- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 23-05-2016.

(index / closing price / change items /% change)

Nikkei 225 16,654.6 -81.75 -0.49 %

Hang Seng 19,809.03 -43.17 -0.22 %

S&P/ASX 200 5,318.94 -32.36 -0.60 %

Shanghai Composite 2,844.02 +18.53 +0.66 %

FTSE 100 6,136.43 -19.89 -0.32 %

CAC 40 4,325.1 -28.80 -0.66 %

Xetra DAX 9,842.29 -73.73 -0.74 %

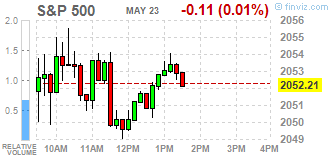

S&P 500 2,048.04 -4.28 -0.21 %

NASDAQ Composite 4,765.78 -3.78 -0.08 %

Dow Jones 17,492.93 -8.01 -0.05 %

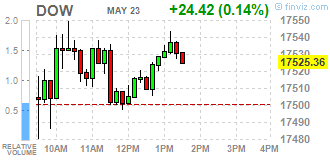

Major U.S. stock-indexes slightly rose on Monday, while a bounce in Apple's stock kept the Nasdaq in positive territory. However, oil slid as Iran vowed to ramp up output and rig reductions paused in the United States. Investors are awaiting speeches by several U.S. Federal Reserve officials this week for further clues on the trajectory of rate hikes, with Fed Chair Janet Yellen set to speak on Friday.

Most of Dow stocks in positive area (19 of 30). Top looser - Verizon Communications Inc. (VZ, -0,89%). Top gainer - Apple Inc. (AAPL, +1,69%).

S&P sectors mixed. Top looser - Utilities (-0,5%). Top gainer - Consumer goods (+0,2%).

At the moment:

Dow 17508.00 +26.00 +0.15%

S&P 500 2050.00 0.00 0.00%

Nasdaq 100 4369.50 +7.25 +0.17%

Oil 47.96 -0.45 -0.93%

Gold 1251.30 -1.60 -0.13%

U.S. 10yr 1.84 -0.01

Stock closed lower on the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0. Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6. The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8. The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6. The services index was driven by rises in new orders, employment and input prices.

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

Falling oil prices also weighed on stock markets. News that Iran has no plans to freeze its oil production also weighed on oil prices. Iran's Deputy Oil Minister Rokneddin Javadi said on Sunday that the country was not ready to freeze its oil output as it has not reached pre-sanctions levels. He noted that Iran's crude oil exports, excluding gas condensates, reached 2 million barrels a day, adding that the country's crude oil export capacity was expected to reach 2.2 million barrels a day by the middle of summer.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,147.53 -8.79 -0.14 %

