- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 22-02-2017.

(index / closing price / change items /% change)

Nikkei -1.57 19379.87 -0.01%

TOPIX +1.49 1557.09 +0.10%

Hang Seng +238.33 24201.96 +0.99%

CSI 300 +6.94 3489.76 +0.20%

Euro Stoxx 50 -0.06 3339.27 +0.00%

FTSE 100 +27.42 7302.25 +0.38%

DAX +31.10 11998.59 +0.26%

CAC 40 +7.12 4895.88 +0.15%

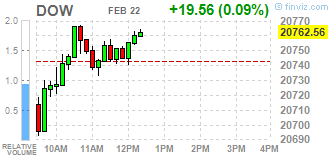

DJIA +32.60 20775.60 +0.16%

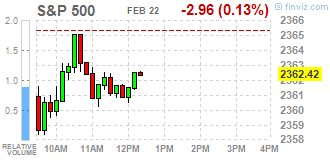

S&P 500 -2.56 2362.82 -0.11%

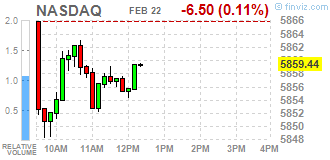

NASDAQ -5.32 5860.63 -0.09%

S&P/TSX -92.15 15830.22 -0.58%

Major U.S. stock-indexes little changed on Wednesday as investors looked ahead to the Federal Reserve's minutes of its most recent meeting for clues on the timing of the next interest rate hike. Policymakers, including Fed Chair Janet Yellen, have been hinting at the possibility of a rate hike at an upcoming meeting. But traders have priced in slim chances of a move until June despite strong economic data.

Most of Dow stocks in negative area (20 of 30). Top loser - Intel Corporation (INTC, -1.59%). Top gainer - E. I. du Pont de Nemours and Company (DD, +4.04%).

Most of S&P sectors are also in negative area. Top loser - Basic Materials (-1.0%). Top gainer - Conglomerates (+1.0%).

At the moment:

Dow 20735.00 +47.00 +0.23%

S&P 500 2360.50 +0.50 +0.02%

Nasdaq 100 5350.25 +6.50 +0.12%

Oil 53.54 -0.79 -1.45%

Gold 1232.90 -6.00 -0.48%

U.S. 10yr 2.42 -0.00

U.S. stock-index futures were flat as investors awaited the minutes of the Federal Reserve's most recent policy meeting for clues on the timing of the next interest rate hike.

Global Stocks:

Nikkei 19,379.87 -1.57 -0.01%

Hang Seng 24,201.96 +238.33 +0.99%

Shanghai 3,260.94 +7.61 +0.23%

FTSE 7,284.65 +9.82 +0.13%

CAC 4,886.14 -2.62 -0.05%

DAX 11,979.36 +11.87 +0.10%

Crude $53.97 (-0.66%)

Gold $1,240.30 (+0.11%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 36.55 | -0.16(-0.4359%) | 5226 |

| ALTRIA GROUP INC. | MO | 73.52 | -0.13(-0.1765%) | 625 |

| Amazon.com Inc., NASDAQ | AMZN | 856.445 | 0.005(0.0006%) | 20341 |

| American Express Co | AXP | 79.73 | -0.24(-0.3001%) | 1538 |

| Apple Inc. | AAPL | 41.61 | -0.12(-0.2876%) | 1017 |

| AT&T Inc | T | 41.61 | -0.12(-0.2876%) | 1017 |

| Barrick Gold Corporation, NYSE | ABX | 20.16 | 0.05(0.2486%) | 37973 |

| Boeing Co | BA | 41.61 | -0.12(-0.2876%) | 1017 |

| Caterpillar Inc | CAT | 98.2 | 0.10(0.1019%) | 5970 |

| Cisco Systems Inc | CSCO | 34 | -0.13(-0.3809%) | 3206 |

| Citigroup Inc., NYSE | C | 60.26 | -0.29(-0.4789%) | 96580 |

| Deere & Company, NYSE | DE | 108.81 | -0.80(-0.7299%) | 785 |

| Exxon Mobil Corp | XOM | 81.6 | -0.29(-0.3541%) | 989 |

| Facebook, Inc. | FB | 133.56 | -0.16(-0.1197%) | 16610 |

| Ford Motor Co. | F | 12.67 | -0.02(-0.1576%) | 6348 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 13.9 | -0.23(-1.6277%) | 86811 |

