- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 26-01-2016.

Stock indices traded higher as oil prices rebounded. Oil prices climbed on news that oil producer could cooperate to cut oil output.

The Bank of England (BoE) Governor Mark Carney said before the Treasury Select Committee on Tuesday that conditions for an interest rate hike were not met yet.

"My sense of the reporting was that it correctly identified the conditions that would be required for an interest rate hike hadn't come into play, and that those conditions are not yet in place," he said.

Carney noted that low oil prices support the economy in the medium term.

He pointed out that he will by the end of the year whether he will stay for a longer period as governor of the BoE.

Indexes on the close:

Name Price Change Change %

FTSE 100 5,911.46 +34.46 +0.59 %

DAX 9,822.75 +86.60 +0.89 %

CAC 40 4,356.81 +45.48 +1.05 %

Polish equities were lower on Tuesday. The broad market measure, the WIG Index, declined 0.64%. Sector performance within the WIG Index was mixed. Oil and gas sector (-1.62%) was the weakest group, while materials (+1.16%) outperformed.

Large-cap stocks measure, the WIG30 Index, underperformed the broad market, posting a 0.91% drop. In the index basket, thermal coal miner BOGDANKA (WSE: LWB) was the sharpest decliner, tumbling by 3.24%. Other biggest laggards were oil and gas producer PGNIG (WSE: PGN), insurer PZU (WSE: PZU), genco TAURON PE (WSE: TPE) and chemical company GRUPA AZOTY (WSE: ATT), plunging by 2.18%-2.9%. On the other side of the ledger, FMCG wholesaler EUROCASH (WSE: EUR) and videogame developer CD PROJEKT (WSE: CDR) were recorded as the biggest gainers, advancing 3.21% and 2.22% respectively.

Major U.S. stock-indexes higher on Tuesday, driven by strong earnings reports and recovering oil prices, ahead of the Federal Reserve's policy meeting and Apple's results. Crude prices steadied above $31 a barrel on hopes that OPEC and non-OPEC producers would come together to tackle a massive supply glut. While the Fed is not expected to move on interest rates at its two-day meeting this week, investors will parse the commentary to gauge the impact of the recent global turmoil on the central bank's outlook.

Almost all of Dow stocks in positive area (27 of 30). Top looser - UnitedHealth Group Incorporated (UNH, -1,00%) Top gainer - 3M Company (MMM, +4,84%).

Almost all S&P sectors also in positive area. Top looser - Conglomerates (-0,3%). Top gainer - Basic Materials (+2,8%).

At the moment:

Dow 16018.00 +207.00 +1.31%

S&P 500 1887.25 +17.00 +0.91%

Nasdaq 100 4208.25 +21.50 +0.51%

Oil 31.30 +0.96 +3.16%

Gold 1118.00 +12.70 +1.15%

U.S. 10yr 2.01 -0.01

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The composite index for manufacturing declined to 2 in January from 6 in December, missing expectations for a fall to 3.

The decrease was mainly driven by declines in shipments, new orders and employment.

Shipments sub-index slid to -6 in January from -0 in December.

New orders sub-index was down to 4 from 8.

The employment sub-index declined to 9 from 12.

"The volume of new orders grew modestly this month, although shipments decreased. Hiring increased at a slightly slower pace compared to last month, although average wages continued to increase at a moderate pace in January, and the average workweek lengthened. Raw materials prices rose at a somewhat slower pace, while prices of finished goods rose at a faster pace than in December," the survey said.

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 98.1 in January from 96.3 in December, exceeding expectations for a rise to 96.5. December's figure was revised down from 96.5.

The present conditions index remained unchanged at 116.4 in January.

The Conference Board's consumer expectations index for the next six months increased to 85.9 in January from 83.0 in December.

The percentage of consumers expecting more jobs in the coming months was down to 22.8% in January from 24.2% in December.

"Consumer confidence improved slightly in January, following an increase in December. Consumers' assessment of current conditions held steady, while their expectations for the next six months improved moderately. For now, consumers do not foresee the volatility in financial markets as having a negative impact on the economy," the director of economic indicators at The Conference Board, Lynn Franco, said.

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) dropped to 53.7 in January from 54.3 in December. Analysts had expected the index to fell to 54.0.

A reading above 50 indicates expansion in economic activity.

