- Analytics

- News and Tools

- Market News

Analytics, News, and Forecasts for CFD Markets: stock news — 27-04-2018.

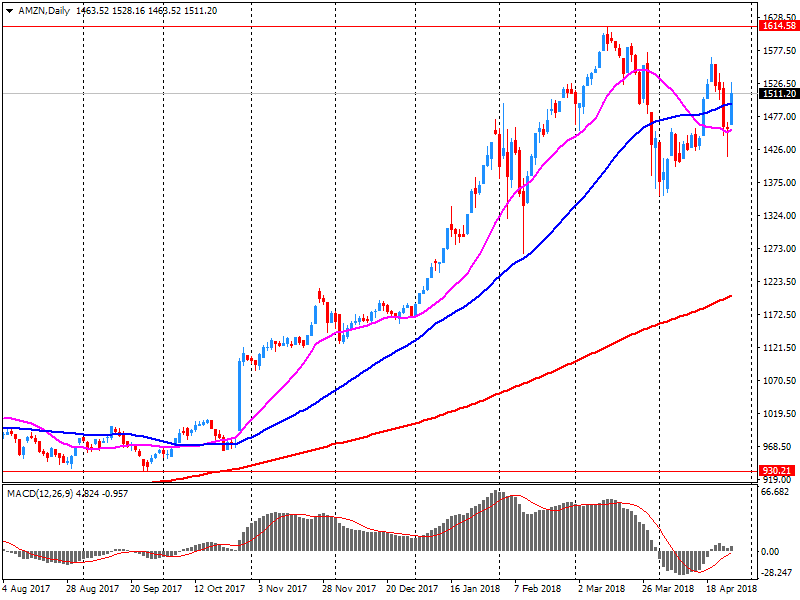

U.S. stock-index futures were mixed on Friday, with Nasdaq futures outperforming due to solid gains in Amazon (AMZN; +9.0%), Microsoft (MSFT; +3.4%) and Intel (INTC; +6.4%), buoyed by better-than-expected earnings reports. Investors also digested preliminary data on the U.S. Q1 GDP.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,467.87 | +148.26 | +0.66% |

| Hang Seng | 30,280.67 | +272.99 | +0.91% |

| Shanghai | 3,082.18 | +7.15 | +0.23% |

| S&P/ASX | 5,953.60 | +42.80 | +0.72% |

| FTSE | 7,487.72 | +66.29 | +0.89% |

| CAC | 5,470.32 | +16.74 | +0.31% |

| DAX | 12,613.41 | +112.94 | +0.90% |

| Crude | $67.93 | | -0.38% |

| Gold | $1,319.00 | | +0.08% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 196.9 | -0.19(-0.10%) | 2173 |

| ALTRIA GROUP INC. | MO | 54.7 | -0.07(-0.13%) | 873 |

| Amazon.com Inc., NASDAQ | AMZN | 1,654.99 | 137.03(9.03%) | 343276 |

| American Express Co | AXP | 100.2 | -0.03(-0.03%) | 535 |

| AMERICAN INTERNATIONAL GROUP | AIG | 55.72 | 0.18(0.32%) | 2755 |

| Apple Inc. | AAPL | 164.79 | 0.57(0.35%) | 86271 |

| AT&T Inc | T | 33.18 | 0.08(0.24%) | 79162 |

| Barrick Gold Corporation, NYSE | ABX | 13.64 | 0.02(0.15%) | 17852 |

| Boeing Co | BA | 341.75 | -1.04(-0.30%) | 11196 |

| Caterpillar Inc | CAT | 146.26 | -0.05(-0.03%) | 6490 |

| Chevron Corp | CVX | 126.45 | 2.23(1.80%) | 52177 |

| Cisco Systems Inc | CSCO | 44.3 | 0.09(0.20%) | 36385 |

| Citigroup Inc., NYSE | C | 68.9 | -0.28(-0.40%) | 27919 |

| Deere & Company, NYSE | DE | 137 | 0.67(0.49%) | 1600 |

| Exxon Mobil Corp | XOM | 78.86 | -2.00(-2.47%) | 278150 |

| Facebook, Inc. | FB | 176.55 | 2.39(1.37%) | 321299 |

| Ford Motor Co. | F | 11.39 | -0.04(-0.35%) | 23559 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 15.4 | -0.23(-1.47%) | 51192 |

