- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 24-12-2015.

Major U.S. stock-indexes little changed on Thursday as a fall in energy stocks dampened spirits in a shortened trading session on Christmas eve. Crude prices were up marginally, with U.S. crude set for gains for the fourth straight day.

Dow stocks mixed (15 in positive area, 15 in negative area). Top looser - NIKE, Inc. (NKE, -1,61%). Top gainer - E. I. du Pont de Nemours and Company (DD, +0.62%).

S&P sectors also mixed. Top looser - Basic Materials (-0.3%). Top gainer - Financial (+0,2%).

At the moment:

Dow 17500.00 +28.00 +0.16%

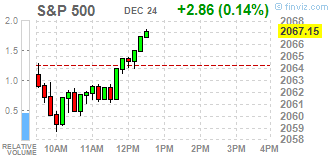

S&P 500 2058.25 +5.25 +0.26%

Nasdaq 100 4629.25 +22.50 +0.49%

Oil 37.93 +0.43 +1.15%

Gold 1076.00 +7.70 +0.72%

U.S. 10yr 2.25 -0.02

U.S. stock-index futures were little changed before the Christmas holiday.

Global Stocks:

Nikkei 18,789.69 -97.01 -0.51%

Shanghai Composite 3,612.88 -23.21 -0.64%

FTSE 6,254.64 +13.66 +0.22%

CAC 4,663.18 -11.35 -0.24%

Crude oil $37.77 (+0.72%)

Gold $1070.00 (+0.35%)

(company / ticker / price / change, % / volume)

| Nike | NKE | 64.47 | 100.36% | 41.7K |

| Yandex N.V., NASDAQ | YNDX | 16.15 | 0.75% | 15.0K |

| Barrick Gold Corporation, NYSE | ABX | 7.68 | 0.26% | 2.0K |

| Amazon.com Inc., NASDAQ | AMZN | 664.90 | 0.18% | 2.6K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7.46 | 0.13% | 80.6K |

| Verizon Communications Inc | VZ | 46.98 | 0.06% | 0.1K |

| JPMorgan Chase and Co | JPM | 66.73 | 0.00% | 5.1K |

| UnitedHealth Group Inc | UNH | 118.69 | 0.00% | 0.8K |

| Hewlett-Packard Co. | HPQ | 11.75 | 0.00% | 5.0K |

| Tesla Motors, Inc., NASDAQ | TSLA | 229.70 | 0.00% | 0.2K |

| Apple Inc. | AAPL | 108.60 | -0.01% | 7.2K |

| Microsoft Corp | MSFT | 55.81 | -0.02% | 0.2K |

| International Business Machines Co... | IBM | 138.50 | -0.03% | 0.8K |

| Pfizer Inc | PFE | 32.55 | -0.03% | 0.2K |

| AT&T Inc | T | 34.75 | -0.09% | 0.1K |

| Twitter, Inc., NYSE | TWTR | 22.65 | -0.09% | 6.0K |

| Facebook, Inc. | FB | 104.51 | -0.11% | 2.5K |

| Caterpillar Inc | CAT | 69.80 | -0.13% | 0.3K |

| Ford Motor Co. | F | 14.34 | -0.14% | 0.5K |

| Boeing Co | BA | 143.85 | -0.15% | 3.0K |

| Exxon Mobil Corp | XOM | 80.00 | -0.24% | 10.1K |

| General Electric Co | GE | 30.86 | -0.29% | 3.8K |

| Wal-Mart Stores Inc | WMT | 60.90 | -0.31% | 0.4K |

| Chevron Corp | CVX | 93.48 | -0.35% | 0.4K |

| General Motors Company, NYSE | GM | 34.60 | -0.52% | 2.5K |

| Walt Disney Co | DIS | 105.00 | -0.53% | 0.2K |

| Visa | V | 78.11 | -0.57% | 2.8K |

| Cisco Systems Inc | CSCO | 27.22 | -0.66% | 0.8K |

| ALCOA INC. | AA | 10.11 | -0.79% | 5.8K |

U.S. stock indices rose on Wednesday as energy stocks rebounded.

The Dow Jones Industrial Average rose 185.34 points, or 1.1%, to 17,602.61. The S&P 500 gained 25.32 points, or 1.2%, to 2,064.29 (all of its 10 sectors closed higher; the energy sector rose 4.2%). The Nasdaq Composite added 44.82 points, or 0.9% to 5,045.93.

Oil prices rose boosting stocks of energy companies after the Energy Information Administration reported an unexpected 5.9 million barrel decline in U.S. crude oil inventories.

Data from the Department of Commerce showed that durable goods orders were unchanged in November, but the business investment indicator improved. Economists had expected durable goods orders to decline by 0.6% after the 2.9% increase in October.

Another report by the Department of Commerce showed that personal income rose by 0.3% in November after a 0.4% rise in October. Meanwhile personal spending rose by 0.3% after being unchanged in the previous month. Economists had expected income to grow by 0.2% and spending by 0.3%.

This morning in Asia Hong Kong Hang Seng rose 0.44%, or 97.54, to 22,138.13. China Shanghai Composite Index dropped 1.22%, or 44.40, to 3,591.69. The Nikkei declined 0.46%, or 86.03, to 18,800.67.

Asian stock indices traded mixed with China leading declines after authorities introduced tighter disclosure requirements for companies buying stakes in listed companies.

The yen's strength weighed on Japanese exporters.

(index / closing price / change items /% change)

HANG SENG 22,009.28 +179.26 +0.82%

S&P/ASX 200 5,141.78 +25.09 +0.49%

SHANGHAI COMP 3,637.28 -14.48 -0.40%

FTSE 100 6,240.98 +157.88 +2.60 %

CAC 40 4,674.53 +106.93 +2.34 %

Xetra DAX 10,727.64 +238.89 +2.28 %

S&P 500 2,064.29 +25.32 +1.24 %

NASDAQ Composite 5,045.93 +44.82 +0.90 %

Dow Jones 17,602.61 +185.34 +1.06 %

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.