- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 23-01-2017.

(index / closing price / change items /% change)

Nikkei -246.88 18891.03 -1.29%

TOPIX -18.83 1514.63 -1.23%

Hang Seng +12.61 22898.52 +0.06%

CSI 300 +9.19 3364.08 +0.27%

Euro Stoxx 50 -26.40 3273.04 -0.80%

FTSE 100 -47.26 7151.18 -0.66%

DAX -84.38 11545.75 -0.73%

CAC 40 -29.26 4821.41 -0.60%

DJIA -27.40 19799.85 -0.14%

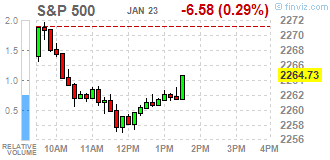

S&P 500 -6.11 2265.20 -0.27%

NASDAQ -2.39 5552.95 -0.04%

S&P/TSX -67.75 15480.13 -0.44%

Major U.S. stock-indexes fell on Monday as President Donald Trump's protectionist stance on trade sent investors scurrying for safe-haven assets on Monday. In his latest executive order, Trump signed to formally withdraw the United States from the 12-nation Trans-Pacific partnership trade deal.Earlier in the day, Trump met with a dozen prominent American manufacturers at the White House and said he would slash regulations and cut corporate taxes to boost the economy.

Most of Dow stocks in negative area (23 of 30). Top gainer - General Electric Company (GE, -3.06%). Top loser - The Home Depot, Inc. (HD, +1.77%).

Most of S&P sectors in negative area. Top loser - Consumer goods (+0.1%). Top gainer - Industrial goods (-0.9%).

At the moment:

Dow 19699.00 -46.00 -0.23%

S&P 500 2257.00 -9.00 -0.40%

Nasdaq 100 5054.50 -3.75 -0.07%

Oil 53.04 -0.18 -0.34%

Gold 1215.20 +10.30 +0.85%

U.S. 10yr 2.40 -0.07

Polish equity market plunged on Monday. The broad market measure, the WIG Index, declined by 0.28%. The WIG sub-sector indices closed mixed. The WIG Clothes (-1.56%) fell the most, while WIG-Pharmaceuticals (+1.32%) outpaced.

The large-cap stocks' measure, the WIG30 Index, fell by 0.59%. Almost 2/3 of the index components recorded losses. Footwear retailer CCC (WSE: CCC) topped the decliners' list, dropping by 4.04%, weight down by an analyst downgrade. Among other largest decliners were three banking sector stocks MBANK (WSE: MBK), BZ WBK (WSE: BZW) and PKO BP (WSE: PKO), and coking coal miner JSW (WSE: JSW), which slumped between 2.11% and 2.83%. At the same time, property developer GTC (WSE: GTC) led the gainers with a 3.01% advance, followed by railway freight transport operator PKP CARGO (WSE: PKP), oil and gas producer PGNIG (WSE: PGN) and videogame developer CD PROJEKT (WSE: CDR), which added 2.86%, 1.87% and 1.21% respectively.

U.S. stock-index futures fell, as investors preferred safe-haven assets such as gold and the U.S. Treasuries in response protectionist sentiment in Trump inauguration speech. Focus also is on quarterly earnings reports; around 20 percent of the S&P 500 components is scheduled to report between today and Friday.

Global Stocks:

Nikkei 18,891.03 -246.88 -1.29%

Hang Seng 22,898.52 +12.61 +0.06%

Shanghai 3,136.64 +13.50 +0.43%

FTSE 7,151.49 -46.95 -0.65%

CAC 4,827.25 -23.42 -0.48%

DAX 11,573.49 -56.64 -0.49%

Crude $52.51 (-1.33%)

Gold $1,210.20 (+0.44%)

