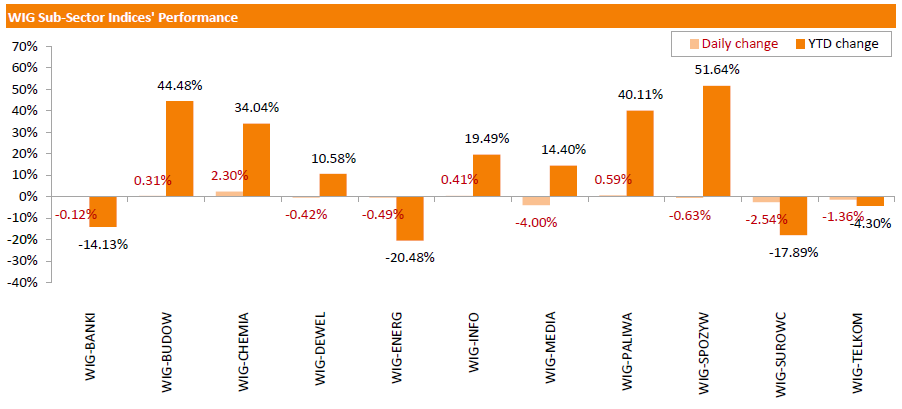

Polish equities declined on Monday. The broad market benchmark, the WIG Index, lost 0.25%. Sector-wise, media sector (-4%) fared the worst, while chemicals (+2.30%) outperformed.

The large-cap stocks plunged by 0.33%, as measured by the WIG30 Index. In the WIG30 index basket, CYFROWY POLSAT (WSE: CPS) and ORANGE POLSKA (WSE: OPL) suffered losses of 4.98% and 1.87% respectively on concerns that today's acquisitions of new broadband frequencies may impact the companies' financial situation. KGHM (WSE: KGH) dropped by 2.93% on tumbling copper prices. Elsewhere, GTC (WSE: GTC) slumped by 2.10%. On the other side of the ledger, EUROCASH (WSE: EUR) was the session's biggest advancer, jumping by 3.28%. It was followed by GRUPAAZOTY (WSE: ATT) and ASSECO POLAND (WSE: ACP), surging by 2.83% and 1.89% respectively.

Stock indices closed mixed on the Chinese economic data. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

The growth missed the official target of 7%.

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview with the Polish newspaper Rzeczpospolita on Monday that additional measures, including structural reforms and fiscal policy changes, are needed to boost the economic growth in the Eurozone.

In an interview with Polish daily Puls Biznesu, Nowotny said on Monday that it is too early to talk about the adjustments of the central bank's asset-buying programme.

Meanwhile, the economic data from the Eurozone was negative. The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,352.33 -25.71 -0.40 %

DAX 10,164.31 +59.88 +0.59 %

CAC 40 4,704.07 +1.28 +0.03 %

Major U.S. stock-indexes lower on Monday as Wall Street bank Morgan Stanley's weak quarterly results stoked investor concerns about U.S. corporate health. Wall Street bank Morgan Stanley (MS.N) reported a quarterly profit that fell far short of market expectations, capping a generally downbeat quarter for big U.S. banks after investors fled the bond, currency and commodity markets. Morgan Stanley's profit slumped for the second straight quarter, as uncertainty about the timing of a U.S. interest rate hike and concerns about China's cooling economy sent shudders through global markets.

Most of Dow stocks in negative area (19 of 30). Top looser - Chevron Corporation (CVX, -1.67%). Top gainer - NIKE, Inc. (NKE, +1.47%).

Most of S&P index sectors in positive area. Top looser - Basic Materials (-1.6%). Top gainer - Services (+0,2%).

At the moment:

Dow 17084.00 -31.00 -0.18%

S&P 500 2021.00 -4.50 -0.22%

Nasdaq 100 4434.50 -0.25 -0.01%

10 Year yield 2,04% +0,02

Oil 46.68 -1.04 -2.18%

Gold 1170.10 -13.00 -1.10%

The European Central Bank (ECB) purchased €12.04 billion of government and agency bonds under its quantitative-easing program last week.

