- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 22-04-2015.

(index / closing price / change items /% change)

Nikkei 225 20,133.9 +224.81 +1.1 %

Hang Seng 27,933.85 +83.36 +0.3 %

Shanghai Composite 4,399.88 +106.26 +2.5 %

FTSE 100 7,028.24 -34.69 -0.5 %

CAC 40 5,211.09 +18.45 +0.4 %

Xetra DAX 11,867.37 -72.21 -0.6 %

S&P 500 2,107.96 +10.67 +0.5 %

NASDAQ Composite 5,035.17 +21.07 +0.4 %

Dow Jones 18,038.27 +88.68 +0.5 %

US stocks closed above zero on the background of corporate reporting and news. For example, McDonald's shares rose 3%, as the company said it is working on a plan to increase sales and profits, while Coca-Cola added about 1% after the publication of the quarterly report.

Visa has increased by more than 5%, and during the regular session beat a record $ 69.98, while MasterCard rose nearly 4% after the announcement of the Chinese leadership that the country will open its market to foreign firms to clean the inside of operations with plastic cards since June.

This week, reports unveil a total of more than 140 corporations included in the list of Standard & Poor's 500. Of the companies have already reported 79% better than expected earnings, 47% - in terms of revenue. "Reporting has so far been better than expected, so that the terrible consequences of which we were intimidated, have not yet become a reality," - said a trader Themis Trading LLC Mark Kepner.

However, sales of existing homes in the US rose to the highest level in 18 months in March, a sign that the housing market is gaining momentum after a slow start to the year. Sales of existing homes rose 6.1% last month from February to a seasonally adjusted annual rate reached 5.19 million., Said Wednesday the National Association of Realtors (NAR). Economists had expected sales to rise in March to 5.04 million. Sales for February were revised to 4.89 million. From the originally reported 4.88 million. Sales in March rose by 10.4% compared with a year earlier.

The cost of WTI oil futures declined moderately, due to the publication of the US Department of Energy data. Traders paid attention primarily on oil production data, rather than the further growth of oil in storage. It is learned that oil production in the US fell last week to 18,000 barrels per day, or 0.19 percent. It is worth emphasizing production decline recorded for the third time in the last four weeks. Meanwhile, the US Department of Energy announced that during the week April 11-17 commercial oil stocks rose 5.3 million barrels to 489 million barrels, while analysts expected an increase of 2.8 million. Barrels.

Most components of the index DOW closed in positive territory (21 of 30). Outsider shares were The Boeing Company (BA, -1.36%). Shares rose more than the rest Visa Inc. (V, + 4.18%).

Almost all sectors of the S & P index recorded an increase. Most finance sector increased (+ 0.8%). Decline recorded only the health sector (-0.1%)

At the time of closing:

Dow + 0.49% 18,038.07 +88.48

Nasdaq + 0.42% 5,035.17 +21.07

S & P + 0.51% 2,107.96 +10.67

Major U.S. indexes ticks up on Wednesday as McDonald's turnaround plan and Visa's potential entry into China helped investors shrug off a mixed bag of results.

U.S. home resales surged to their highest level in 18 months in March as more homes came on the market. This is a sign of strength in housing ahead of the spring selling season.

Most of the Dow stocks are trading in positive area (17 of 30). Top looser - The Boeing Company (BA, -2.70%). Top gainer - Visa Inc. (V, +4.93%).

S&P index sectors are moving mixed. Top gainer - financial (+0,7%). Top looser - Industrial goods (-0.2%).

At the moment:

Dow 17910.00 +27.00 +0.15%

S&P 500 2096.25 +5.25 +0.25%

Nasdaq 100 4439.25 +10.75 +0.24%

10-year yield 1.97% +0.05

Oil 56.39 -0.22 -0.39%

Gold 1188.30 -14.80 -1.23%

The Swiss National Bank (SNB) said on Wednesday that it reduced the number of sight deposit accounts exempt from its negative interest rate. Switzerland's central has been criticised that public institutions were being shielded from the charge.