(company / ticker / price / change ($/%) / volume)

| ALTRIA GROUP INC. | MO | 70 | -0.01(-0.0143%) | 1083 |

| Amazon.com Inc., NASDAQ | AMZN | 806.5 | -1.83(-0.2264%) | 4396 |

| AMERICAN INTERNATIONAL GROUP | AIG | 66.47 | -0.07(-0.1052%) | 400 |

| Apple Inc. | AAPL | 119.8 | -0.20(-0.1667%) | 85817 |

| AT&T Inc | T | 41.4 | -0.05(-0.1206%) | 1449 |

| Barrick Gold Corporation, NYSE | ABX | 17.38 | 0.27(1.578%) | 126591 |

| Boeing Co | BA | 159.5 | -0.03(-0.0188%) | 6198 |

| Chevron Corp | CVX | 115.22 | -0.38(-0.3287%) | 1243 |

| Citigroup Inc., NYSE | C | 55.91 | -0.20(-0.3564%) | 11187 |

| Deere & Company, NYSE | DE | 106.68 | -0.06(-0.0562%) | 481 |

| Exxon Mobil Corp | XOM | 85.6 | -0.29(-0.3376%) | 1696 |

| Ford Motor Co. | F | 170.15 | -0.40(-0.2345%) | 7472 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.62 | 0.11(0.7092%) | 64480 |

| Google Inc. | GOOG | 804.99 | -0.03(-0.0037%) | 1372 |

| International Business Machines Co... | IBM | 170.15 | -0.40(-0.2345%) | 7472 |

| JPMorgan Chase and Co | JPM | 83.38 | -0.29(-0.3466%) | 3795 |

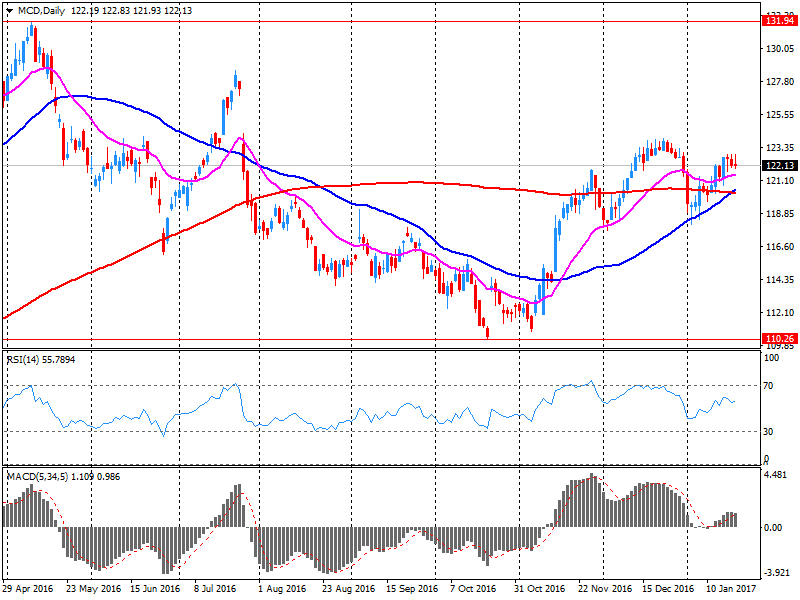

| McDonald's Corp | MCD | 121.6 | -0.66(-0.5398%) | 122507 |

| Merck & Co Inc | MRK | 62.12 | -0.41(-0.6557%) | 682 |

| Microsoft Corp | MSFT | 62.8 | 0.06(0.0956%) | 8589 |

| Nike | NKE | 53.4 | 0.20(0.3759%) | 1375 |

| Pfizer Inc | PFE | 31.86 | 0.09(0.2833%) | 683 |

| Procter & Gamble Co | PG | 87.17 | -0.28(-0.3202%) | 1556 |

| Starbucks Corporation, NASDAQ | SBUX | 57.62 | -0.04(-0.0694%) | 2957 |

| Tesla Motors, Inc., NASDAQ | TSLA | 245 | 0.27(0.1103%) | 4372 |

| The Coca-Cola Co | KO | 41.56 | 0.24(0.5808%) | 1367 |

| Twitter, Inc., NYSE | TWTR | 16.51 | -0.07(-0.4222%) | 40953 |

| Verizon Communications Inc | VZ | 170.15 | -0.40(-0.2345%) | 7472 |

| Wal-Mart Stores Inc | WMT | 67.05 | -0.13(-0.1935%) | 483 |

| Walt Disney Co | DIS | 107.25 | -0.41(-0.3808%) | 3139 |

| Yahoo! Inc., NASDAQ | YHOO | 41.88 | -0.17(-0.4043%) | 652 |

Upgrades:

Downgrades:

Verizon (VZ) downgraded to Market Perform from Outperform at Wells Fargo

Other:

McDonald's reported Q4 FY 2016 earnings of $1.44 per share (versus $1.31 in Q4 FY 2015), beating analysts' consensus estimate of $1.41.

The company's quarterly revenues amounted to $6.029 bln (-4.9% y/y), generally in-line with analysts' consensus estimate of $5.997 bln.

MCD fell to $122.05 (-0.17%) in pre-market trading.

January 23

Before the Open:

McDonald's (MCD). Consensus EPS $1.41, Consensus Revenues $5997.30 mln.

After the Close:

Yahoo! (YHOO). Consensus EPS $0.21, Consensus Revenues $907.72 mln.

January 24

Before the Open:

3M (MMM). Consensus EPS $1.87, Consensus Revenues $7338.29 mln.

DuPont (DD). Consensus EPS $0.42, Consensus Revenues $5265.34 mln.

Johnson & Johnson (JNJ). Consensus EPS $1.56, Consensus Revenues $18259.82 mln.

Travelers (TRV). Consensus EPS $2.81, Consensus Revenues $6176.97 mln.

Verizon (VZ). Consensus EPS $0.89, Consensus Revenues $32123.16 mln.

After the Close:

Alcoa (AA). Consensus EPS $0.24, Consensus Revenues $2365.54 mln.

January 25

Before the Open:

Boeing (BA). Consensus EPS $2.33, Consensus Revenues $23129.14 mln.

Freeport-McMoRan (FCX). Consensus EPS $0.33, Consensus Revenues $4335.63 mln.

United Tech (UTX). Consensus EPS $1.56, Consensus Revenues $14709.58 mln.

After the Close:

AT&T (T). Consensus EPS $0.66, Consensus Revenues $42181.09 mln.

January 26

Before the Open:

Caterpillar (CAT). Consensus EPS $0.67, Consensus Revenues $9811.58 mln.

Ford Motor (F). Consensus EPS $0.32, Consensus Revenues $34892.87 mln.

After the Close:

Alphabet (GOOG). Consensus EPS $9.62, Consensus Revenues $25140.11 mln.

Intel (INTC). Consensus EPS $0.75, Consensus Revenues $15749.89 mln.

Microsoft (MSFT). Consensus EPS $0.79, Consensus Revenues $25286.75 mln.

Starbucks (SBUX). Consensus EPS $0.52, Consensus Revenues $5850.89 mln.

January 27

Before the Open:

Chevron (CVX). Consensus EPS $0.68, Consensus Revenues $32961.41 mln.

Honeywell (HON). Consensus EPS $1.74, Consensus Revenues $10149.17 mln.

Europe's main stock benchmark closed down modestly Friday, snapping a weekly run of gains, as investors remained largely on the sidelines before Donald Trump delivers his inauguration speech as the 45th president of the United States.

U.S. stocks closed higher Friday after coming off intraday highs as Donald Trump was sworn in as the 45th president of the U.S. In his inauguration speech, the new president reiterated his protectionist stance but did not offer details on how he would go about pursuing his agenda.

After some initial softness, Asian stocks are broadly higher as investors continue to digest what Donald Trump means to their holdings. But Japanese equities are a noted laggard as the yen leads broad currency gains in the dollar, rising nearly a full yen from late-Friday levels in the U.S.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.