The drop was driven by a weaker output growth.

"The survey data paint an inauspicious start to the year for the US economy. A struggling manufacturing economy is being accompanied by a services sector where growth showed further signs of losing momentum in January even before the bad weather hit," Markit Chief Economist Chris Williamson said.

The S&P/Case-Shiller home price index increased 5.8% year-on-year in November, exceeding expectations for a 5.7% rise, after a 5.5% gain in October.

Portland, San Francisco and Denver were the largest contributors to the rise, where prices climbed by 11.1%, 11.0% and 10.9%, respectively.

"Home prices extended their gains, supported by continued low mortgage rates, tight supplies and an improving labour market," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index rose by a seasonally adjusted 0.1% rate in November.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

U.S. stock-index futures advanced.

Global Stocks:

Nikkei 16,708.9 -402.01 -2.35%

Hang Seng 18,860.8 -479.34 -2.48%

Shanghai Composite 2,751.03 -187.49 -6.38%

FTSE 5,877.98 +0.98 +0.02%

CAC 4,323.14 +11.81 +0.27%

DAX 9,757.81 +21.66 +0.22%

Crude oil $30.60 (+0.86%)

Gold $1114.00 (+0.79%)

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.5% on a seasonally adjusted basis in November, exceeding expectations for a 0.4% increase, after a 0.5% gain in October.

On a yearly basis, U.S. house prices climbed 5.9% in November, after a 6.1% rise in October.

"The index levels for October and November 2015 exceeded the prior peak level from March 2007," the FHFA said in its statement.

Upgrades:

Downgrades:

Other:

McDonald's (MCD) target raised to $122 from $115 at Robert W. Baird

McDonald's (MCD) target raised to $130 from $128 at Credit Suisse

McDonald's (MCD) target raised to $116 at Cowen

McDonald's (MCD) target raised to $136 from $125 at Barclays

McDonald's (MCD) target raised to $135 from $130 at Deutsche Bank

Twitter (TWTR) target lowered to $19 from $30 at Nomura

(company / ticker / price / change, % / volume)