| General Electric Co | GE | 30.48 | -0.04(-0.1311%) | 34487 |

| General Motors Company, NYSE | GM | 37.73 | -0.08(-0.2116%) | 2721 |

| Goldman Sachs | GS | 250.49 | -1.27(-0.5044%) | 5297 |

| Google Inc. | GOOG | 830.77 | -0.89(-0.107%) | 1094 |

| Hewlett-Packard Co. | HPQ | 16.12 | -0.01(-0.062%) | 1014 |

| Intel Corp | INTC | 36.45 | -0.07(-0.1917%) | 72027 |

| International Business Machines Co... | IBM | 179.97 | -0.29(-0.1609%) | 470 |

| JPMorgan Chase and Co | JPM | 90.6 | -0.41(-0.4505%) | 8617 |

| McDonald's Corp | MCD | 90.6 | -0.41(-0.4505%) | 8617 |

| Merck & Co Inc | MRK | 41.61 | -0.12(-0.2876%) | 1017 |

| Microsoft Corp | MSFT | 64.36 | -0.13(-0.2016%) | 14948 |

| Pfizer Inc | PFE | 41.61 | -0.12(-0.2876%) | 1017 |

| Starbucks Corporation, NASDAQ | SBUX | 57.4 | -0.14(-0.2433%) | 2445 |

| Tesla Motors, Inc., NASDAQ | TSLA | 279.85 | 2.46(0.8868%) | 34882 |

| Twitter, Inc., NYSE | TWTR | 16.4 | -0.02(-0.1218%) | 33484 |

| UnitedHealth Group Inc | UNH | 90.6 | -0.41(-0.4505%) | 8617 |

| Verizon Communications Inc | VZ | 49.45 | 0.02(0.0405%) | 511 |

| Visa | V | 41.61 | -0.12(-0.2876%) | 1017 |

| Wal-Mart Stores Inc | WMT | 71.8 | 0.35(0.4899%) | 41344 |

| Walt Disney Co | DIS | 109.8 | -0.21(-0.1909%) | 100 |

| Yahoo! Inc., NASDAQ | YHOO | 45.27 | -0.23(-0.5055%) | 713 |

| Yandex N.V., NASDAQ | YNDX | 24.02 | -0.32(-1.3147%) | 1580 |

Upgrades:

Wal-Mart (WMT) upgraded to Buy from Neutral at BofA/Merrill; target $88

Downgrades:

Other:

Goldman Sachs (GS) initiated with a Neutral at Compass Point

Morgan Stanley (MS) initiated with a Neutral at Compass Point

Intel (INTC) initiated with a Buy at MKM Partners

Intel (INTC) initiated with a Sell at Rosenblat

Home Depot (HD) target raised to $158 from $153 at RBC Capital Mkts

Home Depot (HD) target raised to $154 from $150 at TAG

Wal-Mart (WMT) target raised to $67 from $66 at RBC Capital Mkts

Wal-Mart (WMT) target raised to $72 from $70 at Stifel

European stocks closed at their highest in more than a year Tuesday, finding support from upbeat eurozone data, but HSBC PLC shares suffered the most since 2009 in the wake of financial results from the London-based lender. European equities climbed Tuesday after a better-than-expected preliminary reading on manufacturing activity in the eurozone. IHS Markit's February PMI gauge of eurozone manufacturing activity came in at 56.0, outstripping a 54.3 estimate from FactSet.

U.S. stocks rallied on Tuesday, with major indexes simultaneously closing at records for a second session in a row on the back of gains in defensive sectors and energy, even as concerns remained about the market's valuation. Stocks finished near their highs of the session with the day's gains broad as all 11 of the S&P 500's sectors finished higher.

Asia-Pacific stocks rose broadly following overnight gains overseas, as investors await the release later Wednesday of minutes from this month's U.S. Federal Reserve meeting. But gains are largely muted, as are declines in the few markets whose benchmark indexes are lower.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.