- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 21-10-2016.

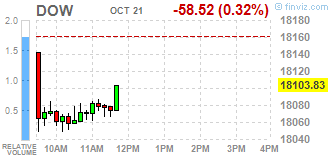

Major U.S. stock-indexes mixed. S&P and Dow lower as GE's shares were off 1,9%, weighing the most on the S&P 500, after the conglomerate lowered its full-year revenue growth target and narrowed its profit forecast. Nasdaq slightly rose due to Microsoft surging to an all-time high.

Most of Dow stocks in negative area (27 of 30). Top gainer - Microsoft Corporation (MSFT, +4.69%). Top loser - The Travelers Companies, Inc. (TRV, -4.87%).

Almost all S&P sectors also in negative area. Top gainer - Services (+0.1%). Top loser - Healthcare (-0.8%).

At the moment:

Dow 17986.00 -122.00 -0.67%

S&P 500 2129.50 -7.50 -0.35%

Nasdaq 100 4836.50 -7.25 -0.15%

Oil 50.58 -0.05 -0.10%

Gold 1267.20 -0.30 -0.02%

U.S. 10yr 1.74 -0.01

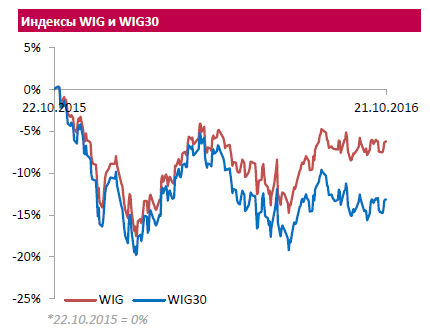

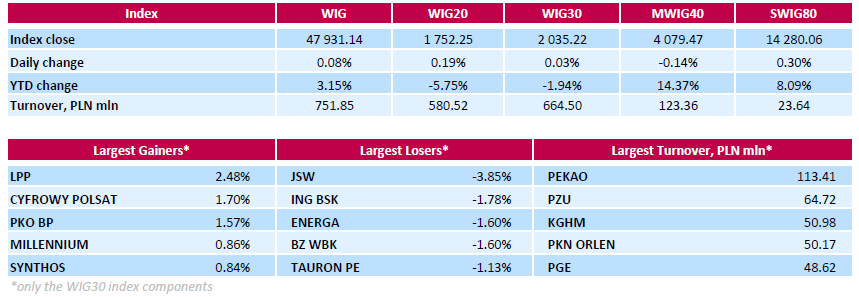

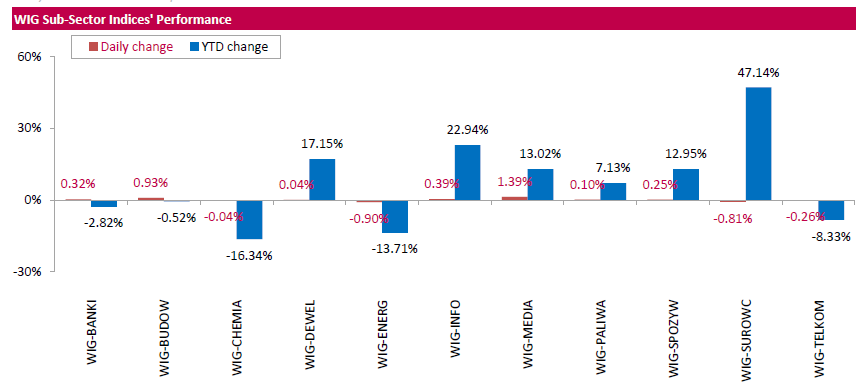

Polish equity market closed flat on Friday. The broad market measure, the WIG Index, edged up 0.08%. Sector performance within the WIG Index was mixed. Media (+1.39%) sector outperformed, while utilities (-0.90%) lagged behind.

The large-cap WIG30 Index inched up 0.03%. Within the index components, clothing retailer LPP (WSE: LPP) was the best-performing name, climbing by 2.48% and almost fully erasing its yesterday's losses. It was followed by media group CYFROWY POLSAT (WSE: CPS) and bank PKO BP (WSE: PKO), advancing 1.7% and 1.57% respectively. On the other side of the ledger, coking coal producer JSW (WSE: JSW) fell the most, down 3.85%, correcting after significant growth, observed in the second decade of October. Among other biggest decliners were two banking sector names ING BSK (WSE: ING) and BZ WBK (WSE: BZW) as well as three gencos ENERGA (WSE: ENG), TAURON (WSE: TPE) and PGE (WSE: PGE), which retreated by 0.93%-1.78%.

