- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 26-05-2015.

(index / closing price / change items /% change)

Nikkei 225 20,437.48 +23.71 +0.12 %

Hang Seng 28,249.86 +257.03 +0.92 %

S&P/ASX 200 5,773.4 +51.91 +0.91 %

Shanghai Composite 4,910.9 +97.10 +2.02 %

FTSE 100 6,948.99 -82.73 -1.18 %

CAC 40 5,083.54 -33.63 -0.66 %

Xetra DAX 11,625.13 -189.88 -1.61 %

S&P 500 2,104.2 -21.86 -1.03 %

NASDAQ Composite 5,032.75 -56.61 -1.11 %

Dow Jones 18,041.54 -190.48 -1.04 %

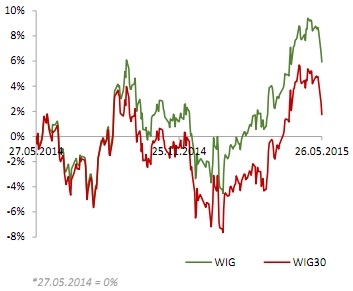

Polish equity market continued its downward trajectory on Tuesday. The broad market benchmark - the WIG index shed by 0.72% and the large liquid companies measure - the WIG30 index fell by 0.93%.

Chemicals name GRUPA AZOTY (WSE: ATT) was the worst-performing name within the WIG30 index, losing 4.34%. It was followed by CCC (WSE: CCC) and PKO BP (WSE: PKO), slumping 3.31% and 2.76% respectively. On the other side of the ledger, oil and gas sector representatives PGNIG (WSE: PGN) and PKN ORLEN (WSE: PKN), developer GTC (WSE: GTC) and bank ALIOR (WSE: ALR) were among the biggest advancers, gaining in the range of 1.35%-2.93%.

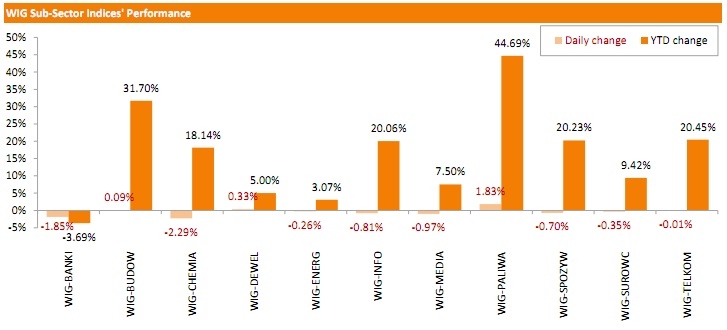

The WIG sub-sector indices mostly closed in negative territory, with chemicals benchmark - the WIG-CHEMIA index (-2.29%) lagging behind.

Stock indices closed lower as the Greek debt crisis and on election results in Spain weighed on markets. The Greek government is running out of cash and might not repay the IMF loans in June.

Greece's interior minister Nikos Voutsis said on Greek TV on Sunday that Greece cannot repay the IMF loans on June 05 as the country does not have money.

Greece cannot reach an agreement with its creditors to unlock the €7.2 billion tranche of loans.

The leftist Podemos and center-right Ciudadanos parties won in regional and municipal elections in Spain on Sunday.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,948.99 -82.73 -1.18 %

DAX 11,625.13 -189.88 -1.61 %

CAC 40 5,083.54 -33.63 -0.66 %

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The lender said that "manufacturing activity flattened in May ".

The composite index for manufacturing rose to 1 in May from −3 in April.

The increase was driven by higher shipments and the volume of new orders.

Major U.S. stock-indexes fell on Tuesday after the dollar jumped to a one-month high on data showing that U.S. business investment spending plans increased solidly for a second straight month in April. Also, Federal Reserve Chair Janet Yellen said on Friday that the central bank could raise interest rates this year if the economy keeps improving as expected.

All of Dow stocks in negative area (30 of 30). Top looser - Caterpillar Inc. (САТ, -1.42%).