Starting from May 01, the negative rate will apply to institutions such as the pension funds of the federal government and the central bank.

According to the German newspaper Handelsblatt on Wednesday, the European Central Bank (ECB) on Tuesday raised the amount the Greek central bank can lend its banks to €75.5 billion from €74.0 billion the previous week.

The ECB declined to comment.

Stock indices closed mixed on concerns over Greek default and on mixed corporate earnings. Greece is still running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans (€7.2 billion) at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

The European Commission President Jean-Claude Juncker ruled out the Greek exit from the Eurozone.

Eurozone's consumer confidence index declined to -4.6 in April from -4.0 in March. Analysts had expected the index to climb to -3.0.

The Bank of England's Monetary Policy Committee (MPC) released its April meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced."

MPC members noted that the economy in the Eurozone grew strongly than expected.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,028.24 -34.69 -0.5 %

DAX 11,867.37 -72.21 -0.6 %

CAC 40 5,211.09 +18.45 +0.4 %

The National Association of Realtors released existing homes sales figures in the U.S. on Wednesday. Sales of existing homes rose 6.1% to a seasonally adjusted annual rate of 5.19 million in March from 4.89 million in February. It was the highest level since September 2013.

February's figure was revised up from 4.88 million units.

Analysts had expected an increase to 5.04 million units.

The NAR chief economist Lawrence Yun said that sales activity picked up in March.

"The combination of low interest rates and the ongoing stability in the job market is improving buyer confidence and finally releasing some of the sizable pent-up demand that accumulated in recent years," he noted.

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Wednesday. The U.S. house price index rose 0.7% on a seasonally adjusted basis in February, in line with expectations, after a 0.3% gain in January.

On a yearly basis, the house price index climbed 5.4% in February.

These figures showed that housing demand increased.

The Canadian government Tuesday released its budget for this financial year ending on March 31, 2016. Canada's Finance Minister Joe Oliver said that the government projects a surplus of 1.4 billion Canadian dollars (US$1.15 billion) for the fiscal year.

"A balanced budget is the only way to ensure long-term prosperity for Canadians," Oliver noted.