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 4.25 | 7.87% | 470.2K |

| AMERICAN INTERNATIONAL GROUP | AIG | 56.70 | 2.42% | 80.9K |

| Procter & Gamble Co | PG | 78.10 | 1.63% | 63.2K |

| ALCOA INC. | AA | 6.90 | 1.47% | 30.1K |

| 3M Co | MMM | 139.50 | 1.40% | 1.7K |

| International Paper Company | IP | 33.02 | 1.35% | 93.2K |

| Barrick Gold Corporation, NYSE | ABX | 9.39 | 1.29% | 28.9K |

| Chevron Corp | CVX | 81.80 | 1.12% | 5.8K |

| Exxon Mobil Corp | XOM | 74.75 | 1.04% | 34.3K |

| General Motors Company, NYSE | GM | 29.53 | 1.03% | 0.6K |

| Amazon.com Inc., NASDAQ | AMZN | 602.47 | 1.00% | 20.5K |

| Twitter, Inc., NYSE | TWTR | 17.19 | 1.00% | 41.9K |

| Ford Motor Co. | F | 12.08 | 0.83% | 24.6K |

| Nike | NKE | 61.16 | 0.76% | 0.1K |

| Facebook, Inc. | FB | 97.74 | 0.75% | 66.2K |

| Deere & Company, NYSE | DE | 72.29 | 0.71% | 1K |

| Caterpillar Inc | CAT | 58.30 | 0.67% | 57.4K |

| Johnson & Johnson | JNJ | 97.00 | 0.62% | 3.0K |

| Google Inc. | GOOG | 715.50 | 0.54% | 2.4K |

| Apple Inc. | AAPL | 99.97 | 0.53% | 174.3K |

| McDonald's Corp | MCD | 119.77 | 0.48% | 2.3K |

| General Electric Co | GE | 28.17 | 0.46% | 12.1K |

| Pfizer Inc | PFE | 30.63 | 0.43% | 75.7K |

| JPMorgan Chase and Co | JPM | 55.89 | 0.41% | 0.3K |

| Yandex N.V., NASDAQ | YNDX | 12.62 | 0.40% | 1.5K |

| Goldman Sachs | GS | 151.66 | 0.36% | 7.1K |

| Starbucks Corporation, NASDAQ | SBUX | 57.90 | 0.33% | 1.8K |

| Tesla Motors, Inc., NASDAQ | TSLA | 197.00 | 0.32% | 2.0K |

| Microsoft Corp | MSFT | 51.95 | 0.31% | 4.5K |

| Citigroup Inc., NYSE | C | 39.65 | 0.25% | 11.3K |

| International Business Machines Co... | IBM | 122.30 | 0.18% | 0.5K |

| Verizon Communications Inc | VZ | 47.10 | 0.15% | 3.7K |

| Walt Disney Co | DIS | 95.39 | 0.10% | 6.3K |

| AT&T Inc | T | 35.02 | 0.06% | 1.7K |

| Visa | V | 71.77 | 0.04% | 1.3K |

| American Express Co | AXP | 55.02 | 0.00% | 1.8K |

| Cisco Systems Inc | CSCO | 23.17 | 0.00% | 1.7K |

| Intel Corp | INTC | 29.60 | 0.00% | 1.2K |

| The Coca-Cola Co | KO | 42.10 | -0.14% | 7.4K |

| Yahoo! Inc., NASDAQ | YHOO | 29.70 | -0.27% | 1.9K |

| E. I. du Pont de Nemours and Co | DD | 52.75 | -0.45% | 10.2K

|

Freeport-McMoRan reported Q4 FY 2015 loss of $0.02 per share (versus earnings of $0.25 in Q4 FY 2014), better than analysts' consensus of -$0.19.

The company's quarterly revenues amounted to $3.795 bln (-27.5% y/y), generally in line with consensus estimate of $3.823 bln.

FCX rose to $4.25 (+7.87%) in pre-market trading.

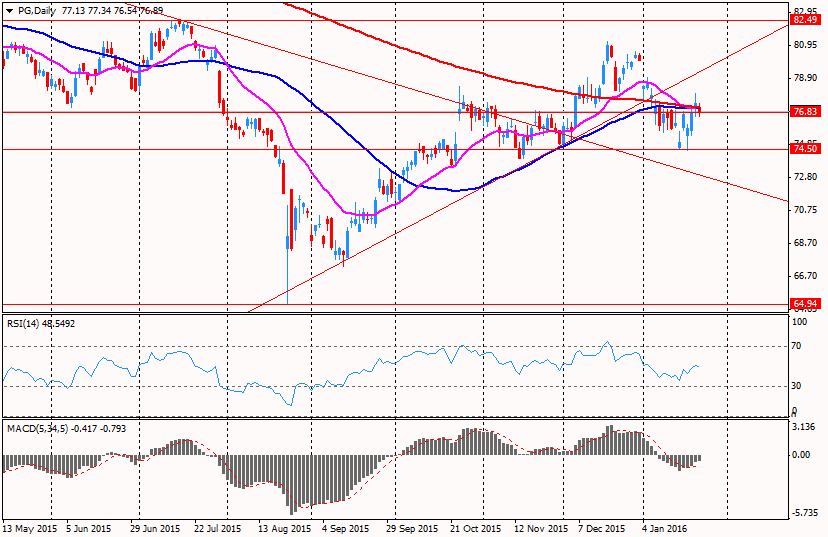

Procter & Gamble reported Q4 FY 2015 earnings of $1.04 per share (versus $1.06 in Q4 FY 2014), beating analysts' consensus of $0.98.

The company's quarterly revenues amounted to $16.915 bln (-8.5% y/y), generally in line with consensus estimate of $16.941 bln.

The company also issued downside guidance for FY 2016, projecting EPS of down 3-8% to $3.46-3.65 versus analysts' consensus of $3.75

PG rose to $78.00 (-+1.50%) in pre-market trading.

The Bank of England (BoE) Governor Mark Carney said before the Treasury Select Committee on Tuesday that conditions for an interest rate hike were not met yet.

"My sense of the reporting was that it correctly identified the conditions that would be required for an interest rate hike hadn't come into play, and that those conditions are not yet in place," he said.

Carney noted that low oil prices support the economy in the medium term.

He pointed out that he will by the end of the year whether he will stay for a longer period as governor of the BoE.