All of S&P index sectors also in negative area. Top looser - Basic Materials (-1.6%).

At the moment:

Dow 18045.00 -179.00 -0.98%

S&P 500 2105.75 -18.75 -0.88%

Nasdaq 100 4478.75 -50.00 -1.10%

10-year yield 2.18% -0.03

Oil 58.46 -1.26 -2.11%

Gold 1187.10 -16.90 -1.40%

The U.S. Commerce Department released new home sales data on Tuesday. New home sales increased 6.8% to a seasonally adjusted annual rate of 517,000 units in April from 484,000 units in March.

March's figure was revised up from 481,000 units.

Analysts had expected new home sales to reach 510,000 units.

The increase was driven by higher sales in the Midwest. New home sales in the Midwest climbed 36.8% in April.

The median sales price of new houses sold was $285,500 in April, up from $274,500 in March.

The Conference Board released its consumer confidence index for the U.S. on Tuesday. The index rose to 95.4 in May from 94.3 in April, exceeding expectations for a rise to 95.0. April's figure was revised down from 95.2.

The increase was driven by the better outlook for present conditions. The present conditions index climbed to 108.1 in May from 105.1 in April.

The Conference Board's consumer expectations index for the next six months decreased to 86.9 in May from 87.1 in April.

"Consumer confidence improved modestly in May, after declining sharply in April. While current conditions in the second quarter appear to be improving, consumers still remain cautious about the short-term outlook" the director of economic indicators at The Conference Board, Lynn Franco, said.

The percentage of consumers expecting more jobs in the coming months was up to 14.6% in May from 13.8% in April.

Markit Economics released its preliminary services purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary services purchasing managers' index (PMI) declined to 56.4 in May from 57.4 in April, missing expectations for a decrease to 57.0.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a decrease in new business growth. The preliminary new business index declined to 55.8 in May from 57.7 in April.

"The rate of expansion remains below the buoyant rates seen throughout much of last year, as slower growth of service activity has been accompanied by a slowdown in the manufacturing sector, which has seen exporters hit by the stronger dollar," Markit Chief Economist Chris Williamson.

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.3% on a seasonally adjusted basis in March, after a 0.6% gain in February. February's figure was revised down from a 0.7% rise.

There were increases in 7 of 9 regions.

On a quarterly basis, the house price index climbed 1.3% in the first quarter.

The S&P/Case-Shiller home price index increased 5.0% in March, beating expectations for a 4.6% rise, after a 5.0% gain in February.

San Francisco and Denver were the largest contributors to the rise, where prices climbed by 10.3% and 10.0%, respectively.

"Given the long stretch of strong reports, it is no surprise that people are asking if we're in a new home price bubble. The only way you can be sure of a bubble is looking back after it's over," chairman of the index committee at S&P Dow Jones Indices David Blitzer said.

On a monthly basis, the S&P/Case-Shiller home price index climbed by a seasonally adjusted 1.0% in March, after a revised 1.2% in February.

The S&P/Case-Shiller home price index measures single-family home prices in 20 U.S. cities.

U.S. stock-index futures fell after data on durable goods added to evidence the economy is emerging from a first-quarter slowdown.

Global markets:

Nikkei 20,437.48 +23.71 +0.12%

Hang Seng 28,249.86 +257.03 +0.92%

Shanghai Composite 4,910.9 +97.10 +2.02%

FTSE 7,011.94 -19.78 -0.28%

CAC 5,128.15 +10.98 +0.21%

DAX 11,712.09 -102.92 -0.87%

Crude oil $59.72 (-1.65%)

Gold $1204.00 (-0.01%)

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders declined 0.5% in April, missing expectations for a 0.4% decrease, after a 5.1% gain in March.

The decline was driven by lower orders for commercial aircraft. Orders for commercial aircraft declined 4.0% in April.

The U.S. durable goods orders excluding transportation rose 0.5% in April, in line with expectations, after a 0.6% increase in March.