DAX 9,842.29 -73.73 -0.74 %

CAC 40 4,325.1 -28.80 -0.66 %

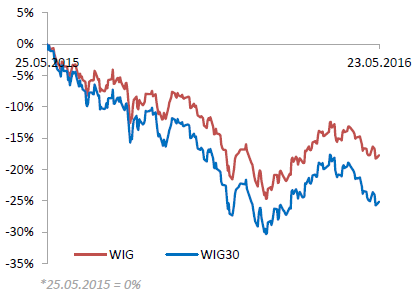

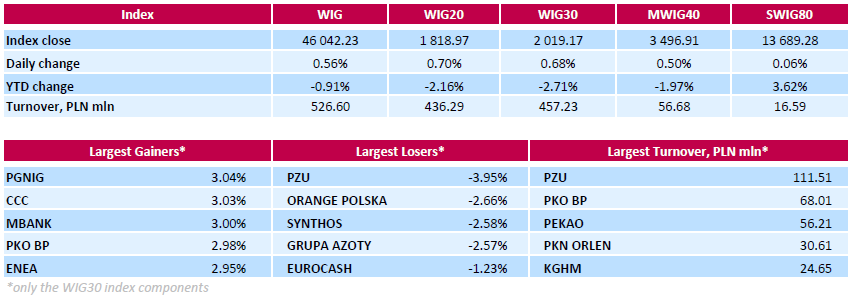

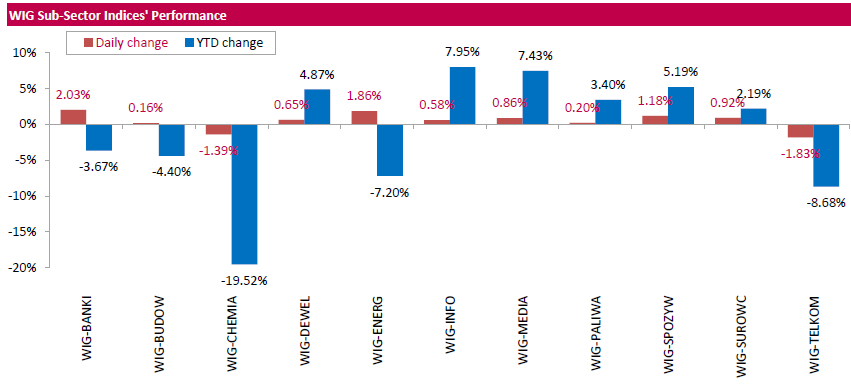

Polish equity market closed higher on Monday, with the broad market measure, the WIG index, adding 0.56%. Except for chemicals (-1.39%) and telecoms (-1.83%), every sector in the WIG Index rose, with banking sector (+2.03%) outperforming.

The large-cap stocks' benchmark, the WIG30 Index, advanced 0.68%. In the index basket, the day's strongest performers were oil and gas producer PGNIG (WSE: PGN), footwear retailer CCC (WSE: CCC), genco ENEA (WSE: ENA) and two banking sector names MBANK (WSE: MBK) and PKO BP (WSE: PKO), which gained between 2.95% and 3.04%. At the same time, insurer PZU (WSE: PZU) was hit the hardest, down 3.95%, as investors were frustrated by the announcement the company plans to pay out lower-than-expected FY 2015 dividend of PLN 2.08 per share (div. yield 6% based on Friday's closing price), which however is in-line with its policy of handing out 50-100 pct of profit. Other major laggards were telecommunication services provider ORANGE POLSKA (WSE: OPL) and two chemicals names SYNTHOS (WSE: SNS) and GRUPA AZOTY (WSE: ATT), declining by 2.66%, 2.58% and 2.57% respectively.

San Francisco Fed President John Williams said on Monday that the Fed could raise its interest rate in June or in July. He added that the referendum on Britain's membership in the European Union (EU) would be taken into account in June.

San Francisco Fed president expects two or three interest rate hikes this year.

Williams is not a voting member of the Federal Open Market Committee (FOMC) this year.

The Conference Board (CB) released its leading economic index for Australia on Monday. The leading economic index (LEI) rose 0.1% in March, after a 0.3% decline in February.

The coincident index increased 0.3% in March, after a 0.2% rise in February.

St. Louis Federal Reserve President James Bullard said on Monday that low interest rates for a longer period could lead to financial instability in future.

"I do worry that keeping rates too low for too long could feed into future financial instability even if it doesn't look like we're in that situation today," he said.

St. Louis Federal Reserve president noted that interest rate hikes would depend on the economic data.

He pointed out that the referendum on Britain's membership in the European Union (EU) would not weigh on the Fed's interest rate decision in June.

Bullard is a voting member of the Federal Open Market Committee (FOMC) this year.

The European Central Bank (ECB) purchased €16.19 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €907 million of covered bonds, and €142 million of asset-backed securities.

The ECB cut its interest rate to 0.00% from 0.05% and deposit rate to -0.4% from -0.3% at its March monetary policy meeting. The ECB also expanded its monthly purchases to €80 billion from €60 billion, to take effect in April. Purchases will include non-bank corporate debt.

The European Commission released its preliminary consumer confidence figures for the Eurozone on Monday. Eurozone's preliminary consumer confidence index rose to -7 in May from -9.3 in April. Analysts had expected the index to increase to -9.0.

European Union's consumer confidence index increased by 1.1 points to 5.7 in May.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Monday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 50.5 in May from 50.8 in April, missing expectations for an increase to 51.0. It was the lowest level since September 2009.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a fall in output and a softer pace of expansion in new business.

"The weak manufacturing PMI data cast doubt on the ability of the US economy to rebound from its disappointing start to the year in the second quarter," Markit Chief Economist Chris Williamson said.

"The survey is signalling that manufacturing will act as a drag on economic growth in the second quarter, leaving the economy once again dependent on the service sector, and consumers in particular, to sustain growth," he added.