The ECB said in its minutes of September meeting that it will raise the pace of its asset purchases from September to November 2015 "to prepare for the expected decline in market liquidity in December".

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €1.47 billion of covered bonds, and €1.07 billion of asset-backed securities.

The Italian newspaper CorrierEconomia reported on Monday that New York Fed President William Dudley said last Thursday that it is too early for an interest rate hike by the Fed as the global economic growth is weak.

"It's true we thought we could raise interest rates by the end of 2015, but turbulence on financial markets, modest global growth, energy prices and macro-prudential imbalances are slowing this process down," he said.

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index rose to 64 in October from 61 in September, exceeding expectations for an increase to 62. It was the highest level since 2005.

September's figure was revised down from 62.

A level above 50.0 is considered positive, below indicates a negative outlook.

The increase was driven by a rise in two of three components of the index. The buyer traffic subindex remained unchanged at 47 in October, the current sales conditions subindex rose to 70 from 67, while the subindex measuring sales expectations in the next six months climbed to 75 from 68.

"The fact that builder confidence has held in the 60s since June is proof that the single-family housing market is making lasting gains as more serious buyers come forward," the NAHB Chairman Tom Woods said.

"With firm job creation, economic growth and the release of pent-up demand, we expect housing to keep moving forward as we start to close out 2015," the NAHB Chief Economist David Crowe said.

U.S. stock-index futures fell, as Morgan Stanley's Q3 results disappointed investors.

Global Stocks:

Nikkei 18,131.23 -160.57 -0.88%

Hang Seng 23,075.61 +8.24 +0.04%

Shanghai Composite 3,387.46 -3.89 -0.11%

FTSE 6,343.68 -34.36 -0.54%

CAC 4,688.67 -14.12 -0.30%

DAX 10,128.51 +24.08 +0.24%

Crude oil $46.51 (-1.59%)

Gold $1175.20 (-0.67%)

(company / ticker / price / change, % / volume)

| Nike | NKE | 131.62 | 0.88% | 6.8K |

| Twitter, Inc., NYSE | TWTR | 31.24 | 0.29% | 154.1K |

| Boeing Co | BA | 137.99 | 0.28% | 290.4K |

| E. I. du Pont de Nemours and Co | DD | 57.38 | 0.19% | 0.3K |

| Amazon.com Inc., NASDAQ | AMZN | 571.00 | 0.04% | 8.1K |

| Johnson & Johnson | JNJ | 98.26 | 0.02% | 0.1K |

| Microsoft Corp | MSFT | 47.51 | 0.00% | 15.3K |

| Procter & Gamble Co | PG | 74.90 | 0.00% | 2.6K |

| United Technologies Corp | UTX | 93.00 | 0.00% | 4.2K |

| Home Depot Inc | HD | 122.71 | -0.02% | 0.1K |

| Apple Inc. | AAPL | 110.98 | -0.05% | 89.1K |

| Starbucks Corporation, NASDAQ | SBUX | 59.90 | -0.05% | 0.1K |

| Pfizer Inc | PFE | 34.39 | -0.06% | 2.2K |

| Caterpillar Inc | CAT | 69.59 | -0.13% | 0.5K |

| AT&T Inc | T | 33.78 | -0.15% | 1.3K |

| Cisco Systems Inc | CSCO | 28.20 | -0.18% | 0.2K |

| ALTRIA GROUP INC. | MO | 58.61 | -0.19% | 7.6K |

| McDonald's Corp | MCD | 104.61 | -0.20% | 0.8K |

| American Express Co | AXP | 77.05 | -0.21% | 0.2K |

| Walt Disney Co | DIS | 108.00 | -0.22% | 9.4K |

| Yahoo! Inc., NASDAQ | YHOO | 33.29 | -0.24% | 0.3K |

| International Business Machines Co... | IBM | 150.00 | -0.26% | 0.8K |

| Visa | V | 75.79 | -0.28% | 0.8K |

| AMERICAN INTERNATIONAL GROUP | AIG | 59.80 | -0.33% | 0.4K |

| The Coca-Cola Co | KO | 41.87 | -0.36% | 1.6M |

| Verizon Communications Inc | VZ | 44.51 | -0.43% | 2.9K |

| General Motors Company, NYSE | GM | 33.00 | -0.45% | 0.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 225.99 | -0.45% | 8.2K |

