- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 25-11-2011.

Resistance 3:1195 (38,2 % FIBO 1270-1147)

Resistance 2:1178 (intraday low on Nov 23)

Resistance 1:1174 (Nov 24 high)

Current price: 1169,75

Support 1 : 1159 (area of intraday high)

Support 2 : 1147/45 (session low, Oct 7 low)

Support 3 : 1129 (Oct 6 low)

U.S. stock index futures fell as fears about the euro zone's debt crisis overshadowed what appeared to be a buoyant start to the holiday shopping season.

Stocks were facing their worst week in two months and their second consecutive week of losses.

Yields on Italy's debt approached recent highs that sparked a sell-off in world markets. Italy paid a record 6.5 percent to borrow money over six months on Friday, and its longer-term funding costs soared far above levels seen as sustainable for public finances, raising the pressure on Rome's new emergency government.

U.S. stock markets were closed for the Thanksgiving holiday on Thursday and will be open on Friday until 1 p.m. The day after Thanksgiving is typically one of the lightest trading volume days of the year.

World markets:

Nikkei 8,160 -5.17 -0.06%

Hang Seng 17,689 -245.62 -1.37%

Shanghai Composite 2,380 -17.33 -0.72%

FTSE 5,131 +3.50 +0.07%

CAC 2,825 +2.88 +0.10%

DAX 5,448 +19.78 +0.36%

Crude oil: $95.36 (-1,7%).

Gold: $1677,80 (-1,0%).

Nikkei 225 8,160 -5.17 -0.06%

Hang Seng 17,725 -210.12 -1.17%

S&P/ASX 3,984 -59.87 -1.48%

Shanghai Composite 2,380 -17.33 -0.72%

At first half of yesterday the euro strengthened from a seven-week low against the dollar as German reports showed business confidence improved and economic growth accelerated even with Europe’s worsening debt crisis. The Munich-based Ifo institute said its business climate index increased to 106.6 this month from 106.4 in October. The euro also advanced versus the pound amid signs Germany is softening its opposition to allowing issuance of common euro-area bonds. Yesterday Germany received insufficient bids at a bond auction, fueling concern that Europe’s sovereign-debt crisis is driving away investors from the region’s assets. German newspaper editorials and opposition politicians stepped up bids for Chancellor Angela Merkel to shift from an incremental approach after the government sold 35 percent less bonds than its maximum target at yesterday’s auction. Bild newspaper reported Merkel’s coalition is concerned it may have to agree to euro bonds under certain conditions.

But euro fell later. At second half of yesterday Fitch lowers Portugal's growth fcst due European outlook. Sees Portugal 2012 GDP falling 3%. Cites Portugal high debt,large fiscal imbalances. Portugal could be further downgraded if growth disappoints.

EUR/USD: yesterday the pair showed a new week’s low, but restored later.

GBP/USD: yesterday the pair fell.

USD/JPY: yesterday the pair weakened.

On Friday the output of significant macroeconomic statistics is not planned.

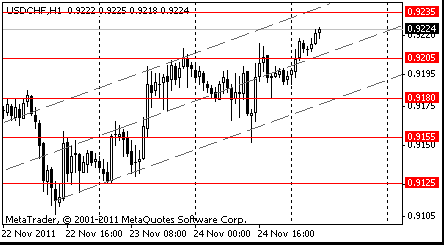

Resistance 3: Chf0.9310 (Oct 6 high)

Resistance 2: Chf0.9285 (Oct 7 high)

Resistance 1: Chf0.9235 (Nov 17 high)

The current price: Chf0.9224

Support 1: Chf0.9205 (middle line from Nov 22)

Support 2: Chf0.9180 (support line from Nov 22)

Support 3: Chf0.9155 (Nov 24 low)

Comments: the pair is on uptrend. In focus resistance Chf0.9235.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.