The market in the United States opened at neutral level and more importantly, over the support level. Currently the April lows is a key reference point. Last week was an opportunity to go down at the bottom, but it did not. Now that the bulls have their chance for a recovery and subsequent days will show whether they manage to overcome the support line.

On the Warsaw market puts a shadow of weakening of the zloty. The reason is a retreat from the assets of emerging countries as a result of a possible rate hike in the United States and the conflict between Poland-EU. There are also concerns that zloty may continue its downward movement.

Japan's Cabinet Office released its final leading index data on Monday. The leading index increased to 99.3 in March from 98.9 in February, up from the preliminary estimate of 98.4.

Japan's coincident index was up to 111.1 in March from 110.7 in February, down from the preliminary reading of 111.2.

U.S. stock-index futures were little changed.

Global Stocks:

Nikkei 16,654.6 -81.75 -0.49%

Hang Seng 19,809.03 -43.17 -0.22%

Shanghai Composite 2,844.02 +18.53 +0.66%

FTSE 6,138.2 -18.12 -0.29%

CAC 4,321.79 -32.11 -0.74%

DAX 9,846.04 -69.98 -0.71%

Crude $47.59 (-1.69%)

Gold $1247.50 (-0.43%)

(company / ticker / price / change ($/%) / volume)

| ALCOA INC. | AA | 9.24 | 0.13(1.427%) | 187882 |

| Amazon.com Inc., NASDAQ | AMZN | 703.71 | 0.91(0.1295%) | 7477 |

| Apple Inc. | AAPL | 95.8 | 0.58(0.6091%) | 263407 |

| AT&T Inc | T | 38.5 | 0.05(0.13%) | 2481 |

| Barrick Gold Corporation, NYSE | ABX | 17.86 | -0.34(-1.8681%) | 52417 |

| Boeing Co | BA | 127.61 | 0.22(0.1727%) | 10644 |

| Caterpillar Inc | CAT | 69.87 | 0.00(0.00%) | 1038 |

| Cisco Systems Inc | CSCO | 27.93 | -0.04(-0.143%) | 3023 |

| Citigroup Inc., NYSE | C | 44.91 | 0.01(0.0223%) | 115 |

| Deere & Company, NYSE | DE | 77.5 | -0.24(-0.3087%) | 995 |

| Exxon Mobil Corp | XOM | 89.25 | -0.49(-0.546%) | 2861 |

| Facebook, Inc. | FB | 117.53 | 0.18(0.1534%) | 22466 |

| Ford Motor Co. | F | 13.2 | 0.01(0.0758%) | 3609 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 10.84 | -0.24(-2.1661%) | 121986 |

| General Electric Co | GE | 29.52 | -0.04(-0.1353%) | 4338 |

| General Motors Company, NYSE | GM | 30.53 | -0.04(-0.1308%) | 873 |

| Goldman Sachs | GS | 154.7 | 0.19(0.123%) | 1394 |

| Google Inc. | GOOG | 707.53 | -2.21(-0.3114%) | 877 |

| Hewlett-Packard Co. | HPQ | 11.65 | -0.01(-0.0858%) | 116 |

| Home Depot Inc | HD | 131.98 | 0.13(0.0986%) | 2014 |

| Intel Corp | INTC | 30.21 | 0.06(0.199%) | 2277 |

| Johnson & Johnson | JNJ | 112.64 | -0.00(-0.00%) | 409 |

| Merck & Co Inc | MRK | 55.07 | -0.04(-0.0726%) | 265 |

| Microsoft Corp | MSFT | 50.63 | 0.01(0.0198%) | 2183 |

| Nike | NKE | 56.61 | 0.13(0.2302%) | 3226 |

| Pfizer Inc | PFE | 33.7 | -0.04(-0.1186%) | 349 |

| Procter & Gamble Co | PG | 79.99 | -0.03(-0.0375%) | 472 |

| Starbucks Corporation, NASDAQ | SBUX | 54.67 | 0.05(0.0915%) | 1949 |

| Tesla Motors, Inc., NASDAQ | TSLA | 220.5 | 0.22(0.0999%) | 24305 |

| The Coca-Cola Co | KO | 44 | 0.05(0.1138%) | 679 |

| Twitter, Inc., NYSE | TWTR | 14.48 | 0.05(0.3465%) | 17356 |

| United Technologies Corp | UTX | 99.21 | 0.11(0.111%) | 107 |

| Visa | V | 78.23 | 0.56(0.721%) | 6292 |

| Wal-Mart Stores Inc | WMT | 69.67 | -0.19(-0.272%) | 5552 |

| Walt Disney Co | DIS | 99.74 | -0.04(-0.0401%) | 384 |

| Yahoo! Inc., NASDAQ | YHOO | 36.42 | -0.08(-0.2192%) | 1845 |

| Yandex N.V., NASDAQ | YNDX | 19.22 | -0.00(-0.00%) | 1000 |

Upgrades:

Alcoa (AA) upgraded to Buy from Neutral at BofA/Merrill

Downgrades:

Other:

Japan's Ministry of Economy, Trade and Industry (METI) released its all industry activity index on Monday. The index rose 0.1% in March, missing expectations for a 0.7% gain, after a 0.9% drop in February. February's figure was revised down from a 1.2% decrease.

Construction industry activity index fell 1.6% in March, industrial production index jumped 3.8%, while tertiary industry activity decreased 0.7%.

In the first half of the session noticeably weakened the zloty, which in relation to the euro is weaker than in the week before the message from Moody's. Today the European Commission is to submit its opinion on the state of the rule of law in Poland, which adversely affects the national assets. The WSE also weakened and the WIG20 index set new daily lows below the level of 1,800 points. In the southern phase of the session there was a rebound and the situation was saved by the banking sector.

Published at 10:00 (Warsaw time) European macroeconomic publications (PMI) presented a negative image, and currently we see a return to session lows with a loss of the order of 0.9% in Germany and 1% in France.

Stock indices traded mixed on the PMI data from the Eurozone. Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0. Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6. The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8. The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6. The services index was driven by rises in new orders, employment and input prices.

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

Current figures:

Name Price Change Change %

FTSE 100 6,153.58 -2.74 -0.04 %

DAX 9,916.14 +0.12 0.00%

CAC 40 4,341.04 -12.86 -0.30 %

The European Central Bank (ECB) chief economist Peter Praet said in an interview with the Portuguese newspaper Publico on Monday that the central bank could cut its interest rates further but it would depend on conditions.

"Interest rates are still in the tool box. The question is of course the conditions under which we would decide to use that instrument, because it is clear that the negative rates at some point have also side effects that start to become more important, namely on the profitability of banks," he said.

Praet noted that the ECB was independent.

"I don't think the Governing Council changes in any way its capacity to decide because of political debates. We do what we have to do as good central bankers," the ECB chief economist said.

The preliminary Markit/Nikkei manufacturing Purchasing Managers' Index (PMI) for Japan declined to 47.6 in May from 48.2 in April. It was the lowest level since December 2012.

A reading below 50 indicates contraction of activity, a reading above 50 indicates expansion.

The index was mainly driven by drop in output and new orders.

"Manufacturing conditions deteriorated at a faster rate mid-way through the second quarter of 2016, suggesting the aftermath of the earthquakes were still weighing heavily on goods producers. Both production and new orders declined sharply and at the quickest rates in 25 and 41 months respectively," economist at Markit, Amy Brownbill, said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for France on Monday. France's preliminary manufacturing PMI rose to 48.3 in May from 48.0 in April. Analysts had expected the index to rise to 48.8.

The manufacturing index was driven by a slower decline in new orders and in input prices.

France's preliminary services PMI climbed to 51.8 in May from 50.6 in April. Analysts had expected the index to remain unchanged at 50.6.

The services index was driven by rises in new orders, employment and input prices.

"First-quarter GDP data showed a surprisingly punchy 0.5% expansion, but the PMIs continue to point to a more subdued trend in private sector activity midway through the second quarter," the Senior Economist at Markit Jack Kennedy said.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for Germany on Monday. Germany's preliminary manufacturing PMI climbed to 52.4 in May from 51.8 in April, beating forecasts of a rise to 52.0.

Germany's preliminary services PMI was up to 55.2 in May from 54.5 in April. Analysts had expected index to increase to 54.6.

The rise in the manufacturing and services PMI was driven by a backlogs and increased new orders.

"A first look at today's survey results is encouraging, as output growth accelerated for the first time in 2016 so far. However, we should not be too complacent about these numbers and should instead view them with some caution," Markit's economist Oliver Kolodseike noted.

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Monday. Eurozone's preliminary manufacturing PMI declined to 51.5 in May from 51.7 in April. Analysts had expected the index to increase to 51.9.