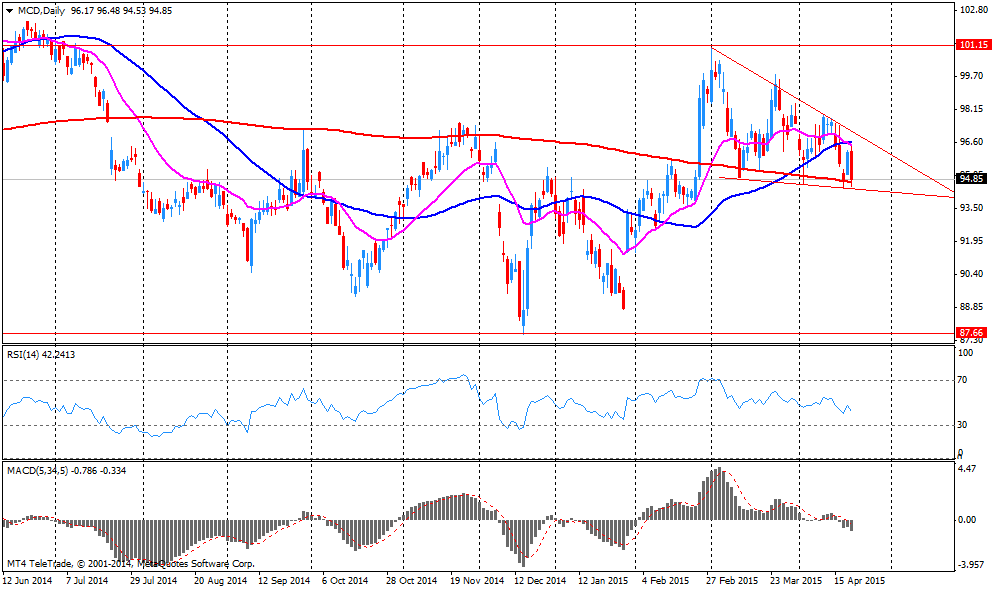

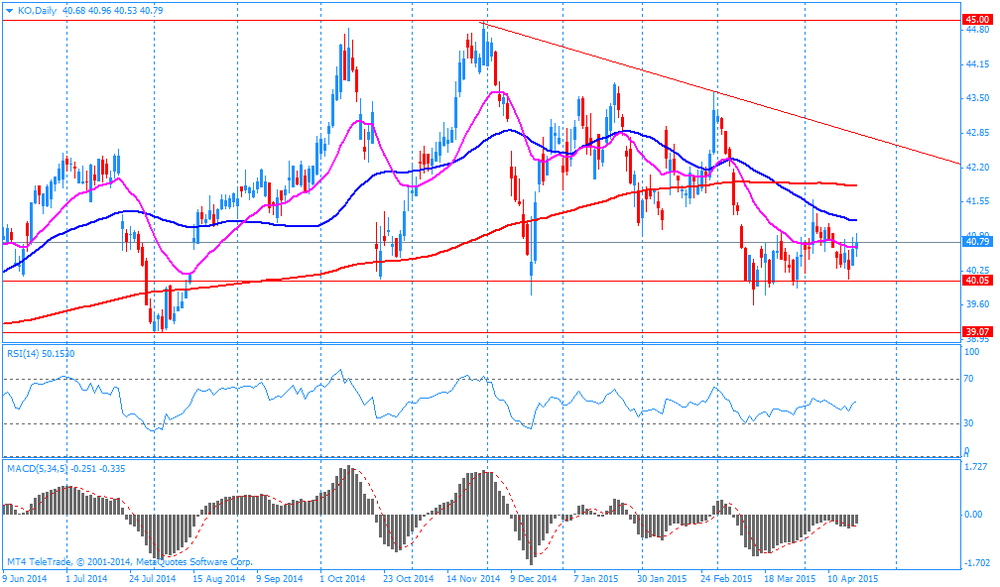

U.S. stock-index futures rose slightly. Investors estimate company's quartely results. Quartely results from Boeing (BA), Coca-Cola (KO) and McDonald's (MCD) are in focus today.

More than 140 companies in the S&P 500 are posting earnings this week. Of the companies that have reported so far, 79 percent beat profit projections and 47 percent topped sales estimates.

Global markets:

Nikkei 20,133.9 +224.81 +1.13%

Hang Seng 27,933.85 +83.36 +0.30%

Shanghai Composite 4,399.88 +106.26 +2.47%

FTSE 7,011.49 -51.44 -0.73%

CAC 5,197.39 +4.75 +0.09%

DAX 11,887.88 -51.70 -0.43%

Crude oil $56.48 (-0.23%)

Gold $1200.00 (-0.27%)

The Conference Board released its Leading Economic Index (LEI) for China on Wednesday. The index rose 0.2% in March, after a 1.4% increase in February. The rise was driven by increases in three of the six components.

The economist at The Conference Board Andrew Polk said that exports, consumer confidence, and real estate had a negative impact on the index.

(company / ticker / price / change, % / volume)

| AMERICAN INTERNATIONAL GROUP | AIG | 56.65 | +0.02% | 0.2K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.25 | +0.10% | 1.9K |

| Twitter, Inc., NYSE | TWTR | 51.37 | +0.10% | 11.8K |

| Travelers Companies Inc | TRV | 102.00 | +0.12% | 0.1K |

| Exxon Mobil Corp | XOM | 87.02 | +0.16% | 11.7K |

| Amazon.com Inc., NASDAQ | AMZN | 391.94 | +0.19% | 5.0K |

| E. I. du Pont de Nemours and Co | DD | 70.85 | +0.23% | 0.6K |

| Walt Disney Co | DIS | 108.00 | +0.30% | 1.6K |

| Barrick Gold Corporation, NYSE | ABX | 12.86 | +0.39% | 2.4K |

| Facebook, Inc. | FB | 84.27 | +0.78% | 141.9K |

| Yahoo! Inc., NASDAQ | YHOO | 44.85 | +0.81% | 171.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 212.40 | +1.43% | 68.2K |