| Citigroup Inc., NYSE | C | 52.45 | -0.46% | 17.0K |

| General Electric Co | GE | 28.84 | -0.48% | 69.5K |

| Wal-Mart Stores Inc | WMT | 58.60 | -0.49% | 13.3K |

| Barrick Gold Corporation, NYSE | ABX | 7.81 | -0.51% | 7.3K |

| Facebook, Inc. | FB | 97.04 | -0.51% | 26.6K |

| JPMorgan Chase and Co | JPM | 62.10 | -0.53% | 3.7K |

| Exxon Mobil Corp | XOM | 82.03 | -0.55% | 5.2K |

| Intel Corp | INTC | 32.85 | -0.58% | 12.9K |

| ALCOA INC. | AA | 9.49 | -0.63% | 3.8K |

| Goldman Sachs | GS | 183.68 | -0.81% | 0.6K |

| Ford Motor Co. | F | 15.12 | -1.05% | 0.2K |

| Chevron Corp | CVX | 90.21 | -1.18% | 835.4K |

| Yandex N.V., NASDAQ | YNDX | 13.31 | -2.13% | 3.9K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.15 | -2.33% | 14.9K |

Upgrades:

NIKE (NKE) upgraded to Buy at BB&T Capital Mkts

Downgrades:

Other:

Yahoo! (YHOO) target raised to $45 at Axiom Capital

General Electric (GE) target raised to $32 at RBC Capital Mkts

General Electric (GE) target raised to $32 at Stifel

McDonald's (MCD) added to US and Global Focus List at Credit Suisse

Bundesbank board member Joachim Nagel said on Monday that only a significant slowdown in the Chinese economy would a have a negative effect on the German economic growth, adding that such a slowdown "is not to be expected at present".

Nagel noted that the Chinese economy is undergoing a transformation.

October 19

After the Close:

IBM (IBM). Consensus EPS $3.30, Consensus Revenue $19640.51 mln.

October 20

Before the Open:

Travelers (TRV). Consensus EPS $2.25, Consensus Revenue $6038.47 mln.

United Tech (UTX). Consensus EPS $1.56, Consensus Revenue $14587.26 mln.

Verizon (VZ). Consensus EPS $1.02, Consensus Revenue $32969.76 mln.

After the Close:

Yahoo! (YHOO). Consensus EPS $0.16, Consensus Revenue $1023.79 mln.

October 21

Before the Open:

Boeing (BA). Consensus EPS $2.20, Consensus Revenue $24781.01 mln.

Coca-Cola (KO). Consensus EPS $0.50, Consensus Revenue $11562.69 mln.

General Motors (GM). Consensus EPS $1.19, Consensus Revenue $37171.75 mln.

After the Close:

American Express (AXP). Consensus EPS $1.31, Consensus Revenue $8335.83 mln.

October 22

Before the Open:

3M (MMM). Consensus EPS $2.01, Consensus Revenue $7866.41 mln.

Caterpillar (CAT). Consensus EPS $0.79, Consensus Revenue $11257.47 mln.

Freeport-McMoRan (FCX). Consensus EPS $-0.10, Consensus Revenue $3973.48 mln.

McDonald's (MCD). Consensus EPS $1.28, Consensus Revenue $6410.20 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $7.21, Consensus Revenue $18308.76 mln.

Amazon (AMZN). Consensus EPS $-0.15, Consensus Revenue $24913.96 mln.

AT&T (T). Consensus EPS $0.69, Consensus Revenue $41020.88 mln.

Microsoft (MSFT). Consensus EPS $0.59, Consensus Revenue $21097.41 mln.

October 23

Before the Open:

Procter & Gamble (PG). Consensus EPS $0.95, Consensus Revenue $17391.44 mln.

Stock indices traded mixed after the Chinese economic data. The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

The growth missed the official target of 7%.