| General Electric Co | GE | 14.3 | -0.08(-0.56%) | 201933 |

| General Motors Company, NYSE | GM | 38 | -0.25(-0.65%) | 1466 |

| Goldman Sachs | GS | 239.7 | -0.39(-0.16%) | 6083 |

| Google Inc. | GOOG | 1,049.30 | 9.26(0.89%) | 9393 |

| Hewlett-Packard Co. | HPQ | 21.6 | 0.12(0.56%) | 3839 |

| Home Depot Inc | HD | 185.39 | -0.33(-0.18%) | 5791 |

| Intel Corp | INTC | 56.76 | 3.71(6.99%) | 624734 |

| International Business Machines Co... | IBM | 146.52 | -0.20(-0.14%) | 6738 |

| Johnson & Johnson | JNJ | 127.78 | -0.23(-0.18%) | 1423 |

| JPMorgan Chase and Co | JPM | 109.85 | -0.25(-0.23%) | 10288 |

| McDonald's Corp | MCD | 158.78 | -0.12(-0.08%) | 4341 |

| Merck & Co Inc | MRK | 59.3 | -0.11(-0.19%) | 5968 |

| Microsoft Corp | MSFT | 97.68 | 3.42(3.63%) | 481925 |

| Nike | NKE | 68.24 | 0.19(0.28%) | 13867 |

| Pfizer Inc | PFE | 36.69 | -0.16(-0.43%) | 6133 |

| Procter & Gamble Co | PG | 72.6 | -0.15(-0.21%) | 12592 |

| Starbucks Corporation, NASDAQ | SBUX | 58.44 | -0.94(-1.58%) | 17239 |

| Tesla Motors, Inc., NASDAQ | TSLA | 284.28 | -1.20(-0.42%) | 21393 |

| The Coca-Cola Co | KO | 42.7 | -0.05(-0.12%) | 6935 |

| Twitter, Inc., NYSE | TWTR | 30.38 | 0.11(0.36%) | 66717 |

| Verizon Communications Inc | VZ | 50.1 | 0.34(0.68%) | 39157 |

| Visa | V | 127.03 | -0.05(-0.04%) | 19115 |

| Wal-Mart Stores Inc | WMT | 87.61 | -0.33(-0.38%) | 7958 |

| Walt Disney Co | DIS | 99.8 | -0.04(-0.04%) | 10949 |