U.S. stock-index futures declined as investors assessed mixed earnings reports and guidances from American companies.

Global Stocks:

Nikkei 17,184.59 -50.91 -0.30%

Hang Seng - Closed

Shanghai 3,091.29 +6.83 +0.22%

FTSE 7,037.35 +10.45 +0.15%

CAC 4,527.22 -12.90 -0.28%

DAX 10,694.97 -6.42 -0.06%

Crude $50.48 (-0.30%)

Gold $1266.80 (-0.06%)

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 169.06 | -0.80(-0.471%) | 4656 |

| ALCOA INC. | AA | 26.67 | -0.02(-0.0749%) | 6503 |

| ALTRIA GROUP INC. | MO | 64.26 | 2.41(3.8965%) | 217201 |

| Amazon.com Inc., NASDAQ | AMZN | 809.15 | -1.17(-0.1444%) | 12866 |

| American Express Co | AXP | 66.63 | -0.15(-0.2246%) | 17306 |

| Apple Inc. | AAPL | 117.05 | -0.01(-0.0085%) | 72686 |

| AT&T Inc | T | 38.6 | -0.05(-0.1294%) | 42953 |

| Boeing Co | BA | 135.25 | -0.59(-0.4343%) | 5345 |

| Caterpillar Inc | CAT | 86.19 | -0.44(-0.5079%) | 3936 |

| Cisco Systems Inc | CSCO | 30.13 | -0.03(-0.0995%) | 29638 |

| E. I. du Pont de Nemours and Co | DD | 69.03 | -0.43(-0.6191%) | 4885 |

| Exxon Mobil Corp | XOM | 86.8 | -0.41(-0.4701%) | 22664 |

| Facebook, Inc. | FB | 129.85 | -0.15(-0.1154%) | 73943 |

| Ford Motor Co. | F | 11.95 | -0.02(-0.1671%) | 26468 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.12 | -0.09(-0.8815%) | 15519 |

| General Electric Co | GE | 28.75 | -0.32(-1.1008%) | 463547 |

| Goldman Sachs | GS | 173.81 | -0.70(-0.4011%) | 3691 |

| Home Depot Inc | HD | 125.72 | -0.53(-0.4198%) | 9840 |

| HONEYWELL INTERNATIONAL INC. | HON | 109 | 0.86(0.7953%) | 4392 |

| Intel Corp | INTC | 35.32 | -0.11(-0.3105%) | 38134 |

| International Business Machines Co... | IBM | 151.08 | -0.44(-0.2904%) | 6268 |

| Johnson & Johnson | JNJ | 114.45 | -0.42(-0.3656%) | 16707 |

| JPMorgan Chase and Co | JPM | 67.94 | -0.32(-0.4688%) | 22979 |

| McDonald's Corp | MCD | 114.54 | 3.97(3.5905%) | 576332 |

| Merck & Co Inc | MRK | 62.1 | 0.18(0.2907%) | 18624 |

| Microsoft Corp | MSFT | 60.78 | 3.53(6.1659%) | 1582401 |

| Nike | NKE | 51.69 | -0.20(-0.3854%) | 10107 |

| Pfizer Inc | PFE | 32.58 | 0.04(0.1229%) | 35612 |

| Procter & Gamble Co | PG | 84.52 | -0.41(-0.4828%) | 4071 |

| Starbucks Corporation, NASDAQ | SBUX | 53.5 | -0.09(-0.1679%) | 9835 |

| Tesla Motors, Inc., NASDAQ | TSLA | 199.59 | 0.49(0.2461%) | 5400 |

| The Coca-Cola Co | KO | 42 | 0.07(0.1669%) | 33426 |

| Travelers Companies Inc | TRV | 109.21 | -0.31(-0.2831%) | 2565 |

| Twitter, Inc., NYSE | TWTR | 16.92 | 0.02(0.1183%) | 23226 |

| UnitedHealth Group Inc | UNH | 144.64 | -0.43(-0.2964%) | 5168 |

| Verizon Communications Inc | VZ | 49.03 | -0.11(-0.2239%) | 25528 |

| Visa | V | 82.55 | 0.05(0.0606%) | 12634 |

| Wal-Mart Stores Inc | WMT | 68.55 | -0.18(-0.2619%) | 8776 |

| Walt Disney Co | DIS | 91.64 | -0.39(-0.4238%) | 9605 |

| Yahoo! Inc., NASDAQ | YHOO | 42.24 | -0.14(-0.3303%) | 6901 |

Upgrades:

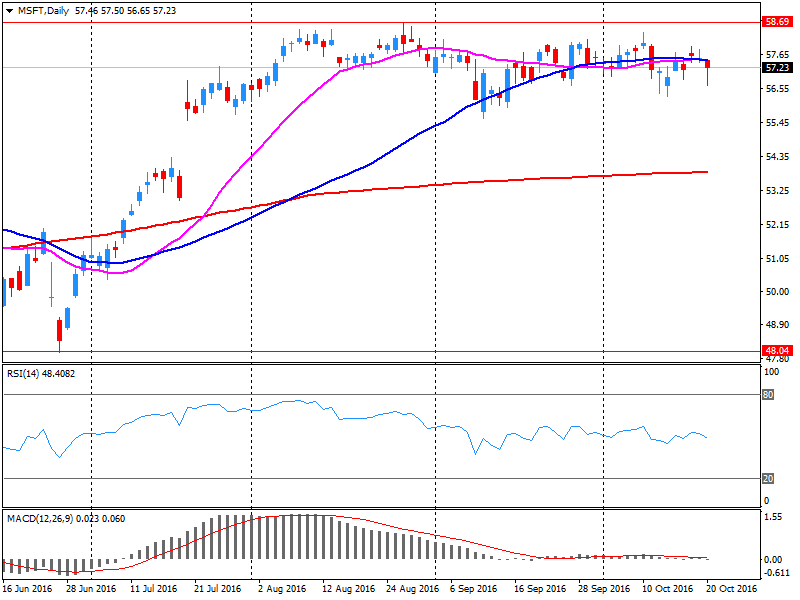

Microsoft (MSFT) upgraded to Outperform from Market Perform at William Blair

Microsoft (MSFT) upgraded to Buy at Wunderlich; target raised to $70

Downgrades:

Yahoo! (YHOO) downgraded to Hold from Buy at Jefferies

Other:

Apple (AAPL) target raised to $135 from $125 at Cowen

Microsoft (MSFT) target raised to $69 from $62 at BMO Capital Markets

Wal-Mart (WMT) initiated with a Neutral at Piper Jaffray; target $73

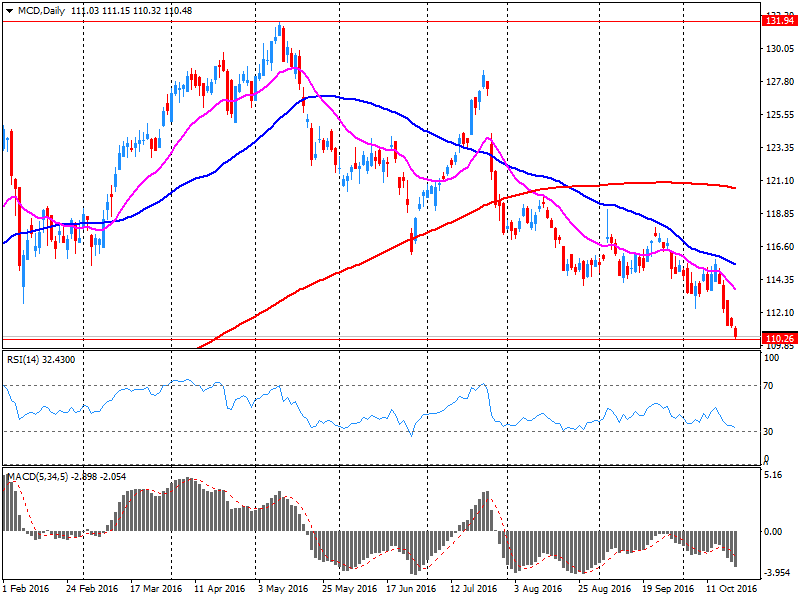

McDonald's reported Q3 FY 2016 earnings of $1.62 per share (versus $1.40 in Q3 FY 2015), beating analysts' consensus estimate of $1.48.

The company's quarterly revenues amounted to $6.424 bln (-2.9% y/y), beating analysts' consensus estimate of $6.280 bln.

MCD rose to $114.52 (+3.57%) in pre-market trading.