Meanwhile, the economic data from the Eurozone was negative. The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

Current figures:

Name Price Change Change %

FTSE 100 6,372.99 -5.05 -0.08 %

DAX 10,189.8 +85.37 +0.84 %

CAC 40 4,720.11 +17.32 +0.37 %

The European Central Bank (ECB) Governing Council Member Ewald Nowotny said in an interview with the Polish newspaper Rzeczpospolita on Monday that additional measures, including structural reforms and fiscal policy changes, are needed to boost the economic growth in the Eurozone.

In an interview with Polish daily Puls Biznesu, Nowotny said on Monday that it is too early to talk about the adjustments of the central bank's asset-buying programme.

"In my view, we should keep calm and show that we're in control of the situation," he said.

The Eurostat released its construction production data for the Eurozone on Monday. Construction production in the Eurozone decreased 0.2% in August, after a 0.4% rise in July.

Civil engineering output fell 0.3% in August, while production in the building sector was down 0.2%.

On a yearly basis, construction output dropped 6.0% in August, after a 0.3% decline in July. July's figure was revised down from a 1.8% gain.

Civil engineering output plunged 5.5% year-on-year in August, while production in the building sector slid 6.3% year-on-year.

Bank of England's (BoE) Monetary Policy Committee Member Kristin Forbes said in a speech on Friday that the BoE will start raising its interest rates "sooner rather than later" despite high volatility in financial markets.

She pointed out the risks to the U.K. economy are manageable as the direct effect to the U.K. economy from the slowdown in emerging economies is limited.

Fobes concluded that the U.K. economy will continue to expand.

The Greek parliament approved a package of economic overhauls and austerity measures on Saturday morning. 154 to 140 members voted for new measures.

The next package of measures must be approved by the Greek parliament next month. The improvement will unlock €15bn-€25bn of bailout funds.

The National Bureau of Statistics said on Monday that China's economy expanded 6.9% in the third quarter, beating expectations for a 6.8% gain, after a 7.0% in the second quarter. It was the weakest growth since 2009.

The growth missed the official target of 7%.

The tertiary industry climbed by 8.4% in the third quarter, while secondary industry increased by 6%.

"In order to restructure, the economy will face some downward pressure," a spokesman for the National Bureau of Statistics, Sheng Laiyun, said, adding that "all this indicates the restructuring and upgrading of the Chinese economy are going steadily".

The National Bureau of Statistics said on Monday that China's industrial production increased 5.7% on year in September, missing expectations for a 6.0% rise, down from a 6.1% gain in August.

Fixed-asset investment in China climbed 10.3% year-on-year in the January-September period, after a 10.9% rise in the January-August period. Analysts had expected a 10.8% increase.

Retail sales in China increased 10.9% year-on-year in September, exceeding expectations for a 10.8% gain, after a 10.8% rise in August.

U.S. stock indices rose on Friday as investors paid little attention to mixed economic data. Some analysts also say that equities gained amid speculation that the Federal Reserve will avoid raising rates in the near future considering signs of weakness in the economy.

The Dow Jones Industrial Average rose 74.09 points, or 0.4%, to 17,215.84 (+0.8% over the week). The S&P 500 advanced by 9.21, or 0.5%, to 2,033.07 (+0.9% over the week). The Nasdaq Composite Index climbed 16.59, or 0.3%, to 4,886.69 (+1.2% over the week).

Data showed on Friday that U.S. industrial production fell by 0.2% m/m and rose only by 0.4% y/y in September. Meanwhile preliminary Reuters/Michigan Consumer Sentiment Index rose to 92.1 in October from 87.2 reported previously.

This morning in Asia Hong Kong Hang Seng declined 0.41%, or 95.19, to 22,972.18. China Shanghai Composite Index added 0.08%, or 2.74, to 3.394.09. The Nikkei declined 0.95%, or 173.66, to 18,118.14.

Asian indices posted mixed results after initial gains amid China GDP data. Data showed on Monday morning that the pace of GDP growth of the world's second biggest economy slowed less than expected (6.9% y/y in the third quarter vs 6.8% expected and 7.0% previous).

National Bureau of Statistics of China noted that the economy still expanded about 7% and that there is a clear trend of transforming into a service-oriented economy. The bureau also said that the economic slowdown is partly caused by expectations of a rate hike in the U.S. and a weaker global economy.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.