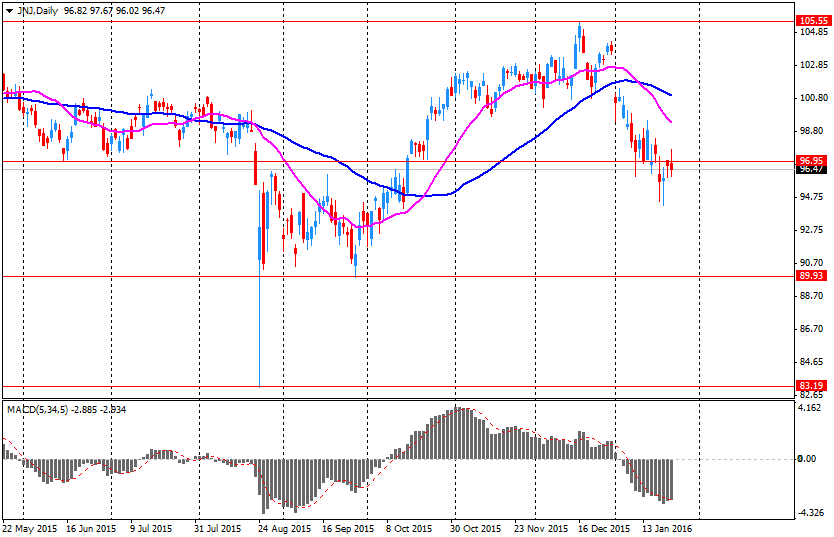

Johnson & Johnson reported Q4 FY 2015 earnings of $1.44 per share (versus $1.27 in Q4 FY 2014), beating analysts' consensus of $1.42.

The company's quarterly revenues amounted to $17.811 bln (-2.4% y/y), generally in line with consensus estimate of $17.856 bln.

The company also issued guidance for FY 2016, projecting EPS of $6.43-6.58 (versus analysts' consensus of $6.40) and revenues of $70.8-71.5 bln (versus analysts' consensus of $71.99 bln).

JNJ rose to $96.75 (+0.36%) in pre-market trading.

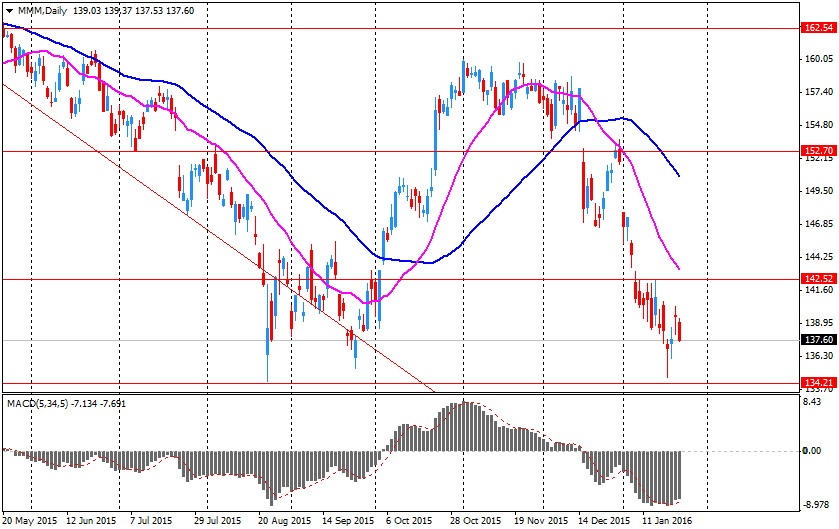

3M Company reported Q4 FY 2015 earnings of $1.66 (including $0.14 in restructuring charges) per share (versus $1.81 in Q4 FY 2014), beating analysts' consensus of $1.62.

The company's quarterly revenues amounted to $7.298 bln (-5.5% y/y), slightly beating consensus estimate of $7.208 bln.

3M Company reaffirmed guidance for FY 2016, projecting EPS of $8.10-8.45 ersus analysts' consensus of $8.22.

MMM fell to $137.57 (-1.40%) in yesterday's trading.

DuPont reported Q4 FY 2015 earnings of $0.27 per share (versus $0.71 in Q4 FY 2014), beating analysts' consensus of $0.26.

The company's quarterly revenues amounted to $5.299 bln (-9.4% y/y), generally inline with consensus estimate of $5.313 bln.