Orders for primary metals declined 2.1% in April, orders for computers dropped 3.4%, while orders for machinery climbed 3.1%.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

(company / ticker / price / change, % / volume)

| Google Inc. | GOOG | 540.24 | +0.02% | 3.0K |

| Walt Disney Co | DIS | 110.29 | +0.03% | 5.7K |

| Home Depot Inc | HD | 112.20 | +0.04% | 1.1K |

| Tesla Motors, Inc., NASDAQ | TSLA | 247.90 | +0.07% | 10.7K |

| Yahoo! Inc., NASDAQ | YHOO | 43.54 | +0.13% | 8.9K |

| Apple Inc. | AAPL | 132.78 | +0.18% | 232.8K |

| Twitter, Inc., NYSE | TWTR | 36.76 | +0.44% | 11.3K |

| Merck & Co Inc | MRK | 59.38 | 0.00% | 9.0K |

| AT&T Inc | T | 34.70 | -0.03% | 3.6K |

| Visa | V | 69.60 | -0.03% | 0.6K |

| Ford Motor Co. | F | 15.26 | -0.07% | 3.2K |

| International Paper Company | IP | 53.06 | -0.08% | 3.2K |

| FedEx Corporation, NYSE | FDX | 175.03 | -0.09% | 0.1K |

| Facebook, Inc. | FB | 80.46 | -0.10% | 41.8K |

| Johnson & Johnson | JNJ | 101.22 | -0.13% | 0.1K |

| Goldman Sachs | GS | 207.50 | -0.14% | 0.3K |

| Procter & Gamble Co | PG | 79.84 | -0.14% | 2.2K |

| Intel Corp | INTC | 33.40 | -0.15% | 4.1K |

| Amazon.com Inc., NASDAQ | AMZN | 427.00 | -0.15% | 1.1K |

| McDonald's Corp | MCD | 98.83 | -0.16% | 0.2K |

| Starbucks Corporation, NASDAQ | SBUX | 51.40 | -0.16% | 0.6K |

| Verizon Communications Inc | VZ | 49.52 | -0.18% | 11.6K |

| The Coca-Cola Co | KO | 41.12 | -0.22% | 0.7K |

| Wal-Mart Stores Inc | WMT | 75.69 | -0.22% | 12.6K |

| JPMorgan Chase and Co | JPM | 66.32 | -0.23% | 0.6K |

| ALCOA INC. | AA | 12.91 | -0.23% | 3.1K |

| Yandex N.V., NASDAQ | YNDX | 18.45 | -0.27% | 17.9K |

| Citigroup Inc., NYSE | C | 54.81 | -0.29% | 115.8K |

| Exxon Mobil Corp | XOM | 86.25 | -0.31% | 8.0K |

| Nike | NKE | 104.11 | -0.31% | 3.6K |

| Microsoft Corp | MSFT | 46.73 | -0.36% | 0.6K |

| ALTRIA GROUP INC. | MO | 51.04 | -0.37% | 0.1K |

| HONEYWELL INTERNATIONAL INC. | HON | 105.52 | -0.38% | 0.4K |

| General Motors Company, NYSE | GM | 35.55 | -0.42% | 0.1K |

| General Electric Co | GE | 27.55 | -0.47% | 2.0K |

| Hewlett-Packard Co. | HPQ | 34.59 | -0.49% | 0.7K |

| Chevron Corp | CVX | 104.31 | -0.55% | 6.7K |

| Deere & Company, NYSE | DE | 92.72 | -0.67% | 3.5K |

| Caterpillar Inc | CAT | 88.00 | -0.71% | 0.1K |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 20.81 | -0.86% | 40.1K |

| Barrick Gold Corporation, NYSE | ABX | 12.08 | -1.71% | 7.1K |

Upgrades:

eBay (EBAY) upgraded from Hold to Buy at Axiom Capital, target raised from $60 to $70

Downgrades:

Deere (DE) downgraded to Neutral from Outperform at Robert W. Baird, target lowered to $98 from $102

Other:

Apple (AAPL) reiterated at Outperform at Cowen, target raised from $135 to $140

The Confederation of British Industry released its retail sales balance data on Wednesday. The Confederation of British Industry released its retail sales balance data on Tuesday. The CBI retail sales balance jumped to +51% in May from +12% in April.