| The Coca-Cola Co | KO | 41.65 | +2.14% | 327.9K |

| McDonald's Corp | MCD | 97.11 | +2.36% | 2.1K |

| AT&T Inc | T | 32.66 | 0.00% | 6.5K |

| ALCOA INC. | AA | 13.52 | 0.00% | 7.9K |

| ALTRIA GROUP INC. | MO | 52.10 | 0.00% | 0.4K |

| Starbucks Corporation, NASDAQ | SBUX | 48.37 | 0.00% | 0.9K |

| Verizon Communications Inc | VZ | 49.16 | -0.02% | 1.6K |

| General Motors Company, NYSE | GM | 37.15 | -0.03% | 0.3K |

| Caterpillar Inc | CAT | 83.89 | -0.04% | 1.4K |

| International Business Machines Co... | IBM | 164.20 | -0.04% | 1.4K |

| Chevron Corp | CVX | 109.68 | -0.05% | 0.7K |

| Pfizer Inc | PFE | 34.87 | -0.06% | 1.3K |

| Ford Motor Co. | F | 15.81 | -0.06% | 1.4K |

| Apple Inc. | AAPL | 126.81 | -0.08% | 137.5K |

| Deere & Company, NYSE | DE | 87.82 | -0.11% | 0.1K |

| Nike | NKE | 100.14 | -0.15% | 3.1K |

| Citigroup Inc., NYSE | C | 52.40 | -0.15% | 6.0K |

| Goldman Sachs | GS | 196.50 | -0.17% | 0.5K |

| Microsoft Corp | MSFT | 42.56 | -0.18% | 14.3K |

| Intel Corp | INTC | 32.37 | -0.19% | 4.7K |

| JPMorgan Chase and Co | JPM | 62.19 | -0.19% | 5.8K |

| Google Inc. | GOOG | 532.94 | -0.19% | 4.9K |

| Cisco Systems Inc | CSCO | 28.63 | -0.21% | 5.5K |

| American Express Co | AXP | 77.06 | -0.28% | 0.6K |

| General Electric Co | GE | 26.54 | -0.30% | 64.5K |

| Wal-Mart Stores Inc | WMT | 77.66 | -0.47% | 18.5K |

| Visa | V | 65.01 | -0.52% | 0.9K |

| Procter & Gamble Co | PG | 82.60 | -0.58% | 0.2K |

| Yandex N.V., NASDAQ | YNDX | 20.27 | -0.83% | 4.6K |

| Boeing Co | BA | 151.25 | -1.36% | 43.9K |

According to Eurostat, government debt in the Eurozone reached 91.9% of GDP in 2014. It was the highest level since the euro was introduced in 1999. Only 4 of the Eurozone's 19 countries were below the Maastricht Treaty's 60% debt limit.

The highest ratios of government debt were recorded in Greece (177.1% of GDP), followed by Italy (132.1%), Portugal (130.2%) and Ireland (109.7%).

The lowest ratios of government debt were recorded in in Estonia (10.6%), Luxembourg (23.6%) and Latvia (40.0%).

Germany' ratio of government debt decreased to 74.7% in 2014 from 77.1% in 2013.

France's ratio of government debt rose to 95% in 2014 from 92.3% in 2013.

UK's ratio of government debt declined to 89.4% in 2014 from 87.3% in 2013.

Company reports Q1 earnings of $1.01 per share versus $1.06 consensus. Revenues fell 11.1% year/year to $5.96 bln versus $5.97 bln consensus.