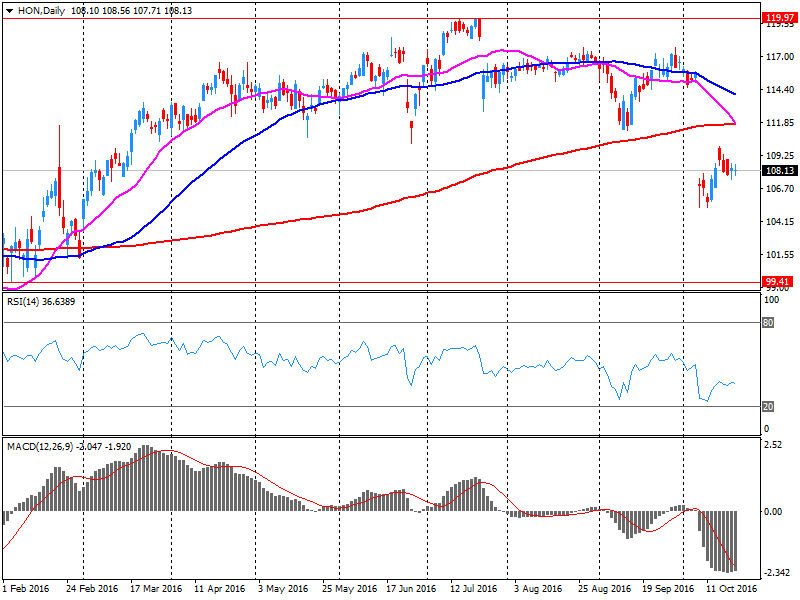

Honeywell reported Q3 FY 2016 earnings of $1.67 per share (versus $1.57 in Q3 FY 2015), missing analysts' consensus estimate of $1.68.

The company's quarterly revenues amounted to $9.800 bln (+2% y/y), generally in-line analysts' consensus estimate of $9.786 bln .

HON rose to $109 (+0.80%) in pre-market trading.

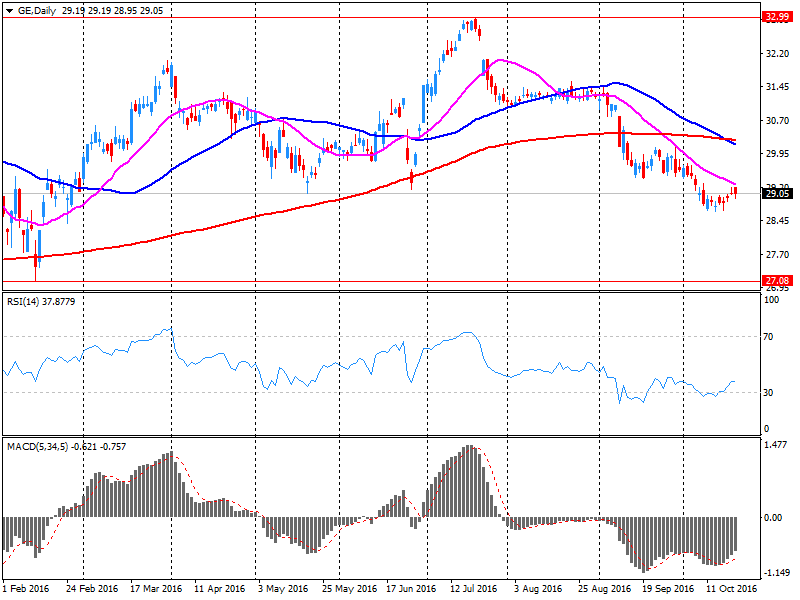

General Electric reported Q3 FY 2016 earnings of $0.32 per share (versus $0.32 in Q3 FY 2015), beating analysts' consensus estimate of $0.30.

The company's quarterly revenues amounted to $30.021 bln (+3.8% y/y), beating analysts' consensus estimate of $29.680 bln.

GE fell to $28.95 (-0.41%) in pre-market trading.

Microsoft reported Q3 FY 2016 earnings of $0.76 per share (versus $0.67 in Q3 FY 2015), beating analysts' consensus estimate of $0.68.

The company's quarterly revenues amounted to 22.334 bln (+3.1% y/y), beating analysts' consensus estimate of $21.695 bln.

MSFT rose to $60.56 (+5.78%) in pre-market trading.

European stock markets erased losses and closed higher on Thursday after European Central Bank President Mario Draghi hinted the December policy meeting will be key to deciding on further easing measures.

U.S. stocks closed lower Thursday, but off session lows, as a sharp drop in oil and telecommunications shares weighed on investors' sentiment. Investors also grappled with a mixed bag of economic data, earnings results, a steep drop in crude-oil prices, the prospect of a rate increase by the Federal Reserve and tumult wrought by the U.S. presidential election.

Asian stocks were mostly lower on Friday as the dollar climbed to seven-month highs against a basket of currencies and dragged down crude oil prices, cooling investor risk appetite. The greenback was boosted by a fall in the euro after the European Central Bank shot down talk it was contemplating tapering its monetary easing - sending the common currency to its lowest since March.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.