"Low inflation, which we expect to remain below 1 percent for the rest of the year, has given household incomes a much-needed boost and greater spending power," the CBI director of economics Rain Newton-Smith said.

Sales expectations for next month jumped to +58% in May from +40% in March, the highest level since September 1988.

Speaking on Friday, Federal Reserve Chair Janet Yellen said that the U.S. economy is well positioned for growth despite the persistence of certain problems on a global scale. She noted that she expects the interest rate to be raised this year.

"If the economy continues to improve as I expect, I think it will be appropriate at some point this year to take the initial step to raise the federal funds rate target," Yellen noted.

Most stock indices traded lower on the Greek debt crisis and on election results in Spain. The Greek government is running out of cash and might not repay the IMF loans in June.

Greece's interior minister Nikos Voutsis said on Greek TV on Sunday that Greece cannot repay the IMF loans on June 05 as the country does not have money.

Greece cannot reach an agreement with its creditors to unlock the €7.2 billion tranche of loans.

The leftist Podemos and center-right Ciudadanos parties won in regional and municipal elections in Spain on Sunday.

Current figures:

Name Price Change Change %

FTSE 100 6,994.57 -37.15 -0.53 %

DAX 11,736.03 -78.98 -0.67 %

CAC 40 5,106.93 -10.24 -0.20 %

Statistics New Zealand released its trade data on Monday. New Zealand's trade surplus narrowed to NZ$123 million in April from NZ$754 million in March. March's figure was revised up from a surplus of NZ$631 million.

The increase was driven by lower exports. Exports declined at an annual pace of 5.5% in April, while imports rose by 2.6%.

For the year ended April 2015, New Zealand's trade deficit was NZ$2.6 billion. It was the largest annual trade deficit since the year ended June 2009.

Statistics New Zealand said that it had received additional information too late. Additional information has not been included in April's release, and it may affect the petroleum and products import category, selected country totals and total imports for March 2015 and April 2015.

Federal Reserve Vice Chairman Stanley Fischer said in Israel on Monday that the interest rate hike by the Fed will depend on the incoming data, not on date.

"Our processes are not date determined, they are data determined," Fischer noted.

He pointed that market participants are focused too much on the first interest rate hike. "I think it's misleading," he added.

Fed economists expect the interest rate in the U.S. will reach from 3.25% to 4% in three to four years, according to the Fed vice chairman. Fischer noted that it would not be like the relatively rapid and predictable path of Fed interest rate hikes from 2004 to 2006.

Federal Reserve Bank of Cleveland President Loretta Mester said in Reykjavik on Monday that the "time is near" for the interest rate hike by the Fed.

"If the data comes in according to my forecasts then the time is near where we're going to be wanting to raise rates," she noted.

Mester pointed out that the interest rate hike is possible on every monetary policy meeting.

Federal Reserve Bank of Cleveland president also said that a longer period of low interest rates may pose risks to financial stability.

Mester is not a voting member of the Federal Open Market Committee this year.

Greece's interior minister Nikos Voutsis said on Greek TV on Sunday that Greece cannot repay the IMF loans on June 05 as the country does not have money. Greece failed to reach an agreement with its creditors to unlock the €7.2 billion tranche of loans.

China's Ministry of Finance said in a statement on Monday that it will lower import taxes on some products such as cosmetics, shoes, clothes and diapers in June to boost domestic consumption. The government will cut import taxes by an average over 50%.

Britain's Prime Minister David Cameron has announced on Sunday to freeze ministerial pay until 2020. This decision will help to save about £800,000 a year and £4 million by 2020.

Cabinet ministers in the U.K. currently receive a salary of £134,565. The prime minister's salary is £142,500.

The independent watchdog, the Independent Parliamentary Standards Authority (IPSA), said that salaries of Members of the Parliament should be increased by 9% this year. But the government made it clear that the increase should not be more than 1%.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.