| Yandex N.V., NASDAQ | YNDX | 33.32 | 0.59(1.80%) | 7109 |

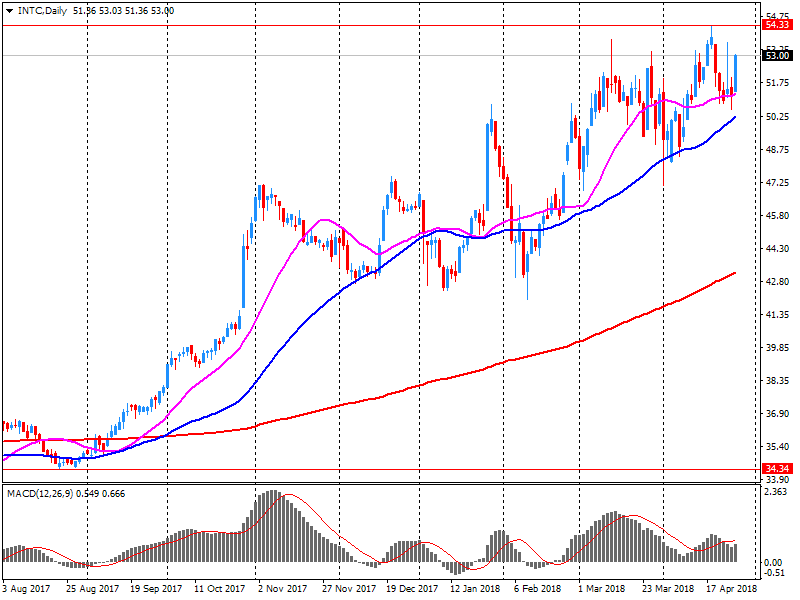

Intel (INTC) target raised to $65 from $55 at B. Riley FBR

Intel (INTC) target raised to $57 from $53 at Stifel

Intel (INTC) target raised to $62 from $50 at Needham

Intel (INTC) target raised to $65 at JPMorgan

Amazon (AMZN) target raised to $2200 from $2000 at Monness Crespi & Hardt

Amazon (AMZN) target raised to $2020 from $1800 at Stifel

Amazon (AMZN) target raised to $1900 at JPMorgan

Amazon (AMZN) target raised to $1900 at RBC Capital Mkts

Amazon (AMZN) target raised to $1800 at Deutsche Bank

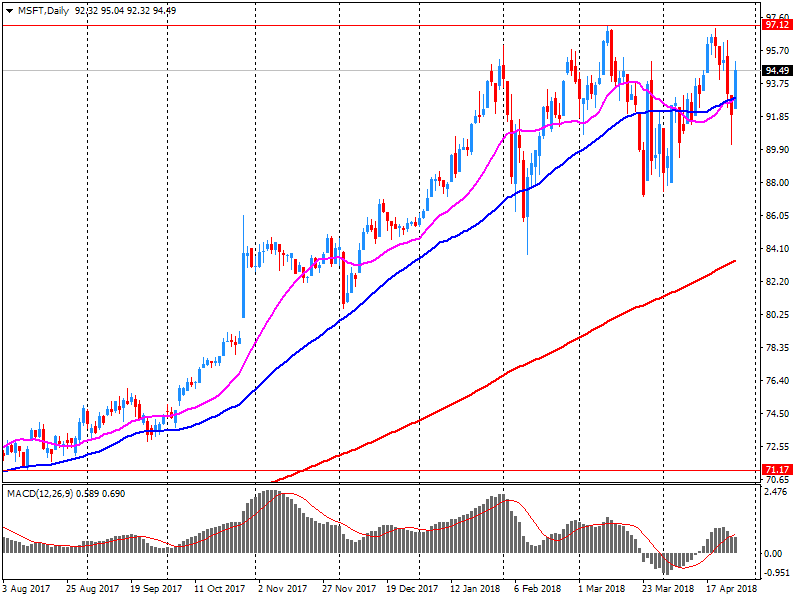

Microsoft (MSFT) target raised to $109 from $107 at BMO Capital Mkts

Microsoft (MSFT) target raised to $107 from $105 at Stifel

Microsoft (MSFT) target raised to $75 from $62 at Jefferies

Microsoft (MSFT) target raised to $115 at RBC Capital Mkts

Intel (INTC) upgraded to Mkt Perform at Bernstein

Facebook (FB) upgraded to Buy at Stifel; target raised to $202

NIKE (NKE) upgraded to Buy from Hold at HSBC Securities; target $77

Microsoft (MSFT) upgraded to Overweight from Neutral at JP Morgan; target raised to $110 from $94

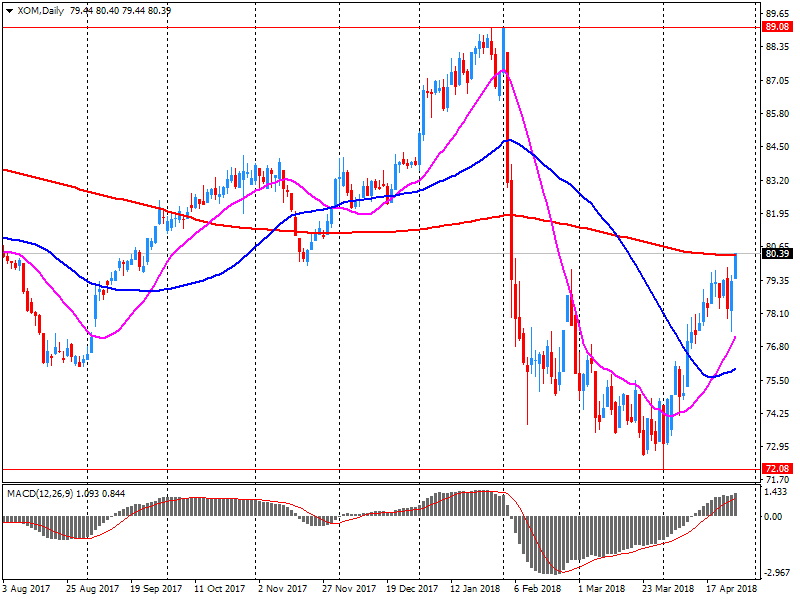

Exxon Mobil (XOM) reported Q1 FY 2018 earnings of $1.09 per share (versus $0.95 in Q1 FY 2017), missing analysts' consensus estimate of $1.10.

The company's quarterly revenues amounted to $68.211 bln (+2.5% y/y), beating analysts' consensus estimate of $61.495 bln.

