- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 23-01-2012.

U.S. stock futures were little changed as finance ministers gathered in Brussels to discuss new budget rules and a Greek debt swap.

European officials will forge ahead today with crafting a long-term plan to tackle the region’s debt crisis, as banking and government negotiators continue trying to reach an agreement that will lighten Greece debt burden. Bondholders negotiating a debt swap with Greece have made their “maximum” offer, leaving it to the European Union and International Monetary Fund to decide whether to accept the deal, the negotiator for private creditors said.

Global stocks:

Nikkei 8,766 -0.46 -0.01%

FTSE 5,767 +38.59 +0.67%

CAC 3,335 +13.83 +0.42%

DAX 6,431 +26.61 +0.42%

Crude oil: $99.31 (+1,0%).

Gold: $1667.40 (+0,2%).

Jan 24

McDonald's Corp (MCD). Cons. EPS $1.30.

Verizon Communications (VZ). Cons. EPS $0.53.

Johnson & Johnson (JNJ). Cons. EPS $1.09.

Asian stocks swung between gains and losses as increasing home sales in the U.S. added to signs the world’s biggest economy is recovering, outweighing uncertainties over continuing debt negotiations in Greece.

Nikkei 225 8,766 -0.46 -0.01%

Hang Seng Closed

S&P/ASX 200 4,225 -14.53 -0.34%

Shanghai Composite Closed

Canon Inc. (7751), the Japanese camera maker that gets a third of its sales from Europe, fell 1 percent in Tokyo.

Reliance Industries (RIL) Ltd., India’s biggest company by market value, sank 2.9 percent in Mumbai after earnings dropped for the first time in two years.

Olympus Corp. (7733), the world’s No. 1 maker of endoscopes, jumped 8.2 percent after it was allowed to keep its stock market listing following an accounting fraud that cut the company’s market value by about $4 billion.

Asian stocks rose, with a regional benchmark index heading for its fifth straight weekly advance, as fewer Americans than forecast filed claims for jobless benefits and after Spain and France sold bonds at lower yields.

Toyota Motor Corp. (7203), a Japanese carmaker that gets about 70 percent of its sales overseas, climbed 4.1 percent in Tokyo.

Japanese lenders rallied after the central bank said it will postpone the sale of shares purchased from financial institutions. HSBC Holdings Plc. (HSBA), Europe’s biggest bank by market value, advanced 3.4 percent in Hong Kong.

Li Ning Co., China’s No. 1 sportswear company, surged 7.1 percent after selling 750 million yuan ($119 million) of convertible bonds.

European stocks retreated from a five-month high as U.S. home sales rose less than forecast, adding to concern that gains in equities have outpaced the outlook for economic growth.

Greek officials and private creditors met for a third day to seek agreement on a debt swap. European officials and bondholders agreed in October to implement a 50 percent cut in the face value of Greek debt by voluntarily exchanging outstanding bonds for new securities, with a goal of reducing borrowings to 120 percent of gross domestic product by 2020.

The government and creditors reached an initial agreement for a voluntary swap of Greek debt, Proto Thema reported on its website, without saying how it got the information. The parties agreed that new bonds to replace existing Greek debt would be of a 30-year maturity and carry a coupon beginning at 3.1 percent, reach 3.9 percent and go as high as 4.75 percent, the Athens- based newspaper said.

National benchmark indexes fell in 12 of the 18 western European markets today. France’s CAC 40, the U.K.’s FTSE 100 and Germany’s DAX Index all slid 0.2 percent. Greece’s ASE rallied 2.7 percent to a two-month high.

Cie. de Saint-Gobain, Europe’s largest building-materials supplier, led construction shares lower, falling 2 percent.

BP, the U.K.’s second-largest oil company, dropped 3.1 percent to 467.45 pence as crude declined for a third day in New York trading.

Petrofac Ltd. fell 4.3 percent to 1,440 pence, dropping for a sixth day, as JPMorgan Chase & Co. downgraded the shares.

Meyer Burger Technology AG, the biggest maker of solar- panel manufacturing equipment, sank 6.6 percent to 17.8 Swiss francs as Germany said it will increase the frequency of cuts to solar subsidies. Solarworld AG (SWV) slid 6.5 percent to 4.04 euros in Frankfurt trading.

Most U.S. stocks rose, erasing a loss for the Standard & Poor’s 500 Index in the final minutes of trading, as banks gained and results from International Business Machines Corp. (IBM) to Intel Corp. (INTC) boosted technology shares.

Sales of previously owned U.S. homes rose for a third month in December to the highest level since January 2011, a sign the housing market ended last year with momentum. Greek officials and private creditors entered a third day of negotiations on a debt swap deal that’s crucial to lowering the country’s borrowings and freeing up a second round of international aid.

IBM gained 4.4 percent to $188.52 after forecasting 2012 earnings that beat analysts’ estimates as fourth-quarter profit rose 4.4 percent because of rising software demand.

Intel increased 2.9 percent to $26.38. The chipmaker predicted first-quarter revenue that may top analysts’ estimates, signaling that the shortage of disk drives that throttled personal computer production may be ending.

Microsoft added 5.7 percent to $29.71. The company’s Xbox business got a boost from Christmas shoppers, who snapped up its video-game consoles and Kinect sensor controllers, and signed up for the Xbox Live online service.

GE (GE) closed unchanged at $19.15. Profit topped estimates after the company’s industrial order backlog rose to a record $200 billion even as weaker demand in Europe hindered sales in health care.

Google tumbled 8.4 percent to $585.99. Chief Executive Officer Larry Page is moving into new markets to ignite growth outside Google’s traditional search-based business. That effort contributed to an 8 percent drop in the average price Google gets when users click an ad, because it charges less for ads on mobile devices and in emerging markets, said Herman Leung, an analyst at Susquehanna Financial Group.

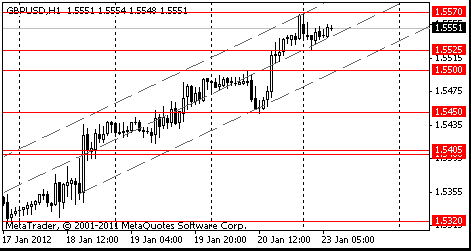

Resistance 3 : $1.5670 (Jan 3 high)

Resistance 2 : $1.5630 (Jan 5 high)

Resistance 1 : $1.5570 (session high)

The current price: $1.5551

Support 1 : $1.5525 (session low)

Support 2 : $1.5500 (support line from Jan 18)

Support 3 : $1.5450 (Jan 20 low)

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.