Output in the manufacturing sector showed a softer growth.

Eurozone's preliminary services PMI remained unchanged at 53.1 in May. Analysts had expected the index to climb to 53.3.

New business in the services sector rose at the weakest pace since January 2015.

"A disappointing flash Eurozone PMI for May adds further to the suggestion that the robust pace of economic growth seen in the first quarter will prove temporary," Markit's Chief Economist Chris Williamson said.

"The forward-looking indicators also suggest that growth is more likely to weaken further than accelerate," he added.

Japanese Finance Minister Taro Aso said on Friday that the country would not devaluate its currency.

"Japan is committed to refraining from competitive devaluation," he said.

Aso noted that "excessive volatility" would have a negative impact on the economy.

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Thursday. Real GDP of 34 OECD member countries rose 0.4% in the first quarter, after a 0.4% gain in the fourth quarter.

Real GDP of the United States was down to 0.1% from 0.3%, real GDP of Germany rose to 0.7% from 0.3%, while Britain's economy decreased to 0.4% from 0.6%.

GDP of France increased to 0.5% from 0.3%, Italy's economy was up to 0.3% from 0.2%, while Japan's GDP climbed to 0.4% from -0.4%.

Eurozone's economy expanded at 0.5% in the first quarter, after a 0.3% rise in the fourth quarter.

On a yearly basis, GDP of 34 OECD member countries was down 1.8% in the first quarter, after a 2.0% gain in the previous quarter.

The Ministry of Finance released its trade data for Japan on the late Sunday evening. Japan's trade surplus rose to ¥824 billion in April from ¥755 billion in March. Analysts had expected a surplus of ¥492.8 billion.

Exports fell 10.1% year-on-year in April, while imports dropped 23.3%.

Exports to Asia declined by 11.1% year-on-year in April, exports to the United States decreased by 11.8%, while exports to the European Union climbed by 9.9%.

Imports from Asia plunged by 19.2% year-on-year in April, imports from the United States slid by 18.1%, while imports from the European Union declined by 8.4%.

The futures market (WSE: FW20M16) began the week from decline by 0.22% to 1,811 points.

WIG20 index opened at 1805.88 points (-0.03%)*

WIG 45801.86 0.04%

WIG30 2005.90 0.01%

mWIG40 3483.47 0.12%

*/ - change to previous close

The cash market opens at neutral level with low turnover and a distinction of PZU (WSE: PZU), which shares went down after information on the recommended dividend payment. Surrounded DAX drops significantly, which is a change, because until the opening seemed that the behavior of the market in Frankfurt should be neutral.

Today's morning moods are tend to be neutral. Asian's markets were dominated by modest increases, except Japan, where, however, discount is not large. Listing of contracts in the United States do not differ much from the levels of Friday's closing session.

On the Warsaw Stock Exchange on Friday we had a slight increase, helped by better preserve of the environment and the words of Adam Glapiński (candidate to head of the National Bank of Poland) who said, during the hearing in front of the Public Finance Committee, that the reduction of interest rates would endanger the stability of banks and it is not known whether the solution to the issue of loans mortgage will be connected with the currency conversion. It was support for the banks, for which the potential rate cut would be prejudicial, and the issue of foreign currency lending remains a significant unknown. The WIG20 index closed above the 1,800 pts. and there is no clear argument this morning that it does not persist. Surroundings maintains its support, which means that the supply side could not get a clear advantage, even though the growing expectations of an imminent interest rate hike in the US.

European stocks rallied Friday, recording their second consecutive weekly gain, as investors' appetite for risk returned after a selloff spurred by concerns about the next U.S. interest-rate hike.

U.S. stocks closed higher on Friday as fears of an interest-rate hike ebbed with the S&P 500 and the Nasdaq posting weekly gains, but the Dow Jones Industrial Average extended its losing streak for a fourth week. Friday's gains follow a day of losses on Thursday, when worries that the Fed could hike interest rates in June sent markets lower in both the U.S. and Europe.

Asia's benchmark stock index swung between gains and losses as Japanese shares fell as the yen advanced, offsetting gains in Chinese and Taiwanese shares. The biggest source of tension at the G-7 meeting over the weekend, held in northern Japan, was the strong yen, with Japanese officials concerned about the currency's impact on exports. Finance Minister Taro Aso signaled a willingness to take action against "disorderly" moves.

Based on MarketWatch materials

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.