DuPont issued downside guidance for FY 2016, projecting EPS of $2.95-3.10 versus analysts' consensus of $3.13.

DD fell to $52.99 (-3.20%) in yesterday's trade.

Stock indices traded lower as oil prices dropped again. Oil prices fell on concerns over the global oil oversupply.

European Central Bank (ECB) President Mario Draghi said on Monday that the central bank will fulfil its mandate in reaching 2% inflation target.

"Meeting our objective is about credibility. If a central bank sets an objective, it can't just move the goalposts when it misses it. Confidence comes from every party fulfilling its mandate. And that's what the ECB will do," he noted.

Draghi also said that there are "no warning signs of serious financial instability".

Current figures:

Name Price Change Change %

FTSE 100 5,826.07 -50.93 -0.87 %

DAX 9,669.69 -66.46 -0.68 %

CAC 40 4,280.05 -31.28 -0.73 %

The People's Bank of China (PBoC) on Tuesday injected 440 billion yuan ($67 billion) into market to boost liquidity via seven-day reverse bond repurchase agreements and via 28-day reverse repos.

The central bank usually injects extra money before the Lunar New Year holiday.

The Swiss Federal Customs Administration released its trade data on Tuesday. The Swiss trade surplus fell to CHF2.54 billion in December from CHF3.16 billion in the previous month. October's figure was revised up from a surplus of CHF3.14 billion.

Exports dropped 1.q% year-on-year in December, while imports were down 6.3% year-on-year.

In 2015 as whole, the Swiss foreign trade surplus climbed to CHF36.61 billion from CHF29.75 billion in 2014.

Exports dropped 0.7% in 2015, while imports declined 0.5%.

Low exports were driven by a drop in machine industry, accounting for two fifths of total decline.

Exports to the U.S. and China rose, while exports to the Eurozone declined.

European Central Bank (ECB) President Mario Draghi said on Monday that the central bank will fulfil its mandate in reaching 2% inflation target.

"Meeting our objective is about credibility. If a central bank sets an objective, it can't just move the goalposts when it misses it. Confidence comes from every party fulfilling its mandate. And that's what the ECB will do," he noted.

Draghi also said that there are "no warning signs of serious financial instability".

The ECB president pointed out that the central bank's stimulus measures led to higher consumption.

The Bank of England's (BoE) Monetary Policy Committee member Kristin Forbes said in a speech on Monday that wage growth is not strong enough to start raising interest rates.

"Labour costs are not yet at the levels consistent with inflation meeting the 2% target sustainably in the UK," she said.

"I would like to see a bit more upward movement in these wage and cost measures to build confidence that the normal chain of tight labour markets feeding through into higher wages is still intact," Forbes added.

Japanese Finance Minister Taro Aso said on Tuesday that he will support further stimulus measures by the Bank of Japan (BoJ).

"The BOJ has said it would not hesitate (to adjust policy) if necessary so we believe it is adhering to that stance," he said.

"We hope the BOJ will continue its efforts to achieve its price stability target while taking into consideration economic and price conditions," Aso added.

U.S. stock indices fell on Monday with energy and materials companies leading declines amid resumed drop in crude oil prices.

The Dow Jones Industrial Average lost 208.29 points, or 1.3%, to 15,885.22. The S&P 500 fell 29.83 points, or 1.6%, to 1,877.08 (its energy sector led declines with a 4.52% drop). The Nasdaq Composite fell 72.69 points, or 1.6%, to 4,518.49.

Dallas Federal Reserve reported that economic activity deteriorated in Texas in January. The business activity index fell to -34.6 from -21.6 in December marking the 13th decline in a row. Lower energy costs decrease demand in the oil sector. The production index, which reflects manufacturing activity, fell about 23 points, to -10.2 from 12.7.

This morning in Asia Hong Kong Hang Seng fell 1.89%, or 365.37, to 18,974.77. China Shanghai Composite Index plunged 2.61%, or 76.82, to 2,861.70. The Nikkei dropped 2.26%, or 386.37, to 16,724.54.

Asian stock indices declined as investors were concerned about several factors, but oil prices were the biggest contributor to today's loss. Investors were also cautious about China's economic outlook and plans by the U.S. Federal Reserve to raise interest rates.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.