XOM fell to $80.01 (-1.05%) in pre-market trading.

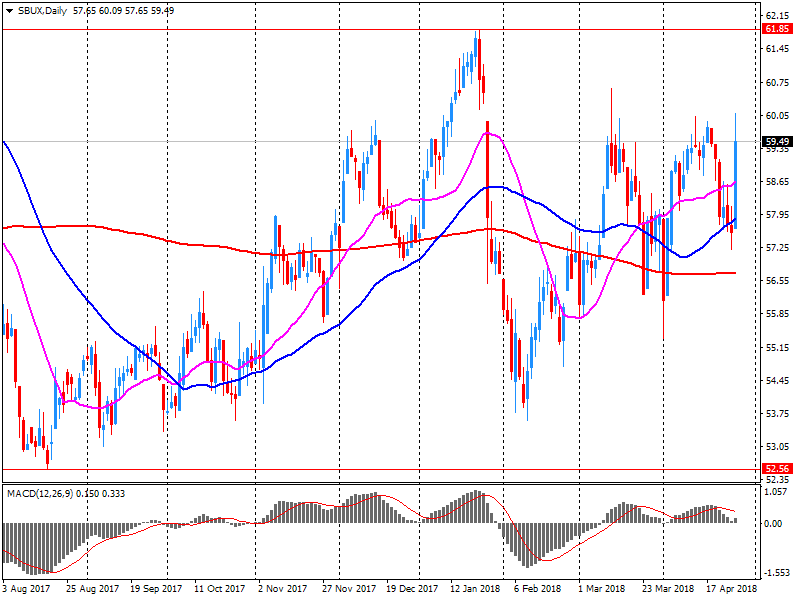

Starbucks (SBUX) reported Q2 FY 2018 earnings of $0.53 per share (versus $0.45 in Q2 FY 2017), in-line with analysts' consensus estimate.

The company's quarterly revenues amounted to $6.032 bln (+13.9% y/y), beating analysts' consensus estimate of $5.934 bln.

The company also reaffirmed guidance for FY 2018, projecting EPS of $2.48-2.53 versus analysts' consensus estimate of $2.49.

SBUX fell to $58.35 (-1.73%) in pre-market trading.

Microsoft (MSFT) reported Q3 FY 2018 earnings of $0.95 per share (versus $0.73 in Q3 FY 2017), beating analysts' consensus estimate of $0.85.

The company's quarterly revenues amounted to $26.819 bln (+15.5% y/y), beating analysts' consensus estimate of $25.784 bln.

MSFT rose to $97.82 (+3.78%) in pre-market trading.

Intel (INTC) reported Q1 FY 2018 earnings of $0.87 per share (versus $0.66 in Q1 FY 2017), beating analysts' consensus estimate of $0.72.

The company's quarterly revenues amounted to $16.100 bln (+8.8% y/y), beating analysts' consensus estimate of $15.076 bln.

The company also issued upside guidance for Q2, projecting EPS of $0.80-0.90 (versus analysts' consensus estimate of $0.82) at Q2 revenues of $15.8-16.8 bln (versus analysts' consensus estimate of $15.59 bln).

For the FY 2018, the company forecasts EPS of $3.66-4.04 (versus its prior guidance of $3.55 and analysts' consensus estimate of $3.58) and revenues of $66.5-68.5 bln (versus its prior projection of $65 bln and analysts' consensus estimate of $65.07 bln).

INTC rose to $56.35 (+6.22%) in pre-market trading.

Amazon (AMZN) reported Q1 FY 2018 earnings of $3.27 per share (versus $1.48 in Q1 FY 2017), beating analysts' consensus estimate of $1.25.

The company's quarterly revenues amounted to $51.042 bln (+42.9% y/y), beating analysts' consensus estimate of $49.937 bln.

AMZN rose to $1,626.98 (+7.18%) in pre-market trading.

European stocks leapt Thursday, strengthened by a slide in the euro after European Central Bank President Mario Draghi offered little in the way of providing further insight into when the central bank will wind down bond purchases and begin to raise interest rates.

U.S. stocks closed sharply higher on Thursday, with major indexes up 1% as strong results from a number of bellwethers, including technology behemoth Facebook, jolted equities in to a broad advance.

Asian stocks gave back much of their early gains Friday as trade concerns remained in the spotlight despite easing geopolitical risks.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.