Company reported about developing a turnaround plan to improve performance and deliver enduring profitable growth. Initial details of this plan will be published on May 4.

MCD rose to $97.00 (+2.25%) on the premarket.

Company reports Q1 earnings of $1.97 per share versus $1.81 consensus. Revenues rose 8.3% year/year to $22.15 bln versus $22.60 bln consensus.

Company reaffirms guidance for FY15: EPS of $8.20-8.40 versus $8.48 consensus, revenue of $94.5-96.5 bln versus $94.82 bln consensus.

BA fell to $150.80 (-1.65%) on the premarket.

The Federal Reserve Bank of Boston President Eric Rosengren said in an interview with the Financial Times on Tuesday that central banks including the Fed should set higher inflation targets to avoid dealing with low economic growth.

Higher inflation rate target could mean more room to lower interest rate, Rosengren said.

The Federal Reserve Bank of Boston president expects the U.S. economy to expand slower than 2.2% in the first quarter.

Rosengren is not a voting member of the Federal Open Market Committee this year.

Stock indices traded lower on concerns over Greece's debt crisis. Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

Corporate earnings also weighed on markets.

The Bank of England's Monetary Policy Committee (MPC) released its April meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced."

MPC members noted that the economy in the Eurozone grew strongly than expected.

Current figures:

Name Price Change Change %

FTSE 100 7,025.68 -37.25 -0.53 %

DAX 11,859.45 -80.13 -0.67 %

CAC 40 5,166.98 -25.66 -0.49 %

The Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel at EU summit in Brussels on Thursday.

Greece is running out of cash, and it needs a new tranche of loans. The Greek government hopes to unlock a new tranche of loans at the Eurogroup meeting on April 24. Some European officials expressed concerns that an agreement between Greece and its creditors will be signed this week.

The head of the Eurogroup Jeroen Dijsselbloem said on Tuesday that he expects that Greece and its creditors will sign an agreement in the coming weeks.

The European Commission President Jean-Claude Juncker said on Tuesday that Greece should step up efforts to sign an agreement with its creditors. He added that he is not satisfied with the course of talks.

"The intensity of talks has increased in the past four or five days but is not yet at the maturity needed to be able to reach a quick conclusion," Juncker.

The European Commission president ruled out the Greek exit from the Eurozone.

The Bank of England's Monetary Policy Committee (MPC) released its April meeting minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that the decision not to hike interest rate in April was "finely balanced."

MPC members noted that the economy in the Eurozone grew strongly than expected.

The Bank of England (BoE) still expects the consumer inflation to decline into negative territory in the coming months, but inflation could recover strongly next year.

Some policymakers said that weakness in the U.S. and China offset the stronger growth in the Eurozone.

MPC members pointed out that Greece's debt problem still pose a risk to global growth.

The Australian Bureau of Statistics released its consumer inflation data on Wednesday. The consumer price inflation in Australia increased 0.2% in the first quarter, exceeding expectations for a 0.1% gain, after a 0.2% rise in fourth quarter.

On a yearly basis, Australia's consumer price inflation declined to 1.3% in the first quarter from 1.7% in the fourth quarter, in line with expectations.

The decline was driven by a drop in fuel prices. Fuel prices dropped more than 12%.

Fruit prices slid 8%.

Domestic travel and accommodation prices rose 3.5% in the first quarter, while tertiary education prices climbed 5.7%.

The trimmed mean consumer price index (CPI) (the Reserve Bank of Australia's (RBA) main indicator of inflation) gained to 0.6% in the fourth quarter, in line with expectations, after 0.6% rise in the fourth quarter. The fourth quarter's figure was revised down from a 0.7% increase.

The trimmed mean consumer price index (CPI) rose to 2.3% year-on-year in the fourth quarter from 2.2% in the fourth quarter.

However, the RBA could cut its interest rate at the May meeting despite this slightly increase in inflation. But the small rise could mean that the central bank may wait.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.